|

市場調查報告書

商品編碼

1627109

防偽包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)Anti-Counterfeit Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

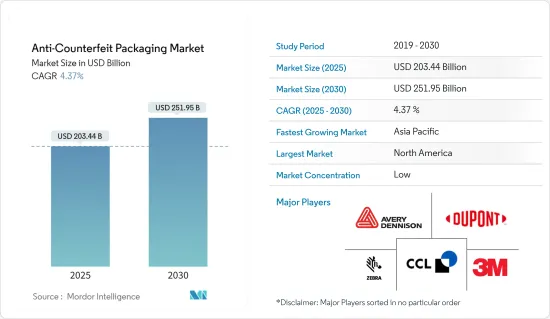

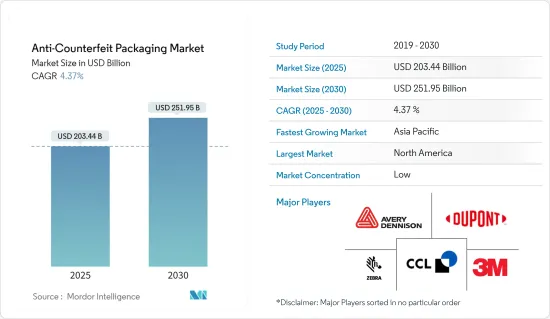

防偽包裝市場規模預計到2025年為2034.4億美元,預計到2030年將達到2519.5億美元,預測期內(2025-2030年)複合年成長率為4.37%。

由於保護生命攸關產品的法規不斷發展、防盜措施的技術進步、各種新出現的威脅以及對品牌保護的日益重視,防偽包裝市場正在不斷成長。

主要亮點

- 包括美國反假冒和盜版協議以及歐盟委員會的標籤和序列化舉措在內的監管措施預計將在預測期內加強新興經濟體的市場。

- 電子商務的蓬勃發展正在推動對防偽包裝解決方案的需求。線上市場簡化了造假者接觸消費者的過程。為此,各品牌正在採用2D碼和近距離場通訊(NFC) 標籤等高級身份驗證功能,使客戶能夠在智慧型手機上驗證產品的真偽。

- 政府和監管機構制定的嚴格法規進一步刺激了市場擴張。歐盟假藥指令 (FMD) 要求所有處方藥均配備唯一識別碼和防篡改裝置。中國有法規要求對某些產品類型實施追蹤系統。這些要求正在刺激序列化技術和安全包裝解決方案的創新。

- 根據 Macfarlane Group UK Ltd 2024 年 7 月報道,客製化防偽包裝符合各行業的獨特要求。製藥業在保護其產品免受假冒威脅方面面臨著巨大的挑戰。為了解決這個問題,請考慮整合防偽包裝功能,例如全像標籤、序列化2D碼和識別條碼。這些增強功能可防止篡改、加強產品認證並確保整個供應鏈中藥品的完整性。

- 然而,由於安裝防偽包裝和技術創新的成本高昂,他們面臨阻礙新進入者和潛在客戶的挑戰。如果沒有足夠的客戶意識,這種猶豫以及條碼和2D碼等現有技術可以輕鬆複製正在阻礙市場擴張。

防偽包裝市場趨勢

藥品和醫療保健推動市場需求

- 假藥包裝是全球非法仿製商品貿易中利潤豐厚的領域之一。假藥傷害甚至殺死了全世界數百萬人。也對各大藥品生產企業的品牌造成了嚴重損害。

- 已經發生多起向不同國家的人們注射假冒新冠肺炎 (COVID-19) 疫苗的事件。例如,世界衛生組織(WHO)發現了仿冒品的Covishield(由印度血清研究所製造),引起了世界各地相關人員的廣泛關注。為了克服這種情況,世界各國政府都致力於制定法規來防止假藥。

- 根據 Oliver 2024 年 9 月的一項研究,零售商擴大在藥品標籤和包裝上採取防偽措施。仿冒品可能會削弱消費者的信心並危及銷售。例如,假藥可能不含活性藥物成分、可能無效或可能含有有害配方。

- 與此同時,製藥業正在將防偽功能融入標籤和包裝中。雖然這些技術不能完全防止犯罪分子篡改產品,但它們確實允許零售商驗證藥品包裝並區分正品和惡意方製造的產品。

- 根據專門從事生命科學的資料分析、技術解決方案和臨床研究服務領域的全球領導者 IQVIA 的數據,2020 年全球醫藥市場收入為 13,120 億美元,預計 2023 年將達到 16,070 億美元。 。因此,全球製藥業收益的增加也可能增加預測期內對防偽包裝的需求。

