|

市場調查報告書

商品編碼

1637834

印度玻璃包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)India Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

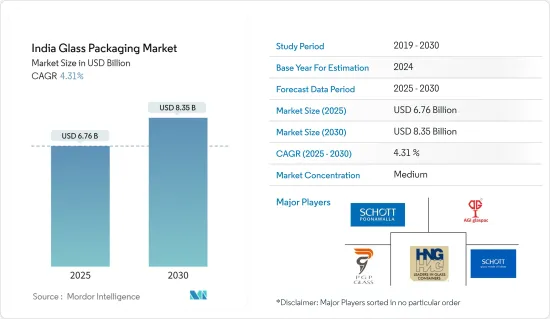

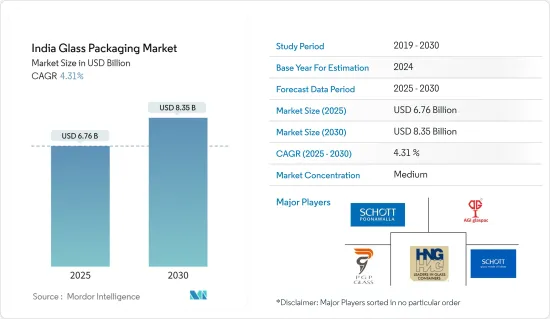

預計 2025 年印度玻璃包裝市場價值為 67.6 億美元,到 2030 年將達到 83.5 億美元,預測期內(2025-2030 年)的複合年成長率為 4.31%。

包裝及相關產業的製造和生產僅在許多包裝對 GDP 貢獻較大的國家中發揮作用。此舉標誌著公司重點從國內玻璃包裝產業轉向製藥業。

主要亮點

- 印度擁有世界第二大製藥和生技產業勞動力佔有率。根據《2021 年印度經濟調查》,預計未來十年醫藥市場將成長三倍。預計2021年該國醫藥市場規模將達410億美元,2024年將達650億美元,到2030年將進一步擴大至1200至1300億美元。

- 由於玻璃瓶具有無孔、不滲透、環保、美觀等特性,在包裝產業的應用越來越廣泛。在印度,玻璃產業已經很成熟,並且長期以來一直是家庭工業。該行業最近已從手動流程發展為現代自動化方法。根據印度斯坦國家玻璃工業有限公司統計,印度的人均玻璃包裝消費量(1.8公斤)遠低於其他國家。

- 消費者環保意識的增強也推動了玻璃包裝產業的發展,因為玻璃包裝可回收並且是塑膠包裝的環保替代品。此外,可支配收入的增加和消費者生活方式的改變也有望推動市場成長。

- 市場面臨的主要挑戰之一是來自鋁罐和塑膠容器等替代包裝形式的競爭日益激烈。鋁罐和塑膠容器越來越受到製造商和消費者的歡迎,因為它們比笨重的玻璃重量輕,而且攜帶和運輸成本較低。此外,玻璃包裝行業最近一直致力於提高可追溯性,以限制國內的假冒活動。本公司對容器進行永久標記,以保護消費者免受仿冒品製造商的有害行為的侵害。

- 近期,該國對 COVID-19 疫苗的投資趨勢已成為管瓶的主要驅動力。例如,根據 IBEF 的數據,印度製藥業供應了全球 50% 以上的各種疫苗需求、美國非專利市場的 40% 左右以及英國所有藥品的 25%。

印度玻璃包裝市場的趨勢

玻璃瓶/容器:預計需求旺盛

- 在印度,玻璃包裝解決方案(尤其是瓶子)的使用正在增加,因為消費者重視環保和健康選擇並且更喜歡玻璃包裝而不是其他選擇。此外,印度斯坦國家玻璃有限公司和朝日印度玻璃有限公司等許多公司為所有工業領域提供玻璃包裝解決方案。

- 去年,印度容器玻璃製造商Sunrise Glass增加了一座產能為240 TPD的新熔爐。該公司目前營運兩座熔爐,總合為 380 TPD。該公司表示,該爐有四條生產線,配備三台 AIS 10 Triple Gob (TG) Emhart 機器。所有生產線上都將安裝EVM(檢查機)。隨著生產能力的擴大,該公司現在向美國和歐洲出口食品罐,主要出口到酒精飲料製造商。

