|

市場調查報告書

商品編碼

1686245

印度油漆和塗料:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)India Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

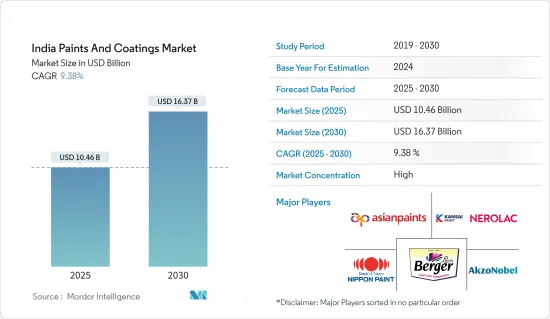

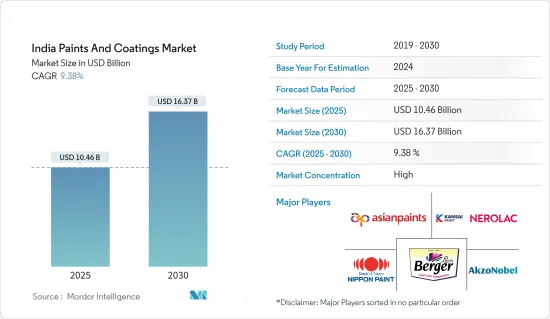

印度油漆和塗料市場規模預計在 2025 年為 104.6 億美元,預計到 2030 年將達到 163.7 億美元,預測期內(2025-2030 年)的複合年成長率為 9.38%。

COVID-19 阻礙了印度塗料行業市場的發展。經濟的不確定性以及房地產、建築和汽車等各行業的放緩導致塗料需求大幅下降。許多建築計劃被取消或推遲,減少了對裝飾塗料和工業塗料的需求。隨著經濟活動逐漸恢復和建築計劃恢復,建築和房地產領域對塗料的需求開始恢復。

建築業需求的成長加上汽車業的復甦正在推動印度塗料產業的需求。

另一方面,原料價格波動和有關揮發性有機化合物(VOC)的嚴格環境法規可能會阻礙市場成長。

預計在預測期內,油漆和塗料行業中奈米技術的使用以及對環保塗料日益成長的需求將提供各種市場成長機會。

印度油漆和塗料市場趨勢

建築業佔據市場主導地位

- 建築塗料用於辦公大樓、倉庫、便利商店、商場、住宅等商業用途。這些塗料適用於外部和內部表面,還包括密封劑和特殊產品。

- 印度正經歷快速的都市化和基礎設施建設,導致建築計劃激增。這直接增加了建築物和建築用建築塗料的需求。

- 該國的住宅產業正在崛起,政府的支持和舉措進一步刺激了需求。例如,住房與城市發展部(MoHUA)在其 2022-23 年預算中撥款 76,549.46 億印度盧比用於住宅建設,並設立基金以完成停滯的計劃。

- 此外,根據《今日商業》報道,印度政府還撥款 80,671 億印度盧比用於 Pradhan Mantri Awas Yojana (PMAY) 計劃等舉措,旨在為更多人提供經濟適用住宅。當人們建造或購買第一套房屋時,政府也會補貼抵押房屋抵押貸款利息。

- 根據《經濟時報》報道,預計2023年7-9月季度建築業年增13.3%,高於上一季的7.9%,創下近5季以來的最佳表現。

- 《經濟時報》公佈的資料顯示,2023年7-9月季度,孟買、新德里、班加羅爾等印度七大城市住宅與前一年同期比較成長36%,超過11.2萬套,價格上漲8-18%。

- 此外,該國正在擴大其商業部門,這也對建築乳膠塗料市場產生了積極影響。

- 因此,由於上述因素,預計未來印度建築領域對塗料的需求將穩定成長。

丙烯酸樹脂領域佔據市場主導地位

- 壓克力型塗料具有優異的光澤和保色性以及優異的耐久性和對多種基材的良好附著力。壓克力型塗料也是主要的建築塗料。

- 壓克力型塗料在建築業有著重要的應用,包括橋樑、優質屋頂飾面、地板和甲板。此外,由於環境問題(例如揮發性有機化合物(VOC)對環境的負面影響),水性壓克力型塗料的需求量很大。

