|

市場調查報告書

商品編碼

1687043

玻璃包裝:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

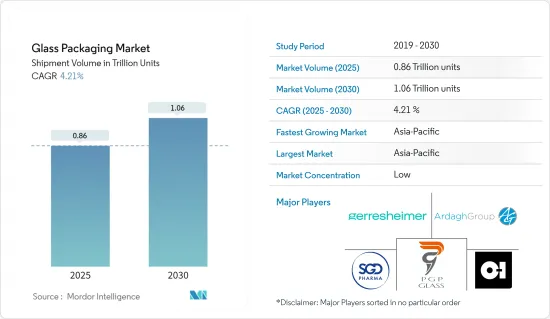

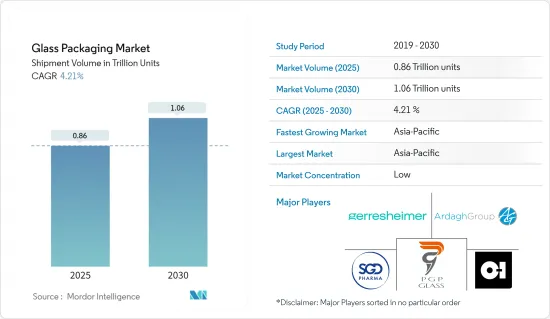

玻璃包裝市場預計將從 2025 年的 8,600 億個單位成長到 2030 年的 1.6 兆個單位,預測期內(2025-2030 年)的複合年成長率為 4.21%。

主要亮點

- 玻璃包裝在健康、偏好和環境安全方面被認為是最值得信賴的包裝形式之一。優質玻璃包裝保持了產品的新鮮度和安全。因此,儘管面臨其他形式包裝的激烈競爭,但它仍然在各種終端用戶行業中被使用。

- 消費者對更安全、更健康包裝的需求不斷成長,推動玻璃包裝在各個類別中不斷發展。此外,在玻璃上壓花、塑形和添加藝術飾面的創新技術也使玻璃包裝更受最終用戶的青睞。由於對環保產品的需求不斷增加以及食品和飲料行業的需求不斷成長,市場正在成長。

- 玻璃被廣泛認為是最環保的包裝形式,因為它可回收。輕質玻璃已成為一項重大創新,它具有與傳統玻璃材料相同的耐久性和高穩定性,同時減少了原料需求和二氧化碳排放。

- 隨著消費者人均支出的增加和生活方式的改變,印度和中國等新興市場對啤酒、軟性飲料和蘋果酒的需求很高。然而,營運成本的上升以及塑膠和錫等替代產品的使用的增加正在抑制市場的成長。

- 市場面臨的主要挑戰之一是來自鋁罐和塑膠容器等替代包裝形式的競爭日益激烈。這些產品比大塊玻璃更輕,運輸成本更低,因此越來越受到製造商和客戶的歡迎。此外,原物料價格上漲導致成本上升,使得大規模生產商品在經濟上不可行。

- 隨著消費者對永續性的興趣越來越大,啤酒製造商正在與玻璃瓶和容器製造商採取合作和夥伴關係策略,以玻璃瓶形式提供啤酒產品,以實現其永續性目標。 2023 年 5 月,Ardagh Glass Packaging Ltd.(Ardagh Group)與 Sprecher Brewing Co. 宣佈建立合作夥伴關係。此次夥伴關係將透過 Ardagh Glass Packaging 持續供應玻璃啤酒和飲料瓶,支持該啤酒廠保持在地化和永續的業務。使用高品質玻璃瓶提供啤酒也有助於釀酒商實現其品牌和永續性目標。

玻璃瓶市場趨勢

飲料業佔最高市場佔有率

- 優質化趨勢在包括軟性飲料在內的各種飲料類別的玻璃包裝選擇中發揮作用。軟性飲料在世界各地很受歡迎,因此佔據了很大的市場佔有率。軟性飲料有多種口味和形式,適合任何飲酒場合。

- 酒精飲料產業的玻璃包裝市場面臨來自罐裝金屬包裝領域的激烈競爭。然而,由於其在高級產品中的應用,預計在預測期內它將保持其佔有率。預計果汁、咖啡、茶、湯和非乳類飲料等一系列飲料產品都將成長。

- 在酒精飲料中,啤酒近年來經歷了顯著的成長。大多數啤酒都是用玻璃瓶包裝出售的,這給玻璃包裝行業帶來了增加產量的壓力。對優質酒精飲料的需求不斷成長,推動了玻璃瓶的成長。

- 可回收玻璃瓶是企業運送產品的經濟有效的選擇。這種包裝形式主要用於非酒精飲料行業。大約70%的天然礦泉水瓶都是由塑膠製成的。出於對環境問題的考慮,瓶裝水的包裝材料選擇越來越多。

