|

市場調查報告書

商品編碼

1627127

雲端識別及存取管理軟體:市場佔有率分析、產業趨勢、成長預測(2025-2030)Cloud Identity and Access Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

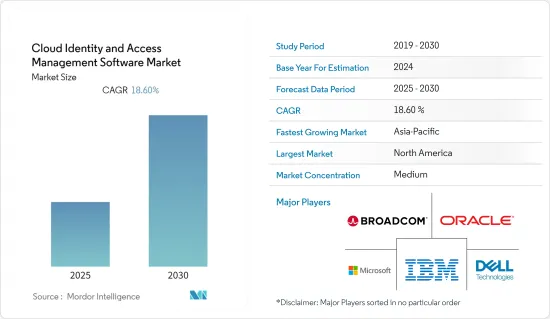

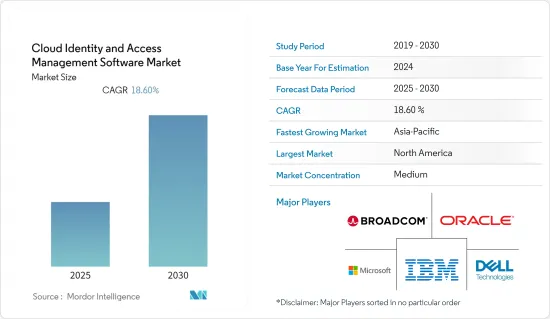

雲端識別及存取管理軟體市場預計在預測期內複合年成長率為 18.6%

主要亮點

- 隨著成本的降低和規模經濟的發展,雲端技術正在徹底改變企業的營運方式。然而,缺乏適當的安全措施可能會削弱雲端運算的優勢。這需要對安全解決方案的基本需求,其中包括針對身分相關犯罪的安全性,這正在推動雲端識別及存取管理市場的發展。

- 公共雲端是市場上最受歡迎的雲端部署類型。這是由於它在各個行業中的使用越來越多。然而,由於混合雲端的採用將保持最高的複合年成長率。

- 隨著行動電話和平板電腦變得越來越流行,員工現在可以將行動電話和筆記型電腦連接到業務網路。員工不再使用舊的辦公桌面,而是更喜歡在企業中使用自己的設備,這增加了對雲端身分和存取管理軟體的需求,從而推動了市場研究。

雲端識別及存取管理 (IAM) 軟體在 COVID-19 影響期間對市場產生了積極影響,預計將在預測期間為市場成長做出重大貢獻。 IAM廠商紛紛出面為企業提供協助。例如,IBM 在疫情期間宣布將向新客戶免費提供 IBM Security MAss360 with Watson 和 IBM Cloud Identity 等關鍵技術 90 天。

雲端識別及存取管理軟體市場趨勢

單一登入 (SSO) 和統一配置將實現最高成長

- 單一登入 (SSO) 是身分存取管理的最新創新。該解決方案的緊湊性和靈活性使其對從 IT 公司到製造業的廣泛最終用戶具有吸引力。

- 在聯合配置的情況下,解決方案是稱為聯合身份和配置的兩個獨立系統的混合。聯合身分是指允許不同計畫/域共用身分管理責任的標準。另一方面,配置是管理使用者或系統存取權限所需的生命週期中所有步驟的自動化。

- 在利用雲端中的應用程式和資料的同時管理內部用戶帳戶的能力是聯合配置解決方案提供的主要優勢,並且正在推動這些解決方案在市場上的顯著成長。

- 此外,社會工程攻擊和身分盜竊的增加正在推動單一登入和統一配置的成長,特別是在北美和歐洲的已開發國家。

- 身分盜竊資源中心估計,2022 年美國資料將被竊盜 1,802 次。同年,資料外洩、資料外洩、資料外洩等資料入侵也影響了超過4.22億人。雖然這是三個不同的事件,但它們都有相似的特徵。所有這三個案例都是未經授權的威脅行為者存取敏感資料的結果。

