|

市場調查報告書

商品編碼

1640590

拉丁美洲乳製品包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Latin America Dairy Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

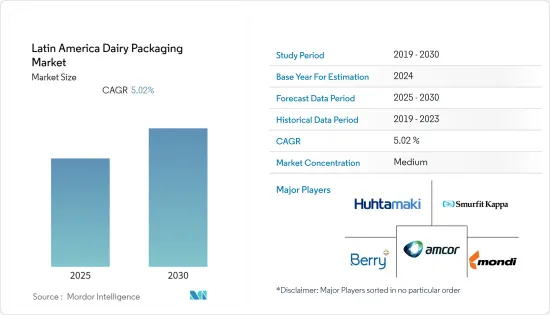

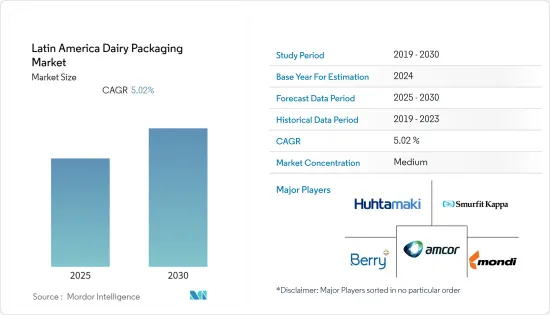

預計預測期內拉丁美洲乳製品包裝市場的複合年成長率將達到 5.02%。

乳製品容易受到污染,長期暴露在空氣中就會受到污染,不再適合人類食用。乳製品行業正在逐步適應消費者的期望,並且越來越注重健康以滿足這些需求。

包裝正在演變成一種更有效的乳製品行銷工具。標籤、收縮包裝和印刷設備的改進正在促進具有美觀性的容器的發展,這些容器具有防篡改、可回收的薄膜和套管,有助於延長產品的保存期限。

高階技術的使用將促進產量成長,並可能影響拉丁美洲的包裝市場。北美自由貿易組織(NAFTA)協定可能會進一步促進出口,增加乳製品製造商對高效包裝解決方案的需求。

該地區的包裝供應商正在擴大提供符合消費者期望的各種產品。這一趨勢的一個主要推動因素是乳製品高效包裝解決方案的發展。包裝公司在創新和產品方面採取的舉措對乳製品市場的成長做出了重大貢獻。

隨著拉丁美洲乳製品消費量的增加,對環境永續且保存期限長的高效包裝系統的需求預計也將成長。各種包裝尺寸和形式滿足了乳製品包裝產品的需求。

快速的都市化和新興市場的崛起正在推動拉丁美洲乳製品市場的發展。隨著消費者健康意識的增強,對低熱量和無乳糖乳製品的需求也日益成長。優格就是一個例子,由於消費者日程繁忙,其需求正在增加。

然而,該地區對乳製品包裝和標籤的嚴格規定嚴重限制了市場。

此外,隨著 COVID-19 疫情的加劇,該地區的乳製品包裝製造商將面臨需求波動,這可能會對生產和收益破壞性影響。然而,牛奶和牛奶相關產品被視為必需品。因此,由於消費者更喜歡瓶裝乳製品作為安全措施,生產和消費仍在持續甚至增加。污染並不是主要問題。

拉丁美洲乳製品包裝市場趨勢

牛奶市場可望佔據主要市場佔有率

人口成長和飲食習慣的改變,再加上各種零售通路中包裝乳製品的供應以及消費者對蛋白質產品的日益成長的偏好,正在推動整個全部區域乳製品市場的發展。不斷提高,這將推動市場生長。

牛奶是全世界消費量最大的乳製品。牛奶含水量和礦物質含量高,因此商販很難長期儲存牛奶。這就是為什麼牛奶以奶粉、加工乳製品進行貿易的重要原因之一。

在目前的牛奶加工技術下,瓶裝液態乳在攝氏4至8度的環境下保存期限約為10至21天。隨著牛奶超高溫(UHT)處理等治療方法的出現,包裝牛奶的保存期限無需冷藏即可進一步延長至一年。

