|

市場調查報告書

商品編碼

1644630

中東和非洲變頻驅動器 (VFD):市場佔有率分析、行業趨勢、統計數據、成長預測(2025-2030 年)Middle East & Africa Variable Frequency Drive (VFD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

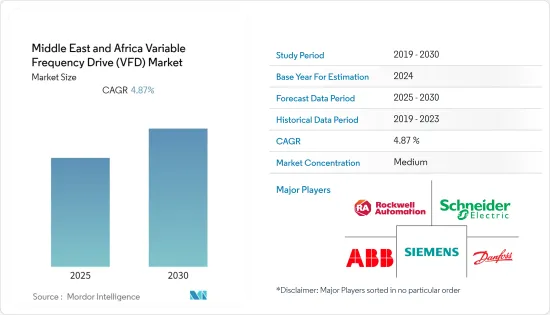

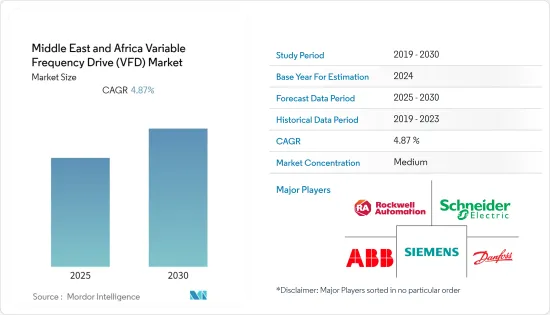

預測期內,中東和非洲的變頻驅動器 (VFD) 市場預計將實現 4.87% 的複合年成長率。

主要亮點

- 快速的技術進步已導致驅動器被各行各業所採用。這項進步專注於高可靠性和降低能源成本,配備馬達系統的商業建築每平方英尺的能源消耗可能減少 30-40%。此外,現代先進的驅動器整合了網路和診斷功能,以實現更好的效能和更高的生產力。智慧型馬達控制和降低的峰值電流是選擇 VFD 作為任何馬達驅動系統控制器的主要原因。

- 水資源短缺是該地區的主要問題之一。造成這現象的因素有很多,包括氣候變遷導致的乾旱和洪水、水質下降以及衝突和暴力背景下的水資源管理不善。彌補供不應求的一個常見方法是將鹽從海水中分離出來,這個過程稱為海水淡化。根據世界銀行統計,中東和北非地區佔全球海水淡化產能的近一半,是最大的海水淡化市場。該地區的許多海水淡化廠(例如阿拉伯聯合大公國)都是按照獨立水力發電生產商模式建造的。科威特也計劃在2025年建造8座海水淡化廠,以滿足日益成長的用水需求。這些投資也推動了對 VFD 的需求,因為它們是一種可靠、經濟高效的解決方案,可以精確控制海水淡化廠中旋轉機械(如泵浦)的扭矩和速度。

- 2021 年 6 月,位於沙烏地阿拉伯朱拜勒的 Sarain Water Conversion Corporation (SWCC) 水處理廠宣布將使用 ABB 數位化 ACS2000 高壓變速驅動器 (VSD) 來確保泵浦的高效可靠,降低消費量並降低總擁有成本。該廠日產水質淨化能力為 40 萬立方米,將成為該地區最大的計劃之一,旨在滿足利雅德以及達曼、科巴爾和朱拜勒等其他城市未來的供水需求。

- 變頻驅動器 (VFD) 廣泛用於商業和工業領域的暖氣、通風和空調系統。 VFD 允許尖峰容量滿足恆定電流 HVAC 系統中尖峰負載的高需求,然後透過減少負載需求來幫助緩慢控制能量。

- 另一方面,在現有馬達上添加 VFD 會帶來一些技術挑戰,從而為多個行業相關人員的採用帶來障礙。對現有馬達加裝 VFD 後,馬達軸轉速降低,導致安全驅動風扇提供的冷卻效果降低。工程師在使用 VFD 時遇到的主要問題是軸承故障。許多工程師報告稱,現代 VFD 控制的馬達軸承壽命較短。眾所周知,軸承會從軸承滾道進入軸承本身,造成軸承內追蹤並導致意外故障。軸承經常發生故障,從而增加維護成本。 VFD 從逆變器輸出產生諧波電流。這些諧波會對馬達本身造成損害,並且除非得到適當緩解,否則會在整個更大的電力系統中產生共振。這些諧波會導致轉子過熱和扭矩振盪,從而導致機械共振和振動。這最終會縮短馬達的使用壽命。這些因素,再加上高昂的資本和維護成本,可能會抑制所研究市場的成長。

