|

市場調查報告書

商品編碼

1640395

北美碳纖維:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Carbon Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

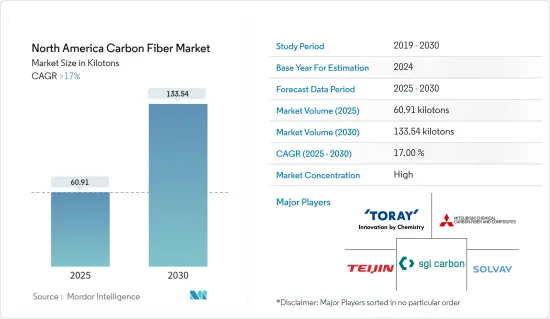

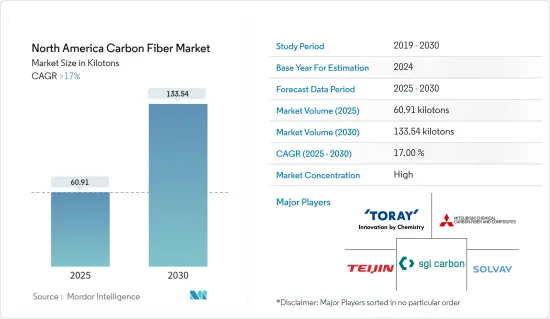

北美碳纖維市場規模預計在 2025 年為 60.91 千噸,預計在 2030 年將達到 133.54 千噸,預測期內(2025-2030 年)的複合年成長率將超過 17%。

COVID-19疫情擾亂了北美碳纖維市場。封鎖措施、生產停頓和消費支出下降減少了對碳纖維複合材料的需求,而碳纖維複合材料用於汽車零件、飛機結構和其他應用。經濟不確定性導致許多公司推遲或取消碳纖維材料的訂單。隨著隔離措施的放鬆和經濟活動的恢復,北美對碳纖維的需求開始恢復。汽車、航太、建築等碳纖維消費大戶產業逐步恢復營運,帶動了碳纖維產品的需求。

對更輕、更省油的汽車的需求不斷增加、碳纖維在航太和國防工業中的使用不斷增加以及碳纖維在可再生能源中的使用不斷增加是推動北美碳纖維市場發展的主要因素。

然而,該領域研發活動的高投入和替代品的可用性預計將阻礙碳纖維市場的成長。

未來的機會將來自於對再生碳纖維的需求不斷成長,以及對使用木質素作為碳纖維主要原料的日益關注。

美國佔據著最大的市場佔有率,並且這種狀況在未來幾年內可能仍將持續。

北美碳纖維市場趨勢

航太和國防工業佔市場主導地位

- 碳纖維因其優異的強度重量比而在航太和國防工業中廣受歡迎。飛機和防禦系統需要既堅固又輕巧的材料來最大限度地提高性能和燃油效率。碳纖維複合材料的這些特性使製造商能夠減輕飛機和國防設備的重量,而不會影響結構完整性或性能。

- 航太和國防應用通常需要能夠承受高溫、高壓和機械應力等惡劣條件的材料。碳纖維複合材料對這些元素具有出色的抵抗力,使其成為飛機機身、機翼、旋翼和防彈系統等關鍵部件的理想選擇。

- 北美航太和國防領域是碳纖維製造商的關鍵市場。這些產業的需求通常會推動對大型生產設施和研發的投資。包括主要航太製造商和國防承包商在內的北美公司一直在大力投資碳纖維技術,以滿足對輕質高性能材料日益成長的需求。

- 根據航太工業協會發布的預估,2022年美國航太和國防工業的總銷售額將超過9,520億美元,較2021年成長約6.7%。

- 此外,航太工業協會 (AIA) 估計,2022 年航太和國防工業出口總額將增加 4.4%,達到 1,048 億美元。

- 航太和國防合約通常涉及製造商、供應商和政府機構之間的長期協議和夥伴關係。碳纖維供應商經常與航太和國防公司建立戰略關係,以確保材料供應的長期合約。這些夥伴關係有助於航太和國防工業主導北美碳纖維市場。

- 由於這些因素,預計航太和國防工業將在預測期內佔據該地區的市場主導地位,從而導致該地區的碳纖維市場呈指數級成長。

美國主導市場

- 美國擁有一些世界上最大、最先進的航太和國防公司,包括波音、洛克希德馬丁、諾斯羅普格魯曼和雷神公司。這些公司對飛機、太空船、飛彈和防禦系統的碳纖維材料的需求很高。

