|

市場調查報告書

商品編碼

1639463

中東和非洲油漆和塗料:市場佔有率分析、行業趨勢、統計和成長預測(2025-2030)Middle-East and Africa Paints and Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

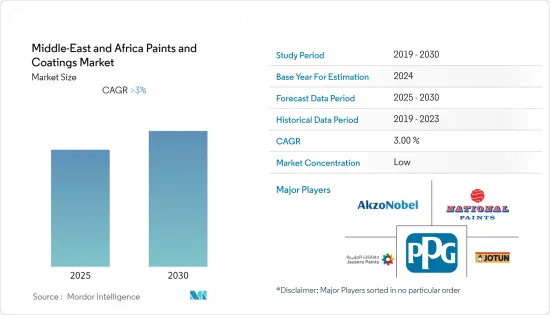

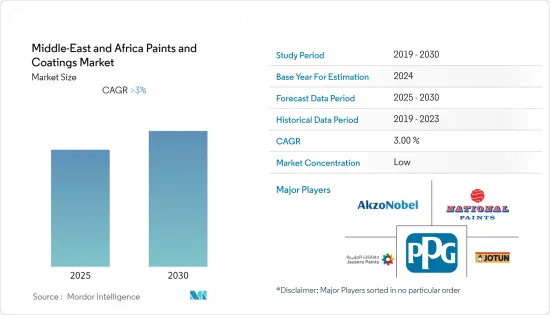

中東和非洲油漆和塗料市場預計在預測期內複合年成長率將超過 3%。

2020年市場受到了COVID-19大流行的影響。然而,2021年,由於各地區基礎建設需求增加,市場呈現成長。油漆和被覆劑用於建築、汽車、運輸和木材領域。它們在建築和施工項目中具有重要的應用,並用於保護結構免受外部傷害。此外,隨著政府專注於增加公共支出以實施新計畫,預計未來幾年市場將擴大。

主要亮點

- 對中東旅遊業和建築業的日益關注是市場研究的關鍵驅動力。

- 另一方面,汽車行業的放緩預計將阻礙市場成長。

- 在市場區隔方面,建築塗料佔據市場主導地位,由於該地區建設活動的增加,預計該細分市場在預測期內將成長。

- 對環保產品的需求不斷成長、阿曼的成長機會以及卡達新豪華房地產計劃的計劃可能有利於所研究的市場。

中東和非洲油漆和塗料市場趨勢

建築業的需求增加

- 建築油漆和塗料佔據油漆和塗料市場的大部分。建築塗料用於保護和裝飾建築物的外部。用於粉刷建築物和住宅。建築塗料用於多種應用,包括商業建築、倉庫、便利商店、購物中心和住宅。

- 憑藉著阿拉伯聯合大公國政府的堅定承諾和資源,建設公司和工程公司即將實施多個大型企劃。例如,最近宣布了杜拜米納拉希德重建和杜拜國際金融中心擴建2.0等大型建設計劃。

- 利雅德地鐵計劃是沙烏地阿拉伯最大的地鐵計劃,擬興建6條地鐵線路,總長176公里。它將由 Ariyadh 發展局 (ADA) 管理,擁有 85 個車站,包括幾個轉乘站。

- 卡達開發了重大基礎設施計劃,為 2022 年 FIFA 世界盃做準備。這些建設計劃包括阿爾拜特體育場和哈利法國際體育場,可容納 6 萬人。

- 沙烏地阿拉伯的大規模住宅基礎設施開發以及卡達、杜拜和阿布達比的持續建設都推動了該地區對油漆和塗料的需求。

- 在南非,中國投資80億美元正在興建約翰尼斯堡莫德方丹新城。該計劃將使用位於奧利弗雷金納德坦博國際機場和桑頓之間的 1,600 公頃土地。擁有中央商務區、國際會展中心、銀髮養老產業、娛樂中心、國際住宅區、體育中心、教育訓練中心、貿易物流園區等九大功能區,以及一個輕工業園區。

埃及可望迎來良好的市場成長

- 埃及是非洲建築業最發達的國家。此外,由於一些建築計劃的外國投資增加,預計建築業將顯著發展。埃及的建築業是世界上成長最快的行業之一,近年來年增率超過9%。該國的建設計劃約佔非洲全部建設計劃的10%。

