|

市場調查報告書

商品編碼

1645128

亞太玻璃包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

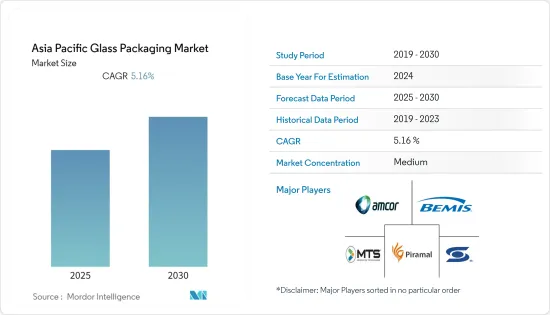

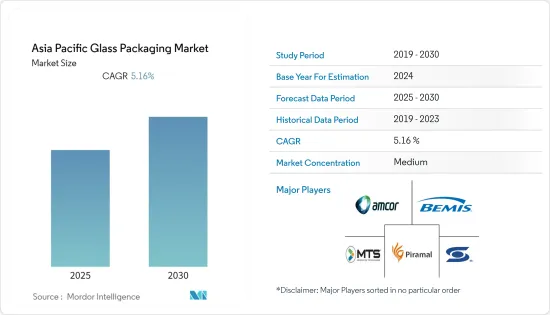

預計預測期內亞太玻璃包裝市場複合年成長率為 5.16%。

主要亮點

- 對更健康、更安全的包裝的需求正在推動各個類別的玻璃包裝產業的成長。成型、藝術精加工和壓花等創新技術使包裝對最終用戶更具吸引力。對生物分解性和環保產品的需求以及食品和飲料市場的成長進一步刺激了玻璃包裝的成長。

- 它是最值得信賴的包裝形式之一,因為它環保、健康和安全。由於其精美的設計和飾面,以及保持產品新鮮度和安全性的能力,它們也被視為奢侈品。玻璃包裝主要用於各種終端用戶行業。

- 玻璃包裝由於其可回收的特性,也是最受歡迎的環保包裝。最近最重要的創新是輕質玻璃,它具有與傳統玻璃類型相同的抵抗力,但穩定性更高,並減少了二氧化碳排放。

- 由於消費者越來越偏好用塑膠作為包裝材料,預計玻璃材料市場將受到限制。製造商也因為塑膠重量輕、柔韌的特性而青睞它。因此,塑膠作為包裝材料的使用越來越多可能會影響市場的成長。

- COVID-19對玻璃包裝產業的影響好壞參半。疫情期間,醫療保健、雜貨和電子商務運輸的包裝需求激增。然而,奢侈品、工業和B2B運輸的需求下降。其影響將取決於各包裝企業的地理分佈和投資組合。

亞太玻璃包裝市場趨勢

飲料業預計將佔據主要市場佔有率

- 在酒精飲料領域,玻璃包裝產業面臨來自金屬包裝產業的激烈競爭。然而,由於高價值物品的使用不斷增加,預計玻璃包裝在預測期內仍將佔據相當大的市場佔有率。預計各種飲料的需求將會增加,包括咖啡、果汁、茶、非乳類飲料和湯。

- 在酒精飲料中,啤酒市場近年來大幅擴張。啤酒通常以瓶裝形式出售,這提高了玻璃包裝行業的生產力。酒精飲料需求的不斷成長也刺激了生產。

- 中國、印度、泰國等新興國家對啤酒品質的認知較高。因此,預計整個預測期內飲料消費量的增加將推動亞太地區玻璃包裝市場的成長。

- 隨著世界人口的成長,這些必需的非酒精飲料的消費量預計會增加。零售市場上各種尺寸的瓶子供應量不斷增加,設計和化學成分的創新導致玻璃瓶重量更輕,這些因素預計將在預測期內顯著增加對酒精飲料玻璃包裝的需求。

- 許多酒精飲料公司都優先考慮在其包裝中使用再生材料,並增加其包裝瓶中使用的再生玻璃的數量。例如,Absolut 推出了一款由 41% 再生玻璃製成的限量版設計,並致力於減少包裝廢棄物。

