|

市場調查報告書

商品編碼

1627195

亞太地區智慧眼鏡 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)APAC Smart Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

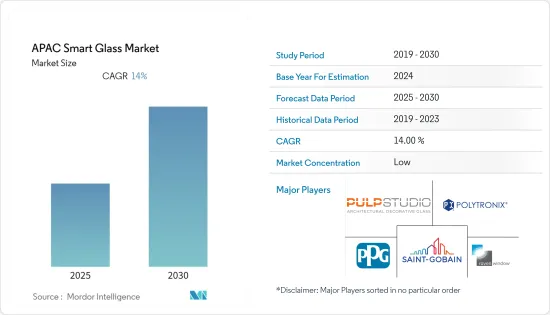

亞太地區智慧玻璃市場預計在預測期內複合年成長率為 14%。

隨著對永續發展的日益關注,越來越多的人選擇在建築物中安裝用戶控制的窗戶。智慧玻璃製造商正在積極投資研發,透過引入新技術和更低成本的原料來降低生產成本。

該地區正在積極進行與智慧玻璃相關的研究和開發。例如,上海大學的研究人員最近設計了第一個可以發電的智慧窗戶。這些窗戶的功能類似於太陽能板,使用二氧化釩膜來發電。此類開發預計將帶來進一步的成長機會,特別是在辦公室、住宅和酒店市場。

此外,新加坡工程研究機構之一南洋理工大學的研究人員開發了一種獨特的液體窗板,可以阻擋陽光並調整其對室內空間的穿透力。同時,面板可以捕捉從太陽接收到的熱量,然後逐漸釋放出來,有助於調節房間內的溫度。

該地區智慧玻璃的大部分成長預計將出現在建築領域,利用顯著的成本節約和能源效率。員工和居住者希望增加自然光和戶外景觀,以改善他們的健康和生產力。

然而,受疫情影響,商業景氣惡化、營業盈餘和收入減少、COVID-19管理資金挪用以及流動性問題,導致建築計劃需求下降。建設活動減少和供應鏈中斷導致計劃在短期內推遲或取消,從而抑制了市場成長。

亞太地區智慧玻璃市場趨勢

建築業預計將有進一步的市場成長機會。

更聰明的施工流程和方法正在影響該地區的建築業。根據中國國家統計局預測,到2024年,中國建築業收入預計將達到約38.12億美元。中國已成為全球最大的建築市場之一。 2020年,中國地區建築業規模達1.49兆美元。國家統計局預計,隨著國家重點發展中小城市基礎建設,建築業預計將保持每年5%左右的持續成長。

乾淨科技、節能和永續能源利用的各種方法鼓勵客戶使用各種產品來實現他們的目標。該地區被認為是經濟成長最快的地區,中國和印度等國家發展迅速。此外,馬來西亞和新加坡等新興經濟體的工業、建築和基礎設施領域正在經歷成長。經濟發展對基礎建設提出了需求,購物中心、醫院等建設正在快速推進。這些國家建築業的成長預計將影響智慧玻璃市場。

在新加坡,建築物是第二大能源消耗者,消耗了近三分之一的電力。許多現代建築建築幕牆通常 80% 是玻璃,這不符合政府為應對都市化和氣候變遷而規定的永續性和能源效率目標。因此,與傳統玻璃相比,安裝智慧著色窗可以平均減少建築物20%的消費量,從而減輕暖氣、通風和空調系統的負荷。

此外,隨著都市化的進步以及節省資源和減少溫室氣體排放的努力,該地區可能有進一步採用智慧玻璃的空間。中國等國家在製定國家綠建築標準方面取得了長足進展。近期進展,中國住宅建部在《建築節能與綠建築發展「十三五」規劃》中明確了2020年實現綠建築發展的目標。中國政府在政府計劃中強制推行綠色建築,並利用市場化手段(如補貼和公共採購)來促進綠建築。

同樣,韓國綠色建築委員會認知到實施綠色建築是建築業的基本要素之一,旨在創建永續和環境友善城市。這正在影響該地區智慧玻璃的採用。

日本市場存在巨大的成長機會

在該地區,智慧玻璃主要用於提高交通領域乘客的便利性。例如,日本鐵道建設交通設施開發機構的車輛上安裝了AGC的光控玻璃,該玻璃採用了Research Frontier的SPD-SmartGlass。車內安裝的車窗玻璃採用薄型化學強化玻璃和SPD-SmartGlass的組合,減輕了30%的重量,並提高了乘客的舒適度。

