|

市場調查報告書

商品編碼

1627123

美國玻璃包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)United States Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

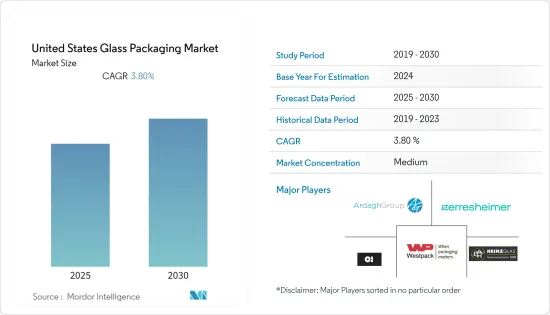

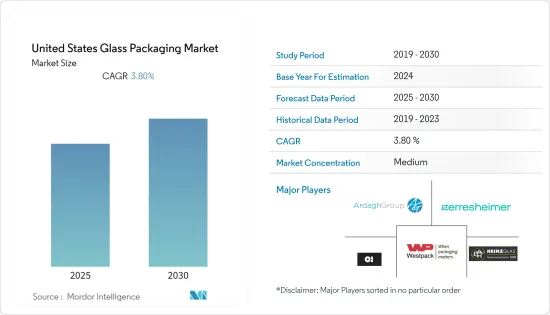

美國玻璃包裝市場預計在預測期內複合年成長率為3.8%

主要亮點

- 消費者對安全健康包裝的需求不斷成長,推動了各類別玻璃包裝的成長。此外,在玻璃製造和包裝中添加壓花、成型和藝術飾面的創新技術也越來越受到最終用戶的青睞。此外,對環保產品的需求增加以及食品和飲料市場需求的增加等因素預計也將刺激市場成長。

- 軟性飲料在全球一次性寶特瓶佔據主導地位。然而,政府法規的收緊正在促使各種軟性飲料供應商轉而使用玻璃瓶。

- 美國在醫藥市場的消費和發展方面也佔據主導地位。根據專注於健康研究的媒體 STAT 報導,預計 2019 年處方藥支出將從估計的 5,000 億美元增加到 6,000 億美元,這將進一步推動該國的藥用玻璃包裝市場。

- 美國不同地區擴大採用紙張、塑膠、金屬和木材等替代形式的包裝,是影響預測期內市場成長的突出因素之一。去年 5 月,美國能源局(DOE) 宣布將投資 1,450 萬美元用於研發,以減少廢棄物並減少用於回收一次性塑膠(例如塑膠購物袋、薄膜和包裝材料)的能源。

- 鑑於需求增加,美國的其他製造商也在提高產量,以滿足對 COVID-19 疫苗包裝的需求。例如,去年 3 月,美國兩家主要醫療保健和製藥公司默克 (Merck) 和強生 (Johnson & Johnson) 宣佈建立合作夥伴關係,以擴大強生 (J&J) 的 COVID-19 疫苗的生產規模。此次合作將提升疫苗原料藥的製造和填充能力。疫情大流行後,消費者開始關注更健康的生活方式,並開始尋找永續的解決方案,特別是與食品和飲料產業相關的產品。由於購買力增加、現代零售、都市化以及消費者健康和衛生意識的提高而導致的需求激增,預計將為疫情後世界的玻璃包裝行業提供顯著的成長機會。

美國玻璃包裝市場趨勢

食品和飲料需求的增加推動了市場

- 玻璃因其中性反應和可回收性等特性而被廣泛用作食品和飲料領域的包裝材料。它還可以讓您長期儲存食物和飲料並避免污染。例如,啤酒儲存在深色玻璃瓶中以避免變質。

- 各種食物都放置在玻璃容器中。其中包括即溶咖啡、嬰兒食品、乾混料、香辛料、乳製品、糖漬(果醬和橘子醬)、糖漿、塗抹醬、加工水果和蔬菜、魚和肉品、芥末和調味料。在這些食品和飲料類別中,產品範圍從乾粉和顆粒到液體、碳酸和壓力包裝產品以及熱滅菌產品。