隨著全球原乳產量的上升,對區域包裝解決方案的需求也在增加,從而推動了市場的發展。隨著乳製品通路擴大到便利商店和超級市場,預計未來幾年該地區對包裝牛奶和單瓶牛奶的需求將會成長。

根據美國農業部的資料,墨西哥的牛奶產量預計在 2021 年超過 1,300 萬噸,高於去年的約 1,290 萬噸。墨西哥是該地區重要的牛奶生產國之一,其牛奶產量正在增加,對牛奶包裝的需求也日益成長。

預測期內,玻璃包裝預計將推動市場成長

玻璃是包裝乳製品最受歡迎的材料之一,尤其是含有牛奶的食品和飲料產品。其良好的阻隔性、無菌性和再生性等特性使其成為優良的包裝材料。玻璃包裝的另一個優點是它可以形成各種形狀和尺寸,方便在各行各業使用。

儘管玻璃仍然是各種產品的首選包裝材料,但擴大使用塑膠作為玻璃的替代品預計會阻礙市場成長。包裝塑膠在各種應用中的安全使用方面的進步有望限制玻璃作為包裝材料。

可回收玻璃瓶是企業運送產品的經濟有效的選擇。這種包裝形式主要用於非酒精飲料行業。大約70%的天然礦泉水瓶都是由塑膠製成的。出於對環境問題的考慮,瓶裝水的包裝材料選擇越來越多。

巴西是該地區的一個重要市場,其變化將影響拉丁美洲的乳製品產業。在巴西,由於雷凱霍起司等傳統乳製品的使用日益增多,對加工起司的需求也日益增加。對於該地區所有收入群體來說,牛奶都是日常主食中消費的標準產品。

例如,根據國際貿易中心(ITC)的數據,2021年巴西玻璃及玻璃製品進口額約為6.75275億美元,較上年的約5.20703億美元成長29.68%,2020年則為7.4775億美元。

然而,由於駕駛人罷工造成飼料供不應求,預計國內牛奶產量需要一段時間才能恢復。該國不斷成長的乳酪市場預計也將受到牛奶產量下降的影響。

拉丁美洲乳製品包裝產業概況

乳製品包裝市場規模較大,競爭激烈,市場集中度較高。為了維持市場佔有率,公司不斷創新、建立策略聯盟和進行收購。

2022 年 9 月,Smurfit Kappa 宣布已簽署協議,收購位於里約熱內盧的包裝廠 PaperBox。此次收購將使該公司加強在里約熱內盧的業務,提高其生產能力,並繼續開發新的業務前景和客戶關係,包括在乳製品領域。

2022 年 4 月,Sonoco 宣布從私人投資者手中收購了巴西軟包裝合資企業 Sonoco do Brasil Participacoes Ltda 剩餘三分之一的股份。該合資企業服務於巴西的糖果零食、乳製品、製藥和工業行業,2021 年的銷售額約為 3,400 萬美元。該合資企業是多家跨國消費品包裝公司的著名軟包裝供應商。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業政策

- COVID-19 市場影響評估

- 技術簡介

第5章 市場動態

- 市場促進因素

- 消費者健康意識不斷增強,推動乳製品營養需求

- 隨著本地超級市場和大賣場數量的增加,乳製品分銷管道的擴張正在推動市場

- 市場限制

- 由於運輸商抗議燃料價格上漲,導致周期性飼料短缺

- 回收和環境問題

第6章 市場細分

- 依材料類型

- 塑膠

- 紙

- 金屬

- 玻璃

- 其他材料

- 按產品

- 起司

- 牛奶

- 豆奶飲料

- 優格

- 咖啡增白劑

- 奶油

- 奶油

- 汁

- 其他產品

- 依封裝類型

- 瓶子

- 能

- 紙箱和盒子

- 小袋

- 其他

- 按國家

- 巴西

- 墨西哥

- 哥倫比亞

- 阿根廷

- 其他國家

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Mondi PLC

- Huhtamaki Oyj

- Berry Global Inc.