- 在汽車工業中,壓克力型塗料用於內部和外部應用。非環式塗料主要被汽車OEM製造商用作外部應用的底漆和麵漆。近年來,汽車產業的成長率不斷加快,進而帶動汽車壓克力型塗料的成長。

- 例如,根據印度品牌股權基金會(IBEF)發布的資料,印度在22會計年度生產了2,293萬輛汽車。

- 此外,2023會計年度印度汽車出口量為4,761,487輛。

- 印度國家投資促進與便利局(Invest India)發布的資料顯示,印度政府已撥款98.1億美元用於開發印度古吉拉突邦GIFT城,預計2025年完工。

- 因此,由於上述積極因素,預計預測期內該國油漆和塗料市場對丙烯酸樹脂的需求將會增加。

印度塗料產業概況

印度油漆和塗料市場高度整合。市場的主要企業(不分先後順序)包括亞洲塗料公司、Berger Paints India Limited、關西塗料有限公司、阿克蘇諾貝爾公司和日本塗料控股公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 國內建築業的成長

- 汽車產業復甦

- 限制因素

- 原物料價格波動

- 有關揮發性有機化合物(VOC)的嚴格環境法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 技術領域

- 水性塗料

- 溶劑型塗料

- 粉末塗料

- 輻射固化塗料

- 樹脂類型

- 丙烯酸纖維

- 醇酸

- 聚氨酯

- 環氧樹脂

- 聚酯纖維

- 其他樹脂類型(乙烯基、乳膠)

- 最終用戶產業

- 建築學

- 車

- 木頭

- 防護漆

- 一般工業

- 運輸

- 包裝

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Asian Paints

- Berger Paints India Limited

- Indigo Paints

- Jotun

- JSW PAINTS

- KAMDHENU COLOUR AND COATINGS LIMITED(KCCL)

- Kansai Nerolac Paints Limited

- Nippon Paint Holding Co. Ltd

- Shalimar Paints

- Sheenlac Paints Ltd

第7章 市場機會與未來趨勢

- 奈米技術在油漆塗料工業的應用

- 環保塗料需求不斷成長

The India Paints And Coatings Market size is estimated at USD 10.46 billion in 2025, and is expected to reach USD 16.37 billion by 2030, at a CAGR of 9.38% during the forecast period (2025-2030).

COVID-19 hampered the paint industry market in India. With economic uncertainties and a slowdown in various sectors such as real estate, construction, and automotive, the demand for paints decreased significantly. Many construction projects were halted or delayed, leading to reduced demand for decorative and industrial paint. As economic activities gradually resumed and construction projects restarted, the demand for paints in the construction and real estate sectors began to recover.

Factors such as the growing demand from the construction industry, coupled with the recovering automotive industry, are driving the demand for the paint industry in India.

On the flip side, fluctuations in raw material prices and stringent environmental regulations regarding volatile organic compounds (VOC) are likely to hamper the market's growth.

The use of nanotechnology in the paints and coatings industry and the rising demand for eco-friendly paints are expected to offer various market growth opportunities during the forecast period.

India Paints And Coatings Market Trends

Architectural Industry to Dominate the Market

- Architectural coatings are used for commercial purposes, such as office buildings, warehouses, retail convenience stores, shopping malls, and residential buildings. These coatings can be applied on outer and inner surfaces and include sealers or specialty products.

- India has been experiencing rapid urbanization and infrastructure development, which has led to a surge in construction projects. Thus, this has directly increased the demand for architectural paints used in buildings and structures.

- The residential sector in the country is on an increasing trend, with government support and initiatives that are further boosting the demand. For instance, the Ministry of Housing and Urban Development (MoHUA) allocated the funds of INR 76,549.46 crore in the 2022-23 budget for the construction of houses and the creation of funds in order to complete the halted projects.