中東和非洲的變頻驅動器 (VFD) 市場趨勢

石油和天然氣領域可望推動市場成長

- 中東是世界最重要的產油區之一。根據石油輸出國組織統計,沙烏地阿拉伯持有全球約17%的已探明石油蘊藏量。石油和天然氣產業約佔國內生產總值的50% 和出口收益的70% 。石油以外的天然資源包括天然氣、鐵礦石、黃金和銅。據美國能源資訊署稱,沙烏地阿拉伯還持有全球已探明石油蘊藏量的 15%。沙烏地阿拉伯是世界最大原油出口國,擁有世界最大的原油產能,約1,200萬桶/日,其中包括與科威特共用的中立區的產能。沙烏地阿拉伯是歐佩克最大的原油生產國,也是僅次於美國的世界第二大液體石油生產國。大規模石油生產需要高效的變頻器來確保該行業的無縫運作。

- 在石油和天然氣領域,低壓驅動器主要用於上游應用,例如水力壓裂滑橇、海上鑽機和浮式生產儲卸油裝置 (FPSO)。中壓驅動器主要用於中游和液化天然氣子子部門的電力應用,例如壓縮和液化天然氣以及操作大型泵浦。預計預測期內,加強海上石油和天然氣活動將增加對低壓驅動器的需求。

- 近期,由於全球市場原油供應過剩,價格下跌導致石油市場波動,該地區尤其是中東地區的一些國家正在加大對製造業和工業4.0概念的投資,以減少對石油和天然氣行業的依賴。

- 此外,近年來中東石油和天然氣產業格局與全球趨勢相似,既面臨挑戰,也面臨變革。全部區域的投資日趨多樣化,新的投資途徑正在不斷被發現,包括液化天然氣和更複雜的海上計劃。根據多邊開發銀行阿拉伯石油投資公司(APICORP)預測,2021年至2025年,全部區域的投資計畫和承諾將超過8,050億美元,比前五年預測的7,920億美元增加130億美元。

- 由於新的鑽井合約、許可證授予和未來的競標輪次將推動公司的投資,未來幾年投資的增加可能會刺激 VFD 行業的成長。例如,Zadkois 油田最近考慮採用大位移鑽井和最大儲存接觸井技術鑽探更多油井,以便在 2024 年將該油田的產量從 75 萬桶/天提高到約 100 萬桶/天。

預計各終端用戶產業的投資增加將推動市場成長

- 區域公司正在進行投資以增加其生產能力,這可能會推動所研究的市場發展。例如,2022年3月,沙烏地阿拉伯國有石油巨頭阿美公司報告稱,其2021年利潤成長了兩倍,並宣布將在2022年增加支出約50%,儘管西方呼籲在油價飆升的情況下增加產量。去年,由於新冠疫苗接種率上升和限制措施放鬆導致需求超過供應,沙烏地阿美受益於原油價格上漲 50% 以上。沙烏地阿美表示,計劃今年將資本支出增加至 400 億至 500 億美元,並可能在本世紀中葉進一步增加。

- 該國已採用廢水處理的國際標準。此外,由於廢水處理趨勢而出現的新處理廠預計將推動對 VFD 的需求。水資源短缺是該地區的主要問題之一。

- 2017 年 9 月,阿拉伯聯合大公國能源和基礎設施部啟動了“阿拉伯聯合大公國水安全戰略 2036”,旨在確保在標準時期和緊急時期都能永續獲得水資源,符合當地法規、世界衛生組織 (WHO) 標準和阿拉伯聯合大公國的永續性與永續發展願景。該策略的總體目標是,將水資源總需求減少21%,水生產率指數提高到每立方公尺110美元,水資源短缺程度降低三度,將處理水的再利用率提高到95%,並將該國的蓄水能力擴大到兩天的用水量。