- 自古以來,玻璃已被證明是飲料行業的絕佳包裝選擇,並且今天仍然如此。玻璃瓶可保持內容物的品質並保護產品免受外部因素的影響,因此在食品和飲料行業中具有出色的應用。

- 玻璃不會滲透空氣和其他液體,因此玻璃瓶不會影響產品的風味或新鮮度。此外,熱量等外部溫度不會影響玻璃的材質或形狀,而塑膠則不同,塑膠會熔化並影響產品的品質。這使得玻璃包裝的食品和飲料能夠保持極其新鮮。另外,由於玻璃瓶的內部溫度不會變化,因此產品不會變質。

- 在美國,酒精飲料佔玻璃瓶的大部分。大部分烈酒和葡萄酒採用玻璃容器包裝。根據美國人口普查局的數據,美國啤酒、葡萄酒和烈酒商店去年的銷售額約為 77 億美元。

個人護理領域預計將顯著成長

- 儘管塑膠包裝技術近年來取得了長足的進步,但玻璃仍然在奢華香水、護膚和個人護理包裝中佔據主導地位。化妝品和香水應用中使用的大多數玻璃是由天然或永續材料製成的,例如沙子、石灰石和堿灰。大多數玻璃包裝產品都是100%可回收的,可以無限期回收而不會影響品質或純度,80%的回收玻璃被加工成新的玻璃產品。

- 化妝品容器包括瓶子、調色盤、罐子、管瓶和安瓿,用於包裝護膚、護髮品、指甲護理品和化妝品。化妝品容器包括用於豪華化妝品包裝的玻璃容器。玻璃容器(包括罐子和瓶子)在美國廣泛使用,因為它有多種分配器可供選擇,包括噴嘴和滴嘴、泡沫蓋、噴嘴和泵頭。

- 推動化妝品玻璃包裝需求的因素是不斷擴大的全球香水市場,該市場一直是玻璃包裝的大本營。儘管該行業繼續受到個人整裝儀容和收入驅動型消費支出的推動,主要企業也專注於推出具有吸引力的形狀和尺寸的玻璃瓶。

- 此外,市場正在轉向高度創新的產品,包括輕質、防碎和裝飾複雜的替代品。化妝品玻璃瓶市場目前由豪華香水領域主導,該領域佔有重要的市場佔有率,預計在未來五到七年內將保持其成長速度。

- 美國美容和個人護理市場在全球範圍內受到青睞。在購買行為方面,美國消費者經常光顧沃爾瑪和塔吉特等「大型」零售商以及 CVS 等連鎖藥局,尋找他們喜歡的產品。根據美國勞工統計局的數據,去年美國每位消費者在化妝品、香水和沐浴產品上的平均年支出約為 182.3 美元。

美國玻璃包裝產業概況

美國玻璃包裝市場適度分散,有多家公司在國內和國際上運作。公司正在採取產品創新、聯盟、併購和收購等策略來增加市場佔有率。市場的領先供應商包括 Owens illinois Inc.、West-Pack, LLC、Gerresheimer AG、Ardagh Group 和 Heinz Glas USA Inc.。

2022 年 9 月:Ardagh Glass Packaging 與 Ste.Michelle Wine Estates 合作,過渡到 Eco 系列玻璃包裝。此創新系列提供玻璃的所有永續性優勢,同時保持高品質、增加客戶吸引力並減少整體環境影響。

2022 年 8 月:美國、生技和化妝品的醫療保健、美容解決方案和給藥系統的領先供應商 Gerresheimer AG 將擴大其在美國的管瓶製造、供應和物流能力,宣布將進行投資。製造工廠的投資額達到9,400 萬美元。該計劃得到了生物醫學高級研究與開發局(BARDA) 的支持,該機構是衛生與公眾服務部(HHS) 負責準備和響應的助理部長辦公室(ASPR) 的一部分,並得到了衛生與公眾服務部(HHS) 的合約支援。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 對環保產品的需求不斷增加

- 食品和飲料市場需求增加

- 市場挑戰

- 來自替代包裝解決方案的激烈競爭

第6章 市場細分

- 依產品

- 瓶子

- 瓶子

- 管瓶

- 其他

- 按最終用戶產業

- 食物

- 飲料

- 個人護理

- 衛生保健

- 家居用品

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- Owens Illinois Inc.