- 根據埃及財政部的報告,該國的建築業約佔GDP的16.2%。這正在推動該國的油漆和塗料市場。

- 埃及正在其擁有 1000 年歷史的首都開羅以東約 50 公里處的一片面積與新加坡相當的沙漠地區建設一座大規模的新行政首都 (NAC)。埃及新行政首都(NAC)建設計劃預計2022年啟動,並帶來建設熱潮。總建築成本預計將超過450億美元,被譽為解決人口超過2000萬的開羅過度擁擠問題的解決方案。

- 埃及是知名市場主要企業建立的汽車製造廠的所在地,其業務遍及世界各地。通用、寶馬、現代、豐田等埃及乘用車和輕型商用車的需求不斷成長,汽車產量預計將擴大以支持市場需求。

- 根據OICA稱,2017年至2021年埃及的乘用車產量大幅成長。

- 此外,埃及擁有非洲最大的建築業。根據埃及財政部的報告,該國的建築業約佔GDP的16.2%。

中東和非洲油漆塗料行業概況

中東和非洲油漆和塗料市場是細分的。該市場的主要企業包括(排名不分先後)Akzo Nobel NV、Jazeera Paints、Jotun、PPG Industries Inc. 和 National Paints Factories。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 中東旅遊業和建築業日益受到關注

- 其他司機

- 抑制因素

- 汽車業放緩

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 樹脂型

- 丙烯酸纖維

- 醇酸

- 聚氨酯

- 環氧樹脂

- 聚酯纖維

- 其他

- 科技

- 水性的

- 溶劑型

- 輻射固化

- 其他

- 最終用戶產業

- 建築學

- 車

- 木頭

- 工業的

- 其他

- 地區

- 沙烏地阿拉伯

- 卡達

- 科威特

- 阿拉伯聯合大公國

- 伊朗

- 伊拉克

- 奈及利亞

- 南非

- 土耳其

- 坦尚尼亞

- 肯亞

- 阿爾及利亞

- 摩洛哥

- 埃及

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Al-Tabieaa Company

- Akzo Nobel NV

- Asian Paints BERGER

- ATLAS Peintures

- BASF SE

- Basco Paints

- Beckers Group

- Crown Paints Kenya PLC

- DAW SE(Caparol)

- Hempel AS

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd.

- National Paint Factories Co. Ltd.

- Betek Boya Kimya ve Sanayi AS(Nippon Paint Holdings Co. Ltd.)

- PACHIN

- PPG Industries Inc.

- The Sherwin-Williams Company

- RPM International Inc.

- Wacker Chemie AG

- Saba Shimi Aria

- Scib Paints

- Terraco Holdings Limited

- Thermilate Middle East

第7章 市場機會及未來趨勢

- 對環保產品的需求不斷成長

- 卡達新豪華房地產計劃計劃

- 阿曼的成長前景

The Middle-East and Africa Paints and Coatings Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was impacted due to the COVID-19 pandemic in 2020. However, the market witnessed growth in 2021 owing to increasing infrastructure demand in various regions. Construction, automotive and transportation, and the wood sectors all employ paints and coatings. They have a significant application in the building and construction business, where they are used to protect structures from external harm. Furthermore, the market is expected to expand in the coming years as governments focus on boosting public spending to undertake new projects.

Key Highlights

- A major factor driving the market studied is the increased focus on tourism and construction in the Middle East.

- On the flip side, the slowdown in the automotive sector is expected to hinder the market's growth.

- Architectural coatings dominated the market, and the segment is expected to grow during the forecast period, owing to the increasing construction activities across the region.

- Rising demand for eco-friendly products, growth prospects in Oman, and plans for new luxury real estate projects in Qatar are likely to act as an opportunity for the market studied.

MEA Paints and Coatings Market Trends

Increasing Demand from the Architectural Sector

- Architectural paints and coatings make up the vast majority of the paints and coatings market. Architectural coatings are used to protect and embellish the characteristics of a building's exterior. They are used to coat structures and residences. Architectural coatings are utilized in various applications, including commercial buildings, warehouses, retail convenience shops, shopping malls, and residential structures.

- The UAE government's strong dedication and resources have established several mega-project prospects for construction and engineering firms. For instance, mega construction projects like the redevelopment of Mina Rashid in Dubai and the Dubai International Financial Centre Expansion 2.0 have all recently been announced.

- The Riyadh Metro Project is the largest metro project in Saudi Arabia which aims to establish six metro lines with a total distance coverage of 176 km. It will be managed by Arriyadh Development Authority (ADA) and served by 85 stations, including several interchange stations.

