|

市場調查報告書

商品編碼

1627197

歐洲聲學感測器:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Acoustic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

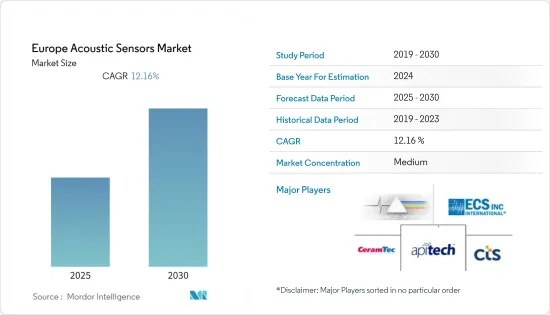

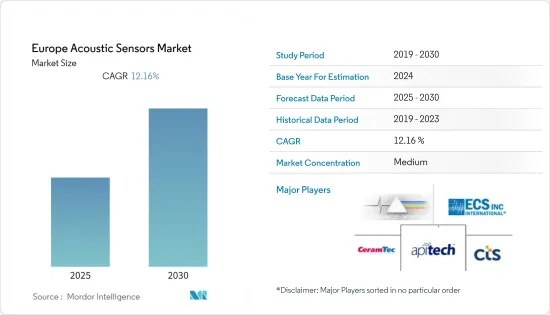

歐洲聲學感測器市場預計在預測期內複合年成長率為 12.16%

主要亮點

- 聲學感測器預計在預測期內將出現高速成長,因為它們被應用於生成廣播訊號的電視發送器和收音機中。 SAW 裝置對於射頻應用而言是不可或缺的濾波器,也是衛星通訊終端和基地台使用的重要元件。

- 隨著通訊領域的進步,SAW 和體聲波(BAW)共振器、濾波器、振盪器和延遲線越來越受歡迎。除了被動和無線之外,SAW 感測器還具有價格競爭力、固有的穩健性、高響應性和固有的可靠性。

- 汽車、國防和航太產業也吸引了近年來探索的市場供應商。由於這些感測器對磁場不敏感,因此許多汽車應用需要感測馬達或螺線管附近的扭矩。這對於其他類型的感測器技術來說是一個問題。例如,總部位於英國的 Transense 設計了用於特種車輛電動輔助轉向 (EPAS) 的 SAW 扭矩感測器技術,並與麥克拉倫合作開發馬達扭矩感測產品。

- 在 COVID-19 的早期階段,由於全國範圍內的封鎖和許多製造產能的關閉,研究市場出現了供應鏈中斷。然而,從2020年第二季開始,市場開始出現需求和生產的復甦,半導體產業的趨勢也反映在研究市場。

歐洲聲學感測器市場趨勢

消費性電子佔最高佔有率

- 消費性電子產品過去一直是採用 SAW 感測器的主要投資者之一,並在 SAW 感測器和設備的開發中發揮了重要作用。 SAW 感測器在各種消費和通訊應用的射頻濾波器的開發中發揮著重要作用。例如,SAW 設備的配置相對簡單。由於智慧型手機產業廣泛採用 SAW 濾波器,感測器材料的成本在過去三十年中有所下降。

- 智慧型手機銷售的增加以及家用電子電器中新興射頻技術的日益採用,導致射頻感測器和其他射頻相關設備的銷售大幅成長,擴大了研究市場的範圍。

- 聲波濾波器(典型的聲表面波元件)已生產超過 10 億個,主要用於智慧型手機。 SAW 裝置在收發器電子元件的射頻和中頻部分充當帶通濾波器。該技術在智慧型手機和個人數位助理的觸控螢幕輸入中也最常見。由於IDT形態直接決定傳輸功能,因此易於設計和製造IDT的SAW元件被廣泛用作智慧型手機和電視等家用電子電器中收發器和其他訊號處理模組中的濾波器。

- 隨著家用電子電器產業的進步和功能的增加,射頻識別技術中 SAW 感測器的生產和需求將持續增加。 SAW 技術採用晶圓級封裝 (WLP),提供小外形規格、提高功率處理能力、以高抑制率降低插入損耗,並提高 Fi-Fi 和藍牙應用、無線行動裝置手機、平板電腦、筆記型電腦、智慧型手錶等

汽車領域成長最快

- 由於對更高效率和減少排放的需求不斷成長,現代汽車的感測器系統正在快速成長。聲表面波感測技術為汽車安全環境(尤其是旋轉部件)中的壓力、扭矩和溫度感測提供了新的機會。

- 歐洲在先進汽車製造領域的主導地位,以及現在在電動車領域的主導地位,是推動該地區聲學感測器成長的關鍵因素。 IEA數據顯示,2020年歐洲首次超越中國成為全球電動車市場中心。歐洲的電動車註冊量增加了一倍多,達到 140 萬輛,而中國的電動車註冊量增加了 9%,達到 120 萬輛。

