|

市場調查報告書

商品編碼

1628730

乳製品包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)Dairy Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

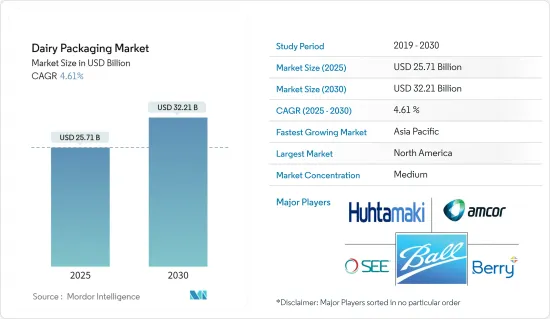

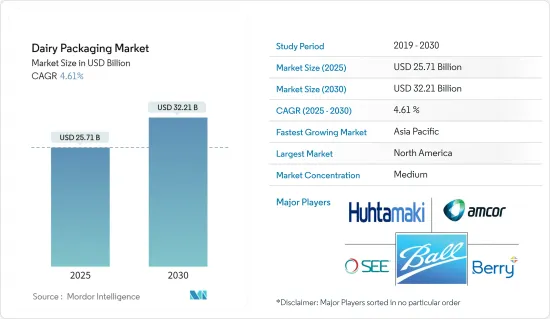

乳製品包裝市場規模預計到2025年為257.1億美元,預計2030年將達到322.1億美元,預測期內(2025-2030年)複合年成長率為4.61%。

主要亮點

- 向健康零食的轉變、已調理食品消費的增加以及網路購物和行動購物的興起正在改變食品購買和消費模式。這些趨勢,加上健康意識的增強,預計將對乳製品市場產生重大影響。

- 由於人口成長和飲食習慣的改變,透過各種零售管道增加包裝乳製品的供應預計將推動市場成長。此外,消費者對蛋白質產品日益成長的偏好預計將推動全球乳製品的採用。

- 乳製品行業的全球趨勢表明,製造商越來越注重包裝,以使其產品脫穎而出。現今的乳製品包裝通常具有引人注目的設計和無菌功能。由於日本、亞太地區、西歐和北美等主要市場的激烈競爭,最終用戶正在採用創新的乳製品包裝策略。

- 乳製品製造商越來越注重透過提高國際出口能力和本地生產來獲取全球乳製品貿易的更大佔有率。這一趨勢正在推動對更先進的乳製品包裝解決方案的需求。

- 包裝類型的多樣化是擴大乳製品銷售的關鍵因素。例如,曾經主要以山形蓋頂紙盒形式出售的牛奶現在通常以攜帶式、品牌友好的寶特瓶形式出售,以吸引時間有限的消費者。

- 然而,乳製品包裝市場面臨挑戰。受食品價格影響的包裝材料價格波動可能會阻礙市場成長。此外,對與塑膠包裝相關的潛在健康風險的擔憂,包括對與癌症和生殖健康問題相關的毒素的擔憂,正在阻礙市場的擴張。

乳製品包裝市場趨勢

牛奶佔最大市場佔有率

- 牛奶是世界上消費最多的乳製品。由於水分和礦物質含量高,儲存對供應商來說是一個重大挑戰,這就是為什麼奶粉和加工乳製品被廣泛銷售的原因。由於這些特性,原乳極易腐爛,需要先進的保存和包裝技術來保持品質並延長保存期限。

- 目前的牛奶加工技術允許液態奶裝瓶並在4-8°C下儲存,保存期限為10-21天。超高溫(UHT)加工等先進製程將不冷藏包裝的牛奶保存期限延長至一年。這項技術進步徹底改變了牛奶分銷,擴大了市場准入並減少了浪費。

- 近年來,地產地銷,特別是在亞洲。這項轉變旨在減少對進口的依賴並支持國內乳製品產業。儘管印度等國家的牛奶產量約佔全球的 16%,但供需缺口仍存在。這種差異凸顯了新興市場需要改善基礎設施和分銷網路。