- Qatar developed major infrastructure projects for the FIFA World Cup in 2022. Al Bayt Stadium and Khalifa International Stadium was one of those construction projects with a capacity of 60,000 seats.

- Massive housing and infrastructure developments in Saudi Arabia and ongoing construction in Qatar, Dubai, and Abu Dhabi are all driving demand for paints and coatings in the region.

- In South Africa, Modderfontein New City is a Chinese-funded USD 8 billion city that is being built in Modderfontein, Johannesburg-South Africa. The project will occupy 1,600-hectare land between OR Tambo International Airport and Sandton. The city will include nine functional zones, the central business district, international conference and exhibition center, silver industry and retirement industry, an entertainment center, international residential community, sports center, education and training center, trade and logistic park, and light industry park.

Egypt to Witness Lucrative Market Growth

- Egypt has the most-developed building sector in Africa. In addition, the construction sector is predicted to develop significantly due to increased foreign investments in several building projects. Egypt's construction sector has been one of the fastest-growing in the world, rising at a rate of over 9% per year during the last several years. Construction projects in the nation accounted for around 10% of all African construction projects.

- As reported by the Egyptian Ministry of Finance, the country's building and construction industry represent approximately 16.2% of the country's GDP. This is boosting the paints and coatings market in the country.

- Egypt is building a massive New Administrative Capital (NAC) about 50 km east of the 1,000-year-old capital Cairo on a tract of the desert the size of Singapore. Building projects in Egypt's New Administrative Capital (NAC) were expected to kick up in 2022, resulting in a construction boom. The city is expected to cost over USD 45 billion and has been hailed as a solution to overcrowding in Cairo, with a population of more than 20 million people.

- Egypt has automobile manufacturing units set up by prominent market leaders operating across the globe. These include GM, BMW, Hyundai, Toyota, and others. The growing demand for passenger cars and light commercial vehicles in the country is expected to upscale the production of auto vehicles, thereby likely to support the market demand.

- According to the OICA, the production of passenger vehicles in Egypt increased significantly from 2017 to 2021.

- Further, Egypt has the most significant construction industry in the African region. The construction industry is growing in the country; as reported by the Egyptian Ministry of Finance, the country's building and construction industry represents approximately 16.2% of the country's GDP.

MEA Paints and Coatings Industry Overview

The paints and coatings market in the Middle East and Africa is fragmented. Key players in the market include (not in any particular order) Akzo Nobel NV, Jazeera Paints, Jotun, PPG Industries Inc., and National Paints Factories Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Focus on Tourism and Construction in the Middle-East

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Slowdown in Automotive Sector

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Sixr

- 5.1 Resin Type

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Radiation Cure

- 5.2.4 Other Technologies

- 5.3 End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Saudi Arabia

- 5.4.2 Qatar

- 5.4.3 Kuwait

- 5.4.4 United Arab Emirates

- 5.4.5 Iran

- 5.4.6 Iraq

- 5.4.7 Nigeria

- 5.4.8 South Africa

- 5.4.9 Turkey

- 5.4.10 Tanzania

- 5.4.11 Kenya

- 5.4.12 Algeria

- 5.4.13 Morocco

- 5.4.14 Egypt

- 5.4.15 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Al-Tabieaa Company

- 6.4.2 Akzo Nobel NV

- 6.4.3 Asian Paints BERGER

- 6.4.4 ATLAS Peintures

- 6.4.5 BASF SE

- 6.4.6 Basco Paints

- 6.4.7 Beckers Group

- 6.4.8 Crown Paints Kenya PLC

- 6.4.9 DAW SE (Caparol)

- 6.4.10 Hempel AS

- 6.4.11 Jazeera Paints

- 6.4.12 Jotun

- 6.4.13 Kansai Paint Co. Ltd.

- 6.4.14 National Paint Factories Co. Ltd.

- 6.4.15 Betek Boya Kimya ve Sanayi AS (Nippon Paint Holdings Co. Ltd.)

- 6.4.16 PACHIN

- 6.4.17 PPG Industries Inc.

- 6.4.18 The Sherwin-Williams Company

- 6.4.19 RPM International Inc.

- 6.4.20 Wacker Chemie AG

- 6.4.21 Saba Shimi Aria

- 6.4.22 Scib Paints

- 6.4.23 Terraco Holdings Limited

- 6.4.24 Thermilate Middle East

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Eco-friendly Products

- 7.2 Plans for New Luxury Real Estate Projects in Qatar

- 7.3 Growth Prospects in Oman