- Smurfit Kappa

- Winpak Ltd

- AptarGroup Inc.

- Sonoco Products Company

- Silgan Holdings Inc.

- Tetra Laval Group

- DS Smith PLC

- CAN-PACK SA

- Prolamina Packaging

第8章投資分析

第9章:市場的未來

The Latin America Dairy Packaging Market is expected to register a CAGR of 5.02% during the forecast period.

Dairy products are easily susceptible to contamination and can get soiled on prolonged exposure to the atmosphere, making them unfit for human consumption. The dairy business is gradually adapting to consumers' expectations, becoming more health-conscious to meet those needs.

Packaging is evolving into a more effective dairy marketing tool. The development of aesthetically attractive containers with tamper-evident recyclable films and sleeves that assist in extending a product's shelf life is facilitated by improvements to labeling, shrink wrapping, and printing equipment.

Using high-end technology will boost production and impact the Latin American packaging market. The NAFTA agreement will further drive exports and the demand for efficient packaging solutions from dairy product manufacturers.

The regional packaging vendors are now offering a range of products in line with consumer expectations. A significant factor contributing to this trend is the development of highly efficient packaging solutions for dairy products. The initiatives the packaging companies have taken in terms of innovations and offerings have contributed significantly to the growth of the dairy market.

As the consumption of dairy products increases across Latin America, the demand for efficient packaging systems is also expected to increase, as they are environmentally sustainable and can provide products with a longer shelf life. The different packaging sizes and formats contribute to the need for dairy packaging products.

The rapidly expanding urbanization and the rise of emerging markets drive the Latin American dairy market. The demand for low-calorie and lactose-free dairy foods has increased as customers' awareness of their health has grown. Yogurt is one example of a product whose demand is rising due to consumers' hectic schedules.

However, the market is severely constrained by the region's strict rules on the packaging and labeling of dairy products.

In addition, dairy packaging manufacturers in the region faced fluctuations in demand as the COVID-19 pandemic intensified, with potentially disruptive effects on production and revenues. However, milk and milk-related items are considered necessities. As a result, both their production and consumption have continued and even multiplied as customers prefer bottled milk products as a safety measure. Contamination is not a significant concern.

Latin America Dairy Packaging Market Trends

Milk Segment is Expected to Account for Significant Market Share

The increasing availability of packaged dairy products through various retailing channels owing to the rising population and changing diets, coupled with an expanding consumer preference toward protein-based products, is expected to increase the adoption of dairy-based products across the region, driving the market's growth.

Milk is the most consumed dairy product across the globe. The high moisture and minerals present in milk make it very challenging for the vendors to store it for an extended period. It is one of the significant reasons for milk being traded as milk powder or processed milk.

With the current milk processing technology, liquid milk packed in a bottle has a shelf-life of around 10 to 21 days when stored at 4-8°C. With the emergence of processes like UHT (Ultra High Temperature) treatment of milk, the shelf life of packaged milk is further extended up to a year without refrigeration.

With the increased milk production on a global scale, packaging solutions regionally will also witness increased demand, driving the market. The need for packaged milk and single-serve drinking bottles is anticipated to expand in the region over the next few years due to the expansion of dairy distribution channels, including convenience stores and supermarkets.

According to data from the US Department of Agriculture, Mexico's fluid milk output was recorded to reach over 13 million metric ton in 2021, from about 12.9 million metric ton in the preceding year, 2020. Mexico, one of the significant milk-producing countries in the region, witnessed increasing milk production volumes, representing the growing need for milk packaging.

Glass Packaging is Anticipated to Drive the Market Growth Over the Forecast Period

Glass is one of the most preferred materials for packaging food and beverages, including dairy products, especially milk. Properties like excellent barrier properties, sterility, and reusability make it a superior packaging material. The other significant advantage of glass packaging is that it can be molded into various shapes and sizes, facilitating its use across different industry verticals.