- 對於基礎設施領域來說,變頻驅動器(VFD)也是一項相當吸引人的能源管理投資。例如,根據阿卜杜拉國王石油研究中心的數據,在阿拉伯聯合大公國,建築物消耗了該國總用電量的近 90%,主要在杜拜和阿布達比。根據阿布達比和杜拜適用的強制性建築評級計劃(如綠色建築規範),阿拉伯聯合大公國 (UAE) 建造的大多數新建築必須滿足一定的能源效率要求。為了提高建築物的能源效率,DEWA(杜拜電力和水務局)於2013年成立了阿提哈德能源服務公司(EES)。 EES 的主要目標是到 2030 年透過建築維修實現 1.7 TWh 的能源節約。

- 2022年5月,沙烏地阿拉伯工業和礦產資源部宣布計劃尋求320億美元的採礦和礦產投資。作為促進礦產出口計畫的一部分,沙烏地阿拉伯希望支持九個中游礦產和金屬採礦計劃的發展。根據沙烏地阿拉伯工業和礦產資源部長班達爾·本·霍拉耶夫介紹,作為這項投資計畫的一部分,政府目前正在建造一座價值超過40億美元的鋼板工廠和一座價值20億美元的電動車電池工廠。

中東和非洲變頻器 (VFD) 產業概況

中東和非洲變頻驅動器 (VFD) 市場受到羅克韋爾自動化公司等多家主要參與者的推動。市場參與者正在創新新產品和新工藝以滿足不斷變化的市場。

- 2021 年 4 月 - 羅克韋爾自動化的 Allen-Bradley PowerFlex 6000T 中壓變頻器現已採用 TotalFORCE 技術,該技術可提供更精確的速度和扭矩控制、用於追蹤系統健康狀況的診斷資訊以及自動更改以保持營運平穩運行。

- 2022 年 1 月 - TMEIC 一直在研究和製造適用於各種應用的高容量和獨特的電力電子轉換器解決方案。其中一款是配備IGBT前端轉換器和多級PWM正弦波輸出的中壓變頻交流變頻器(MV VFD),可與現有的高壓感應馬達配合實現變速運行,為各行業的離心風機、泵浦和壓縮機帶來顯著的節能效果。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 技術簡介

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 增加各終端用戶產業的投資與經濟多樣化

- 對節能解決方案和自動化的需求

- 市場限制

- 石油和天然氣趨勢

- 新興經濟體之間的政治挑戰

第6章 市場細分

- 按最終用戶

- 石油和天然氣

- 化工和石化

- 金屬與礦業

- 發電

- 用水和污水

- HVAC

- 紙漿和造紙

- 其他最終用戶產業

- 按國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 其他中東和非洲地區

第7章 競爭格局

- 公司簡介

- Rockwell Automation, Inc.

- Siemens AG

- Schneider Electric SE

- ABB Ltd.

- Danfoss

- Toshiba Industrial

- Yaskawa

- Mitsubishi

第 8 章:市場的未來

簡介目錄

Product Code: 90988

The Middle East & Africa Variable Frequency Drive Market is expected to register a CAGR of 4.87% during the forecast period.

Key Highlights

- Rapid technological advancement has led to higher acceptability of the drives in several industries. The advances focus on high reliability and reduced energy costs, potentially reducing the per square foot energy by 30-40% when equipped with motor-driven systems in commercial buildings. Additionally, the advanced and modern drives integrate the networking and diagnostic capabilities into better performance and increased productivity. Intelligent motor control and reduction of peak-current drawn are some of the major reasons to choose a VFD as the controller in every motor-driven system.

- Water scarcity is one of the major problems in the region. This is due to various factors such as climate change leading to droughts and floods, low water quality, and poor water management in conflict and violence. One of the popular ways to supplement insufficient water supply is to separate salt from seawater, called desalination. The Middle East & North Africa accounts for nearly half of the world's desalination capacity, as per the World Bank, making it the largest desalination market. Many desalinated plants in the region, such as in the UAE, are built on the independent water and power producer model. Kuwait has also planned to build eight facilities capable of desalinating seawater by 2025 to meet the growing water needs. These investments will also propel the demand for VFDs as they offer a reliable and cost-efficient solution to ensure precise control of torque and speed of rotating machines (such as pumps, etc.) in desalinated plants.

- To ensure efficient and reliable pumping, in June 2021, Saline Water Conversion Corporation's (SWCC) water treatment plant in Jubail, Saudi Arabia, announced that it would use ABB's digitally enabled-ACS2000 medium voltage variable speed drives (VSD) to reduce energy consumption and lower their total cost of ownership. The plant, which would have a daily output capacity of 400,000 m3/day of clean water, would be one of the largest projects in the region, designed to meet the future water needs of Riyadh and other cities such as Dammam, Khobar, and Jubail.