- 世界各地的研究人員正在積極投資這些產品的開發。例如,德國達姆施塔特大學開發了一種SAW輪胎感測器,利用其體積小、無動力結構的優點來測量輪胎壓力和摩擦力。西門子也宣布將與這項研究合作,以便將其納入實際的輪胎胎面中。

- 艾默生電氣公司於 2015 年收購了其 InteliSAW 溫度感測產品。此外,2020年6月,該公司用於監測重型越野車輪胎和車輛性能的iTrack技術被授權給普利司通公司,為期10年。

- 此外,我們於 2020 年 12 月成立了 SAW 商業諮詢委員會 (SAWCAP),以製定商業策略、經營團隊行銷和銷售活動以推動收益成長,並增加 SAW 市場的長期股東價值。

歐洲聲學感測器產業概況

聲學感測器是相對容易製造的設備。因此,市場高度分散,許多全球和本地製造商為市場動態做出了貢獻。儘管MEMS市場正在穩步成長,主要企業面臨激烈的競爭,迫使他們降低價格和利潤。參與企業數量持續增加。

- 2020年4月 - 國內合併子公司Kyocera Document Solutions Inc.收購了德國企業內容管理公司OPTIMAL SYSTEMS GmbH 97%的普通股,並對其進行合併,以擴大其在歐洲的文檔解決方案業務。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 通訊市場的成長

- 製造成本低

- 技術進步

- 市場限制因素

- 使用 SAW 感測器等替代品

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按波浪類型

- 表面波

- 體波

- 按感測參數

- 溫度

- 壓力

- 大量的

- 扭力

- 濕度

- 黏度

- 化學蒸氣

- 其他

- 按用途

- 車

- 航太/國防

- 家用電子電器

- 醫療保健

- 工業的

- 其他

- 按國家/地區

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 歐洲其他地區

第6章 競爭狀況

- 公司簡介

- API Technologies Corp.

- ASR&D Corporation

- Boston Piezo-optics Inc.

- Ceramtec

- CTS Corporation

- ECS Inc. International

- Epcos

- Epson Toyocom

- Honeywell International Inc.

- Kyocera

- Murata Manufacturing Co. Ltd.

- Panasonic Corp.

- Phonon Corporation

- Rakon

- Raltron Electronics Corporation

- Senseor

- Shoulder Electronics Ltd.

- Teledyne Microwave Solutions

- Triquint Semiconductor, Inc.

- Vectron International

第7章 投資分析

- 最近的併購

- 投資機會

第8章 未來展望

簡介目錄

Product Code: 50727

The Europe Acoustic Sensors Market is expected to register a CAGR of 12.16% during the forecast period.

Key Highlights

- The acoustic sensors are expected to have high growth during the forecast period due to their implementation in television transmitters and radios to generate signals for broadcasting. SAW devices are indispensable as filters in radio frequency applications and are essential components used in the terminals and base stations for satellite communication.

- With advancements in the communication sector, SAW and bulk-acoustic-wave (BAW) resonators, filters, oscillators, and delay lines have gained traction. Apart from being passive and wirelessly interrogated, SAW sensors are competitively priced, intrinsically rugged, highly responsive, and intrinsically reliable.

- The automotive, defense and aerospace industries are also attracting vendors in the market studied in recent years. As these sensors are insensitive to Magnetic Fields, many automotive applications require torque-sensing close to electric motors and solenoids. This is problematic for some other types of sensor technology. For instance, a UK-based company, Transense, has designed its SAW torque sensor technology for electric power-assisted steering (EPAS) in specialized vehicles and with partners McLaren for Motorsport torque-sensing products.

- In the initial phase of the COVID-19, the studied market witnessed the disruption in the supply chain owing to nationwide lockdown and closure of many manufacturing capacities. However, after the 2nd Q of 2020, the market started witnessing a recovery in demand and production; the semiconductor industry trend was also reflected in the studied market.

Europe Acoustic Sensors Market Trends

Consumer Electronics to hold the highest market share

- Consumer electronics is one of the significant investors and adopters of the SAW sensors in the past, which has played a substantial role in developing the SAW sensors and devices. The SAW sensors have played a significant role in developing RF filters across various consumer and communication applications. For instance, SAW devices are relatively simple in their composition. Due to the wide adoption of SAW filters in the smartphone industry, the sensor materials cost has dropped in the past three decades.

- There is a significant surge in RF sensors and other RF-related equipment sales due to the increasing smartphone sales and the increasing adoption of emerging RF technologies in consumer electronics, expanding the scope of the market studied.