- 美國擁有強大的專注於碳纖維技術的研發基礎設施。領先的大學、國家實驗室和私人研究機構正在對碳纖維材料、製造流程和應用進行廣泛的研究。此項研發投資促進了碳纖維產業的創新和技術進步。

- 根據美國經濟分析局(BEA)發布的資料,2023年美國汽車業銷售了約1,550萬輛輕型汽車。這一數字包括約 312 萬輛乘用車和略高於 1240 萬輛輕型汽車的零售量。

- 美國是碳纖維材料和複合材料的重要製造地。幾家主要的碳纖維製造商在美國設有生產工廠,包括赫氏公司、東麗和索爾維。這些公司向航太、汽車、風力發電和體育用品等多個行業供應碳纖維產品。

- 碳纖維複合材料主要用於建築領域,例如加固水泥建築物、橋樑組件和建築外部等。碳纖維加固可以使基礎設施計劃更堅固、更耐用、更抗震。

- 根據美國人口普查局的數據,2022年美國建築業公共建設金額為9,391.7億美元。將 2021 年與 2022 年公共建築總支出 3,653.2 億美元進行比較,建築業有所成長。

- 預計所有這些因素都將在未來幾年對該地區的碳纖維需求產生重大影響。

北美碳纖維產業概況

北美碳纖維市場高度整合。主要企業包括(不分先後順序)三菱化學碳纖維複合材料公司、西格里碳纖維公司、索爾維公司、帝人公司、東麗公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 省油、輕量化汽車的需求日益增加

- 加速航太和國防領域的應用

- 擴大可再生能源領域的應用

- 限制因素

- 高研發投入

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模:基於數量)

- 按原料

- 聚丙烯腈(PAN)

- 石油瀝青、人造絲

- 按類型

- 原生纖維 (VCF)

- 再生纖維(RCF)

- 按應用

- 複合材料

- 紡織產品

- 微電極

- 催化劑

- 按最終用戶產業

- 航太和國防

- 替代能源

- 車

- 建築與基礎設施

- 體育用品

- 其他最終用戶產業(海洋和海事)

- 按地區

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- A&P Technology Inc.

- DowAksa

- Formosa M Co. Ltd

- Hexcel Corporation

- Hyosung Advanced Materials

- Mitsubishi Chemical Carbon Fiber and Composites Inc.

- Present Advanced Composites Inc.

- SGL Carbon

- Solvay

- TEIJIN LIMITED

- Toray Industries Inc.

- Vartega Inc.

第7章 市場機會與未來趨勢

- 再生碳纖維越來越受歡迎

- 強調使用木質素作為碳纖維的原料

The North America Carbon Fiber Market size is estimated at 60.91 kilotons in 2025, and is expected to reach 133.54 kilotons by 2030, at a CAGR of greater than 17% during the forecast period (2025-2030).

The COVID-19 pandemic disrupted the North American carbon fiber market. Lockdown measures, production halts, and reduced consumer spending led to a decline in demand for carbon fiber composites used in vehicle components, aircraft structures, and other applications. Many companies postponed or canceled orders for carbon fiber materials amid economic uncertainty. As lockdown measures were eased and economic activities resumed, the demand for carbon fiber in North America began to recover. Industries such as automotive, aerospace, and construction, which are significant consumers of carbon fiber, gradually resumed operations, driving demand for carbon fiber products.

The increased demand for lighter and more fuel-efficient vehicles, increased use of carbon fiber in the aerospace and defense industries, and rise in the use of carbon fiber for renewable energy are the main factors driving the North American carbon fiber market.

However, high investments in research and development activities in this sector and the availability of substitutes are expected to hinder the growth of the carbon fiber market.

Opportunities for the future come from the growing demand for recycled carbon fiber and the increasing focus on using lignin as the primary raw material for carbon fiber.

The United States had the most significant share of the market, and this is likely to stay valid for the upcoming years.

North America Carbon Fiber Market Trends

Aerospace and Defense Industry to Dominate the Market

- Carbon fiber is valued in the aerospace and defense sectors for its exceptional strength-to-weight ratio. Aircraft and defense systems require materials that are both strong and lightweight to maximize performance and fuel efficiency. Carbon fiber composites offer these characteristics, allowing manufacturers to reduce the weight of aircraft and defense equipment without compromising structural integrity or performance.

- Aerospace and defense applications often require materials that can endure extreme conditions like high temperatures, pressure, and mechanical stress. Carbon fiber composites exhibit excellent resistance to these factors, making them suitable for critical components such as aircraft fuselages, wings, rotor blades, and ballistic protection systems.