- 此外,創新和環保的牛奶包裝的興起正在推動市場收入成長。這種趨勢延伸到多種包裝形式,包括瓶子、紙盒和袋子。例如,Delamere Dairy於2024年7月推出了CartoCan風味牛奶系列,針對忙碌的消費者。 CartoCan 完全可回收,減少了塑膠廢棄物,並提供了傳統 500 毫升玻璃瓶的簡單替代品。

- 據美國農業部對外農業服務局稱,全球牛奶產量正在穩步成長。全球牛奶產量將從2017年的5.116億噸增加至2023年的約5.4948億噸。這一成長反映出全球對乳製品的需求不斷成長以及酪農實踐和技術的改進。

- 酪農行業對無菌包裝的需求正在迅速成長。全球牛奶產量的增加可能會釋放新的市場機會。此外,我們也看到消費者行為發生重大轉變,超高溫滅菌牛奶消費量的快速增加就是例證。隨著消費者尋求減少去商店的次數,對具有更長保存期限的超高溫滅菌牛奶的需求正在激增。值得注意的是,消費者對乳製品解決方案的偏好發生了明顯的轉變,從散裝牛奶轉向知名品牌的包裝牛奶,尤其是那些大批量的品牌。

北美佔最大市場佔有率

- 由於牛奶、起司和優格等乳製品的產量和銷量不斷增加,北美在全球乳製品包裝市場中佔據最大佔有率。在美國,乳製品的消費量正在增加,尤其是帕瑪森起司、波伏洛乾酪和莫札瑞拉起司等乳酪,這預計將推動乳製品包裝市場的發展。該地區先進的乳製品產業基礎設施、嚴格的食品安全法規以及消費者對便利和創新包裝解決方案的需求進一步增強了該地區的優勢。

- 美國乳製品包裝市場受到快速變化的消費者對包裝食品的偏好和經濟狀況的顯著影響。由於產品系列(尤其是運動營養品)的顯著擴大以及休閒用戶的增加,預計該市場將進一步成長。

- 健康意識、永續性關注和電子商務的興起等因素也在塑造乳製品產業的包裝趨勢。隨著消費者尋求富含蛋白質的產品以及透過多樣化的零售管道更容易獲得包裝乳製品,全國人民對乳製品的接受度將會提高,市場也將向前發展。

- 據美國農業部稱,美國食用乳產量將從2017年的2,154億英鎊(2,679.1億美元)增加到2023年的2,266億英鎊(2,818.4億美元)。牛奶產量的增加需要用於零售、散裝和分銷目的的更大的包裝解決方案,以處理和分銷增加的產量。牛奶產量的增加刺激了包裝技術的投資,以確保產品新鮮、延長保存期限並適應不同分銷管道的不同消費者偏好。

- 乳製品在北美市場的持續推出似乎也是包裝製造商加強在該地區影響力的絕佳機會。 2023 年 9 月,Ornua Foods North America 發布了其最新產品 Kerrygold 起司零食,該產品採用即食起司棒,方便快速地作為零食。這種不斷的創新可能會推動市場對乳製品包裝選擇的需求。

乳製品包裝產業概況

乳製品包裝市場正在變得半固體,有幾個主要參與者。創新和永續的包裝正在幫助許多公司贏得新合約和開拓新市場,從而提高市場佔有率。該市場的一些主要企業包括 Amcor Group GmbH、Sealed Air Corporation、Berry Global Inc. 和 Ball Corporation。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場概況

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 消費者對蛋白質產品的偏好日益成長

- 小型封裝的採用增加

- 市場挑戰

- 原物料成本上漲可能會阻礙包裝產品製造商的成長

第6章 市場細分

- 按材質

- 塑膠

- 紙板

- 玻璃

- 金屬

- 依產品

- 牛奶

- 起司

- 冷凍食品

- 優格

- 養殖產品

- 依封裝類型

- 瓶子

- 小袋

- 紙箱/盒

- 袋子和包裝

- 其他封裝類型

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 北美洲

第7章 競爭格局

- 公司簡介

- Huhtamaki Group

- Berry Global Inc.