- 可口可樂和百事可樂等飲料公司也嘗試避免使用塑膠包裝。百事可樂的目標是到 2025 年淘汰 670 億個寶特瓶,並用玻璃瓶取代。

- 受消費者對更環保牛奶的需求推動,全球乳製品產業正從塑膠瓶轉向玻璃瓶。 Milk & More 和 Parker Dairies 等乳製品公司發現玻璃瓶的需求大幅增加。消費者願意為這項服務支付更多費用,因為他們試圖減少塑膠的使用並幫助保護環境。

- 根據歐盟委員會預測,2020年葡萄酒產量將達1.44億公頃,2023年將增加至1.59億公頃。彩色玻璃瓶是包裝葡萄酒的首選方式,因為它們可以防止葡萄酒在陽光下變質。預計預測期內葡萄酒消費量的增加將帶動玻璃包裝的需求。釀酒商在包裝方面越來越具有創新性,開發新的概念和設計來吸引顧客。

亞太地區佔最大市場佔有率

- 不斷成長的藥品需求和製藥技術的進步正在推動對玻璃瓶、安瓿瓶和其他玻璃包裝解決方案的需求。慢性病的增加和疫苗的大規模生產預計將推動初級包裝(尤其是玻璃容器)的需求激增。

- 酒精飲料消費量的增加正在推動亞太地區的市場成長。亞太地區啤酒包裝產業的發展主要受到文化趨勢變化、人口成長、都市化以及年輕人群中啤酒日益流行的推動。

- 在印度,大多數蒸餾酒,包括威士忌、杜松子酒、蘭姆酒和白蘭地,都是用玻璃瓶裝的。根據《經濟時報》報道,蒸餾酒消費量的增加將推動2023年銷售量的成長,其中威士忌將以2.5318億箱的銷量領先,其次是8195萬箱,杜松子酒將以4720萬箱的銷量位居第二。

- 中國是世界上最大的醫藥市場之一。與許多已開發國家相比,醫療保健支出仍然不高。中國政府正在提升國內醫藥研發能力。結果是更多的人能夠負擔得起醫療服務。

- 此外,中國的酒精消費量逐年大幅增加。據巴西東北銀行稱,預計未來幾年中國酒精飲料消費將增加對玻璃包裝的需求。此外,許多酒精飲料製造商正在尋求抓住這一機會,並正在探索進入該國的可能性。

- 日本非常重視回收玻璃容器和瓶子以減少二氧化碳排放,並在全國各地建立了多家玻璃回收工廠。超過 18 家玻璃回收廠接收玻璃瓶和容器,並形成玻璃碎片和粉末。由於玻璃包裝具有優越的功能特性,強大的回收基礎設施正在推動其發展。

- 此外,印度等國的啤酒消費量也在上升。出於對健康的考慮,印度消費者擴大選擇玻璃包裝,尤其是玻璃瓶。玻璃包裝比其他包裝更受歡迎,因為它可以防止表面浸出。

- 印度製藥業高度重視研發。近年來,印度透過擴大研發生態系統和增加藥品出口,贏得了全球對醫療強國的認可。

- 各個終端用途領域的玻璃容器出貨量的增加正在推動日本市場的成長。玻璃容器非常適合用於包裝液體藥品、化學物質以及各種易腐爛和不易腐爛的產品。人們對環保包裝解決方案的日益偏好對藥用玻璃包裝的採用產生了積極的影響。

玻璃包裝產業概況

全球玻璃包裝市場較為分散,主要參與者如 Piramal Glass Private Limited、Owens-Illinois Inc.、Westpack LLC、Gerresheimer AG 和 Ardagh Group 在全球佔有重要地位。由於替代品的存在,競爭也十分激烈,因為業內許多公司都在努力不斷創新,以保持市場佔有率。

2024 年 4 月,製造地的大規模維修竣工,以提高永續性、靈活性和生產力。 OI Glass 已投資約 1.2 億美元用於維修,符合其永續性策略、對工廠升級的持續投資以及先前宣布的資本支出計畫。維修將包括安裝具有成熟的氧/燃料燃燒和廢熱回收技術的最先進的熔爐。

2024 年 2 月,特倫甘納邦宣布與 SGD Pharma 和康寧公司合作,為該地區帶來最新的技術和製造專業知識。此次合作將康寧的高品質藥用導管技術與 SGD Pharma 的管瓶製造和加工專業知識完美結合。這將使 SGD Pharma 擁有來自印度 Telangana 的軟管製造能力,為印度國內和海外的客戶提供初級包裝。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 產業政策

第5章市場動態

- 市場促進因素

- 對環保產品的需求不斷增加

- 食品和飲料行業需求增加

- 市場限制

- 營運成本上升

- 擴大替代產品(塑膠)的使用

第6章市場區隔

- 按最終用戶產業

- 食物

- 飲料

- 個人護理

- 衛生保健

- 家居用品

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 北美洲

第7章競爭格局

- 公司簡介

- Piramal Glass Private Limited

- Owens-Illinois Inc.