北美佔最大市場佔有率

- 大多數全球領先的雲端公司都位於北美,也有許多新興企業將雲端作為解決方案部署的首選形式。

- 國際電聯報告稱,除了雲端基礎的軟體服務採用率最高之外,北美地區非常積極主動並專注於網路安全。

- 此外,較低的資本支出和更快的更新部署等優勢是北美採用雲端基礎的身份管理解決方案的關鍵原因。

- 該地區 BFSI 行業主要採用雲端基礎的IAM,並且未來可能會增加。因為,根據美國消費者哨兵網路報道,卡片詐騙和違規行為在身分竊盜總數中佔很大比例。

- 該地區深受網路攻擊影響,是世界上網路安全事件數量最多的地區之一。因此,該地區也採取了措施,是網路安全、技術和實施方面最先進的地區之一。因此,對網路安全日益成長的需求預計也將成為該地區雲端識別及存取管理軟體市場的驅動力。

雲端識別及存取管理軟體產業概述

全球和地區已有多家公司進入雲端識別及存取管理市場,市場競爭溫和。然而,市場正走向各種較小參與企業的整合。一些市場參與企業正在透過創新在市場上獲得永續的競爭優勢。該市場的主要企業包括IBM公司、微軟公司和甲骨文公司。

CloudIBN 於 2022 年 12 月宣布採用識別及存取管理服務。透過這套 IAM 解決方案,企業可以有效管理整個組織的使用者存取控制並確保資料安全。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 安全漏洞數量和相關成本增加

- 企業 BYOD 使用率呈上升趨勢

- 市場限制因素

- 雲端基礎的應用程式面臨網路風險的脆弱性

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 市場影響評估

第5章市場區隔

- 按組織規模

- 小型企業

- 大型組織

- 按解決方案類型

- 審核、合規和管治

- 單一登入 (SSO) 和整合配置

- 特權存取管理

- 目錄服務

- 其他

- 依部署類型

- 民眾

- 私人的

- 混合

- 按行業分類

- 資訊科技/通訊

- BFSI

- 醫療保健

- 娛樂媒體

- 零售

- 教育

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- Cyberark Software Ltd.

- Broadcom Inc.(CA Technologies)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Okta Inc.

- Centrify Corporation

- Sailpoint Technologies Holdings Inc.

- Auth0 Inc.

- Dell Technologies Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The Cloud Identity and Access Management Software Market is expected to register a CAGR of 18.6% during the forecast period.

Key Highlights

- Due to cost savings and economies of scale, cloud technology is revolutionizing how businesses operate. However, the lack of proper security measures can undermine the benefits of cloud computing. This calls for a fundamental need for security solutions, including security for identity-related crimes, and hence drives the market for cloud identity and access management.

- The public cloud is the most popular type of cloud deployment on the market. This is because it is being used more and more in many different industries. However, hybrid cloud deployment is expected to register the highest CAGR over the forecast period because of growing adoption among small and medium-sized enterprises.

- As mobile phones and tablets become more popular, employees can connect their phones and laptops to the business network. Instead of using their old office desktops, employees like to use their own devices in enterprises, which increases the need for cloud identity and access management software and hence drives the market studied.

During the COVID-19 impact period, cloud identity and access management (IAM) software was expected to have a positive impact on the market and contribute significantly to its growth over the forecast period. IAM vendors came forward to assist the enterprises. For instance, during the pandemic, IBM announced that it would make critical technologies such as IBM Security MAss360 with Watson and IBM Cloud Identity available at no charge for new clients for 90 days.

Cloud Identity and Access Management Software Market Trends

Single Sign-on (SSO) and Federated Provisioning is Expected to Witness the Highest Growth

- Single sign-on (SSO) is the most recent innovation in identity access management. The compact and highly flexible nature of this solution is attracting a wide range of end-users, ranging from IT companies to the manufacturing sector.