- More than a billion acoustic wave filters, typically SAW devices, are produced, primarily for smartphones. The SAW devices act as band-pass filters in the transceiver electronics' RF and intermediate-frequency sections. This technology is also the most common for touchscreen input on smartphones or personal digital assistants. The shape of the IDT directly determines the transmission function; therefore, the design and easy fabrication of IDTs makes SAW devices widely used as filters in transceivers and other signal processing modules in consumer electronic devices like smartphones and TV sets.

- With growing advancement and functionality in the consumer electronic industry, the production and demand for SAW sensors will continue to increase in RF identification technologies. SAW technology provides a small form factor using wafer-level packaging (WLP) that improves power handling, lowers insertion loss with high rejection, and makes temperature performance dependable, making it reliable for Wi-Fi and Bluetooth applications, wireless mobile device handsets, tablets, laptops, and smartwatch, among others.

Automotive Segment to register fastest growth

- The modern automobile is witnessing rapid growth in sensor systems, fueled by the growing need for higher efficiency and reduced emissions. Surface acoustic wave sensing technology provides new opportunities for sensing pressure, torque, and temperature within the automotive safety environment, especially on rotating components.

- Europe's dominance in advanced automotive manufacturing, and now in EV, is a significant factor driving the growth of acoustic sensors in the region. According to IEA, For the first time in 2020, Europe overtook China as the center of the global electric car market. Electric car registrations in Europe more than doubled to 1.4 million, while they increased 9% to 1.2 million in China.

- Researchers around the world are actively investing in these product developments. For instance, the Germany-based University of Darmstadt developed SAW tire sensors to measure tire pressure and friction by leveraging its miniature structure and no power requirement. Siemens also announced its cooperation in this research to integrate it into the actual tire tread.

- Emerson Electric Co acquired the company's InteliSAW temperature sensing product in 2015. Moreover, in June 2020, the company's iTrack technology, used for monitoring the tire and vehicle performance of heavy-duty off-road vehicles, was licensed to Bridgestone Corporation for a ten-year term commencing.

- In December 2020, the company also formed its SAW Commercial Advisory Panel ("SAWCAP") to provide advice to the Board and Management in support of the development of commercial strategy, the implementation of marketing and sales activities to promote revenue growth, and to forge strategic alliances that enhance long term shareholder value in the SAW market.

Europe Acoustic Sensors Industry Overview

Acoustic sensors are a relatively simple device to manufacture. Consequently, the market is highly fragmented, with many global and local manufacturers contributing to the market dynamics. The MEMS market is seeing steady growth, but companies have to face cut-throat competition leading to brutal price declines and low margins. The market is continually adding new entrants into the market.

- April 2020 - In order to expand the document solutions business in Europe, Kyocera Document Solutions Inc., a domestic consolidated subsidiary, purchased 97% of the common stocks of OPTIMAL SYSTEMS GmbH, a Germany-based company that conducts enterprise content management business, and made it a consolidated subsidiary.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Telecommunications market

- 4.2.2 Low Manufacturing costs

- 4.2.3 Technological Advancements

- 4.3 Market Restraints

- 4.3.1 Use of alternatives like SAW sensors

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness- Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Wave Type

- 5.1.1 Surface Wave

- 5.1.2 Bulk Wave

- 5.2 By Sensing Parameter

- 5.2.1 Temperature

- 5.2.2 Pressure

- 5.2.3 Mass

- 5.2.4 Torque

- 5.2.5 Humidity

- 5.2.6 Viscocity

- 5.2.7 Chemical Vapor

- 5.2.8 Others

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defence

- 5.3.3 Consumer Electronics

- 5.3.4 Healthcare

- 5.3.5 Industrial

- 5.3.6 Others

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 API Technologies Corp.

- 6.1.2 ASR&D Corporation

- 6.1.3 Boston Piezo-optics Inc.

- 6.1.4 Ceramtec

- 6.1.5 CTS Corporation

- 6.1.6 ECS Inc. International

- 6.1.7 Epcos

- 6.1.8 Epson Toyocom

- 6.1.9 Honeywell International Inc.

- 6.1.10 Kyocera

- 6.1.11 Murata Manufacturing Co. Ltd.

- 6.1.12 Panasonic Corp.

- 6.1.13 Phonon Corporation

- 6.1.14 Rakon

- 6.1.15 Raltron Electronics Corporation

- 6.1.16 Senseor

- 6.1.17 Shoulder Electronics Ltd.

- 6.1.18 Teledyne Microwave Solutions

- 6.1.19 Triquint Semiconductor, Inc.

- 6.1.20 Vectron International

7 INVESTMENT ANALYSIS

- 7.1 Recent Mergers and Acquisitions

- 7.2 Investment Opportunities

8 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219