|

市場調查報告書

商品編碼

1628780

中東和非洲的玻璃包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)MEA Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

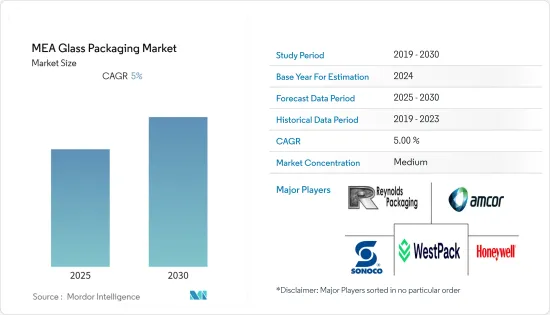

中東和非洲玻璃包裝市場預計在預測期內複合年成長率為 5%

主要亮點

- 近年來,食品包裝的透明化趨勢日益明顯。因此,低不透明度玻璃越來越受到青睞作為包裝材料。水是一個新興領域,對帶有最少標籤的透明玻璃容器的需求不斷增加。中東的幾個品牌已宣布計劃將水包裝轉向玻璃包裝。例如,Earth Water 於 2021 年 4 月在阿拉伯聯合大公國推出了一系列玻璃瓶裝天然礦泉水。在 2020 年杜拜世博會上,百事公司推出了 Aquafina,這是一款完全可回收的玻璃瓶聯合品牌,旨在推廣永續包裝。

- 2021 年 3 月,國藥控股與阿布達比科技公司 Group 42 (G42) 組成的合資企業計劃在阿布達比設立一座新工廠,生產中國製藥巨頭國藥控股的 COVID-19 疫苗。該工廠建於阿布達比哈利工業區 (KIZAD),將擁有 3 條填充線和 5 條自動化包裝線,計劃每年生產 2 億劑疫苗。類似的擴張趨勢和投資預計將顯著增加區域製藥業對玻璃包裝解決方案的需求。

- 包裝塑膠政策也為玻璃瓶和容器市場創造了新的機會。 2021年2月,肯亞簽署了“清潔海洋計劃”,成為東非首批限制一次性塑膠的國家之一。此外,從2020年6月起,遊覽肯亞國家公園、海灘、森林和保護區的遊客不再允許攜帶寶特瓶、杯子、一次性盤子、刀叉餐具和吸管進入保護區。

- 據國際金融公司(IFC)稱,衣索比亞政府正在考慮促進生產學名藥的私人製藥公司和生產原料藥(藥品製造的主要成分)的公司進行本地生產。衣索比亞《國家藥品製造發展策略與行動計畫(2015-2025)》也促進了國家層面的藥品生產。

中東和非洲玻璃包裝市場趨勢

飲料佔據主要市場佔有率

- 酒精飲料行業的玻璃包裝市場面臨來自罐形金屬包裝行業的激烈競爭。然而,由於其在高級產品中的採用,預計在預測期內將保持其佔有率。預計各種飲料產品將成長,包括果汁、咖啡、茶、湯、非乳製品和飲料。

- 精釀啤酒商採取的幾項促進投資的措施預計將進一步刺激對玻璃瓶包裝的需求。例如,2021年10月,喜力接洽Nambian Breweries購買25%的股份,組成喜力南非合資企業。該合資企業預計將幫助 NBL 減少過去五年中產生的虧損投資(損失 3.39 億荷蘭盾)。預計這將增加該地區的啤酒出口和啤酒產量。

- 由於紐西蘭各地酒莊收成不佳且葡萄酒儲存緊張,國際零售商正在增加南非葡萄酒的選擇。因此,各零售商已將重點轉向增加南非葡萄酒的選擇。

- 例如,2021年10月,英國線上葡萄酒零售商Majestic向買家提供了新葡萄酒,例如來自開普敦的Lone Creek Sauvignon Blanc 2021和Boekenhoutskloof Vintager Sauvignon Blanc,以及來自西開普省的Pringle Bay Sauvignon Blanc 2021 。它的價格分佈也較低(每瓶 10-11 英鎊),零售商希望增加南非葡萄酒的銷售量。

阿拉伯聯合大公國市場預計將大幅成長

- 許多大型製藥企業已透過契約製造和當地銷售管道進入阿拉伯聯合大公國多年,為容器玻璃製造商創造了市場機會。輝瑞、諾華、葛蘭素史克(GSK)、默克、艾伯維、禮來、拜耳、阿斯特捷利康、賽諾菲、百時美施貴寶、安進等主要跨國公司已進入國內市場。

- 根據IQVIA預測,到2024年國內藥品銷售額預計將達到510億美元。此外,人們越來越認知到在藥品和醫療保健設施中使用玻璃包裝的既定好處,正在推動藥用玻璃領域的發展。

- 2021 年 5 月,百事公司為阿拉伯聯合大公國 (UAE)居住者推出了 Aquafina 鋁罐和玻璃瓶。這項創新將使 2020 年杜拜世博會的官方飲料和零食合作夥伴百事可樂公司在為期六個月的全球聚會期間收集和回收 2020 年杜拜世博會場館產生的百事可樂廢棄物,以履行我們減少、回收和再造更好、永續產品的承諾。