- Amcor PLC

- Ball Corporation

- Altium Packaging

- Saudi Basic Industries Corporation

- International Paper Company

- Winpak Ltd

- Sealed Air Corporation

- Stora Enso Oyj

- Greiner Packaging international GmbH

第8章投資分析

第9章市場的未來

The Dairy Packaging Market size is estimated at USD 25.71 billion in 2025, and is expected to reach USD 32.21 billion by 2030, at a CAGR of 4.61% during the forecast period (2025-2030).

Key Highlights

- The shift toward healthy snacking, increased consumption of ready-to-eat foods, and the rise of online and mobile shopping are transforming food purchasing and consumption patterns. These trends, combined with a growing focus on health-conscious eating, are expected to impact the dairy market significantly.

- The expanding availability of packaged dairy products through various retail channels, driven by population growth and changing diets, will likely boost market growth. Additionally, increasing consumer preference for protein-based products is expected to enhance the adoption of dairy-based items globally.

- Global trends in the dairy industry reveal that manufacturers are increasingly focusing on packaging to set their products apart. Today's dairy product packaging often boasts eye-catching designs and aseptic features. End users are adopting innovative packaging strategies for dairy products due to intense competition in key markets such as Japan, the broader Asia-Pacific region, Western Europe, and North America.

- Dairy manufacturers increasingly focus on capturing a larger share of the global dairy trade through improved international export capabilities and local production. This trend has fueled the demand for more advanced dairy packaging solutions.

- The diversification of packaging types has been a key factor in the expansion of dairy product sales. For example, milk, once available primarily in gable-topped cartons, is now often sold in portable, brand-friendly PET bottles, appealing to time-constrained consumers.

- However, the dairy packaging market faces challenges. Price fluctuations in packaging materials, influenced by food prices, may hinder market growth. Additionally, concerns about the potential health risks associated with plastic packaging, including fears of toxins linked to cancer or reproductive health issues, pose obstacles to market expansion.

Dairy Packaging Market Trends

Milk Occupies the Largest Market Share

- Milk is the most consumed dairy product globally. Its high moisture and mineral content pose significant storage challenges for vendors, leading to the prevalence of milk powder and processed milk in the trade. These characteristics make fresh milk highly perishable, necessitating advanced preservation and packaging techniques to maintain quality and extend shelf life.

- Current milk processing technology allows liquid milk to be bottled and stored at 4-8°C to maintain a shelf life of 10 to 21 days. Advanced processes like ultra-high temperature (UHT) treatment have extended packaged milk's shelf life up to a year without refrigeration. This technological advancement has revolutionized milk distribution, allowing for broader market reach and reduced waste.

- There has been a trend toward encouraging local production in recent years, particularly in Asia. This shift aims to reduce dependency on imports and support domestic dairy industries. A notable supply-demand gap persists despite countries like India contributing approximately 16% of global milk production. This discrepancy highlights the need for improved infrastructure and distribution networks in developing markets.

- Moreover, the rise of innovative and eco-friendly milk packaging is boosting the market's top line. This trend spans multiple packaging formats, such as bottles, cartons, and pouches. For example, in July 2024, Delamere Dairy unveiled its CartoCan Flavoured Milk range, targeting on-the-go consumers. The fully recyclable CartoCan reduces plastic waste and offers a handy alternative to the conventional 500 ml glass bottle.

- According to the USDA Foreign Agricultural Service, global cow milk production has steadily increased. Worldwide cow milk production rose from 511.6 million metric tonnes in 2017 to approximately 549.48 million metric tonnes in 2023. This growth reflects increasing global demand for dairy products and improvements in dairy farming practices and technologies.