- West-Pack LLC

- Gerresheimer AG

- Ardagh Group

- Heinz Glas USA Inc.

- Stoelzle Glass USA Inc.

- Piramal Glass USA

- Vitro SAB de CV

第8章投資分析

第9章 市場機會及未來趨勢

The United States Glass Packaging Market is expected to register a CAGR of 3.8% during the forecast period.

Key Highlights

- Increasing consumer demand for safe and healthier packaging is helping glass packaging grow in different categories. Also, innovative technologies for embossing, shaping and adding artistic finishes to glass making and packaging are more desirable among end users. Furthermore, factors, such as the increasing demand for eco-friendly products and the rising demand from the food and beverage market are expected to stimulate the market's growth.

- Soft drinks hold a prominent share of single-use plastic bottles globally. Nevertheless, various soft drink vendors are switching back to glass bottles due to increasing government regulation.

- The United States also dominates the pharmaceutical market in consumption and development. According to the STAT (media focused on health survey), prescription drug spending was considered to add up to USD 600 billion, up from an estimated USD 500 billion in the year 2019, which is further expected to drive the market for pharmaceutical glass packaging in the country.

- The growing adoption of alternative forms of packaging, such as paper, plastic, metal, and wood, in different parts of the United States is among the prominent factors affecting the market's growth over the forecast period. In May last year, the US Department of Energy (DOE) announced an investment of up to USD 14.5 million for R&D to cut waste and reduce the energy used to recycle single-use plastics like plastic bags, films, and wraps.

- Considering the growing demand, other manufacturers across the United States have also stepped up their output to meet the demand for packaging COVID-19 vaccines. For instance, in March last year, two of the largest US healthcare and pharmaceutical companies, Merck and Johnson & Johnson, announced their collaboration to expand the production of J&J's COVID-19 vaccine. The partnership would increase the manufacture of vaccine drug substances and their fill-finish capacity. After the pandemic, consumers are now more focused on adopting a healthier lifestyle and have started looking for sustainable solutions, especially for products related to the food and beverage sector. The surge in demand, owing largely to the growing purchasing power, modern retail, urbanization, and increasing awareness about health and hygiene among consumers, is expected to create significant growth opportunities for the glass packaging industry in the post-pandemic world.

US Glass Packaging Market Trends

Rising Demand from the Food and Beverage Driving the Market

- Glass is extensively preferred as a packaging material in the food and beverage sector due to its properties like neutral reacting and recycling reuse nature. It also preserves food and beverages for the long term and avoids contamination. For instance, beer is stored in dark glass bottles to avoid spoilage.

- A wide range of foods is packed in glass containers. Some include instant coffee, processed baby foods, dry mixes, spices, dairy products, sugar preserves (jams and marmalades), syrups, spreads, processed fruit, vegetables, fish and meat products, mustards, condiments, etc. Within these categories of food and drinks, the products range from dry powders and granules to liquids, some carbonated and packed under pressure, and heat sterilized products.

- Since ancient times, glass proved to be a great packaging option for the beverage industry, and this remains true today. Glass bottles provide excellent uses for the food and beverage industry by maintaining the quality of their contents and protecting the product from external factors.

- Glass is an impermeable material that keeps air and other liquids out, so glass bottles never affect the product's flavor or freshness. Additionally, external temperatures, such as heat, do not affect the material or shape of the glass, unlike plastics, which could melt and affect the product quality. Because of this, food and beverage products remain extremely fresh when packaged in glass. Glass bottles also help the packaging's internal temperature stay the same, so products do not spoil.