- WestPack LLC

- Gerresheimer AG

- Hindustan National Glass & Industries Ltd

- Ardagh Group

- HEINZ-GLAS GmbH & Co. KGaA

- Agrado Sa

- SGD SA(SGD Pharma)

- AAPL Solutions Pvt. Ltd

- Crestani Srl

第8章投資分析

第9章 市場機會與未來趨勢

The Glass Packaging Market size in terms of shipment volume is expected to grow from 0.86 trillion units in 2025 to 1.06 trillion units by 2030, at a CAGR of 4.21% during the forecast period (2025-2030).

Key Highlights

- Glass packaging is considered one of the most trusted forms of packaging for health, taste, and environmental safety. Glass packaging, considered premium, maintains the freshness and safety of the product. This can ensure its continuous usage across various end-user industries despite the heavy competition from other packaging forms.

- Rising consumer demand for safe and healthier packaging helps glass packaging grow in different categories. Also, innovative technologies for embossing, shaping, and adding artistic finishes to glass make glass packaging more desirable among end users. The market is growing due to the increasing demand for eco-friendly products and the rising demand from the food and beverage industry.

- Glass is widely considered the most environmentally friendly packaging type due to its recyclable nature. Lightweight glass has become a significant innovation, offering the same resistance as conventional glass materials and higher stability, reducing the volume of raw materials and CO2 emitted.

- Emerging markets like India and China are witnessing high demand for beer, soft drinks, and ciders due to the consumers' increasing per capita spending and changing lifestyles. However, the increasing operational costs and growing usage of substitute products, such as plastics and tin, are restraining the market growth.

- One of the main challenges for the market is the increased competition from alternative forms of packaging, such as aluminum cans and plastic containers. As these items are lighter in weight than bulky glass, they are gaining popularity among manufacturers and customers because of the lower cost of their carriage and transportation. Moreover, the increasing costs of raw materials and other factors have led to higher expenses, making it economically unfeasible for mass-produced goods.

- With consumers' increasing focus on sustainability concerns, brewing companies are adopting collaboration and partnership strategies with glass bottle and container manufacturers to offer beer products in glass bottles to meet sustainability goals. In May 2023, Ardagh Glass Packaging (Ardagh Group) and Sprecher Brewing Company announced the partnership. The partnership will help the brewery's commitment to stay local and sustainable with the continuous supply of glass beer and beverage bottles from Ardagh Glass Packaging. Also, this will help the brewing company meet the brand and sustainability goals by providing beer in high-quality glass bottles.

Glass Packaging Market Trends

The Beverage Industry to Hold the Highest Market Share

- Premiumization trends have played a role in selecting glass packaging for various beverage categories, including soft drinks. Soft drinks hold a significant market share, owing to the popularity of such drinks worldwide. Soft drinks offer various flavors and formats to suit every drinking occasion.

- The market for glass packaging in the alcoholic beverage industry faces intense competition from the metal packaging segment in the form of cans. However, it is expected to maintain its share during the forecast period due to its usage of premium products. The growth is expected across different beverage products, like juices, coffee, tea, soups, and non-dairy beverages.

- Among alcoholic beverages, beer has witnessed tremendous growth in the past few years. Most beer volume is sold in glass bottles, driving the need for increased production rates in the glass packaging industry. The increasing demand for premium variants of alcoholic drinks is driving the growth of glass bottles.

- Returnable glass bottles are a cost-effective option for companies to deliver their products. This form of packaging is used mainly in the non-alcoholic beverage industry. About 70% of the bottles used for natural mineral water are plastic. The choice of bottled water packaging material is increasing, considering environmental considerations.

- Beverage companies like Coke and PepsiCo also try to avoid plastic packaging. By 2025, PepsiCo aims to eliminate the use of 67 billion plastic bottles, which glass bottles will replace.

- The global dairy industry has been witnessing a shift from plastic to glass bottles, driven by consumer demand for environmentally friendly milk. Dairy companies like Milk & More and Parker Dairies have noticed a significant rise in demand for glass bottles. Consumers are willing to pay more for this service as they attempt to reduce their use of plastic and help the environment.

- According to the European Commission, wine production in 2020 was 144 million hectares, which increased to 159 million hectares in 2023. The preferred wine packaging is a colored glass bottle to prevent sunlight from spoiling the wine inside. The increasing consumption of wine is expected to spearhead the demand for glass packaging during the forecast period. Wine manufacturers are becoming increasingly innovative in attracting customers with their packaging and are developing new concepts and designs.