- Furthermore, according to Business Today, the government has allocated INR 80,671 crore for initiatives, such as the Pradhan Mantri Awas Yojana (PMAY) program, which is intended to provide affordable homes to many people. Also, the government offers subsidies for interest on housing loans if the citizens wish to build or buy their first house.

- According to the Economic Times, in July - September 2023, compared with a year earlier, the construction sector grew by 13.3%, up from 7.9% in the previous quarter and its best performance in five quarters.

- Home sales in India's seven most prominent cities, including Mumbai, New Delhi, and Bangalore, increased by 36% in the July-September quarter in 2023 from the previous year to more than 112,000 units, with an 8-18% increase in prices, according to data released by the Economic Times.

- Also, the country is expanding its commercial sector, which has a positive impact on the architectural emulsion coatings market.

- Hence, according to the factors mentioned above, the demand for paints from the architectural segment is expected to witness robust growth in India in the upcoming period.

Acrylic Resin Segment to Dominate the Market

- Acrylic paints have excellent gloss and color retention along with excellent durability and good adhesion to many substrates. Acrylic paints are also the major architectural paints.

- The application of acrylic coatings is significant in the construction industry for bridges, high-end finishing in roofs, floors, decks, and other applications. Furthermore, water-based acrylic coatings are in huge demand due to their environmental concerns, which include the adverse effect of volatile organic compounds (VOCs) on the environment.

- In the automotive industry, acrylic coatings have applications in both interior and exterior surfaces. Acyclic-based paints are mainly used as bases and topcoats for automotive OEM exterior applications. In recent years, the automotive sector has been growing at a faster rate, which has led to an increase in the growth of acrylic automotive paint.

- For instance, according to data published by the Indian Brand Equity Foundation (IBEF), India produced 22.93 million vehicles in the financial year 2022.

- Moreover, automobile exports in India reached 4,761,487 in the financial year 2023.

- According to the data published by the National Investment Promotion and Facilitation Agency (Invest India), the Government of India has allocated USD 9.81 billion for the development of Gift City in Gujarat, India, which is expected to be completed by 2025.

- Thus, the positive factors mentioned above are expected to increase the demand for acrylic resin in the country's paints and coatings market over the forecast period.

India Paints And Coatings Industry Overview

The Indian paints and coatings markets are highly consolidated in nature. Some of the major players in the market (not in any particular order) include Asian Paints, Berger Paints India Limited, Kansai Nerolac Paints Limited, Akzo Nobel NV, and Nippon Paint Holding Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Industry in the Country

- 4.1.2 Recovery of The Automotive Industry

- 4.2 Restraints

- 4.2.1 Fluctuation in the Raw Material Prices

- 4.2.2 Stringent Environmental Regulations Regarding Volatile Organic Compounds (VOC)

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market size in Value)

- 5.1 Technology

- 5.1.1 Water-borne Coatings

- 5.1.2 Solvent-borne Coatings

- 5.1.3 Powder Coatings

- 5.1.4 Radiation Cured Coatings

- 5.2 Resin Type

- 5.2.1 Acrylic

- 5.2.2 Alkyd

- 5.2.3 Polyurethane

- 5.2.4 Epoxy

- 5.2.5 Polyester

- 5.2.6 Other Resin Types (Vinyl, Latex)

- 5.3 End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective Coatings

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Asian Paints

- 6.4.3 Berger Paints India Limited

- 6.4.4 Indigo Paints

- 6.4.5 Jotun

- 6.4.6 JSW PAINTS

- 6.4.7 KAMDHENU COLOUR AND COATINGS LIMITED (KCCL)

- 6.4.8 Kansai Nerolac Paints Limited

- 6.4.9 Nippon Paint Holding Co. Ltd

- 6.4.10 Shalimar Paints

- 6.4.11 Sheenlac Paints Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Nanotechnology in the Paints and Coatings Industry

- 7.2 Rising Demand for Eco-friendly Paints