在該地區,交通領域的應用不斷增加,對智慧玻璃產生了巨大的需求。智慧玻璃正在大規模應用,特別是在汽車行業,例如天窗和汽車內外的自動調光後視鏡。事實上,大多數智慧玻璃都是化學強化玻璃,因此當安裝在汽車上時,它比汽車行業使用的傳統玻璃輕得多,有助於汽車製造商提高燃油效率並有助於遵守當地排放法規。

根據日本經濟產業省統計,2020年日本汽車產量約807萬輛,較前一年的約968萬輛略有下降。下降背後的主要因素是 COVID-19 大流行期間的生產關閉。日本的汽車生產包括乘用車、卡車和公共汽車,其中乘用車佔大多數。

智慧玻璃也在該地區的建築領域被採用。根據財務省統計,2020年日本建築業銷售額約133.9兆日圓。根據國土交通省統計,2020年日本建築投資總額預計約為60.9兆日元,其中房屋建築約佔50%,預計2021年將增至62.7兆日元。

窗戶被認為是建築物中效率最低的部分,在寒冷的月份會導致熱量損失,而在溫暖的月份則會增加太陽熱量。一些研究人員也表示,陽光進入住宅可將冷負荷增加 20%。在某些情況下,刺眼的陽光會使液晶顯示器難以看清,迫使您拉上百葉窗,從而減少自然光的好處。預計這些將為該地區的市場帶來進一步的成長機會。

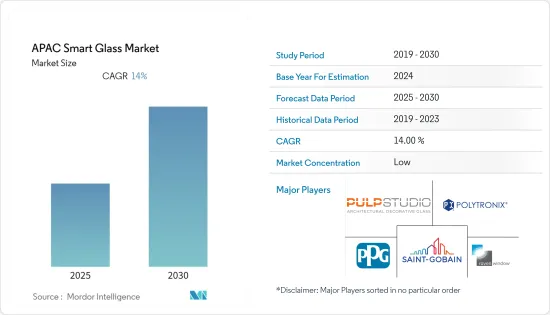

亞太地區智慧玻璃產業概況

亞太地區智慧玻璃市場較為分散。各種國際國內品牌和新參與企業正在塑造競爭格局。主要企業越來越希望透過各種策略併購、技術創新和增加研發投入來擴大市場。

- 2021年4月,聖戈班子公司SageGlass被全球最大的房地產開發商之一Bagmane集團選中安裝全球最大的智慧玻璃。該公司在 Rio Business Park(位於印度班加羅爾的一個 160 萬平方英尺的辦公室開發項目)中列出了 20 萬平方英尺的 SageGlass Harmony 電致變色玻璃、控制設備和軟體。

- 2021 年 10 月,混合實境(AR/MR)新興企業Thirdeye 宣布與香港 IT 供應商 GO VR Immersive 合作,將其 X2 MR 智慧眼鏡的產品擴展到亞太地區。該公司將為亞太地區教育、建築和工業環境中的第一線工作人員提供由該公司強大的 MR 解決方案提供支援的耳機。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 節能環保技術日益受到關注

- 政府法規

- 對節能技術的需求不斷成長

- 市場限制因素

- 對智慧玻璃的好處缺乏認知

- 使用大型智慧玻璃的技術問題

第6章 市場細分

- 技術部分

- 懸浮顆粒裝置

- 液晶

- 電致變色玻璃

- 被動式智慧玻璃

- 主動智慧玻璃

- 其他

- 應用領域

- 用於建築

- 住宅玻璃

- 商業大廈

- 運輸

- 航太

- 鐵路

- 車

- 其他

- 能源

- 家用電子電器

- 其他

- 用於建築

- 國家名稱

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Polytronix

- PPG Industries

- Scienstry Inc

- Saint-Gobain

- Pulp Studio

- Ravenbrick

- Nippon

- Smartglass International

- Pro Display

- Gentex Corporation

- Hitachi Chemical

- LTI Smart Glass

- Citala

- Asahi Glass Corporation

- View, Inc.