- The aerospace and defense sectors in North America represent significant markets for carbon fiber manufacturers. The demand from these industries often drives large-scale production facilities and investments in research and development. Companies in North America, including major aerospace manufacturers and defense contractors, have invested heavily in carbon fiber technology to meet the growing demand for lightweight and high-performance materials.

- According to the estimate released by the Aerospace Industries Association, the American aerospace and defense industry generated total sales of over USD 952 billion in 2022, which increased by almost 6.7% compared to 2021.

- Furthermore, according to the estimate released by the Aerospace Industries Association (AIA), aerospace and defense industry exports increased by 4.4% in 2022 to a total value of USD 104.8 billion.

- Aerospace and defense contracts typically involve long-term agreements and partnerships between manufacturers, suppliers, and government agencies. Carbon fiber suppliers often establish strategic relationships with aerospace and defense companies to secure long-term contracts for the supply of materials. These partnerships contribute to the dominance of the aerospace and defense industry in the North American carbon fiber market.

- In view of these factors, the aeronautics and defense sector is projected to prevail over the regional market during the forecast period, enabling the carbon fiber market in this region to grow at an exponential rate.

United States to Dominate the Market

- The United States is home to some of the world's largest and most advanced aerospace and defense companies, including Boeing, Lockheed Martin, Northrop Grumman, and Raytheon. These companies have significant demand for carbon fiber materials for aircraft, spacecraft, missiles, and defense systems.

- The United States has a robust research and development infrastructure focused on carbon fiber technology. Leading universities, national laboratories, and private research institutions conduct extensive research on carbon fiber materials, manufacturing processes, and applications. This investment in R&D contributes to innovation and technological advancements in the carbon fiber industry.

- According to the data released by the Bureau of Economic Analysis (BEA), the US automotive industry sold approximately 15.5 million units of light vehicles in 2023. Retail sales of about 3.12 million passenger cars and slightly over 12.4 million light vehicles were included in that number.

- The United States has a significant manufacturing base for carbon fiber materials and composites. Several major carbon fiber producers, including Hexcel Corporation, Toray Industries, and Solvay, have manufacturing facilities in the United States. These companies supply carbon fiber products to various industries, that include aerospace, automotive, wind energy, and sporting goods.

- Carbon fiber composites are majorly being used in the construction sector for applications such as reinforcing concrete structures, bridge components, and building facades. Carbon fiber reinforcement can enhance the strength, durability, and seismic resistance of infrastructure projects.

- According to the United States Census Bureau, USD 939.17 billion was spent on public construction in the US construction sector in 2022. Comparing 2022 to 2021, when the total amount spent on public construction was USD 365.32 billion, the construction sector showed a rise.

- In the coming years, all of these factors are expected to have a significant impact on the demand for carbon fiber in this region.

North America Carbon Fiber Industry Overview

The North American carbon fiber market is highly consolidated. The major companies include (not in particular order) Mitsubishi Chemical Carbon Fiber and Composites Inc., SGL Carbon, Solvay, TEIJIN LIMITED, and Toray Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Fuel-efficient and Lightweight Vehicles

- 4.1.2 Accelerating Usage in the Aerospace and Defense Sector

- 4.1.3 Increasing Usage in Renewable Energy

- 4.2 Restraints

- 4.2.1 High R&D Investments

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Raw Material

- 5.1.1 Polyacrtlonitrile (PAN)

- 5.1.2 Petroleum Pitch and Rayon

- 5.2 By Type

- 5.2.1 Virgin Fiber (VCF)

- 5.2.2 Recycled Fiber (RCF)

- 5.3 By Application

- 5.3.1 Composite Materials

- 5.3.2 Textiles

- 5.3.3 Microelectrodes

- 5.3.4 Catalysis

- 5.4 By End-user Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Alternative Energy

- 5.4.3 Automotive

- 5.4.4 Construction and Infrastructure

- 5.4.5 Sporting Goods

- 5.4.6 Other End-user Industries (Marine and Maritime)

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A&P Technology Inc.

- 6.4.2 DowAksa

- 6.4.3 Formosa M Co. Ltd

- 6.4.4 Hexcel Corporation

- 6.4.5 Hyosung Advanced Materials

- 6.4.6 Mitsubishi Chemical Carbon Fiber and Composites Inc.

- 6.4.7 Present Advanced Composites Inc.

- 6.4.8 SGL Carbon

- 6.4.9 Solvay

- 6.4.10 TEIJIN LIMITED

- 6.4.11 Toray Industries Inc.

- 6.4.12 Vartega Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Popularity of Recycled Carbon Fiber

- 7.2 Emphasis on Usage of Lignin as Raw Material for Carbon Fiber