|

市場調查報告書

商品編碼

1626893

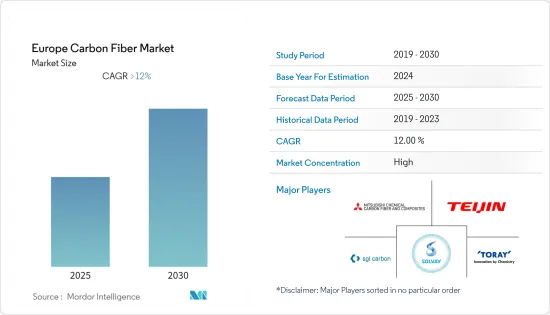

歐洲碳纖維 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Carbon Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計歐洲碳纖維市場在預測期內複合年成長率將超過 12%。

COVID-19 大流行對全球汽車和航太產業產生了重大影響,由於全球政府關閉,最終用戶營運暫時停止。然而,在大流行後的情況下,預計該行業將在未來幾年內復甦並大幅成長。

主要亮點

- 推動市場成長的關鍵因素是對節能和輕型車輛的需求不斷成長以及航太和國防工業的最新進展。

- 然而,再生碳纖維供應鏈的安全性和替代品的可用性是市場研究的限制因素。

- 再生碳纖維的日益普及、對木質素作為碳纖維原料的使用的重視以及風力發電領域應用的增加可能為預測期內所研究的市場帶來機會。

- 德國佔據最大的市場佔有率,預計在預測期內將保持其主導地位。

歐洲碳纖維市場趨勢

航太和國防工業主導市場

- 碳纖維是由丙烯酸樹脂、石油/煤瀝青原纖化,並經過一定的熱處理而製成的具有細石墨結晶結構的纖維狀碳材料。碳纖維的強度約為鋼的 10 倍,重量不到鋼的一半。它還具有高剛性。

- 碳纖維具有優異的物理和機械性能,包括重量輕、耐用、金屬混合成分、耐腐蝕、耐化學性、耐衝擊性和耐溫性,使其具有高度可靠性和燃油效率,通常是航太和國防領域的最佳選擇。這要歸功於這些偉大的品質。

- 碳纖維增強聚合物 (CFRP) 用於航太工業中使用的各種零件。 CFRP 為航太工業提供輕質部件,並在飛機煞車中用作輕質複合材料和高性能隔熱材料的填充材。

- 在經歷了COVID-19的困難時期後,歐洲航太和國防工業以強勁的市場收益從困難時期反彈,展現了其韌性。據歐洲航太、安全與國防工業協會(ASD)稱,計劃在2050年實現二氧化碳淨零排放的目標。

- ASD報告也預計, 與前一年同期比較總銷售額將年增10%,達到約2,380億歐元(2,820億美元)。總銷售額的主要貢獻者是民用航空,約佔總銷售額的45%。

- 根據波音公司預測,2022年至2041年,歐洲在全球服務市場總量中的佔有率將達到24%,即8,500億美元。此外,到 2041 年,該地區機隊總數預計將達到約 9,360 架飛機。

- 德國航太工業協會(BDLI)還在其年度報告中提供了與航太和國防工業相關的關鍵數據。該國 2021 會計年度的銷售額為 314 億歐元(約 370 億美元)。主要佔有率是民用航空,約佔220億歐元(約260億美元)。由於COVID-19對該產業的影響,與去年相比,該國民航市場並未出現任何重大升級。

- 此外,德國是歐洲太空總署 (ESA) 的最大捐助國,2022 年捐款額為 35 億歐元(約 41.4 億美元),其次是法國,捐款額為 32.5 億歐元(約 38.5 億美元)。

- 隨著航太和國防工業市場的擴大,碳纖維的消費需求也將增加,預計將在預測期內帶動市場。

德國主導市場

- 作為飛機工業的主要製造地之一,德國擁有來自各個領域的製造商,包括設備製造商、材料和零件供應商、引擎製造商和系統整合商。

- 飛機內飾件、MRO(維修、修理、大修)、輕量化結構、材料等生產基地眾多,主要集中在巴伐利亞州、不萊梅州、巴登符騰堡州、梅克倫堡-前波莫瑞州。

- 根據德國航太工業協會(BDLI)的數據,2021年德國的總銷售額為314億歐元(約370億美元)。民用航空的收入佔有率最高,約 220 億歐元(約 260 億美元)。這是世界上第六架在德國組裝和交付的民航機。