- 2021 年 1 月,阿拉伯聯合大公國調香師 Salva 推出了一款專為海員打造的新香水:Hope。透過這項舉措,該品牌旨在提高人們對世界各地海員困境的認知並為其提供支持。這些舉措預計將提振該國的玻璃瓶市場。

- 2021 年 8 月,阿拉伯聯合大公國 (UAE) 領先的香水製造商 LOOTAH Perfume 與中東奢華權威指南 Ounass 合作。 LOOTAH 和 Ounass 合作,在我們的網站上展示了超過 50 種 LOOTAH 香味、卓越的香精油和最豐富的香味。

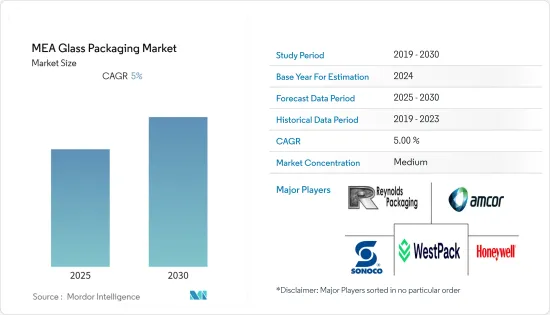

中東和非洲玻璃包裝產業概況

中東和非洲玻璃包裝市場適度分散,有少數幾家主導企業和一些新參與企業。公司不斷創新並結成策略夥伴關係以維持市場佔有率。

- 2021 年 4 月 - 奈及利亞啤酒品牌 Star Lager 擴大其優質冷過濾拉格啤酒在美國的銷售能力。隨著非洲啤酒出口數量和需求的增加,玻璃瓶包裝的需求也預計會增加。

- 2021 年 4 月 - SOURCE Global 是一家斯科茨代爾技術和可再生水公司,推出完全由陽光和空氣製成的可再生瓶裝水。瓶子圖形是網版印刷的。瓶子的背面凸顯了產品的獨特之處。這些瓶裝水將提供給紅海開發計劃(TRSDP)的住宿,紅海開發案是沙烏地阿拉伯西海岸一個正在進行的豪華可再生旅遊目的地。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 中東和非洲玻璃瓶/容器的巨大市場機會

- 市場限制因素

- 減少消費量

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 競爭公司之間的敵對關係

- 新進入者的威脅

- 供應商的議價能力

- 客戶議價能力

- 替代品的威脅

- 產業政策與 COVID-19 影響評估

- 技術簡介

第5章市場區隔

- 依產品

- 瓶子

- 罐

- 管瓶

- 其他產品

- 按最終用戶產業

- 藥品

- 醫療的

- 個人護理

- 家居用品

- 農業

- 按國家名稱

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

第6章供應商市場佔有率分析

第7章 競爭格局

- 公司簡介

- Amcor Ltd

- WestPack

- Sonoco Products Company

- Honeywell International Inc.

- MTS Medication Technologies

- Reynolds Packaging

- The DOW Chemical Company

- Uhlmann Group

- Rohrer Corporation

- Pharma Packaging Solutions

- Tekni-Plex Inc.

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 54097

The MEA Glass Packaging Market is expected to register a CAGR of 5% during the forecast period.

Key Highlights

- An increasing trend of transparency in food packaging over the past few years has been observed. This puts growing preference for glass as a material for packaging, being least opaque. Water is an emerging segment aligned with an increasing need for transparent glass containers with minimalist labeling. Multiple brands across the Middle Eastern region have depicted transitioning to glass to package water. For instance, in April 2021, Earth Water launched its natural mineral water lineup in glass bottles across the UAE. PepsiCo launched Aquafina water in Expo 2020 Dubai-cobranded as fully recyclable glass bottles to promote sustainable packaging.

- In March 2021, a new factory in Abu Dhabi planned to manufacture a COVID-19 vaccine from Chinese pharmaceutical giant Sinopharm under a joint venture between Sinopharm and Abu Dhabi-based technology company Group 42 (G42). The plant, built in the Khalifa Industrial Zone of Abu Dhabi (KIZAD), was planned to produce 200 million doses a year with three filling lines and five automated packaging lines. Similar expansion trends and investments are expected to demand glass packaging solutions in the regional pharmaceutical industry significantly.

- The policies against plastic for packaging are also creating new opportunities for the glass bottles and containers market. In February 2021, Kenya signed the Clean Seas Initiative and became one of the first countries in East Africa to limit single-use plastics. Also, as of June 2020, visitors to Kenya's national parks, beaches, forests, and conservation areas can no longer carry plastic water bottles, cups, disposable plates, cutlery, or straws into protected areas.

- According to International Finance Corporation (IFC), officials are considering promoting more local production from private pharma companies that produce generic medications and companies that manufacture active pharmaceutical ingredients or APIs (the primary components in manufacturing drugs). Ethiopia's National Strategy and Plan of Action for Pharmaceutical Manufacturing Development (2015-2025) also catalyzes pharmaceutical production at the country level.