由於監管規定,北美保持壓倒性的市場佔有率

- 憑藉對研發堅定不移的承諾,北美預計在防偽包裝市場中佔據重要佔有率。美國聯邦政府正在加強消除供應鏈中的仿冒品。透過利用 RFID 和 NFC 等先進包裝技術,互聯包裝正成為保護消費者仿冒品侵害的重要解決方案。

- 隨著消費者對透明度的需求增加,產品的可追溯性也隨之增加。特別是在美國,執法機構每年都要應對經濟合作暨發展組織(OECD) 查獲的價值超過 1 兆美元的假貨。日益嚴格的防偽法規正在進一步提高市場佔有率。

- 為了滿足這種不斷成長的需求,製造商正在將創新技術融入其設備中,以更好地識別和追蹤產品。此外,Astra Zeneca預計,到 2025 年,北美地區的銷售額將達到 7,060 億美元,使該地區成為造假者的有吸引力的目標。然而,防偽包裝市場已趨成熟並有望成長。

- 此外,假冒行為透過濫用與商標相關的商譽和品質來損害品牌聲譽。對於容易受到此類行為影響的品牌來說,法律保護對於保護其在加拿大市場中來之不易的聲譽至關重要。援助請求 (RFA) 計劃允許註冊商標所有者對假貨進口商提出法律質疑,這一過程將在加拿大邊境服務局 (CBSA) 發現後啟動。

- 不斷增加的品牌保護力度和政府的大力支持正在推動北美防偽包裝市場的發展。然而,有限的研發投資和高昂的設置成本的挑戰可能會限制該地區的市場擴張。

防偽包裝產業概況

防偽包裝市場較為分散。就市場佔有率,例如艾利丹尼森公司、CCL工業公司、3M公司、EI杜邦公司和斑馬技術公司。然而,憑藉創新和永續的包裝,許多公司正在透過贏得新合約和開闢新市場來擴大其市場佔有率。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 蓬勃發展的電子商務產業

- 製造商對品牌保護的興趣日益濃厚

- 市場限制因素

- 防偽包裝初始成本較高

- 技術簡介

第6章 市場細分

- 依技術

- 追蹤與追蹤

- 防篡改

- 隱藏

- 隱藏

- 法醫標記

- 按最終用戶產業

- 飲食

- 醫療保健/製藥

- 工業/汽車

- 家用電子產品

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞洲

- 中國

- 印度

- 日本

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 北美洲

第7章 競爭格局

- 公司簡介

- Avery Dennison Corporation

- CCL Industries Inc.

- 3M Company

- EI Du Pont De Nemours and Company

- Zebra Technologies Corporation

- Sicpa Holding SA

- AlpVision SA

- Applied Dna Sciences Inc.

- Uflex Limited

- Authentix Inc.

- Ampacet Corporation

- PharmaSecure Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Anti-Counterfeit Packaging Market size is estimated at USD 203.44 billion in 2025, and is expected to reach USD 251.95 billion by 2030, at a CAGR of 4.37% during the forecast period (2025-2030).

The anti-counterfeit packaging market is witnessing growth, driven by evolving regulations to safeguard life-critical products, technological strides in anti-theft measures, a diverse array of emerging threats, and an increasing emphasis on brand protection.

Key Highlights

- Regulatory measures, including the U.S.'s Anti-counterfeiting Trade Agreement and the EU Commission's labeling and serialization initiatives, are poised to bolster the market in developed economies during the forecast period.

- The surge of e-commerce has heightened the demand for anti-counterfeit packaging solutions. Online marketplaces have simplified counterfeiters' access to consumers. In response, brands are adopting advanced authentication features, like QR codes and near-field communication (NFC) tags, enabling customers to verify product authenticity via smartphones.

- Stringent regulations set by governments and regulatory bodies further fuel the market's expansion. Take the EU's Falsified Medicines Directive (FMD), which mandates unique identifiers and anti-tampering devices for all prescription medications. In China, regulations enforce track-and-trace systems for select product categories. Such mandates have catalyzed innovations in serialization technologies and secure packaging solutions.

- According to Macfarlane Group UK Ltd, in July 2024, customized anti-counterfeit packaging caters to the unique requirements of various industries. The pharmaceutical sector grapples with formidable challenges in safeguarding its products from counterfeit threats. To counteract this, consider integrating anti-counterfeit packaging features such as holographic labels, serialized QR codes, and distinct barcodes. These enhancements deter tampering and bolster product authentication, ensuring the pharmaceuticals' integrity throughout the supply chain.

- However, the market faces challenges owing to the high costs associated with setting up and innovating anti-counterfeit packaging, which deters new entrants and potential clients. Without adequate customer awareness, this hesitance and the ease of replicating existing technologies like barcodes and QR codes hamper market expansion.