- 過去三年來,跨國藥用玻璃製造商和印度藥用玻璃製造商一直在投資提高其設計能力。此外,全球領先的藥用玻璃製造商 Gerresheimer、SGD Pharma 和 Schott 均對其印度業務進行了資本投資。近年來,其他參與者也採取了類似的舉措,預計將推動該國對玻璃瓶的需求。

- 食品飲料、食品加工、個人護理和醫藥終端用戶行業的大量投資為印度瓶和容器玻璃行業創造了巨大的機會。從數量上看,酒精飲料是最大的子區隔,其次是食品和飲料、藥用玻璃以及化妝品和香水。

飲料業需求預計較高

- 玻璃瓶和容器因其保持化學惰性、無菌性和滲透性的能力而主要用於酒精和非酒精飲料行業。啤酒等飲料佔據了很大的市場佔有率,因為玻璃不會與飲料中的化學物質發生反應,從而可以保留這些飲料的香氣、濃度和味道,是一種很好的包裝選擇。由於這些原因,大多數啤酒都用玻璃瓶運輸,預計這一趨勢將在研究期間持續下去。啤酒被包裝在深色玻璃瓶中以保存內容物,但當暴露在紫外線下時,瓶子很容易變質。

- 在國內,飲料終端用戶正在推動市場需求。據印度工商聯合會稱,玻璃和硬質塑膠約佔印度飲料包裝的三分之二。但由於人們對環境問題的日益關注,玻璃包裝的範圍正在擴大。即飲(RTD)飲料,尤其是酒精飲料中擴大使用玻璃包裝是印度飲料包裝行業的當前趨勢。玻璃包裝產業的發展主要受到國內酒精飲料消費量成長的推動。

- 據印度國際經濟關係研究委員會 (ICRIER) 稱,未來十年,印度酒精消費成長的 70% 以上將來自中低收入和高所得人群,預計產品的優質化。

- 軟性飲料是非酒精飲料業務最重要的貢獻者。玻璃瓶裝可樂佔印度可樂銷售的35%。飲料製造商可口可樂印度私人有限公司再次推廣可回收玻璃瓶。這些瓶裝飲料去年在部分邦推出,價格分佈為 10 印度盧比(0.15 美元)(200 毫升),可口可樂、Thumbs Up 和雪碧等公司最暢銷的品牌均有販售。在某些市場,玻璃瓶現在佔飲料銷售額的 30%(資料來源:可口可樂)。

- 許多飲料預計都會使用玻璃瓶,特別是大廠商生產的飲料,都用玻璃瓶來裝飾。對使用者來說,主要的優勢是,使用玻璃瓶包裝果汁和其他飲料時,包裝材料中的化學物質幾乎不會遷移。

印度玻璃包裝產業概況

由於多家公司的競爭,印度玻璃包裝市場適度整合。 Schott Kaisha Pvt Ltd.、AGI glaspac.、Piramal Glass Limited、Borosil Glass Works Limited 和 Haldyn Glass Limited 等市場參與者正在採用產品創新、夥伴關係和併購等策略來進一步擴大市場佔有率。市場的主要發展包括:

- 2022 年 8 月—堿灰製造商 Nirma 已提交以 165 億印度盧比(2.06 億美元)收購最著名的印度斯坦國家玻璃有限公司 (HNGL) 的計劃。非洲瓶子製造商 Madhvani Group 和玻璃容器製造商 AGI Greenpac 也提交了單獨的解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 產業影響評估

- 貿易情景分析

第5章 市場動態

- 市場促進因素

- 民眾環保意識增強

- 國內飲料消費量增加

- 市場限制

- 鋁和塑膠的替代包裝選擇

第6章 市場細分

- 按產品

- 瓶子/容器

- 管瓶

- 安瓿

- 注射器/藥筒

- 按最終用戶產業

- 食物

- 飲料(軟性飲料、牛奶、酒精飲料、其他類型飲料)

- 化妝品、香水和個人護理

- 藥品

第7章 競爭格局

- 公司簡介

- Schott Kaisha Pvt Ltd(SCHOTT AG)

- AGI Glaspac(HSIL Ltd)

- Piramal Glass Limited

- Hindustan National Glass & Industries Limited(HNGIL)

- Schott Poonawalla Private Limited

- Gerresheimer AG

- Borosil Glass Works Limited(Klasspack Pvt. Ltd.)