- In the case of federated provisioning, the solution is a mix of two separate systems called federated identity and provisioning. Federated identity refers to the standards that allow different policy domains to share identity management responsibilities. Provisioning, on the other hand, is the automation of all the steps in the lifecycle that are needed to manage user or system access entitlements.

- The capability of retaining in-house control of user accounts while leveraging cloud applications and data is the significant advantage that federated provisioning solutions offer and is driving the immense growth of these solutions in the market.

- Furthermore, the increasing number of social engineering attacks and identity thefts is driving the growth of both single sign-on and federated provisioning, especially in the developed countries of North America and Europe.

- The Identity Theft Resource Center thinks that in the United States in 2022, there were 1802 times when data was stolen. In the same year, data intrusions such as data breaches, data leaks, and data exposure also had an impact on over 422 million people. Even though these are three distinct events, they all share a similar trait. All three instances result in an unauthorized threat actor accessing the sensitive data.

North America Occupies the Largest Market Share

- Most of the cloud-advanced organizations in the world are from the North American region, along with a high number of startups whose most preferred mode of solution deployment is in the cloud.

- Along with the highest adoption of cloud-based software services, it is also reported by the ITU that the North American region is very proactive and committed to cybersecurity.

- Moreover, benefits like reduced CAPEX and faster rollouts of updates are some of the major reasons for the adoption of cloud-based identity management solutions in the North American region.

- Major adoption of cloud-based IAM in the region is seen in the BFSI sector, and it may continue to rise, as credit card frauds and breaches accounted for a major share of the total number of identity thefts, as reported by the US consumer sentinel network.

- The region is highly affected by cyberattacks and has one of the highest cybersecurity incidents in the world. Therefore, the region has also implemented its countermeasures and has become one of the most advanced regions with respect to cybersecurity, technology, and its adoption. Therefore, rising cybersecurity needs will also drive the cloud identity and access management software market in the region.

Cloud Identity and Access Management Software Industry Overview

The cloud identity and access management market comprises several global and regional players and is a moderately contested market space. However, the market is shifting toward the consolidation of various smaller players. Several market players are gaining a sustainable competitive advantage in the market through innovations. Some of the major players in the market are IBM Corporation, Microsoft Corporation, and Oracle Corporation, among others.

CloudIBN announced the introduction of Identity and Access Management services in December 2022. With the help of this IAM solution suite, businesses can effectively manage user access control across their whole organization and keep their data safe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Security Breaches and Related Costs

- 4.2.2 Increasing Trend of Using BYODs in Enterprises

- 4.3 Market Restraints

- 4.3.1 Vulnerability of Cloud-based Applications to Cyber Risks

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technology Snapshot

- 4.6 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Size of Organization

- 5.1.1 SMEs

- 5.1.2 Large Organization

- 5.2 By Type of Solution

- 5.2.1 Audit, Compliance, and Governance

- 5.2.2 Single Sign-on (SSO) and Federated Provisioning

- 5.2.3 Privileged Access Management

- 5.2.4 Directory Service

- 5.2.5 Other Types of Solutions

- 5.3 By Deployment Type

- 5.3.1 Public

- 5.3.2 Private

- 5.3.3 Hybrid

- 5.4 By End-User Vertical

- 5.4.1 IT and Telecommunication

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 Entertainment and Media

- 5.4.5 Retail

- 5.4.6 Education

- 5.4.7 Other End-User Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cyberark Software Ltd.

- 6.1.2 Broadcom Inc. (CA Technologies)

- 6.1.3 IBM Corporation

- 6.1.4 Microsoft Corporation

- 6.1.5 Oracle Corporation

- 6.1.6 Okta Inc.

- 6.1.7 Centrify Corporation

- 6.1.8 Sailpoint Technologies Holdings Inc.

- 6.1.9 Auth0 Inc.

- 6.1.10 Dell Technologies Inc.