|

市場調查報告書

商品編碼

1628764

北美油漆和塗料:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Paints and Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

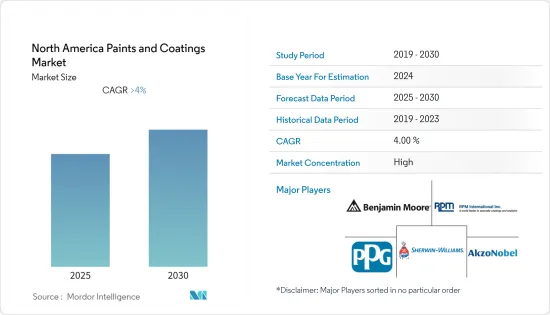

北美油漆和塗料市場預計在預測期內將以超過 4% 的複合年成長率成長

主要亮點

- 該地區工業和基礎設施建設的快速成長正在推動預測期內的市場成長。

- 另一方面,原料價格上漲預計將阻礙市場成長。

- 預計建築業在預測期內將主導該地區的市場。

- 奈米技術在油漆和塗料中的應用預計將成為未來市場成長的機會。

北美油漆和塗料市場趨勢

建築業需求不斷成長

- 油漆和塗料廣泛應用於建築領域的外部和內部應用。油漆和塗料應用於住宅的外部,使其煥然一新,並保護住宅免受明媚的夏季、寒冷的冬季、傾盆大雨和日常紫外線照射(防止外部褪色、剝落和開裂)。

- 建築塗料旨在保護和裝飾表面特徵。它用於粉刷建築物和住宅。大多數用於特定用途,例如屋頂油漆或牆壁油漆。

- 建築塗料的範圍從辦公大樓、倉庫、便利商店、購物中心等商業用途到住宅用途。這些塗料適用於外表面和內表面,還可以包括密封劑和特殊產品。建築塗料主要分為內牆塗料和外牆塗料。

- 由於家庭的快速形成和住宅建設的增加,北美的建設產業正在崛起,這推動了該地區對建築塗料的需求。

- 該地區正在進行多個建設計劃,這可能會增加預測期內建築油漆和塗料的消耗。

- 例如,2022年11月,三星宣布計畫在德克薩斯州奧斯汀興建耗資170億美元的半導體製造廠。這增加了預測期內該地區對建築塗料的需求。

- 此外,美國建築塗料的消費量正在顯著成長。 DIY產業在美國建築塗料消費量中的佔有率已達39%。

- 上述因素預計將在預測期內推動北美建築業油漆和塗料市場的發展。

美國主導市場

- 由於其國內基礎設施發達,美國是世界領先的油漆和塗料消費國和生產國之一。

- 美國是北美地區最大的建築業國家。該國人均GDP為25,350美元,預計2022年與前一年同期比較成長3.7%。

- 由於強勁的經濟和良好的商業房地產市場基本面,以及聯邦和州對公共工程和機構建築津貼的增加,美國建設產業持續擴張。

- 美國在北美建設產業中佔有主要佔有率。根據美國人口普查局的數據,2022年美國新建設年度金額為17,929億美元,較2021年的1,6264億美元成長超過10%。

- 該國正在進行多個建設計劃,預計將在預測期內增加對油漆和塗料的需求。例如,在美國,大都會公園園區將在兩棟 22 層 LEED 認證建築中容納 210 萬平方英尺的亞馬遜辦公空間,預算約為 25 億美元。

- 由於這些因素,預計該地區對油漆和塗料的需求在預測期內將會增加。

北美油漆和塗料行業概況

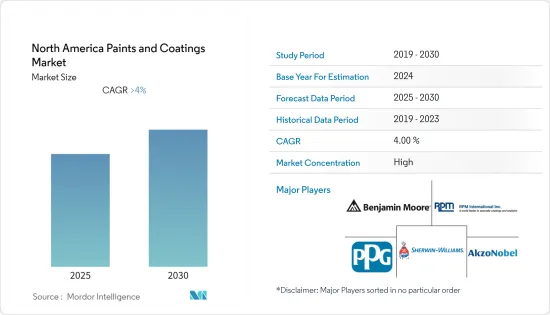

北美油漆和塗料市場本質上是整合的。該市場的主要參與者包括宣偉公司、PPG 工業公司、RPM 國際公司、本傑明莫耳公司和阿克蘇諾貝爾公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 商業建設活動增加

- 其他司機

- 抑制因素

- 原物料價格上漲

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 依樹脂類型

- 丙烯酸纖維

- 醇酸

- 環氧樹脂

- 聚酯纖維

- 聚氨酯

- 其他樹脂

- 依技術

- 水系統

- 溶劑型

- 粉末塗料

- 紫外線固化塗料

- 按最終用戶

- 建築學

- 車

- 木頭

- 防護漆

- 一般工業

- 運輸

- 包裝

- 按地區

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Akzo Nobel NV

- Axalta Coatings Systems

- BASF SE

- Beckers Group

- Benjamin Moore & Co.