- Haldyn Glass Limited(HGL)

- Sunrise Glass Industries Private Limited

- Ajanta Bottle Pvt Ltd

- GM Overseas

- Empire Industries Limited-Vitrum Glass

第8章投資分析

第9章:未來市場展望

The India Glass Packaging Market size is estimated at USD 6.76 billion in 2025, and is expected to reach USD 8.35 billion by 2030, at a CAGR of 4.31% during the forecast period (2025-2030).

The manufacturing and production of packaging and relatable industries are only functional in many countries where packaging contributes significantly to GDP. The trend witnessed a shift of focus from glass packagers in the country to the pharmaceutical industry.

Key Highlights

- India contributes the second-largest share of the pharmaceutical and biotech workforce worldwide. According to the Indian Economic Survey of 2021, the pharmaceutical market is expected to grow three times in the next decade. The country's pharmaceutical market was projected at USD 41 billion in 2021 and will reach USD 65 billion by 2024 and further expand to around USD 120-130 billion by 2030.

- Glass bottle characteristics, such as being non-porous, impermeable, eco-friendly, and aesthetically pleasing, lead to ever-increasing use in the packaging industry. In India, the glass industry is well established and has remained a cottage industry for a long time. The sector is recently evolving from hand-working processes to modern automation methods. According to the Hindusthan National Glass & Industries Ltd, Indian per capita consumption of glass packaging (1.8 kg) is much lower than other nations.

- The glass packaging industry is also driven by the growing environmental awareness among consumers, with glass packaging being reusable and an environmentally friendly alternative to plastic packaging. The increasing disposable incomes and changing consumers' lifestyles are also expected to drive the market's growth.

- One of the main challenges for the market is the increased competition from alternative forms of packaging, such as aluminum cans and plastic containers. The items are lighter in weight than the bulky glass, gaining popularity among manufacturers and customers because of the lower cost involved in their carriage and transportation. Moreover, the glass packaging industry is recently concentrating on increasing traceability to restrict counterfeit activities in the country. The companies are mentioned using permanent engravings on containers, protecting consumers from harmful practices by spurious product manufacturers.

- The recent investing trend in vaccines for COVID-19 in the country is emerging as a significant driver for the vials growth. For instance, according to IBEF, the Indian pharmaceutical sector supplies more than 50% of the global demand for various vaccines, around 40% of the generic market for the United States, and 25% of all medicines for the United Kingdom.

India Glass Packaging Market Trends

Glass Bottles/Containers Expected to Witness Significant Demand

- In India, only the usage of glass packaging solutions, especially bottles, is increasing as consumers emphasize eco-friendly and healthy options and prefer glass packaging over other options. Also, the country comprises many companies, including Hindustan National Glass and Asahi India Glass, offering glass packaging solutions across industries.

- Last year, India's container glass producer Sunrise Glass added a new furnace with an installed capacity of 240 TPD. The company currently operates two furnaces with a combined installed of 380 TPD. The company stated that the stove would have four lines with three AIS 10 triple gob (TG) Emhart Machines. All the lines will have EVM (Inspection Machines). With this capacity expansion, the company focuses on catering to significant liquor clients and exports to the USA and Europe for food-grade jars.

- Multinational pharmaceutical glass producers, along with Indian pharmaceutical glass producers, have invested in increasing designed capacity over the last three years. In addition, leading global pharmaceutical glass producers Gerresheimer, SGD Pharma, and Schott have invested capital in Indian operations. Such initiatives by other players are estimated to take place in recent years and will fuel the demand for glass bottles in the country.

- Considerable investments in the beverages, food processing, personal care, and pharmaceutical end-user industries have created enormous opportunities for the country's bottles/container glass industry. Alcoholic beverages are the largest sub-segment for bottles/container glass consumption on a volume basis, followed by food, pharmaceutical glass, and cosmetics & perfumery.