第8章投資分析

第9章市場的未來

The APAC Smart Glass Market is expected to register a CAGR of 14% during the forecast period.

With a growing focus on sustainable development, an increasing number of people have been opting for user-controlled windows in buildings. Smart glass manufacturers have been actively investing in research and development to cut production costs by implementing newer technologies and low-cost raw materials.

There has been a great amount of research and development going on in the region on smart glasses. For instance, in recent years, researchers at Shanghai University have designed the first smart window, which can produce electricity. The window acts like a solar panel and uses Vanadium dioxide film to produce electricity. Such developments are expected to provide further growth opportunities to the market, especially in offices, residential homes, and hotels.

Also, Scientists at the Nanyang Technological University, one of Singapore's engineering research institutes, have developed a unique liquid window panel that can block sunlight to regulate solar transmission into a room. Besides this, the panel can simultaneously trap thermal heat received from sunlight, gradually release it later, and help regulate indoor temperature.

The majority of the smart glass growth in the region is expected to be observed in the building sector, taking advantage of the significant cost savings and energy efficiency. Employees and residents are looking forward to benefiting from the increased natural light and access to views of the outdoors, which can improve both their health and productivity.

However, due to the pandemic, construction projects' demand has fallen due to poor business sentiments, lower operating surpluses and incomes, diversion of funds for COVID-19 management, and liquidity problems. There has been a decrease in construction activities and supply chain disruptions that have resulted in projects being delayed or halted for the short term, restraining the market's growth.

APAC Smart Glass Market Trends

Construction industry is expected to have further growth opportunities in the market

Smarter construction processes and methods are influencing the construction industry in the region. As per the National Bureau of Statistics of China, it is projected that the construction revenue in China will amount to approximately USD 3.812 billion by 2024. China has become one of the largest construction markets in the world. In 2020, the construction industry value in the China region amounted to USD 1,049 billion U.S. dollars. As the government has planned to focus on improving the infrastructure in small and medium-sized cities, the construction industry is expected to maintain a continuous growth at around 5% annually, as per the National Bureau of Statistics of China.

Various initiatives for clean technology, energy conservation, and sustainable use of energy are driving the customers to use different products, which would serve their purpose. The region is considered to be the fastest-growing economic region, with countries such as China and India developing at a rapid rate. Also, the emerging economies, such as Malaysia, Singapore, and others, are experiencing growth in their industrial, construction, and infrastructural sectors. This economic development has created a need for enhanced infrastructure; thus, the construction of malls, hospitals, and other buildings is growing at a high pace. The growing construction sector in these countries is expected to influence the smart glass market.

In Singapore, buildings are the second largest energy consumers, using almost a third of the electricity. Most of the modern building facades are often as much as 80% glass, which makes them less compatible with the sustainability and energy efficiency goals, as mandated by the government, to cope with urbanization and climate change. Thus, installing smart-tinting windows can reduce a building's energy consumption by 20%, on average, as compared to conventional glass, thus, reducing the load on the heating, ventilation, and air-conditioning systems.

Also, increasing urbanization and commitments to conserve resources and reduce greenhouse gas emissions will further create a scope for the adoption of smart glass in the region. Countries, such as China, made significant progress in developing national green building standards. In recent years, The Ministry of Housing and Urban-Rural Development of China set clear goals to achieve the development of green buildings by 2020, in the 13th Five Year Plan for Building Energy Efficiency and Green Building Development. The Chinese government has mandated green building in government projects and has also used market-based instruments (like subsidies and public procurement) to promote green building.

Similarly, Korea Green Building Council also recognizes that the deployment of green buildings is one of the essential factors in the construction sector, with an aim to build sustainable and eco-friendly cities. This is impacting the adoption of smart glass in the region.

Japan region witnesses significant growth opportunities in the market

Smart glass is primarily used in the region to improve passenger experience in the transportation sector. For instance, AGC's light control glass, using Research Frontiers' SPD-SmartGlass, is installed in one of the trains of the Japan Railway Construction, Transport, and Technology Agency. This window glass, mounted in the train, combines a thin, chemically-strengthened glass with SPD-SmartGlass, to reduce weight by 30% and improve passenger comfort.