中國佔最大市場佔有率

- 近幾十年來,玻璃作為儲存藥品的容器變得越來越流行。玻璃容器通常用於儲存食物和飲料。與其他容器相比,它具有多種優勢,包括強度、耐用性以及保持風味、品質和口感的能力。

- 在預測期內,用於運送 COVID-19 疫苗的管瓶需求不斷成長、原料的易得性以及個人可支配收入的增加可能會推動亞太地區玻璃包裝市場的成長。

- 該地區的其他成長要素包括個人可支配收入的增加以及對採用尖端製造技術的創意包裝解決方案的需求。

- 預計推動市場擴張的另一個關鍵方面是食品和飲料行業的擴張。此外,政府提倡使用環保產品的成長措施也可能促進該地區玻璃包裝市場的成長。

- 中國人口老化,是世界上最大的醫藥和醫療保健市場之一。然而,由於最近的監管變化,特別是市場准入和定價控制,外國製藥公司發現在中國企業發展變得更加困難。因此,當地企業可能會看到成長機會,因為這些企業對玻璃瓶和容器的需求可能會增加。

亞太玻璃包裝產業概況

亞太玻璃包裝市場中等分散。 Amcor、AptarGroup、Bemis、Piramal Glass Company、MTS Medication Technologies 和 Sonoco Products Company 等領先公司正在投入大量資金進行研發,以擴大其市場並實現其在亞太地區的包裝業務數位化。

- 2022 年 5 月-Gerresheimer 宣布與 ISR 藥物開發公司達成協議,生產足夠數量的 IcoOne 吸入器,以確保商業性供應鏈安全並使其令人興奮的乾粉 SARS-CoV-2 疫苗能夠在全球推出。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 消費者議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 對耐久包裝產品的需求不斷增加

- 對永續和創新食品包裝產品的需求不斷增加

- 市場限制

- 嚴格的環境法規

第6章 市場細分

- 依產品類型

- 瓶子和罐子

- 瓶蓋和瓶塞

- 托盤和容器

- 管瓶

- 標籤

- 其他產品類型

- 按最終用戶產業

- 食物

- 飲料

- 個人護理

- 衛生保健

- 家居用品

- 藥品

- 其他最終用戶產業

- 按國家

- 中國

- 日本

- 印度

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Amcor Ltd

- Bemis Company Inc.

- Sonoco Products Company

- Piramal Glass Company

- MTS Medication Technologies(Omnicell Inc.)

- Tetra Laval

- RPC Group

- Gerresheimer AG

- Saver Glass

- Hindustan National Glass & Industries Ltd

第8章投資分析

第9章 市場機會與未來趨勢

簡介目錄

Product Code: 53683

The Asia Pacific Glass Packaging Market is expected to register a CAGR of 5.16% during the forecast period.

Key Highlights

- The demand for healthier and safer packaging is boosting the growth of the glass packaging industry in different categories. Innovative techniques for shaping, giving artistic finish, and embossing make packaging more desirable to the end users. The demand for biodegradable and eco-friendly products and the growth of the beverage and food market further stimulate the growth of glass packaging.

- It is one of the most trusted forms of packaging, as it is eco-friendly, healthy, and safe. It is also considered premium because of its elite designs or finish and its ability to maintain the product's freshness and safety. It is primarily used across a range of end-user industries.

- Glass packaging is also the most desirable eco-friendly packaging due to its recyclable nature. The most significant innovation in recent times is lightweight glass, which offers the same resistance as the previous glass type with higher stability and lower CO2 emissions.

- The market for glass materials is expected to be limited by rising consumer preferences for plastic as a packaging material. Manufacturers also favor plastic because of its lightweight and flexible characteristics. As a result, the increased use of plastic as a packaging material will impact the market's growth.

- The impact of COVID-19 on the glass packaging industry is mixed. The packaging demand for healthcare, groceries, and e-commerce transportation rose sharply during the pandemic. However, the demand for luxury, industrial, and B2B transportation declined. The impact depends on the exposure to different regions and the portfolio of packaging players.