- 德國工業協會在報告中表示,2022年至2026年間,德國汽車工業將投資2,200億歐元(約2,603億美元)。

- OICA也在年報中宣布,2021年汽車(僅汽車和輕型商用車)產量為330萬輛。因此,隨著飛機和汽車產量的增加,預測期內碳纖維的消費量將會增加。

- 總體而言,預計各個最終用戶行業需求的增加將在預測期內推動該國的市場。

歐洲碳纖維產業概況

歐洲碳纖維市場高度整合。主要企業包括(排名不分先後)三菱化學碳纖維及複合材料公司、西格里碳素公司、索爾維公司、帝人有限公司和東麗工業公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對節能和輕型車輛的需求不斷增加

- 航太和國防領域的最新進展

- 抑制因素

- 再生碳纖維供應鏈安全

- 替代品的可用性

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(金額/數量))

- 原料

- 聚丙烯腈 (PAN)

- 石油瀝青和人造絲

- 類型

- 原生纖維 (VCF)

- 再生纖維(RCF)

- 目的

- 複合材料

- 紡織產品

- 微電極

- 催化劑

- 最終用戶產業

- 航太/國防

- 替代能源

- 車

- 建築基礎設施

- 體育用品

- 其他

- 地區

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)分析**/排名分析

- 主要企業策略

- 公司簡介

- Airborne International BV

- Fairmat

- Hexcel Corporation

- HYOSUNG ADVANCED MATERIALS

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Nippon Graphite Fiber Co., Ltd.

- SGL Carbon

- Solvay

- TEIJIN LIMITED

- TORAY INDUSTRIES, INC.

第7章 市場機會及未來趨勢

- 再生碳纖維越來越受歡迎

- 重視使用木質素作為碳纖維原料

- 擴大風力發電領域的應用

The Europe Carbon Fiber Market is expected to register a CAGR of greater than 12% during the forecast period.

The COVID-19 pandemic significantly impacted the worldwide automobile and aerospace industries, considering a temporary halt in end-user operations owing to government-imposed lockdowns in many parts of the world. In the post-pandemic scenario, however, the industry recovered and is anticipated to grow significantly over the next few years.

Key Highlights

- The major factors driving the market's growth are the increasing demand for fuel-efficient and lightweight vehicles and recent advancements in the aerospace and defense industry.

- However, supply chain security for recycled carbon fiber and substitutes' availability was restraining the market studied.

- The increasing popularity of recycled carbon fiber, the emphasis on using lignin as raw material for carbon fiber, and the increasing application in the wind energy sector are likely to act as opportunities for the market studied over the forecast period.

- Germany accounted for the largest market share and is expected to remain dominant during the forecast period.

Europe Carbon Fiber Market Trends

Aerospace and Defense Industry to Dominate the Market

- Carbon fiber is a fibrous carbon material with a micro graphite crystal structure made by fibrillation of acrylic resin or from oil/coal pitch and then given certain heat treatment. Carbon fiber is almost ten times stronger than steel and less than half its weight. It also exhibits high rigidity.

- Carbon fiber's excellent physical and mechanical qualities, which include its light weight, durability, metal-hybrid compositions, resistance to corrosion and chemical deterioration, impact resistance, and temperature resistance, make it a reliable, fuel-efficient, and top choice in the aerospace and defense sectors. It is due to thanks to these exceptional qualities.

- Carbon Fiber Reinforced Polymer (CFRP) is used in the different parts used in the aerospace industry. The CFRP provides lightweight components for the industry and is used in aircraft brakes as the filler for lightweight composite materials and high-performance insulation material.

- After going through a tough COVID-19 period, the European aerospace and defense industry demonstrated its resilience by rebounding from the tough period with strong revenue generated in the market. According to the Aerospace, Security, and Defence Industries Association of Europe (ASD), the organization plans to achieve the challenge of being the net zero emission of CO2 by 2050.

- The report by ASD also stated that the total turnover for the year 2021 was estimated to be around EUR 238 billion (USD 282 billion), an increase of 10% compared to the previous year. The major contributor to overall turnover is civil aeronautics which holds a share of about 45% of the total turnover.