- For heating, ventilation, and air-conditioning systems used in the commercial and industrial sector, the Variable Frequency Drives find wide usage as they can handle the variable load in several components, like chillers. The VFD helps allow peak capacity to meet the high demands of peak loads in constant flow HVAC systems and then slowly control the energy by decreasing the need for the load.

- On the flip side, adding VFDs to existing motors gives rise to several technical problems, creating barriers to adoption amongst several industry players. After integrating the VFD with an existing motor, the motor shaft speed decreases, which causes decreased cooling from the safe-driven fan. The primary issue the engineers are experiencing in using a VFD is bearing failure. Many engineers have reported a reduced lifecycle of the bearings in the motors controlled by modern VFDs. The bearing is seen arcing from the bearing race to the bearing itself, creating a tracking within the bearing, which leads to an unexpected failure. The regular failure of the bearings increases their maintenance costs. VFD produces harmonic current from the output of the inverter. These harmonics can harm the motor itself and, unless properly mitigated, resonate across the larger electrical power system. These harmonics cause over-heating and torque oscillations in the rotor, leading to mechanical resonance and vibration. This eventually leads to a shortening of the motor life. These factors, when coupled with the high equipment and maintenance cost, can restrain the studied market's growth.

MEA Variable Frequency Drive (VFD) Market Trends

The Oil and Gas Segment is Expected to Drive the Market's Growth

- The Middle Eastern region is a significant oil-producing region in the world. According to the Organization of the Petroleum Exporting Countries, Saudi Arabia possesses around 17% of the world's proven petroleum reserves. The oil and gas sector accounts for about 50% of gross domestic product and about 70% of export earnings. Apart from petroleum, the Kingdom's other natural resources include natural gas, iron ore, gold, and copper. Further, according to Energy Information Administration, Saudi Arabia holds 15% of the world's proven oil reserves. It is the largest exporter of crude oil in the world and holds the world's largest crude oil production capacity at approximately 12 million barrels per day, including capacity from the Neutral Zone that is shared with Kuwait. Saudi Arabia is the largest crude oil producer in OPEC and the second-largest total petroleum liquids producer in the world after the United States. The extensive oil production calls for efficient VFDs for the seamless functioning of the sector.

- In the oil and gas sector, low voltage drives are used mainly in upstream applications, such as hydraulic fracturing skids and offshore rigs and FPSOs (Floating Production Storage and Offloading). Medium voltage drives are used mainly for power applications in midstream and LNG subsectors, like for natural gas compression and liquefaction and to operate larger pumps. Strengthening offshore oil and gas operations is expected to increase demand for low voltage drives over the forecast period.

- In the recent time, owing to the fluctuations in the oil market caused by an oversupply of crude oil in the global market and low prices, several countries in the region, especially Middle-East have been increasing their investments in the manufacturing sector and Industry 4.0 concepts to reduce their dependency on the oil and gas sector.

- Further, the landscape of the Middle East oil & gas industry in the past few years has mirrored global trends and has experienced both challenges and changes. Investment across the region has become more diverse, and new avenues are being discovered, such as LNG and more complex offshore projects. As per the Arab Petroleum Investments Corporation (APICORP), a multilateral development financial institution, the overall planned and committed investments in the MENA region will exceed USD 805 billion from 2021 to 2025, a USD 13 billion increase from the USD 792 billion estimates in previous year's five-year outlook.

- The investment upsurge in the coming years will be driven by new drilling contracts, licensing awards, and future bid rounds, thus, likely to spur the VFD industry growth. For instance, recently, Zadcois has been looking to increase production from the field from 750,000 b/d to around 1 million b/d by 2024 by drilling additional wells using extended-reach drilling and maximum reservoir contact well technologies.

Increasing Investments in Various End-user Industries is Expected to Boost the Market Growth

- The regional companies are investing to increase production capacity, which may drive the studied market. For Instance, in March 2022, Saudi Arabia's state oil giant, Aramco, announced to increase spending by approximately 50% this 2022 as it reported a tripling in 2021 profits, despite demands from the West to increase output amid high prices. Last year, Saudi Aramco benefited from a more than 50% increase in oil prices, as demand outpaced supply due to rising COVID-19 immunization rates and loosening restrictions. Aramco has stated that it plans to increase capital expenditures (CAPEX) to USD 40-50 billion this year, with further rise likely until the middle of the decade.