Asia Pacific Glass Packaging Market Trends

The Beverage Segment is Expected to Account for Significant Market Share

- For alcoholic beverages, the glass packaging sector faces fierce competition from the metal packaging industry. However, glass packaging is expected to keep a sizable portion of the market during the projection period, increasing the use of expensive goods. The demand for various beverage items, including coffee, juices, tea, non-dairy beverages, and soups, is projected to rise.

- Among alcoholic beverages, the beer market has experienced a considerable expansion in recent years. Beer is generally sold in bottles, driving the glass packaging industry's production rates. The rising demand for alcoholic beverages also accelerates the production.

- Emerging nations like China, India, and Thailand have greater perceptions of beer quality. As a result, growing beverage consumption is likely to drive the growth of the glass packaging market in Asia-Pacific throughout the forecast period.

- As the world's population increases, consumption of these essential non-alcoholic beverages is anticipated to rise. The expanding availability of bottles in different sizes in the retail market, as well as innovation in design and chemical composition that results in reduced weight of glass bottles, are additional factors that are anticipated to significantly increase the demand for glass packaging of alcoholic beverages during the forecast period.

- Many producers of alcoholic beverages are emphasizing recycled materials in their packaging and increasing the amount of recycled glass used in their bottles. For example, Absolut pledged to reduce packaging waste by releasing a limited-edition design composed of 41% recycled glass.

China Accounts for the Largest Market Share

- Glass has become famous for drug storage containers in the past few decades. They are usually used to keep food and drinks. Compared to other containers, they have a few benefits, including strength, durability, and the capacity to maintain flavor, quality, and taste.

- Due to the expanding need for glass vials to provide COVID-19 vaccines, the accessibility of raw materials, and rising personal disposable income, China may continue to lead the glass packaging market in the Asia-Pacific region during the forecast period.

- A few other growth reasons in the region include increased personal discretionary income and the need for creative packaging solutions using cutting-edge manufacturing techniques.

- Another key aspect anticipated to boost market expansion is the expanding food and beverage industry. The government's growth initiatives to promote the usage of eco- friendly products may also boost the growth of the glass packaging market across the region.

- Due to its aging population, China has one of the largest pharmaceutical and healthcare markets in the world. However, foreign pharmaceutical businesses are finding it difficult to operate in the country due to recent regulatory changes in China, particularly when it comes to market access and price regulation. Thus, local players may have a chance to grow as a result of the possible rise in demand for glass bottles and containers from these businesses.

Asia Pacific Glass Packaging Industry Overview

The Asia-Pacific glass packaging market is moderately fragmented. Major firms like Amcor, AptarGroup, Bemis, Piramal Glass Company, MTS Medication Technologies, and Sonoco Products Company are making significant R&D expenditures to upscale the market and digitize the packaging business in the Asia-Pacific region.

- May 2022 - Gerresheimer announced an agreement with an ISR drug development company to produce sufficient quantities of IcoOne inhalers to secure a commercial supply chain and the global launch of an exciting dry powder SARS-CoV-2 vaccine.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Bargaining Power of Consumers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Longer-lasting Packaging Products

- 5.1.2 Rising Demand for Sustainable and Innovative Food Packaging Products

- 5.2 Market Restraints

- 5.2.1 Stringent Environmental Regulations

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Bottles and Jars

- 6.1.2 Caps and Closures

- 6.1.3 Trays and Containers

- 6.1.4 Vials

- 6.1.5 Labels

- 6.1.6 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Personal Care

- 6.2.4 Healthcare

- 6.2.5 Household Care

- 6.2.6 Pharmaceutical

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Ltd

- 7.1.2 Bemis Company Inc.

- 7.1.3 Sonoco Products Company

- 7.1.4 Piramal Glass Company

- 7.1.5 MTS Medication Technologies (Omnicell Inc.)

- 7.1.6 Tetra Laval

- 7.1.7 RPC Group

- 7.1.8 Gerresheimer AG

- 7.1.9 Saver Glass

- 7.1.10 Hindustan National Glass & Industries Ltd

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219