- According to Boeing, Europe will have a share of 24% across the global services market value, accounting for USD 850 billion of the total market share for 2022-2041. The total number of fleets in the region is also expected to reach about 9,360 in 2041.

- The German Aerospace Industries Association (BDLI) also provided key figures related to the Aerospace and Defense Industry in its annual report. The country saw a total sale of EUR 31.4 billion (~USD 37 billion) during the financial year 2021. The major share is civil aviation, which accounts for about EUR 22 billion (~USD 26 billion). The country's civil aviation market had never seen a major upgrade compared to last year due to the COVID-19 effect on the industry.

- Moreover, Germany is the largest contributor to the European Space Agency (ESA), with a contribution of EUR 3.5 billion (~USD 4.14 billion) in the year 2022, followed by France, which had a contribution of EUR 3.25 billion (~USD 3.85 billion).

- With the increasing market for the aerospace and defense industry, the demand for carbon fiber consumption is also expected to enhance and thus drive the market forward for the forecast period.

Germany to Dominate the Market

- Germany, one of the leading manufacturing bases for the aircraft industry, is home to manufacturers from different segments, such as equipment manufacturers, material and component suppliers, engine producers, and whole system integrators.

- The country hosts many production bases for interior aircraft components, MRO (maintenance, repair, and overhaul), and lightweight construction and materials, largely in Bavaria, Bremen, Baden-Wurttemberg, and Mecklenburg-Vorpommern.

- According to the German Aerospace Industries Association (BDLI), the country saw total sales of EUR 31.4 billion (~USD 37 billion) during the financial year 2021. Civil aviation observed the highest market share of sales, around EUR 22 billion (~USD 26 billion). Every sixth commercial aircraft worldwide is assembled in and delivered from Germany.

- The German Association of Automotive Industry stated in its report that there will be an investment of EUR 220 billion (~USD 260.3 billion) in the German automotive industry between 2022-2026.

- OICA also published in its yearly report that there was a production of 3.3 million units of automobiles (cars and LCVs only) in the year 2021. Thus, with the increased production of aircraft and automobiles production, carbon fiber consumption will increase during the forecast period.

- Overall, the growing demand from various end-user industries is projected to drive the market in the country during the forecast period.

Europe Carbon Fiber Industry Overview

The carbon fiber market in Europe is highly consolidated. The major companies include (not in particular order) Mitsubishi Chemical Carbon Fiber and Composites Inc., SGL Carbon, Solvay, TEIJIN LIMITED, and TORAY INDUSTRIES, INC., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Fuel-efficient and Lightweight Vehicles

- 4.1.2 Recent Advancements in the Aerospace and Defense Sector

- 4.2 Restraints

- 4.2.1 Supply Chain Security for Recycled Carbon Fiber

- 4.2.2 Availability of Substitutes

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Raw Material

- 5.1.1 Polyacrtlonitrile (PAN)

- 5.1.2 Petroleum Pitch and Rayon

- 5.2 Type

- 5.2.1 Virgin Fiber (VCF)

- 5.2.2 Recycled Fiber (RCF)

- 5.3 Application

- 5.3.1 Composite Materials

- 5.3.2 Textiles

- 5.3.3 Microelectrodes

- 5.3.4 Catalysis

- 5.4 End-user Industry

- 5.4.1 Aerospace & Defense

- 5.4.2 Alternative Energy

- 5.4.3 Automotive

- 5.4.4 Construction & Infrastructure

- 5.4.5 Sporting Goods

- 5.4.6 Other End-user Industries

- 5.5 Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Italy

- 5.5.4 France

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Airborne International BV

- 6.4.2 Fairmat

- 6.4.3 Hexcel Corporation

- 6.4.4 HYOSUNG ADVANCED MATERIALS

- 6.4.5 Mitsubishi Chemical Carbon Fiber and Composites Inc.

- 6.4.6 Nippon Graphite Fiber Co., Ltd.

- 6.4.7 SGL Carbon

- 6.4.8 Solvay

- 6.4.9 TEIJIN LIMITED

- 6.4.10 TORAY INDUSTRIES, INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Popularity of Recycled Carbon Fibre

- 7.2 Emphasis on Usage of Lignin as Raw Material for Carbon Fiber

- 7.3 Increasing Application in Wind Energy Sector