- Cloverdale Paint Inc.

- Diamond Vogel

- Dunn-Edwards Corporation

- Hempel A/S

- Kelly-Moore Paints

- Masco Corporation

- Parker Hannifin Corp

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

第7章 市場機會及未來趨勢

- 奈米技術在油漆和塗料的應用

簡介目錄

Product Code: 53400

The North America Paints and Coatings Market is expected to register a CAGR of greater than 4% during the forecast period.

Key Highlights

- The rapid growth of industries and infrastructural construction in the region is fueling the market's growth during the forecast period.

- On the other hand, increasing raw material prices are expected to hinder market growth.

- The architectural segment is expected to dominate the regional market during the forecast period.

- Using nanotechnology in paints and coatings is expected to act as an opportunity for future market growth.

North America Paints and Coatings Market Trends

Increasing Demand from the Architectural Industry

- Paints and coatings are extensively used in the architectural sector for exterior and interior applications. Paints and coatings are applied on the house's exterior to give them a new look and protect it from blistering summers, freezing winters, soaking rain, and daily exposure to UV radiation (without fading, peeling away, and cracking the exteriors).

- Architectural coatings are meant to protect and decorate the surface features. These are used to coat buildings and homes. Most are for specific uses, such as roof coatings, wall paints, etc.

- Architectural coatings range from commercial purposes, such as office buildings, warehouses, retail convenience stores, and shopping malls, to residential buildings. Such coatings can be applied on outer and inner surfaces and include sealers or specialty products. Architectural coatings can be mainly divided into interior and exterior coatings.

- The construction industry in North America is increasing in response to rapid household formation and growing residential construction, which, in turn, is boosting the demand for architectural coatings in the region.

- Several construction projects are going on in the region, likely increasing the consumption of architectural paints and coatings during the forecast period.

- For instance, in November 2022, the company Samsung announced its plans to construct a USD 17 billion semiconductor fabrication facility in Austin, Texas. Thus, creating the demand for architectural coating in the region during the forecast period.

- Moreover, in the United States, the consumption of architectural paint is growing significantly. The DIY sector accounted for the major architectural paint consumption accounting for a 39% share of the total architectural paint consumption in the United States.

- All the factors above are expected to drive the North American paints and coatings market in the architectural industry during the forecast period.

United States to Dominate the Market

- The United States is one of the major consumers and producers of paints and coatings globally, owing to the growing infrastructure in the country.

- The United States is the largest country for construction activities in the North American region. The country had a GDP of USD 25,350 per capita, with an expected growth rate of 3.7% Y-o-Y in 2022.

- The construction industry in the United States continued to expand, owing to a strong economy and positive market fundamentals for commercial real estate, along with increased federal and state funding for public works and institutional buildings.

- The United States holds a major share of the construction industry in North America. According to the US Census Bureau, the annual value for new construction put in place in the United States accounted for USD 1,792.9 billion in 2022, a more than 10% increase compared to USD 1,626.4 billion in 2021.

- Several construction projects are going on in the country, expected to boost the demand for paints and coatings during the forecast period. For instance, in the United States, the Metropolitan Park campus plans to house 2.1 million sq ft of office space for Amazon in two 22-story LEED-certified buildings with a nearly USD 2.5 billion budget.

- Owing to all these factors, the demand for paints and coatings in the region is expected to increase during the forecast period.

North America Paints and Coatings Industry Overview

The North America Paints & coatings market is consolidated in nature. Some of the major players in the market include Sherwin-Williams Company, PPG Industries, Inc., RPM International Inc., Benjamin Moore & Co., and Akzo Nobel N.V., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Commercial Construction Activities

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Acrylics

- 5.1.2 Alkyd

- 5.1.3 Epoxy

- 5.1.4 Polyester

- 5.1.5 Polyurethane

- 5.1.6 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV-cured Coating

- 5.3 End-user

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective Coatings

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Axalta Coatings Systems

- 6.4.4 BASF SE

- 6.4.5 Beckers Group

- 6.4.6 Benjamin Moore & Co.

- 6.4.7 Cloverdale Paint Inc.

- 6.4.8 Diamond Vogel

- 6.4.9 Dunn-Edwards Corporation

- 6.4.10 Hempel A/S

- 6.4.11 Kelly-Moore Paints

- 6.4.12 Masco Corporation

- 6.4.13 Parker Hannifin Corp

- 6.4.14 PPG Industries, Inc.

- 6.4.15 RPM International Inc.

- 6.4.16 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Nano Technology in Paints and Coatings

02-2729-4219

+886-2-2729-4219