|

市場調查報告書

商品編碼

1628749

虛擬視網膜顯示器:市場佔有率分析、產業趨勢與成長預測(2025-2030)Virtual Retinal Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

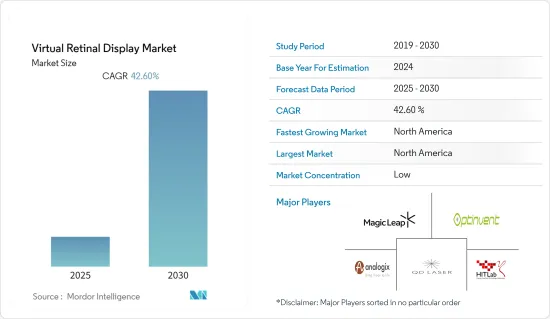

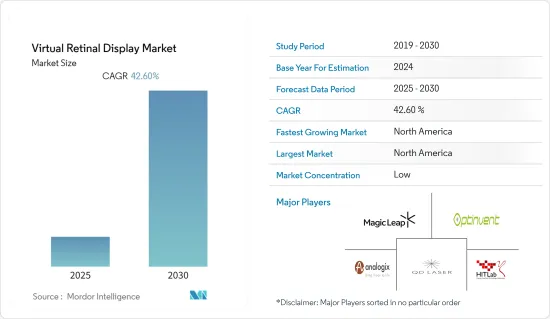

虛擬視網膜顯示器市場預計在預測期內複合年成長率為 42.6%

主要亮點

- 視網膜顯示器比其他顯示器更安全。視網膜顯示器可讓使用者使用語音控制顯示強度。這項技術的採用使人們可以更輕鬆地在任何環境中工作,而不會出現安全或隱私問題。

- 該技術已應用於航太和國防領域,以對抗夜視鏡引起的高眼疲勞。醫療保健領域的應用範圍廣泛,從創傷治療到輔助癌症檢測。

- 虛擬視網膜顯示器在功耗方面非常高效,比當今行動裝置中常用的類似郵票的 LCD 螢幕所需的功耗要少得多。遊戲和娛樂產業的應用正在推動虛擬視網膜顯示器市場的需求,因為該產業是該技術的早期採用者,創造了使用者對擴增實境(AR) 和虛擬實境 (VR) 應用的需求。

- 另一方面,提高對虛擬視網膜顯示器的認知的需求預計將阻礙市場成長。虛擬視網膜顯示器的主要問題是它們可能導致暈動病。據說這些限制因素會降低市場成長。

- COVID-19 的爆發正在影響社會和全球經濟。全球製造工廠的關閉導致關閉國家的收入和業務遭受重大損失。疫情對生產和製造流程產生了重大負面影響。然而,為了對抗 COVID-19,各公司正積極投資產品開發。

虛擬視網膜顯示器市場趨勢

虛擬實境和擴增實境是娛樂產業蓬勃發展的需求

- 娛樂產業對虛擬實境和擴增實境的需求不斷增加。擴增實境技術主要用於使用新視網膜顯示系統的現實世界遊戲和動畫。在娛樂產業,眼鏡用於3D電影院。但如今,它們正在被智慧眼鏡取代,以改善觀眾的電影體驗。智慧眼鏡也被用於虛擬實境電影體驗。

- 由於高需求和購買意願,Avegant 和 Magic Leap 進入了這個領域。當今精通技術的一代需要最具創新性的遊戲和媒體解決方案以及最身臨其境的體驗。因此,將各種解決方案商業化的公司創造了諸如“個人劇院”之類的術語。

- 另一方面,擴增實境遊戲可以在戶外玩,並且基於與其他人和增強虛擬物件的交互,可能會覆蓋比玩遊戲的人更廣泛的受眾。高對比度、高解析度、低功耗和高亮度增加了對虛擬視網膜顯示器的需求,使其成為媒體和工業等各種應用的理想選擇。

- 據 FICCI 稱,到 2022 年,印度媒體和娛樂業的價值將超過 1.8 兆印度盧比(220 億美元)。虛擬實境環境讓公眾以以前未知和禁止的方式參與展覽、音樂會、博物館、藝廊等。 3D影像呈現真人大小,讓您的娛樂真實有趣。

北美正在經歷顯著的成長

- 美國是最早採用虛擬視網膜顯示技術的國家之一,這也是北美市場在研究市場中佔據主導地位的原因。此外,該地區對擴增實境和虛擬實境的需求正在激增,預計這將推動其在預測期內的成長。

