|

市場調查報告書

商品編碼

1628758

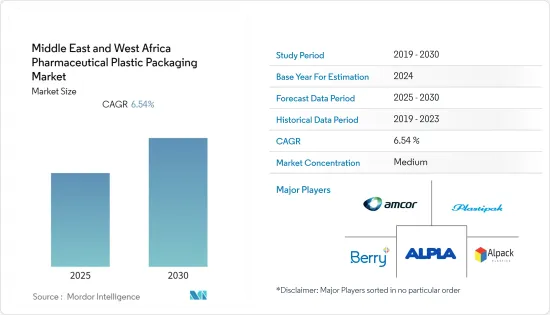

中東和西非的藥用塑膠包裝:市場佔有率分析、產業趨勢和成長預測(2025-2030)Middle East and West Africa Pharmaceutical Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

中東和西非醫藥塑膠包裝市場預計在預測期內複合年成長率為6.54%

主要亮點

- 由於慢性病的增加、生技藥品市場的成長以及技術的進步,預計醫藥塑膠包裝市場將繼續擴大。

- 零售藥局預計將在該地區變得更加普遍,藥廠預計將更加重視產品差異化和品牌提升。此外,飲食模式、生活方式和睡眠週期的變化正在增加慢性病的盛行率,從而增加對藥物的需求。

- 藥品包裝最常用的材料是塑膠。塑膠由於其防潮阻隔性、高尺寸穩定性、高衝擊強度、抗應變性、低吸水性、透明性以及耐熱性和阻燃性,在藥品包裝中變得越來越重要。此外,政府對改善醫療保健系統和保險覆蓋範圍的關注正在增加對藥物的需求並刺激市場擴張。

- 儘管非洲在改善食品生產和加工方面有著巨大的前景,但該地區供應鏈的缺乏或不足繼續減緩了塑膠藥品包裝需求的成長。

- 在新冠肺炎 (COVID-19) 疫情期間,瓶子和容器等市場持續飆升。此外,對生技藥品和疫苗的需求促使包裝公司投資無菌形式並提高產能。

中東和西非藥用塑膠包裝市場趨勢

瓶子推動市場成長

- 塑膠瓶預計將顯著成長,因為它們重量輕且易於處理,比玻璃瓶更容易運輸且不易破碎。此外,塑膠美觀且具有優異的空氣和濕氣阻隔性。塑膠瓶的這些特性預計將刺激跨地區的市場擴張。

- 硬質塑膠包裝更容易消毒,並支持製藥業的無菌瓶。 PAA(過氧乙酸)已通過化學方法和傳統方法用於對寶特瓶進行消毒。它是淨化整體細菌(細菌、孢子、黴菌、酵母)的最廣泛、最有效的介質,可與強酸性和弱酸性產品一起使用。

- 此外,塑膠非常適合各種成分。由於塑膠容器可能與藥物製劑接觸,因此它們通常由不含可能影響藥品功效或穩定性或引起毒性問題的成分的材料製成。

- 此外,塑膠滴管瓶主要供患有眼睛綜合症的人使用。個人生活方式的改變,尤其是長時間使用電腦、電視等電子設備,導致乾眼症盛行率急遽上升。 Gerresheimer 等公司提供固態、液體和眼科藥物塑膠包裝。產品範圍包括用於輸液和眼用溶液的寶特瓶。

- 例如,2022 年 5 月,Amcor Plc 開發了最新技術 PowerPostTM,使瓶子重量減輕了 30%,並且可以由 100% 回收材料製成。此外,該產品基於真空吸附技術PowerStrap。

沙烏地阿拉伯預計將成長

- 根據衛生署) 的數據,沙烏地阿拉伯的醫藥市場到 2021 年將達到約 93 億美元,反映出 2017 年至 2021 年的醫藥支出為 420 億美元。由於醫療基礎設施的改善和非傳染性疾病盛行率的上升,沙烏地阿拉伯市場正在迅速擴張。

- 此外,四個「經濟城市」的發展預計將為在該地區建立藥品加工和包裝業務開闢新的可能性。例如,阿卜杜拉國王的工業城市標誌著製藥業的成長。該地區的藥品製造和包裝設施已獲得輝瑞(沙烏地阿拉伯)等公司的投資。

- 醫療保健支出的增加和健康意識的提高可能會推動市場擴張。由於宏觀經濟因素(例如醫療保險公司滲透率的提高以及醫療改革(例如允許100%直接投資製藥業)),該行業預計也會成長。

- 糖尿病、心血管疾病和癌症等非傳染性疾病現已成為沙烏地阿拉伯的主要原因。這是由久坐的生活方式、超重、大量吸煙和不良的飲食習慣引起的。世界衛生組織 (WHO) 報告稱,沙烏地阿拉伯 68.2% 的人口超重,33.7% 的人口肥胖。

- 該國政府的政策偏向國內生產商,提供無息貸款、公用事業補貼以及原料和中間產品免進口關稅等優惠。因此,由於治療糖尿病等疾病的藥物需求不斷成長,預計該國對包裝的需求將大幅增加。