Beverage Sector Expected to Witness Significant Demand

- Glass bottles and containers are majorly used in the alcoholic and non-alcoholic beverage industries due to their ability to maintain chemical inertness, sterility, and non-permeability. Drinks such as beer account for a significant market share, as glass does not react with the chemicals present in drinks and, therefore, preserves the aroma, strength, and flavor of these beverages, making them a good packaging option. Due to this reason, most beer volume is transported in glass bottles, and this trend is expected to continue over the study period. Beer is packaged in dark-colored glass bottles to preserve the contents, which are prone to spoilage when exposed to UV light.

- The beverage end-user vertical is driving the market demand in the country. According to ASSOCHAM, glass and rigid plastics constitute about two-thirds of packaging in India's beverage sector. However, the industry's glass packaging scope is expanding due to growing environmental concerns. Increasing glass packaging usage for Beverages, especially for the alcoholic Ready to Drink (RTD) segment, is a current trend in the Beverage packaging industry of India. The glass packaging industry is primarily boosted by increasing alcoholic beverage consumption in the country.

- Moreover, ICRIER (Indian Council for Research on International Economic Relations) said over 70% of the growth in alcoholic beverage consumption in India in the next decade would be driven by the lower middle and upper middle-income groups, and there is a growing trend toward product premiumization.

- Soft drinks are the most significant contributor on which the business of non-alcoholic drinks rests. Glass bottles retain a 35% share of sales for Coke in India. Beverage maker Coca-Cola India Pvt. Ltd. is again promoting returnable glass bottles. The bottles rolled out last year at INR 10 (USD 0.15) price point (200 ml) in select states are available across the company's top-selling brands, such as Coca-Cola, Thums Up, and Sprite. In some markets, glass bottles now make up 30% of beverage sales (source: Coca-Cola).

- Many beverages are expected to use glass bottles, particularly those from large manufacturers that have been decorated with glass bottles. The main advantage for the user is that there is almost no dissolution from container materials when glass bottles are used as packaging containers for juice or other drinks.

India Glass Packaging Industry Overview

The India Glass Packaging Market is competitive owing to multiple players, which led the market to be moderately consolidated. Players in the market, such as Schott Kaisha Pvt Ltd., AGI glaspac., Piramal Glass Limited, Borosil Glass Works Limited, and Haldyn Glass Limited are adopting strategies like product innovation, partnerships, and mergers and acquisitions to increase their market share further. Some of the critical advancements in the market are:

- August 2022 - Soda ash producer Nirma submitted an INR 16,500 million (USD 206 million) plan to acquire one of the most prominent Hindustan National Glass Limited (HNGL). Africa-based bottle maker Madhvani Group and container glass producer AGI Greenpac have also submitted separate resolution plans for the company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Trade Scenario Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Environmental Awareness Among the Population

- 5.1.2 Increasing Beverage Consumption in the Country

- 5.2 Market Restraints

- 5.2.1 Alternative Packaging Options such as Aluminum and Plastic

6 MARKET SEGMENTATION

- 6.1 By Product ( Revenue in USD Billion and Volume in Million Metric Tones)

- 6.1.1 Bottles/Containers

- 6.1.2 Vials

- 6.1.3 Ampoules

- 6.1.4 Syringe/Cartridges

- 6.2 By End-user Vertical ( Revenue in USD Billion and Volume in Million Metric Tones)

- 6.2.1 Food

- 6.2.2 Beverage (Soft Drinks, Milk, Alcoholic Beverages, Other Beverage Types)

- 6.2.3 Cosmetics, Perfumery and Personal Care

- 6.2.4 Pharmaceuticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schott Kaisha Pvt Ltd (SCHOTT AG)

- 7.1.2 AGI Glaspac (HSIL Ltd)

- 7.1.3 Piramal Glass Limited

- 7.1.4 Hindustan National Glass & Industries Limited (HNGIL)

- 7.1.5 Schott Poonawalla Private Limited

- 7.1.6 Gerresheimer AG

- 7.1.7 Borosil Glass Works Limited (Klasspack Pvt. Ltd.)

- 7.1.8 Haldyn Glass Limited (HGL)

- 7.1.9 Sunrise Glass Industries Private Limited

- 7.1.10 Ajanta Bottle Pvt Ltd

- 7.1.11 G.M Overseas

- 7.1.12 Empire Industries Limited- Vitrum Glass