- 尤其是虛擬視網膜顯示器具有重量輕、視角廣、解析度新興企業、對比度和亮度比足夠等優異的優勢,因此我們在籌集資金來推動該產品的研發和商業化方面也相當有實力。

- 虛擬視網膜顯示器是虛擬實境和擴增實境的下一代技術,VR 和 AR 公司有巨大的機會透過早期市場推出來滲透市場。然而,產品價格高可能會限制該細分市場的成長。

- 與其他技術增強一樣,虛擬視網膜顯示器是為軍事用途而開發的。指揮官可以透過頭盔上安裝的日光讀數顯示器查看車載戰場電腦。他們還可以更好地觀察周圍環境,選擇最佳路線並共用戰術資訊。

- 據美國預算辦公室稱,到 2032 年,美國國防工業支出預計每年都會增加。美國2022年國防支出達7,600億美元。該預測也預測,到 2032 年,國防支出將增加至 9,980 億美元。政府對國防工業不斷增加的投資正在推動虛擬視網膜顯示器市場的需求。

虛擬視網膜顯示器產業概述

虛擬顯示市場的競爭日益激烈,多家供應商不斷擴展其產品線以提供廣泛的解決方案組合。供應商正在推出虛擬視網膜顯示器,其中包括許多產品改進和擴展的內建功能。為了獲得更高的客戶佔有率,供應商在技術、價格和產品支援方面展開競爭。該市場的主要企業包括Avegant Corporation、Magic Leap Inc.、QD Laser、德州儀器公司、OmniVision Technologies Inc.、Himax Technologies Inc.、Movidius Inc.(英特爾公司)和Analogix Semiconductor Inc.。

2022年10月,TDK公司展出了配備目前正在開發的世界上最小的超小型全彩雷射模組(FCLM)的智慧眼鏡。 FCLM被用作智慧眼鏡的重要組件。 TDK 與擁有自己的雷射視網膜直接投影技術的 QD Laser 聯合開發,製作了一款智慧眼鏡演示樣品,該眼鏡能夠將雷射視網膜直接投影到雙眼,其視角約為傳統產品的兩倍。無論觀看者的視力如何,雷射直接視網膜投影都可以觀看影像。 2022 年 1 月,微軟和 Magic Leap 將合作並拓展擴增實境眼鏡業務。兩家公司的 AR 眼鏡都比人們想像的更先進,尤其是在醫療保健和製造等專業應用方面。 AR在醫療產業中有著巨大的潛力,因此醫療保健公司正在努力開發適用於Hololens和Magic Leap眼鏡的耳機和系統。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力——波特五力

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 對虛擬視網膜顯示器市場的影響

第5章市場動態

- 市場促進因素

- 相對於基於螢幕的設備的技術優勢

- 市場挑戰

- 高成本且缺乏意識

第6章 市場細分

- 按最終用戶產業

- 醫學/生命科學

- 航太/國防

- 媒體娛樂

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Avegant Corporation

- Magic Leap Inc.

- QD Laser Co. Ltd

- Texas Instruments Inc.

- OmniVision Technologies Inc.

- Himax Technologies Inc.

- Movidius Inc.(Intel Corporation)

- Analogix Semiconductor Inc.

- Human Interface Technology Laboratory

- eMagin Corporation

- Vuzix

- Optivent

第8章投資分析

第9章市場的未來

The Virtual Retinal Display Market is expected to register a CAGR of 42.6% during the forecast period.

Key Highlights

- The retina display is highly secure and safe compared to other displays. Using a retina display, the user can control the intensity of the display through his voice. The adoption of this technology is making people easy to work in any environment without any security or privacy issues.

- As the technology addresses the high eye strain caused by night vision goggles, the technology finds applications in the aerospace and defense sector. The applications are widespread in the healthcare sector and range from treating trauma to being used as an aid in cancer detection.

- The virtual retinal display is highly efficient concerning power consumption, requiring far less power than the postage-stamp LCD screens used commonly in today's mobile devices. The gaming & entertainment industry application is driving the demand for the virtual retinal display market because this industry has been an early adopter of the technology and the demand created for augmented reality and virtual reality applications by users.

- On the other hand, the need for more awareness about the virtual retinal display is expected to hamper the market's growth. The major problem with virtual retinal displays is they can cause motion sickness. These restraining factors are said to decline the market's growth.

- The COVID-19 pandemic is influencing society and the global economy. The closure of manufacturing facilities globally has resulted in a significant loss of revenue and business for the nations under lockdown. The pandemic has had a significant negative impact on the production and manufacturing processes. However, to fight COVID-19, companies have been actively investing in product development.

