|

市場調查報告書

商品編碼

1628771

歐洲撓曲油管:市場佔有率分析、產業趨勢、成長預測(2025-2030)Europe Coiled Tubing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

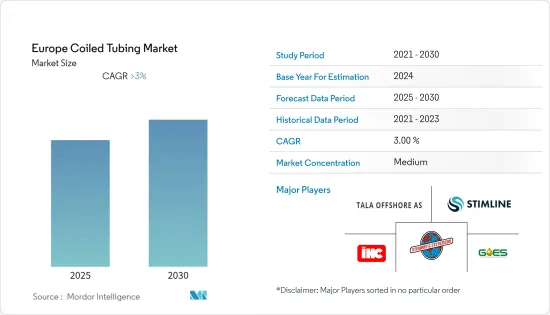

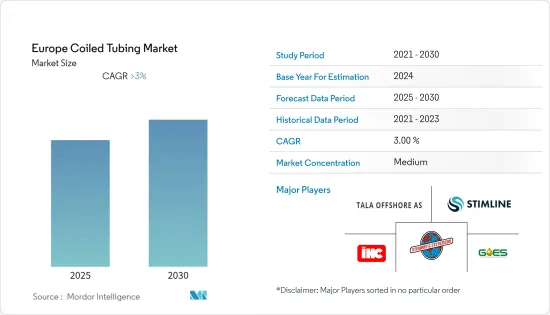

預計歐洲撓曲油管市場在預測期間內將維持3%以上的複合年成長率。

2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從中期來看,成熟油田的增加和現有油田的維護預計將推動市場成長。

- 同時,原油價格的劇烈波動和高昂的維護成本預計將阻礙預測期內歐洲撓曲油管市場的成長。

- 在預測期內,北海深水探勘和生產的增加可能為歐洲撓曲油管市場提供利潤豐厚的成長機會。

- 英國在預測期內經歷了顯著的成長和顯著的複合年成長率。這一成長歸因於投資的增加以及幾個即將推出的計劃。

歐洲撓曲油管市場趨勢

市場區隔可能主導市場

- 油井干預是一種用來提高油井產能的方法。連續管井干預措施通常用於多種應用,包括井眼清洗、鑽井、酸洗、水力壓裂、防砂和捕魚。使用連續管鑽井比鑽桿、管材或有線等其他方法更便宜、更可靠。

- 2021年歐洲天然氣產量達約2,104億立方米,約佔全球天然氣產量的5.2%。歐洲大部分天然氣來自挪威,2021年佔全球天然氣總產量的2.8%。

- 目前,世界主要企業在透過提高現有油井的最佳產量來提高現有油井的性能方面投入的資金比投資新油井的資金要多。為了達到所需的生產率,公司被迫依賴連續油管進行油井維護。

- 隨著傳統型石油和天然氣計劃的增加,對連續油管的需求可能會增加。連續管廣泛用於水力壓裂和酸洗,以增加地質層的滲透性。

- 在北海,撓曲油管裝置也用於鑽探溫度超過 300 華氏度 (F) 和井底壓力超過 1,0000 psi 的高溫高壓井。

- 2022年7月,挪威在2022年上半年錄得高水準探勘活動,共發現六項發現。該國當局預計到 2022年終將鑽探 40 口探勘井。預計這將為撓曲油管市場創造重大機會。

- 2022 年 11 月,挪威領先公司 Equinor 宣布計畫在 2023 年在北歐海岸鑽探 25 口探勘井。儘管該公司專注於向歐洲供應盡可能多的天然氣,但它也在探勘新的天然氣田。這項探勘活動需要大量的盤管。

- 因此,鑑於上述幾點,在預測期內,油井干預可能會主導歐洲撓曲油管市場。

英國預計將出現顯著成長

- 英國有潛力成為歐洲石油和天然氣行業的領導者之一,目前約有 111 個石油和天然氣計劃正在進行中,其中 83 個是上游契約,預計到 2025 年完成。這些計劃大部分位於北海近海。因此,英國北海地區預計將成為該國新鑽探作業的熱點,特別是天然氣生產。

- 2021年英國原油產量約4,090萬噸。這是與前一年同期比較,也是自2014年以來首次低於4000萬噸。預計未來幾年英國的產量將進一步下降。

- 2022年2月,北海6個新油氣天然氣田幾乎獲得英國政府核准。財政部已敦促上級部門加快發放六個能源區塊的建設許可。這將導致該地區撓曲油管市場的成長。

- 2022 年 10 月,英國啟動了新一輪許可,允許石油和天然氣公司在北海探勘石化燃料,儘管氣候變遷活動人士威脅要提起法律訴訟。北海過渡管理局已開始向希望在該地區開採石油和天然氣的公司頒發 100 多個許可證。大約有 900 個地點可供探勘。

- 基於上述情況,預計在預測期內,英國在歐洲撓曲油管市場將大幅成長。

歐洲撓曲油管產業概況

歐洲撓曲油管市場適度整合。市場上的主要企業包括(排名不分先後)Royal IHC、GOES GmbH、Stimline AS、Tala Offshore AS 和 Stewart & Stevenson。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 目的

- 鑽孔

- 幹得好

- 完全的

- 部署地點

- 陸上

- 離岸

- 地區

- 英國

- 挪威

- 土耳其

- 歐洲其他地區

第6章 競爭狀況

- 合併、收購、聯盟和合資企業

- 主要企業策略

- Key Companies Profile

- Royal IHC

- GOES GmbH

- Stimline AS

- Tala Offshore AS

- Stewart & Stevenson

- AnTech Ltd

- Tenaris

第7章 市場潛力及未來趨勢

簡介目錄

Product Code: 53655

The Europe Coiled Tubing Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, an increasing number of mature fields and maintenance of the existing wells are expected to drive the market's growth.