Even though glass remains the preferred packaging material for various products, the growing use of plastics as a replacement for glass is expected to hamper the market's growth. Advancements in the field of plastics for safe usage in different applications are expected to restrict glass as a material for packaging.

Returnable glass bottles are a cost-effective option for companies to deliver their products. This form of packaging is primarily used in the non-alcoholic beverage industry. About 70% of the bottles used for natural mineral water are made of plastic. The choice of bottled-water packaging material is increasing, considering environmental considerations.

Brazil is a significant market in the area, and any changes there impact the dairy industry in Latin America. The demand for processed cheese has increased in Brazil due to the country's growing use of traditional dairy products like Requeijo cheese. Among all income levels in the region, milk is a standard product consumed as part of a daily staple diet.

For instance, according to International Trade Center (ITC), in 2021, the imports of glass and glassware in Brazil were valued at around USD 675.275 million, a 29.68% increase in import value from the previous year, 2020, which was about USD 520.703 million.

However, it is expected to take some time for milk yields in the nation to recover because of the feed supply deficit brought on by the truckers' strike. The country's expanding cheese market is also expected to be impacted by the country's decreased milk production.

Latin America Dairy Packaging Industry Overview

The dairy packaging market is highly competitive due to the presence of several major players; the market is moderately concentrated. The companies keep innovating and entering into strategic partnerships and acquisitions to retain their market share.

In September 2022, Smurfit Kappa said that the company had signed a contract to acquire PaperBox, a packaging facility in Saquarema, 70 km east of Rio de Janeiro. This acquisition will strengthen the company's footprint in the nation, increase its manufacturing capacity, and allow it to continue to develop new business prospects and client relationships, including in the dairy sector.

In April 2022, Sonoco announced that it had purchased the remaining one-third stake from private investors in Sonoco do Brasil Participacoes Ltda, a joint venture for flexible packaging based in Brazil. The joint venture, which serves Brazil's confectionery, dairy, pharmaceutical, and industrial industries, recorded revenues of about USD 34 million in 2021. It is a prominent flexible packaging supplier to numerous multinational consumer packaging goods firms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value-Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Policies

- 4.5 Assessment of the Impact of COVID -19 on the Market

- 4.6 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Consumers' Rising Health Consciousness is Driving Demand For Dairy Nutrition

- 5.1.2 Growing Dairy Product Distribution Channels Supported by an Increase in the Number of Supermarkets and Hypermarkets in the Region, Drives the Market

- 5.2 Market Restraints

- 5.2.1 Regular Feed Shortage Owing to the Transporters' Protest Due to Higher Fuel Prices

- 5.2.2 Concerns About Recycling and the Environment

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Glass

- 6.1.5 Other Material Types

- 6.2 By Product

- 6.2.1 Cheese

- 6.2.2 Milk

- 6.2.3 Soy Beverages

- 6.2.4 Yogurt

- 6.2.5 Coffee Whiteners

- 6.2.6 Cream

- 6.2.7 Butter

- 6.2.8 Juices

- 6.2.9 Other Products

- 6.3 by Package Type

- 6.3.1 Bottles

- 6.3.2 Cans

- 6.3.3 Cartons and Boxes

- 6.3.4 Pouches

- 6.3.5 Others

- 6.4 By Country

- 6.4.1 Brazil

- 6.4.2 Mexico

- 6.4.3 Colombia

- 6.4.4 Argentina

- 6.4.5 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Mondi PLC

- 7.1.3 Huhtamaki Oyj

- 7.1.4 Berry Global Inc.

- 7.1.5 Smurfit Kappa

- 7.1.6 Winpak Ltd

- 7.1.7 AptarGroup Inc.

- 7.1.8 Sonoco Products Company

- 7.1.9 Silgan Holdings Inc.

- 7.1.10 Tetra Laval Group

- 7.1.11 DS Smith PLC

- 7.1.12 CAN-PACK SA

- 7.1.13 Prolamina Packaging