Virtual Retinal Display Market Trends

Virtual Reality and Augmented Reality are Gaining Surging Demand from the Entertainment Industry

- Virtual reality and augmented reality are gaining increasing demand from the entertainment industry. Augmented reality technology is mainly used in games and animations in the real world, using new retinal display systems. In the entertainment industry, eyewear glasses are used in 3D cinemas. However, in recent days, these are being replaced with smart glasses for improved cinema experience for the audience. Smart glasses are also being used for a virtual reality cinema experience.

- Avegant and Magic Leap have entered this segment due to high demand and purchasing propensity. Today's tech-savvy generation demands the most innovative gaming and media solutions and the most immersive experiences. As a result, terms such as 'personal theatre' have been coined by companies to commercialize various solutions.

- On the other hand, augmented reality games could reach a broader audience than those who play games because they can be played outside based on interaction with other people and augmented virtual objects. High contrast, high resolution, low power consumption, and high brightness are increasing the demand for virtual retinal displays, making them an ideal choice in various applications such as media and industry.

- According to FICCI, India's media and entertainment industry were valued at over INR 1.8 trillion (USD 22 Billion) in 2022. Virtual reality environments allow common people to engage with exhibits, concerts, museums, galleries, etc., in previously unknown and forbidden ways. It will enable the person to view 3D images, which appear life-sized to the person, making entertainment realistic and enjoyable.

North America to Witness Significant Growth

- The United States is one of the early adopters of virtual retinal display technology, and because of this, the North American segment dominates the market studied. In addition, the rapid demand for augmented and virtual reality in the region is expected to drive growth over the forecast period.

- Notably, owing to the exceptional benefits of the virtual retinal display, such as lightweight, larger angle of view, higher resolution, and sufficient contrast and brightness ratio, a few startups are raising funds to boost the R&D and commercialization of the product.

- The virtual retinal display is a next-gen technology for virtual and augmented reality, the companies operating in VR and AR have an immense opportunity to penetrate the market with early launches. However, the high price of the products may restrain the segment's growth.

- Like other technology enhancements, the virtual retinal display was developed for military use. The commander can view its onboard battlefield computer with a helmet-mounted daylight-readable display. And also, they can observe the surroundings better, choose the best path, and share tactical information.

- According to US Congressional Budget Office, spending in the Defense industry in the United States is predicted to increase yearly until 2032. In the United States, Defense outlays amounted to USD 760 Billion in 2022. The forecast estimates an increase in defense outlays of up to USD 998 Billion in 2032. Such increasing investments by governments in the defense industry are driving the demand for the virtual retinal display market.

Virtual Retinal Display Industry Overview

The Virtual Display Market is becoming highly competitive, with multiple vendors expanding their product line to offer a broad portfolio of solutions. Vendors have been rolling out virtual retina displays with numerous product improvements and an expanding array of built-in capabilities. In order to capture higher customer mindshare, they are competing on technologies, pricing, and product support. Key players in the market are Avegant Corporation, Magic Leap Inc., QD Laser Co. Ltd, Texas Instruments Inc., OmniVision Technologies Inc., Himax Technologies Inc., Movidius Inc. (Intel Corporation), Analogix Semiconductor Inc., and many more.

In October 2022, TDK Corporation displayed smart glasses equipped with the world's smallest class ultra-compact full-color laser module (FCLM) under development by TDK. The FCLM was used as a critical component in the smart glasses. Through joint development with QD Laser, Inc., which possesses unique laser direct retinal projection technologies, TDK created a demonstration sample of the smart glasses capable of laser direct retinal projection for both eyes and around double the viewing angle of previous products. The laser direct retinal projection method makes images visible regardless of the viewer's eyesight. In January 2022, Microsoft and Magic Leap collaborated and will make inroads in business with augmented reality glasses. Both companies are further along than individuals realize with AR glasses for specialized uses, especially in healthcare and manufacturing. AR has so much potential in the medical industry that healthcare companies are working hard to develop their headsets or create systems for Hololens or Magic Leap glasses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Virtual Retinal Display Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technical Advantages Over Screen-Based Devices

- 5.2 Market Challenges

- 5.2.1 High Costs and Lack of Awareness

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Medical & Lifesciences

- 6.1.2 Aerospace and Defense

- 6.1.3 Media and Entertainment

- 6.1.4 Other End-user Verticals

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avegant Corporation

- 7.1.2 Magic Leap Inc.

- 7.1.3 QD Laser Co. Ltd

- 7.1.4 Texas Instruments Inc.

- 7.1.5 OmniVision Technologies Inc.

- 7.1.6 Himax Technologies Inc.

- 7.1.7 Movidius Inc. (Intel Corporation)

- 7.1.8 Analogix Semiconductor Inc.

- 7.1.9 Human Interface Technology Laboratory

- 7.1.10 eMagin Corporation

- 7.1.11 Vuzix

- 7.1.12 Optivent