|

市場調查報告書

商品編碼

1628785

北美支撐劑:市場佔有率分析、產業趨勢、成長預測(2025-2030)North America Proppants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

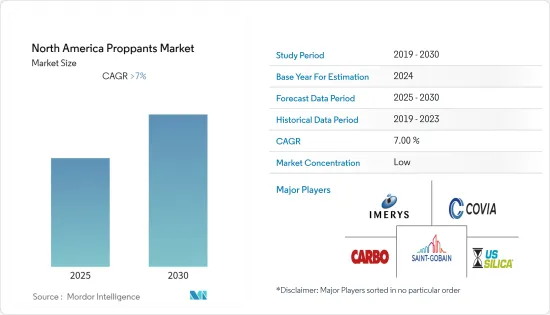

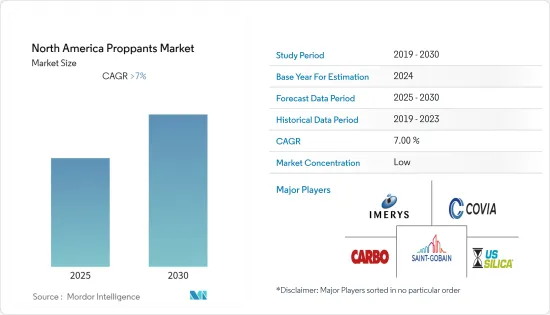

預計北美支撐劑市場在預測期內的複合年成長率將超過 7%。

在 COVID-19 爆發期間,世界許多地區發生了封鎖,擾亂了製造活動和供應鏈、生產停頓和勞動力供應,對市場產生了負面影響。然而,隨著 2021 年情況開始改善,市場成長軌跡可能會在預測期內恢復。

主要亮點

- 短期來看,水力壓裂技術的改進、壓裂砂用量的增加(每井)以及頁岩氣生產活動的增加是推動市場成長的關鍵因素。

- 另一方面,環境問題和法律法規預計將在預測期內抑制目標產業的成長。

- 將重點轉向陶瓷支撐劑的使用可能會在短期內為市場創造利潤豐厚的成長機會。

- 美國是支撐劑的最大市場。預計在預測期內複合年成長率將達到最高。

北美支撐劑市場趨勢

壓裂砂主導市場

- 壓裂砂支撐劑是水力壓裂市場上使用最廣泛的類別。助焊劑砂支撐劑採用高純度、耐用的圓形顆粒砂製成。

- 它主要由砂岩製成。它們的尺寸範圍從直徑約 0.1 毫米到 2 毫米,具體取決於壓裂作業的要求。美國生產的大部分壓裂砂是從聖彼得砂岩和寒武紀約旦砂礦開採的。

- 由於其高效能、低成本和可用性,助焊劑砂佔市場支撐劑用量的 90% 以上。預計助焊劑砂支撐劑市場在預測期內將穩定成長。

- 該地區大量有利的頁岩盆地和不斷成長的天然氣需求,顯著增加了對這些支撐劑的需求。此外,它們也出口。

- 此外,北美陸上和墨西哥灣大陸棚上有許多油田接近成熟,預計將進一步刺激該地區的支撐劑需求。

- Smart Sand 是領先的助焊劑砂供應商之一,目前在美國營運兩座助焊劑砂生產設施,年加工量總合約為 710 萬噸。該公司2022年第一季壓裂砂產量為85.2萬噸。

