|

市場調查報告書

商品編碼

1629765

北美玻璃包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

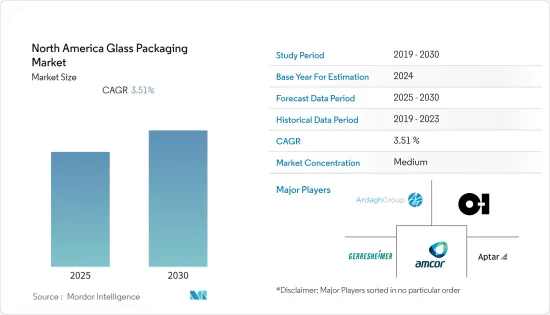

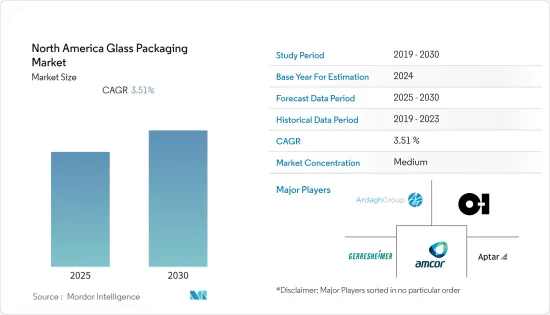

北美玻璃包裝市場預計在預測期內複合年成長率為3.51%

主要亮點

- 酒精飲料在美國玻璃瓶市場佔據主導地位。雖然烈酒和葡萄酒的玻璃容器比例很高,但啤酒領域的玻璃容器比例卻大幅下降。另一方面,在非酒精飲料領域,玻璃容器的比例可以忽略不計,主要用於碳酸飲料、牛奶和新型即飲飲料。

- 2020 年,82% 的啤酒在國內生產,18% 從全球 100 多個國家進口(資料來源:美國TTB 和美國商務部,2021 年)。多年來,酒精飲料市場和三層體係正在迅速發展。自 2012 年以來,全國頒布了 2,300 多部酒精飲料法(資料來源:NBWA 產業事務,2021 年)。這些案例主要採用玻璃包裝。

- 由於玻璃包裝在整個酒精飲料市場中佔據主要佔有率,隨著酒精飲料需求的持續增加,玻璃瓶市場預計在預測期內將成長。 2020 年 11 月,混合包裝供應商 Berlin Packaging 透過收購包裝供應商 Consolidated Bottle 擴大了在加拿大的業務。合併後的業務預計將透過為客戶提供更多的包裝解決方案和附加價值服務來滿足該國對玻璃瓶不斷成長的需求。

- 消費者的飲酒量比全球平均多約 50%,約 78% 的加拿大成年人表示在過去一年中飲酒過。男性比女性飲酒更多,年輕人在過去一年比老年人飲酒更多。根據加拿大統計局的資料,2019/2020 年酒精飲料總銷量增加了 0.2%,達到 31.16 億公升,相當於加拿大法定飲酒年齡或以上的人每週喝 9.5 杯酒。

北美玻璃包裝市場趨勢

酒精飲料預計將佔據主要市場佔有率

- 根據啤酒協會統計,2020年,美國啤酒包裝中鋁材佔81%,玻璃佔19%。

- 小瓶裝,如7至12盎司,佔玻璃瓶啤酒體積的90%以上,並且在瓶裝啤酒體積中所佔的佔有率不斷增加。近年來,大瓶裝的市佔率一直在下降。直到幾年前,許多場外零售商(例如雜貨店和酒類商店)都有更多的空間專門用於存放較大的瓶子,例如 22 盎司和 750 毫升的瓶子。但零售商擴大為快速流通的包裝分配空間。

- 酒杯包裝製造商正在創新其產品,並跟上最新趨勢。例如,2020 年 9 月,Ardagh Group, Glass, North America(Ardagh Group 旗下業務部門,美國烈酒市場玻璃瓶全國製造商)宣布與家族獨立烈酒公司 Heaven Hill Brands 合作供應商已簽署長期供應協議,在美國生產該公司的優質烈酒瓶。

- 推動市場成長的關鍵因素之一是該國的啤酒消費量。據加拿大啤酒公司稱,2020年啤酒總產量為2,112萬百公升。但與2019年相比,數量有所減少。 2019年至2020年,加拿大罐裝啤酒銷量成長12.3%,瓶裝啤酒銷量下降15.1%。這對 COVID-19 大流行期間的市場成長構成了挑戰。

- 此外,2019/2020年葡萄酒銷售額成長5.2%,達78億加元,創八年來最大增幅。去年,啤酒是加拿大大部分地區首選的酒精飲料,而葡萄酒在魁北克省(佔總銷售額的 44.0%)和不列顛哥倫比亞省(34.3%)位居榜首。然而,薩斯喀徹爾居民(15.2%)被發現最不可能購買葡萄酒(資料來源:加拿大統計局)。