- The dairy industry is witnessing a surging demand for aseptic packaging. Rising global milk output is set to unlock new market opportunities. Also, there has been a remarkable shift in consumer behavior, highlighted by the soaring consumption of UHT milk. As consumers aim to reduce their trips to the store, the demand for UHT milk boasting an extended shelf life has surged. Notably, there has been a discernible shift in consumer preference within dairy solutions, moving from loose milk to packaged offerings from major brands, especially those supplying in bulk.

North America Occupies the Largest Market Share

- North America holds the largest share of the global dairy packaging market, driven by increased production and sales of dairy products such as milk, cheese, and yogurt. In the United States, dairy product consumption has risen, particularly for cheese varieties like parmesan, provolone, and mozzarella, which is expected to boost the dairy packaging market. The region's advanced dairy industry infrastructure, stringent food safety regulations, and consumer demand for convenient and innovative packaging solutions further reinforce its dominance.

- The US dairy packaging market is significantly affected by rapidly changing consumer preferences toward packaged food and economic conditions. The market is expected to grow further due to the substantial expansion of the dairy product portfolio, especially in sports nutrition, and increasing casual users.

- Factors such as health consciousness, sustainability concerns, and the rise of e-commerce also shape packaging trends in the dairy industry. As consumers increasingly seek protein-rich products and packaged dairy goods become more accessible through diverse retail channels, the nationwide acceptance of dairy products is set to rise, driving the market forward.

- According to the US Department of Agriculture, milk production for human consumption in the United States rose from GBP 215.4 billion (USD 267.91 billion) in 2017 to GBP 226.6 billion (USD 281.84 billion) in 2023. This higher milk production necessitates greater packaging solutions for retail, bulk, and distribution purposes to handle and distribute the increased volume. The growth in milk production has spurred investments in packaging technologies that ensure product freshness, extend shelf life, and meet diverse consumer preferences across various distribution channels.

- Constant launches of dairy products in the North American market would also create a huge opportunity for packaging manufacturers to strengthen their presence in the region. In September 2023, Ornua Foods North America unveiled its latest offering, Kerrygold Cheese Snacks, featuring ready-to-eat cheese sticks designed for convenience and snacking ease. Constant innovations like this will drive up demand for dairy product packaging options in the market.

Dairy Packaging Industry Overview

The dairy packaging market is semi-consolidated, owing to several significant players. With innovative and sustainable packaging, many companies are increasing their market presence by securing new contracts and tapping new markets. Some of the major players in the market are Amcor Group GmbH, Sealed Air Corporation, Berry Global Inc., and Ball Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Product

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumer Preference Towards Protein-based Products

- 5.1.2 Increasing Adoption of Packages Incorporating Small Portion Size

- 5.2 Market Challenges

- 5.2.1 Rising Raw Material Costs Could Hinder Growth for Packaging Product Manufacturers

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper and Paperboard

- 6.1.3 Glass

- 6.1.4 Metal

- 6.2 By Product

- 6.2.1 Milk

- 6.2.2 Cheese

- 6.2.3 Frozen Foods

- 6.2.4 Yogurt

- 6.2.5 Cultured Products

- 6.3 By Package Type

- 6.3.1 Bottles

- 6.3.2 Pouches

- 6.3.3 Cartons and Boxes

- 6.3.4 Bags and Wraps

- 6.3.5 Other Package Types

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki Group

- 7.1.2 Berry Global Inc.

- 7.1.3 Amcor PLC

- 7.1.4 Ball Corporation

- 7.1.5 Altium Packaging

- 7.1.6 Saudi Basic Industries Corporation

- 7.1.7 International Paper Company

- 7.1.8 Winpak Ltd

- 7.1.9 Sealed Air Corporation

- 7.1.10 Stora Enso Oyj

- 7.1.11 Greiner Packaging international GmbH