- On the other hand, the high volatility of crude oil prices and high maintenance costs are expected to hamper the growth of Europe's coiled tubing market during the forecast period.

- Nevertheless, the increasing deepwater exploration and production in the North Sea are likely to create lucrative growth opportunities for the Europe coiled tubing market in the forecast period.

- United Kingdom to witness signifivant growth and is also likely to witness the prominent CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with several upcoming projects.

Europe Coiled Tubing Market Trends

Well Intervention Segment Expected to Dominate the Market

- Well intervention is the method used for increasing the productivity of the well. Well intervention through coiled tubing is generally done for various applications such as well cleaning, perforation, acidization, hydro-fracture, sand control, fishing, and others. Well intervention through coiled tubing is cheaper and more reliable than other methods such as drilling pipe, tubing, or wireline.

- Natural gas production in Europe amounted to some 210.4 billion cubic meters in 2021, which represented nearly 5.2% of global natural gas production. Most of Europe's natural gas originates in Norway, accounting for 2.8% of the global total natural gas production in 2021.

- Major companies in the world, rather than investing in new wells, are now spending more on increasing the performance of existing wells by getting optimum production from the wells. To attain the required production, companies have to majorly rely on coiled tubing for well maintenance.

- The demand for coiled tubing is likely to increase due to an increasing number of projects in unconventional oil and gas, in which coiled tubing is widely used for hydro-fracturing and acidization to increase the permeability of the formation.

- In the North Sea, coiled tubing units are also being used to perforate high temperature and high pressure wells with temperature crossing over 300 degree-Fahrenheit (F) and having bottom hole pressure over 10000 psi.

- In July 2022, Norway recorded a high level of exploration activity in the first half of 2022, leading to six discoveries. The country's authorities are anticipating 40 exploration wells to be drilled by the end of 2022. This is expected to create significant opportunitoes for coiled tubing market.

- In November 2022, Norwegian major Equinor announced its plans to drill 25 exploration wells off the Nordic country by 2023. The company has focussed on providing as much gas as possible to Europe but exploring new gas fields. The exploration activity will require number of coiled tubings.

- Therefore, owing to the above points, well intervention is likely to dominate the Europe coiled tubing market during the forecast period.

United Kingdom Expected to Experience Significant Growth

- The United Kingdom can become one of the European leaders in the oil and gas industry, holding around 111 oil and gas projects currently in progress, out of which 83 projects are upstream contracts to be completed by 2025. The major part of those projects is held by the offshore swathes of the North Sea. Thus, the British North Sea region is expected to be the hotspot for new drilling operations in the country, particularly for gas production.

- The United Kingdom produced some 40.9 million metric tons of crude oil in 2021. This was a decrease compared to the previous year and the first time since 2014 that figures fell below 40 million metric tons. The UK is projected to see production volume decrease further in the coming years.

- In February 2022, six new oil and gas fields in the North Sea almost confirmed approval from the UK government. The finance department pushed the senior authorities to fast-track the licenses for constructing the six energy areas. This, in turn, culminates in the growth of the coiled tubing market across the region.

- In October 2022, The United Kingdom opened up a new licensing round to allow oil and gas companies to explore fossil fuels in the North Sea despite threats of a legal battle from climate campaigners. The North Sea Transition Authority has begun a process to award more than 100 licenses to companies hoping to extract oil and gas in the area. Almost 900 locations are being offered up for exploration.

- Hence, owing to the above points, the United Kingdom is expected to see significant growth in the Europe coiled tubing market during the forecast period.

Europe Coiled Tubing Industry Overview

The Europe Coiled Tubing market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include Royal IHC, GOES GmbH, Stimline AS, Tala Offshore AS, and Stewart & Stevenson.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Application

- 5.1.1 Drilling

- 5.1.2 Well Intervention

- 5.1.3 Completion

- 5.2 Location Of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 United Kingdom

- 5.3.2 Norway

- 5.3.3 Turkey

- 5.3.4 Rest of the Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Key Companies Profile

- 6.3.1 Royal IHC

- 6.3.2 GOES GmbH

- 6.3.3 Stimline AS

- 6.3.4 Tala Offshore AS

- 6.3.5 Stewart & Stevenson

- 6.3.6 AnTech Ltd

- 6.3.7 Tenaris

7 MARKET OPPORTUNITIES and FUTURE TRENDS

02-2729-4219

+886-2-2729-4219