MEA Glass Packaging Market Trends

Beverages to Hold Major Market Share

- The market for glass packaging in the alcoholic beverage industry faces intense competition from the metal packaging segment in the form of cans. However, it is expected to maintain its share during the forecast period due to its usage of premium products. The growth is expected across different beverage products, including juices, coffee, tea, soups, non-dairy, and beverages.

- Multiple initiatives that drove investments from local beer manufacturers are expected to drive the demand for glass bottle packaging further. For instance, in October 2021, Heineken approached Nambian Breweries to purchase a 25% stake to establish a joint venture for Heineken South Africa. The venture is expected to help NBL reduce loss-making investments (attributed to losses of NAD 339 million) attributable from the past five years. This is expected to increase beer exports and beer production volume in the region.

- International retailers have increased options for South African wines due to poor harvest in wineries across New Zealand and challenging storage of wines. This has shifted the focus of various retailers to increase options for wines from South Africa.

- For instance, in October 2021, Majestic, a UK online retailer for wine, added a new set of wine options for buyers, including Lone Creek Sauvignon Blanc 2021 and Boekenhoutskloof Vintager Sauvignon Blanc from Cape Town and Pringle Bay Sauvignon Blanc 2021 from Western Cape. Also, with the price range being low (GBP 10-11 per bottle), the retailers expect greater sales of South African wines.

The UAE Market is Expected to Grow Significantly

- Most major research-based pharma firms have a long-standing presence in the country through contract manufacturing or local distribution channels, creating a market opportunity for container glass manufacturers. Leading multinationals, such as Pfizer, Novartis, GlaxoSmithKline (GSK), Merck, Abbvie, Eli Lily, Bayer, AstraZeneca, Sanofi, BMS, and Amgen, have a presence in the domestic market.

- The IQVIA projected that pharmaceutical sales in the country are likely to reach USD 51 billion by 2024. Moreover, the increased awareness of the established benefits of using glass packaging for pharmaceutical products and healthcare facilities is driving the segment of the pharmaceutical glass.

- In May 2021, PepsiCo launched Aquafina aluminum cans and glass bottles, the company's infinitely recyclable characteristic offering for UAE residents. The innovation is in line with the commitment of PepsiCo, Expo 2020 Dubai's Official Beverage and Snack Partner, to collect and recycle PepsiCo waste generated on Expo 2020 Dubai's site during the six-month global gathering, accelerating efforts to reduce, recycle, and reinvent better and more sustainable packaging.

- In January 2021, the UAE-based perfumer, Salva, revealed its new fragrance, Hope, devoted to seafarers. Through this initiative, the brand aims to increase awareness about seafarers' plight worldwide and offer support. Such initiatives are anticipated to boost the country's glass bottle market.

- In August 2021, the UAE's leading perfumery, LOOTAH perfumes, teamed up with Ounass, the Middle East's Definitive Home of Luxury. LOOTAH and Ounass's collaboration showcases over 50 of LOOTAH's scents, transcendent fragrance oils, and the richest incenses on the website.

MEA Glass Packaging Industry Overview

The Middle-East and African glass packaging market is moderately fragmented, with a few dominant and few new firms. The companies keep innovating and entering into strategic partnerships to retain their market share.

- April 2021- Nigerian Beer Brand Star Lager expanded its distribution capacity in the United States for a premium cold-filtered lager. This is expected to drive the demand for glass bottle packaging as the number of exports and demand for African beer increases.

- April 2021- SOURCE Global, a Scottsdale tech and renewable water company, introduced renewable bottled water made entirely from sunlight and air. The bottle's graphics are applied using screen printing. The back of the bottle highlights the product's unique attributes. The glass-bottled water will eventually be available to guests at The Red Sea Development Project (TRSDP), a regenerative luxury tourism destination along Saudi Arabia's west coast that is underway.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Opportunity for Middle-East and Africa Glass Bottles/Containers

- 4.3 Market Restraints

- 4.3.1 Decreased Alcohol Consumption

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Competitive Rivalry

- 4.5.2 Threat of New Entrants

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Bargaining Power of Customers

- 4.5.5 Threat of Substitute Products

- 4.6 Industry Policies and Assessment of COVID-19 Impact

- 4.7 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 Products

- 5.1.1 Bottles

- 5.1.2 Jars

- 5.1.3 Vials

- 5.1.4 Other Products

- 5.2 End-user Industry

- 5.2.1 Pharmaceuticals

- 5.2.2 Medical

- 5.2.3 Personal Care

- 5.2.4 Household Care

- 5.2.5 Agricultural

- 5.3 Country

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 South Africa

- 5.3.4 Rest of Middle-East and Africa

6 VENDOR MARKET SHARE ANALYSIS

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Ltd

- 7.1.2 WestPack

- 7.1.3 Sonoco Products Company

- 7.1.4 Honeywell International Inc.

- 7.1.5 MTS Medication Technologies

- 7.1.6 Reynolds Packaging

- 7.1.7 The DOW Chemical Company

- 7.1.8 Uhlmann Group

- 7.1.9 Rohrer Corporation

- 7.1.10 Pharma Packaging Solutions

- 7.1.11 Tekni-Plex Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219