中東和西非醫藥塑膠包裝產業概況

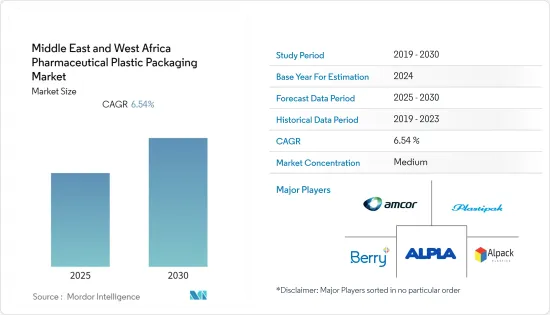

中東和西非藥品塑膠包裝市場是一個適度整合的市場。 Amcor Plc、Plastic Holdings Inc、Berry Global Inc、Alpack Plastic Packaging、Alpla Group等在市場上佔據主要佔有率的領先公司正在擴大基本客群。此外,許多公司正在與多家公司形成策略合作,以提高市場佔有率和盈利。

- 2022 年 7 月 - Alpla 集團宣布收購波蘭公司 APON,該公司位於 Zyrardow,為製藥業生產塑膠包裝,擴大和發展了 2019 年成立的 ALPLApharma 部門。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術見解

- COVID-19 對區域藥用塑膠包裝市場的影響

第5章市場動態

- 市場促進因素

- 對硬質和軟質藥用塑膠產品的需求不斷增加

- 發展更好、更先進的醫療基礎設施

- 市場限制因素

- 限制藥用塑膠產品銷售和供應的法規

- 由於供應商議價能力而導致原物料成本波動

第6章 市場細分

- 按原料分

- 聚丙烯(PP)

- 聚對苯二甲酸乙二酯 (PET)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他材料

- 依產品

- 固態容器

- 滴管瓶

- 滴鼻劑瓶

- 液體瓶

- 口腔護理

- 小袋

- 管瓶/安瓿

- 墨水匣

- 注射器

- 蓋子和封口

- 其他產品

- 按地區

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 土耳其

- 埃及

- 南非

- 其他中東和非洲

- 中東

第7章 競爭格局

- 公司簡介

- Amcor Limited

- Berry Plastics Group, Inc.

- Aptar Pharma

- Berk Company, LLC

- Alpha Packaging

- Graham Packaging Company

- COMAR, LLC

- Alpack Plastic Packaging

- Drug Plastics Group

- Plastipak Holdings, Inc.

- Gulf Pakcaging Industries Limited

第8章投資分析

第9章市場的未來

The Middle East and West Africa Pharmaceutical Plastic Packaging Market is expected to register a CAGR of 6.54% during the forecast period.

Key Highlights

- The market for pharmaceutical plastic packaging is anticipated to continue to rise due to the rising prevalence of chronic diseases, the growth of the biologics market, and technical advancements.

- The penetration of retail pharmacies in the region is expected to increase, while pharmaceutical manufacturers' emphasis on product differentiation and brand improvement is expected to increase. Furthermore, there is a greater demand for drugs due to the rising prevalence of chronic diseases brought on by altered dietary patterns, lifestyles, and sleep cycles.

- Plastics are the most used materials in pharmaceutical packaging. Plastics are gaining increasing importance in the packaging of pharmaceutical goods due to barriers against moisture, high dimensional stability, high impact strength, resistance to strain, low water absorption, transparency, and resistance to heat and flame. Moreover, the government's focus on improving healthcare systems and insurance coverage drives up demand for pharmaceuticals, fueling market expansion.

- Although there are excellent prospects to improve food production and processing in Africa, the region's lack of or inadequate supply chains continue to slow the expansion of the need for plastic pharmaceutical packaging.

- During Covid -19, the market, which includes bottles and containers, has continued to soar. In addition, packaging companies are seen investing in the sterile format while increasing their production capacity due to the need for biologics and vaccines.

Middle East & West Africa Pharmaceutical Plastic Packaging Market Trends

Bottles to Drive the Market Growth

- Due to their small weight and ease of handling, plastic bottles are predicted to experience a significant increase because they are easier to carry and less likely to break than glass bottles. Additionally, plastics are more aesthetically pleasing and provide a superior barrier to air and moisture. These qualities of plastic bottles are anticipated to stimulate market expansion across regions.

- Rigid plastic packaging is more easily sterilized and supports aseptic bottles for the pharmaceutical industry. PAA (peracetic acid) has been chemically and traditionally used for PET bottle sterilization. It is the most efficient medium with the most extensive decontamination spectrum of overall germs (bacteria, spores, molds, and yeasts) and can be used for high and low acid products.

- Additionally, plastics work well with a variety of compositions. Since plastic containers may come into touch with pharmaceutical formulations, they are typically made of materials that don't include any components that could affect the formulation's effectiveness or stability or provide a toxicity concern.