There have been increasing applications in the field of transportation that are creating immense demand for smart glass in the region. Smart glass has found a large-scale application, particularly in the automotive industry, in sunroofs, and exterior and interior automatic dimming rear-view mirrors. In fact, as most of the smart glass products are chemically toughened, they are far lighter than the traditional glass used in the automotive sector when installed in automobiles, helping automakers gain more fuel efficiency and meet regional emission standards.

According to METI (Ministry of Economy, Trade, and Industry) Japan, In 2020, approximately 8.07 million motor vehicles were produced in Japan, which is slightly down from about 9.68 million units in the previous year. The decrease was primarily due to the production halt during the Covid-19 pandemic. The production volume of motor vehicles in Japan included passenger cars, trucks, and buses, of which passenger cars accounted for the majority.

Smart glass is also increasingly being adopted in the construction sector in the region. According to the Ministry of Finance Japan, the construction industry in Japan generated sales of approximately JPY 133.9 trillion in 2020. In 2020, total construction investment in Japan was estimated at around JPY 60.9 trillion, with building construction accounting for almost 50% of these investments, forecasted to increase to JPY 62.7 trillion in 2021, according to the Ministry of Land, Infrastructure, Transport, and Tourism, Japan.

Windows are considered the most inefficient part of a building and are responsible for heat loss in cold months and solar heat gain in warm months. Some researchers also stated that sunlight entering a house could increase cooling loads by 20%. In some cases, glare from the sun can make it difficult to see an LCD screen, requiring the blinds to be pulled, negating the benefits of natural light. These are expected to bring further growth opportunities to the market in the region.

APAC Smart Glass Industry Overview

The Asia Pacific Smart Glass Market is fragmented. Various established international brands, domestic brands, as well as new entrants, form a competitive landscape. The major players are increasingly seeking market expansion through various strategic mergers and acquisitions, innovation, increasing investments in research and development.

- April 2021: SageGlass, a subsidiary of Saint Gobain, was chosen by Bagmane Group, one of the largest build-to-suit real estate developers, to create one of the largest smart glass installations in the world. The company will provide 200,000 square feet of SageGlass Harmony electrochromic glass, controls, and software for Rio Business Park, a 1.6 million square foot office development in Bangalore, India.

- October 2021: Mixed reality (AR/MR) startup Thirdeye announced a partnership with Hong Kong-based IT vendor GO VR Immersive to expand the availability of its X2 MR smart glasses to the Asia-Pacific region. The company will be supplying headsets to APAC frontline workers in education, architecture, and industrial environments with their rugged MR solution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing focus on Energy Conservation and Environment Friendly Technologies

- 5.1.2 Government Regulations

- 5.1.3 Increasing demand for energy savings techniques

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness of Smart Glass Benefits

- 5.2.2 Technical Issues with the Usage of Large Size Smart Glass

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Suspended Particle Devices

- 6.1.2 Liquid Crystals

- 6.1.3 Electro-chromic Glass

- 6.1.4 Passive Smart glass

- 6.1.5 Active Smart glass

- 6.1.6 Others

- 6.2 Applications

- 6.2.1 Construction

- 6.2.1.1 Residential Buildings

- 6.2.1.2 Commercial Buildings

- 6.2.2 Transportation

- 6.2.2.1 Aerospace

- 6.2.2.2 Rail

- 6.2.2.3 Automotive

- 6.2.2.4 Others

- 6.2.3 Energy

- 6.2.4 Consumer Electronics

- 6.2.5 Others

- 6.2.1 Construction

- 6.3 Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 South Korea

- 6.3.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Polytronix

- 7.1.2 PPG Industries

- 7.1.3 Scienstry Inc

- 7.1.4 Saint-Gobain

- 7.1.5 Pulp Studio

- 7.1.6 Ravenbrick

- 7.1.7 Nippon

- 7.1.8 Smartglass International

- 7.1.9 Pro Display

- 7.1.10 Gentex Corporation

- 7.1.11 Hitachi Chemical

- 7.1.12 LTI Smart Glass

- 7.1.13 Citala

- 7.1.14 Asahi Glass Corporation

- 7.1.15 View, Inc.