管瓶預計將獲得顯著的市場佔有率

- 美國藥品監管機構已允許各公司加速生產大管瓶COVID-19 疫苗。美國食品藥物管理局(FDA) 也允許疫苗製造商從現有的管瓶中提取最多 11 劑疫苗。此外,2021 年 4 月,美國藥品監管機構授權 Moderna Inc.管瓶最多灌裝 15 劑,以加速其 COVID-19 疫苗的生產。

- 此外,2020 年 6 月,美國政府生物醫學高級研究與開發局 (BARDA) 授予康寧 2.04 億美元,用於擴大國內生產用於 COVID-19 疫苗的管瓶的產能。

- 同樣,2020年6月,SiO2贏得了美國政府價值1.43億美元的契約,將其產能擴大到4億劑。公司計劃在2021年4月提供1.2億管瓶和國內優先供應10億管瓶。該公司最近還宣布斥資 1.63 億美元擴建位於阿拉巴馬州奧本的製造工廠。

- 加拿大政府已投資約 1.26 億美元,用於設計、建造、試運行和認證毗鄰蒙特利爾皇家山工廠的新生物製造設施。新的生技藥品製造設施稱為生技藥品製造中心,將支持疫苗和其他生技藥品的生產。預計這將增加該地區對管瓶的需求。

北美玻璃包裝產業概況

北美的玻璃包裝產業處於適度整合狀態,有大量的區域和全球參與企業。技術創新透過增加產品種類和飲料投資來推動市場發展。

- 2021 年 10 月 - Owens-Illinois Glass Inc. 與德國克朗斯股份公司簽署策略合作夥伴關係,透過共同創新設計玻璃,以適應不斷擴大的玻璃市場。該協議的重點部分包括提高玻璃填充和包裝線的速度和效率,開發創新和永續的玻璃系統,提高對市場趨勢的應對力和靈活性,以及開發數位解決方案,例如直接玻璃數字印刷技術。

- 2021 年 2 月 - Ardagh 集團推出 Absolut 最新限量版伏特加酒瓶「Absolut Movement」。磨砂藍色玻璃瓶身採用16個漩渦向上螺旋設計,象徵永不停息的變化循環。螺旋的向上流動顯示社會的發展。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 對玻璃包裝市場的影響

第5章市場動態

- 市場促進因素

- 食品和飲料行業的需求不斷成長以及優質包裝的出現

- 提高可回收玻璃的產品價值

- 市場限制因素

- 來自替代包裝解決方案的激烈競爭

- 使用替代產品(塑膠)

第6章 市場細分

- 按類型

- 瓶子和容器

- 管瓶

- 安瓿

- 注射器藥筒

- 按行業分類

- 食物

- 飲料

- 軟性飲料

- 牛奶

- 酒精飲料

- 其他飲品

- 化妝品/香水

- 藥品

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Owens Illinois Inc.

- Amcor Limited

- Ardagh Packaging Group PLC

- Piramal Glass Ltd.

- Gerresheimer AG

- Sonoco Products Company

- Reynolds Packaging

- Gallo Glass Co.

- AptarGroup

- Vitro SAB DE CV

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 56251

The North America Glass Packaging Market is expected to register a CAGR of 3.51% during the forecast period.

Key Highlights

- Alcoholic beverages dominated the glass bottles segment in the United States. A high percentage of distilled spirits and wines are packaged using glass containers, while in the beer segment, the percentage of glass containers has decreased significantly. On the other hand, in the non-alcoholic segment, glass holds a tiny percentage and is used in CSDs, milk, and newer ready-to-drink beverages.

- In 2020, 82% of all beer was domestically produced, and 18% was imported from more than 100 different countries around the world (source: U.S. TTB and U.S. Commerce Department, 2021). The alcohol beverage marketplace and the three-tier system have evolved rapidly over the years. Since 2012, over 2,300 alcohol beverage laws have been passed around the country (Source: NBWA Industry Affairs, 2021). Such instances address the major adoption of glass packaging.

- Glass packaging has a significant share in the overall alcoholic beverage market, and hence, with the ongoing increase in demand for alcoholic beverages, the market for glass bottles is expected to increase in the forecast period. In November 2020, Hybrid packaging supplier Berlin Packaging expanded its Canadian presence with the acquisition of packaging supplier Consolidated Bottle. The combined businesses are expected to offer even more packaging solutions and value-added services to their customers, thereby catering to the growing demand for glass bottles in the country.

- The consumer drinks about 50% more than the worldwide average, and about 78% of Canadian adults report having consumed alcohol in the past year. Men drink more than women, and young adults are more likely to be past-year drinkers than older adults. The total volume of alcohol sold increased by 0.2% to 3,116 million liters in 2019/2020, which is equivalent to 9.5 standard drinks per week per person over the legal drinking age in Canada as per the data from Statistics Canada.

North America Glass Packaging Market Trends

Alcoholic Beverages Expected to Witness Significant Market Share

- According to Brewer's Associations, in 2020, the percentage of package market for US craft beer packaging indicated that aluminum could take 81% share whereas glass packaging took 19%.