Asia-Pacific to Hold the Largest Market Share

- The escalating need for pharmaceutical drugs and advancements in pharmaceutical technology drive the demand for glass bottles, ampules, and other glass packaging solutions. With an upsurge in chronic illnesses and the substantial production of vaccine doses, the demand for primary packaging, particularly glass containers, is expected to surge.

- The increasing consumption of alcoholic beverages drives market growth in the Asia-Pacific region. The beer packaging industry in the Asia-Pacific region is mainly driven by changing cultural trends, growing populations, urbanization, and the growing popularity of beer among the younger populations.

- In India, most spirits, including whiskey, gin, rum, and brandy, are packed in glass bottles. Due to the increasing consumption of spirits, there was an increase in sales in 2023; whiskey had the highest number of cases sold, with 253.18 million cases, followed by 81.95 million cases, and gin at 47.2 million cases, according to Economic Times.

- China is one of the world's largest pharmaceutical markets. Compared to many industrialized countries, healthcare spending is still modest. The Chinese government is improving its ability to research and develop medicines domestically. As a result, it can provide affordable healthcare to more citizens.

- Additionally, alcohol consumption in China has been significantly increasing over the years. As per the Brazil-based bank Banco do Nordeste, the consumption of alcoholic beverages in China is expected to increase the demand for glass packaging in the coming years. Also, many alcoholic beverage companies seek to expand in the country to seize the opportunity.

- Japan has been emphasizing recycling glass containers and bottles to reduce its carbon footprint and has built multiple glass recycling plants nationwide. Over 18 glass recycling plants accept glass bottles and containers to form glass culets and powder. The robust recycling infrastructure promotes glass packaging due to its functional property advantages.

- Also, countries such as India have increased beer consumption. Indian consumers are increasingly opting for glass packaging, particularly bottles, due to health concerns. Glass packaging is preferred over other options as it prevents surface leaching.

- India's pharmaceutical sector places a high value on research and development. In recent years, India achieved global recognition as a medical powerhouse by expanding its R&D ecosystem and boosting pharmaceutical exports, offering growth prospects for various domestic glass packaging providers.

- Increased shipments of glass containers in various end-use sectors are driving market growth in Japan. Glass containers are highly favored for packaging liquid pharmaceuticals, chemicals, and a range of perishable/non-perishable products. The growing preference for eco-friendly packaging solutions positively impacts the adoption of pharmaceutical glass packaging.

Glass Packaging Industry Overview

The global glass packaging market is fragmented due to the strong presence of major players worldwide, like Piramal Glass Private Limited, Owens-Illinois Inc., Westpack LLC, Gerresheimer AG, and Ardagh Group. The competition is also intense due to the presence of substitutes, as many companies in the industry are trying to innovate consistently to retain their market share.

April 2024: O-I Glass Inc. (O-I Glass) significantly refurbished its Zipaquira (Colombia) manufacturing site to improve sustainability, flexibility, and productivity. O-I Glass invested approximately USD 120 million in this refurbishment, which aligns with sustainability strategy, ongoing investments in plant upgrades, and a previously announced capital expenditure plan. The refurbishment included installing a state-of-the-art furnace with proven oxy/fuel combustion and waste heat recovery technology.

February 2024: Telangana announced that it will collaborate with SGD Pharma and Corning Inc. to bring modern technology and manufacturing expertise to this area. This collaboration will combine Corning's high-quality pharmaceutical tubing technology with SGD Pharma's glass vial manufacturing and conversion expertise. This will secure SGD Pharma's tubing capacities to supply primary packaging to its Indian and international customers from Telangana, India.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Policies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Eco-friendly Products

- 5.1.2 Increasing Demand from the Food and Beverage Industries

- 5.2 Market Restraints

- 5.2.1 Rising Operational Costs

- 5.2.2 Growing Usage of Substitute Products (Plastic)

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Food

- 6.1.2 Beverage

- 6.1.3 Personal Care

- 6.1.4 Healthcare

- 6.1.5 Household Care

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Mexico

- 6.2.4.3 Argentina

- 6.2.5 Middle East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 United Arab Emirates

- 6.2.5.3 South Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Piramal Glass Private Limited

- 7.1.2 Owens-Illinois Inc.

- 7.1.3 WestPack LLC

- 7.1.4 Gerresheimer AG

- 7.1.5 Hindustan National Glass & Industries Ltd

- 7.1.6 Ardagh Group

- 7.1.7 HEINZ-GLAS GmbH & Co. KGaA

- 7.1.8 Agrado Sa

- 7.1.9 SGD SA (SGD Pharma)

- 7.1.10 AAPL Solutions Pvt. Ltd

- 7.1.11 Crestani Srl