Anti-Counterfeit Packaging Market Trends

Pharmaceuticals and Healthcare to Drive the Market Demand

- Counterfeit packaging for pharmaceuticals is one of the lucrative sectors of the global trade in illegally copied goods. Fake drugs harm and even kill millions of people across the world. It inflicts severe damage on the brand names of big pharmaceutical manufacturers.

- Several incidents of fake COVID-19 vaccines were administered to the populations of various countries. For example, the World Health Organization (WHO) discovered counterfeit versions of Covishield (manufactured by the Serum Institute of India), which caused widespread concern among stakeholders worldwide. To overcome this, governments across regions focused on implementing regulations to prevent counterfeit medicines.

- According to a study by Oliver Inc. in September 2024, retailers are increasingly adopting anti-counterfeiting measures in pharmaceutical labeling and packaging. Counterfeit products can erode consumer trust and risk sales. Counterfeit medicines, for instance, might lack active pharmaceutical ingredients, possess ineffective qualities, or even contain harmful formulations.

- On a positive note, the pharmaceutical sector has integrated anti-counterfeiting features into its labeling and packaging. While these technologies can not entirely prevent criminals from altering products, they empower retailers to authenticate pharmaceutical packaging, distinguishing between genuine items and those crafted by malicious entities.

- According to IQVIA, a global leader, delivers data analytics, technology solutions, and clinical research services tailored for the life sciences sector, revenue of global pharmaceutical market in 2020 was USD 1,312 billion and it has reached USD 1,607 billion in 2023. Therefore, rise in revenue of pharmaceutical sector globally will also rise the demand for anti-countefeit packaging over the forecast period.

Regulations Have Enabled North America to Maintain a Dominant Market Share

- North America is poised to command a significant share of the anti-counterfeit packaging market, bolstered by its unwavering commitment to research and development. The U.S. Federal Government is intensifying efforts to purge counterfeit goods from its supply chain. Leveraging advanced technologies like RFID and NFC, connected packaging emerges as a pivotal solution in safeguarding consumers from counterfeit products.

- As consumer demand for transparency surges, so does the traceability of products. Notably, the U.S. grapples with counterfeit goods valued over USD 1 trillion annually, derived from law enforcement seizures and reported by the Organization for Economic Cooperation and Development. Strengthened anti-counterfeit regulations have further bolstered the market's share.

- In response to this escalating demand, manufacturers embed innovative technologies into their equipment, enhancing product identification and tracking. Furthermore, with projections from AstraZeneca estimating North American sales at USD 706 billion by 2025, the region becomes a prime target for counterfeiters. However, the anti-counterfeit packaging market is set for growth, given its maturity.

- Further, counterfeiting undermines a brand's reputation by exploiting the goodwill and quality associated with its trademark. Legal protections are vital for brands susceptible to such practices to safeguard their hard-earned reputation in the Canadian market. The Request for Assistance (RFA) program empowers registered trademark owners to legally challenge importers of counterfeit goods, a process initiated upon detection by the Canadian Border Services Agency (CBSA).

- Heightened brand protection efforts and robust government backing fuel the North American anti-counterfeit packaging market. However, challenges loom: limited R&D investments and the burden of high setup costs could temper the market's expansion in the region.

Anti-Counterfeit Packaging Industry Overview

The anti-counterfeit packaging market is fragmented. A few major players, such as Avery Dennison Corporation, CCL Industries Inc., 3M Company, E.I. Du Pont De Nemours and Company, Zebra Technologies Corporation, and others, dominate the market in terms of market share. However, with innovative and sustainable packaging, many companies are increasing their market presence by securing new contracts and tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Booming E-commerce Industry

- 5.1.2 Increasing Focus of Manufacturers on Brand Protection

- 5.2 Market Restraint

- 5.2.1 High-initial Costs of Anti-Counterfeit Packaging

- 5.3 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Trace and Track

- 6.1.2 Tamper-evident

- 6.1.3 Covert

- 6.1.4 Overt

- 6.1.5 Forensic Markers

- 6.2 By End-User Industries

- 6.2.1 Food and Beverage

- 6.2.2 Healthcare and Pharmaceuticals

- 6.2.3 Industrial and Automotive

- 6.2.4 Consumer Electronics

- 6.2.5 Other End User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.6 Middle East & Africa

- 6.3.6.1 South Africa

- 6.3.6.2 United Arab Emirates

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avery Dennison Corporation

- 7.1.2 CCL Industries Inc.

- 7.1.3 3M Company

- 7.1.4 E.I. Du Pont De Nemours and Company

- 7.1.5 Zebra Technologies Corporation

- 7.1.6 Sicpa Holding SA

- 7.1.7 AlpVision SA

- 7.1.8 Applied Dna Sciences Inc.

- 7.1.9 Uflex Limited

- 7.1.10 Authentix Inc.

- 7.1.11 Ampacet Corporation

- 7.1.12 PharmaSecure Inc.