- Alcoholic beverages dominate the glass bottles segment in the United States. A high percentage of distilled spirits and wines are packaged using glass containers. According to U.S. Census Bureau, U.S. beer, wine, and liquor store sales last year were about USD 7.7 billion.

Personal Care Segment is Expected to Witness Significant Growth

- Plastic packaging technologies have come a long way recently, but glass dominates upscale fragrance, skincare, and personal care packaging. Most glass used for cosmetic and fragrance applications is made from natural and sustainable materials, including sand, limestone, and soda ash. Most glass packaging products are 100% recyclable and can be recycled infinitely without loss in quality and purity, from which 80% of the glass recovered is made into new glass products.

- Cosmetic containers comprise bottles, palettes, jars, as well as vials, and ampoules, among others, which are used for the packaging of skincare, haircare, nail-care, and make-up products. Cosmetic containers are available in glass containers for luxury cosmetic packaging. Glass containers containing jars and bottles are widely used in the United States due to the numerous dispensing options, including jet and drop inserts, frothing caps, spray nozzles, and pump heads.

- The factor responsible for boosting demand for cosmetic glass packaging is the growing perfume market globally, which has always been a home for glass packaging. While the sector continues to be driven by personal grooming and income-driven personal spending, key players are also focusing on introducing attractive shapes and sizes of glass bottles.

- Moreover, the market is moving toward highly innovative products, including lightweight, breakage-resistant, and intricately decorated alternatives. The cosmetic glass container market is dominated by the premium perfume segment, which currently holds a substantial percent market share and is expected to continue its pace over the next five to seven years.

- The beauty and personal care market in the United States is lucrative worldwide. Regarding purchasing behavior, American customers frequently resort to "Big-Box" retail shops, such as Walmart or Target, or pharmacy chains, such as CVS, to find their favorite products. According to the Bureau of Labor Statistics, last year, the average yearly expenditure on cosmetics, perfume, and bath preparation items in the United States was approximately USD 182.3 per consumer unit.

US Glass Packaging Industry Overview

The United States Glass Packaging Market is moderately fragmented, owing to multiple domestic and international players operating in the country. The players have been adopting strategies, such as product innovation, partnerships, mergers, and acquisitions to expand their market share. Some prominent vendors in the market are Owens Illinois Inc., West-Pack, LLC, Gerresheimer AG, Ardagh Group, and Heinz Glas USA Inc., among others.

September 2022: Ardagh Glass Packaging partnered with Ste. Michelle Wine Estates to transition to Eco Series glass packaging. The innovative series offers all of the sustainability advantages of glass while maintaining high quality, improving customer appeal, and lowering total environmental impact.

August 2022: Gerresheimer AG, a leading provider of healthcare and beauty solutions and drug delivery systems for pharma, biotech, and cosmetics, announced an investment of up to 94 million USD in a US manufacturing facility to expand its manufacturing rapidly, supply and logistics capability for glass vials in the United States. The project would be supported by the Biomedical Advanced Research and Development Authority (BARDA), which is part of the Office of the Assistant Secretary for Preparedness and Response (ASPR) at the Department of Health and Human Services (HHS), with contracting assistance provided by the Department of Defense.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Eco-friendly Products

- 5.1.2 Rising Demand from the Food and Beverage Market

- 5.2 Market Challenges

- 5.2.1 High Competition from Substitute Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Products

- 6.1.1 Bottles

- 6.1.2 Jars

- 6.1.3 Vials

- 6.1.4 Others

- 6.2 By End-User Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Personal care

- 6.2.4 Healthcare

- 6.2.5 Household care

- 6.2.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Owens Illinois Inc.

- 7.1.2 West-Pack LLC

- 7.1.3 Gerresheimer AG

- 7.1.4 Ardagh Group

- 7.1.5 Heinz Glas USA Inc.

- 7.1.6 Stoelzle Glass USA Inc.

- 7.1.7 Piramal Glass USA

- 7.1.8 Vitro SAB de CV