- Smaller-sized bottles, such as those of 7-12 ounces, compose more than 90% of beer volume in glass bottles and continue to gain a share of bottled beer volume. Large-format bottles have lost their share in recent years. A few years ago, many off-premise retailers like grocery and liquor stores greatly expanded their space dedicated to large bottles such as 22 ounce or 750 milliliters. However, retailers are increasingly reallocating space to faster-moving packages.

- Wine glass packaging manufacturers are innovating their offerings keeping in pace with the latest trends. For instance, in September 2020, Ardagh Group, Glass, North America, a business division of Ardagh Group and the domestic manufacturer of glass bottles for the US spirits market, confirmed a long-term supply agreement with Heaven Hill Brands, the independent, family-owned, and operated distilled spirits supplier, to manufacture its premium spirits bottles in the United States.

- One of the main factors driving the growth of the market is beer consumption in the country. According to Beer Canada, the total beer sales accounted for 21.12 million hectoliters in 2020. However, the sale has fallen as compared to the year 2019. From 2019 to 2020, sales of canned beers grew by 12.3 %, while bottled beer sales decreased by 15.1 % in Canada. This challenged the market growth during a COVID-19 pandemic.

- Moreover, wine sales rose 5.2% to CAD 7.8 billion in FY 2019/2020, which is the largest increase in eight years. While beer was the alcoholic beverage of choice across much of Canada last year, wine claimed the top spot in Quebec (44.0% of total sales) and British Columbia (34.3%). However, residents of Saskatchewan (15.2%) were least likely to buy wine (source: Statistics Canada).

Vials Expected to Witness Significant Market Share

- The US Drug Regulator gave clearance to various companies to speed up COVID-19 vaccine output with bigger vials. The US Food and Drug Administration (FDA) also authorized vaccinators to extract a maximum of 11 doses from the current vials. Further, In April 2021, the US drug regulator gave Moderna Inc. the clearance to speed up the output of its COVID-19 vaccine by letting it fill a single vial with up to 15 doses.

- In addition, In June 2020, the US government's Biomedical Advanced Research and Development Authority (BARDA) awarded USD 204 million to Corning to expand its domestic manufacturing capacity for glass vials for COVID-19 vaccines.

- Similarly, In June 2020. SiO2 received a contract worth USD 143 million from the US government to scale up its manufacturing capacity to 400 million doses. The company is expected to provide 120 million vials for domestic priorities and 1 billion vials by April 2021. The company also recently announced a USD 163 million expansion of its manufacturing plant in Auburn, Alabama.

- The Government of Canada invested around USD 126 million to design, construct, commission, and qualify a new biomanufacturing facility adjacent to its Royalmount site in Montreal. The new biomanufacturing facility, called the Biologics Manufacturing Centre, will support the manufacturing of vaccines and other biologics. This is expected to boost the demand for vials in the region.

North America Glass Packaging Industry Overview

The North America Glass Packaging is moderately consolidated, with a considerable number of regional and global players. The innovation drives the market in the product offerings and increasing investments in beverages.

- October 2021: Owens-Illinois Glass Inc. and Krones AG of Germany signed a strategic collaboration to design glass through collaborative innovation for the expanding glass market. The focus areas of the agreement would include improvements in glass filling and the speed and efficiency of packaging lines, development of innovative and sustainable glass systems, enhanced agility and flexibility of responding to market trends, and advancements in digital solutions, such as direct-to-glass digital printing technology.

- February 2021 - Ardagh Group launched Absolut's latest limited-edition vodka bottle, 'Absolut Movement,' to inspire people in celebration of inclusivity. The frosted blue glass bottle features an upward spiral design of 16 swirls, symbolic of the never-ending cycle of change. The upward flow of the swirling spiral indicates social growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of the COVID-19 on the Glass Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increasing Demand from the Food and Beverage Industry and Emergence of Premium Packaging

- 5.1.2 Commodity Value of Glass Increased with Recyclability

- 5.2 Market Restraints

- 5.2.1 High Competition from Substitute Packaging Solutions

- 5.2.2 Usage of Substitute Products (Plastic)

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Bottles and Containers

- 6.1.2 Vials

- 6.1.3 Ampoules

- 6.1.4 Syringe and Cartridges

- 6.2 By End-User Vertical

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.2.1 Soft Drinks

- 6.2.2.2 Milk

- 6.2.2.3 Alcoholic Beverages

- 6.2.2.4 Other Beverages

- 6.2.3 Cosmetics and Prefumery

- 6.2.4 Pharmaceuticals

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Owens Illinois Inc.

- 7.1.2 Amcor Limited

- 7.1.3 Ardagh Packaging Group PLC

- 7.1.4 Piramal Glass Ltd.

- 7.1.5 Gerresheimer AG

- 7.1.6 Sonoco Products Company

- 7.1.7 Reynolds Packaging

- 7.1.8 Gallo Glass Co.

- 7.1.9 AptarGroup

- 7.1.10 Vitro SAB DE CV

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219