- Furthermore, plastic dropper bottles are predominantly used in people with eye syndrome. The changing lifestyles of individuals, particularly the extended use of electronic gadgets, such as computers and TV, have led to an upsurge in the prevalence of dry eye syndrome. Companies like Gerresheimeroffer pharmaceutical plastic packaging for solid, liquid, and ophthalmic applications. The range of products includes PET bottles for liquid dosage and ophthalmic solutions.

- For instance May 2022, Amcor Plc developed the latest technology, PowerPostTMthat delivers a bottle that is up to 30% lighter and can be made from 100% recycled material. Furthermore, the product is built on vacuum-absorbing technology PowerStrap.

Saudi Arabia is expected to witness the growth

- The Saudi Arabian pharmaceutical market reached a value of roughly USD 9.3 billion in 2021, reflecting 42 billion USD in pharmaceutical spending from 2017 to 2021, according to the Ministry of Health (MoH). Saudi Arabia's market is expanding rapidly due to improving healthcare infrastructure and the rising prevalence of non-communicable illnesses.

- Additionally, it is anticipated that the growth of four "economic cities" will open up new possibilities for establishing pharmaceutical processing and packaging businesses in this area. For instance, the industrial city of King Abdullah suggested that the pharmaceutical industry increase. A pharmaceutical production and packaging facility in the vicinity has received investments from businesses, including Pfizer (Saudi).

- Rising healthcare spending and improved health awareness are likely to propel market expansion. The industry would also be expected to grow due to macroeconomic factors, including increasing health insurance company penetration and healthcare reforms like allowing 100% FDI in the pharmaceutical sector.

- In Saudi Arabia, non-communicable diseases like diabetes, cardiovascular disease, and cancer are now the leading causes of death. This is brought on by living a sedentary lifestyle, being overweight, smoking a lot, and eating poorly. The World Health Organization (WHO) has reported that 68.2% of Saudi Arabia's population is overweight and 33.7% of its population is obese.

- The government policies in the nation are biased in favor of domestic producers, giving them exemptions, including interest-free financing, subsidized utility charges, and no import duties on raw materials and intermediate products. As a result, the country would be expected to experience a significant increase in the demand for packaging due to the rising demand for cures for diseases like diabetes.

Middle East & West Africa Pharmaceutical Plastic Packaging Industry Overview

The Middle East and West Africa Pharmaceutical Plastic Packaging Market is the moderately consolidated market. The major players, such as Amcor Plc, plastic holdings Inc, Berry Global Inc, and Alpack Plastic Packaging, Alpla Group, with a significant share in the market, are expanding their customer base across various regions. In addition, many companies are forming strategic and collaborative initiatives with multiple companies to increase their market share and profitability.

- July 2022 - The ALPLA Group has announced its acquisition of the Polish company APON, which produces plastic packaging for the pharma industry at its site in zyrardow, which will expand and grow the ALPLApharma business division established in 2019.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Insights

- 4.4 Impact of COVID-19 on the Pharmaceutical Plastic Packaging Market in region

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Rigid & Flexible Pharmaceutical Plastic Products

- 5.1.2 Development of Better and More Advanced Healthcare Infrastructure

- 5.2 Market Restraints

- 5.2.1 Regulations Restricting the Sale and Availability of Pharmaceutical Plastic Products

- 5.2.2 Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

6 MARKET SEGMENTATION

- 6.1 By Raw Material

- 6.1.1 Polypropylene (PP)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Low Density Polyethylene (LDPE)

- 6.1.4 High Density Polyethylene (HDPE)

- 6.1.5 Other Types of Materials

- 6.2 By Product

- 6.2.1 Solid Containers

- 6.2.2 Dropper Bottles

- 6.2.3 Nasal Spray Bottles

- 6.2.4 Liquid Bottles

- 6.2.5 Oral Care

- 6.2.6 Pouches

- 6.2.7 Vials & Ampoules

- 6.2.8 Cartridges

- 6.2.9 Syringes

- 6.2.10 Caps & Closures

- 6.2.11 Other Product Types

- 6.3 Region

- 6.3.1 Middle East

- 6.3.1.1 UAE

- 6.3.1.2 Saudi Arabia

- 6.3.1.3 Qatar

- 6.3.1.4 Turkey

- 6.3.1.5 Egypt

- 6.3.1.6 South Africa

- 6.3.1.7 Rest of Middle East and Africa

- 6.3.1 Middle East

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Limited

- 7.1.2 Berry Plastics Group, Inc.

- 7.1.3 Aptar Pharma

- 7.1.4 Berk Company, LLC

- 7.1.5 Alpha Packaging

- 7.1.6 Graham Packaging Company

- 7.1.7 COMAR, LLC

- 7.1.8 Alpack Plastic Packaging

- 7.1.9 Drug Plastics Group

- 7.1.10 Plastipak Holdings, Inc.

- 7.1.11 Gulf Pakcaging Industries Limited