- The country adopts international standards while treating sewage. Additionally, the advent of new treatment plants due to the ongoing trend of sewage treatment is expected to drive the demand for VFDs. Water scarcity is one of the major problems in the region.

- The UAE Water Security Strategy 2036 was unveiled in September 2017 by the Ministry of Energy and Infrastructure to ensure sustainable access to water in both standard and emergencies, in accordance with local regulations, World Health Organization standards, and the UAE's vision of prosperity and sustainability. The strategy's overall goals aimed to reduce the total demand for water resources by 21%, raise the water productivity index to USD 110 per cubic meter, reduce water scarcity by three degrees, boost treated water reuse to 95%, and expand national water storage capacity to two days.

- Variable frequency drives are also an attractive energy management investment for the infrastructure sector. For Instance, according to King Abdullah Petroleum Studies and Research Center, in the UAE, buildings consume almost 90% of the total electricity used in the country, mostly in Dubai and Abu Dhabi. Most of the newly constructed UAE buildings must comply with certain energy efficiency requirements under the mandatory regulations of the building rating systems applied in Abu Dhabi and Dubai (such as the Green Building Regulations). Thus, to improve the energy efficiency of the building, DEWA (Dubai Electricity and Water Authority) created Etihad Energy Services (EES) in 2013. The primary goal of the EES is to achieve 1.7 TWh in energy savings from building retrofits by 2030.

- In May 2022, The Saudi Arabian Ministry of Industry and Mineral Resources announced plans to seek USD 32 billion in mining and minerals investments. The country wants to assist the development of nine mining projects for midstream minerals and metals as part of the plan to boost mineral exports. According to Saudi Arabia's Minister of Industry and Mineral Resources, Bandar bin al-Khorayef, the government is now constructing a steel plate plant worth more than USD 4 billion and a USD 2 billion factories for electric car battery input of this investment plan.

MEA Variable Frequency Drive (VFD) Industry Overview

The Middle East & Africa Variable Frequency Drive (VFD) Market is a moderately fragmented market with significant players like Rockwell Automation, Inc., Siemens AG, Schneider Electric SE, ABB Ltd., etc. The players in the market are striving to enhance their supply chain and partner ecosystem to offer VFDs at an economical price. The market players are innovating new products and processes to cater to the evolving market.

- April 2021 - TotalFORCEtechnology, which enables more precise speed and torque control, diagnostic information for tracking system health, and automatic changes to keep operations operating smoothly, was added to Rockwell Automation's Allen-Bradley PowerFlex6000T medium voltage drives.

- January 2022 - TMEIC has been researching and producing high-capacity, unique power electronic converter solutions for various applications. One of these is a medium voltage variable frequency AC drive (MV VFD) with an IGBT front end converter and multi-level PWM sinusoidal output that works with existing medium voltage induction motors to achieve variable speed operation and saves a significant amount of energy in centrifugal fans, pumps, and compressors in a variety of industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing investments in Various End-user Industries and Diversification of Economies

- 5.1.2 Need for Energy Efficient Solutions and Automation

- 5.2 Market Restraints

- 5.2.1 Dynamic Oil & Gas situation

- 5.2.2 Political Challenges between Developed Economies

6 MARKET SEGMENTATION

- 6.1 By End-User

- 6.1.1 Oil & Gas

- 6.1.2 Chemicals & Petrochemicals

- 6.1.3 Metals & Mining

- 6.1.4 Power Generation

- 6.1.5 Water & Wastewater

- 6.1.6 HVAC

- 6.1.7 Pulp & Paper

- 6.1.8 Other End-user Industries

- 6.2 By Country

- 6.2.1 Saudi Arabia

- 6.2.2 United Arab Emirates

- 6.2.3 Turkey

- 6.2.4 South Africa

- 6.2.5 Rest of Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation, Inc.

- 7.1.2 Siemens AG

- 7.1.3 Schneider Electric SE

- 7.1.4 ABB Ltd.

- 7.1.5 Danfoss

- 7.1.6 Toshiba Industrial

- 7.1.7 Yaskawa

- 7.1.8 Mitsubishi

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219