- 總體而言,由於老化油田的增加以及水平鑽井和頁岩氣生產活動的增加,預計在預測期內每口井的片砂用量將會增加。

美國主導市場

- 美國是非傳統型原油蘊藏量探勘和水力壓裂技術應用的世界主導之一。

- 根據美國地質調查局的數據,2021 年,美國約 64% 的噸位被用作水力壓裂砂和井填充/水泥砂。

- 與傳統壓裂井相比,水力壓裂井的石油產量顯著增加。隨著國內水力壓裂應用的擴大,特別是頁岩氣和緻密油的應用,對支撐劑的需求正受到正面影響。

- 據美國能源資訊署(EIA)稱,美國頁岩氣和緻密油產量預計將從2021年的24.91兆立方英尺增加到2050年的近34兆立方英尺。

- 助焊劑砂是應用最廣泛的支撐劑,而樹脂覆膜砂和陶瓷砂則用於生產深度高、耐熱性高的特定應用。

- 隨著成熟油田數量的增加和能源需求的增加,由於煤層氣、緻密油等非傳統資源的探勘,水力壓裂使用的支撐劑預計將會成長。

- 成熟油田產量的增加預計也將成為陶瓷支撐劑需求大幅增加的因素。

北美支撐劑產業概況

北美的助焊劑砂支撐劑是一個細分市場。市場主要企業包括(排名不分先後)Covia Holdings Corporation、Carbo Ceramics Inc.、Imerys、US Silica 和 Saint-Gobain。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 改良水力壓裂技術

- 片砂使用量增加(每井使用量)

- 頁岩氣生產活動增加

- 抑制因素

- 環境問題和法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 供應鏈概覽

- 技術簡介

- 價格分析

第5章市場區隔(市場規模:數量)

- 類型

- 片狀三明治

- 樹脂塗層

- 陶瓷製品

- 地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Badger Mining Corporation

- CoorsTek Inc.

- Covia Holdings Corporation

- Eagle Materials Inc.

- Fores LTD

- Halliburton

- Hexion

- Hi-Crush

- Imerys

- Preferred Proppants LLC

- Saint-Gobain

- Schlumberger Limited

- Superior Silica Sands(Emerge Energy Services)

- US SILICA

- WAYFINDER

第7章 市場機會及未來趨勢

- 轉向使用陶瓷支撐劑

The North America Proppants Market is expected to register a CAGR of greater than 7% during the forecast period.

During the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, production halts, and labor unavailability negatively impacted the market. However, the conditions started recovering in 2021, which will likely restore the market's growth trajectory during the forecast period.

Key Highlights

- Over the short term, improvements in fracking technology, increasing usage of frac sand (quantity per well), and increasing shale gas production activities are the major driving factors augmenting the growth of the market studied.

- On the flip side, environmental concerns and legislation are anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, shifting focus toward the usage of ceramic proppants is likely to create lucrative growth opportunities for the market soon.

- The United States is the largest market for proppants. It is expected to witness the highest CAGR during the forecast period.

North America Proppants Market Trends

Frac Sand to Dominate the Market

- Frac sand proppants are the market's most widely used category for hydraulic fracturing. Frac sand proppants are made of highly pure and durable sand with round grains.

- They are predominantly made out of sandstone. Their size ranges from about 0.1 mm in diameter to 2 mm in diameter, depending on the requirement of the fracking job. A large portion of the frac sands produced in the United States is extracted from the sand mines of St. Peter Sandstone and Cambrian Jordan.

- Frac sand accounts for more than 90% of the total proppants usage in the market due to its efficiency, low cost, and availability. The market for frac sand proppants is expected to grow steadily during the forecast period.

- There is a considerable increase in demand for these proppants in the region due to numerous favourable shale basins and increasing natural gas demand. Moreover, they are exported.

- In addition, onshore North America and the Gulf of Mexico continental shelf have many oilfields that are about to reach their maturity; this is expected to further add to the proppants demand in the regions.

- Smart Sand is one of the major frac sand supply companies that currently operates two frac sand production facilities in the United States, with a a combined annual processing capacity of around 7.1 million tons. The company produced 852 thousand tons of frac sand in the first quarter of 2022.

- Overall, with the increasing number of aging fields, coupled with the increasing horizontal drilling and shale gas production activities, the amount of frac sand used per well is likely to increase during the forecast period.

United States to Dominate the Market

- The United States is one of the leading countries globally in terms of the exploration of unconventional crude oil reserves and the application of hydraulic fracturing for the same.

- According to the U.S. Geological Survey, in 2021, approximately 64% of the U.S. tonnage was used as hydraulic-fracturing sand and well packing and cementing sand.

- The quantity of oil produced from hydraulically fractured wells has been increasing significantly compared to oil produced from conventionally-fractured wells. With the growing hydraulic fracturing applications in the country, especially for shale gas and tight oil purposes, the demand for proppants has been witnessing a positive impact.

- According to the United States Energy Information Administration (EIA), shale gas and tight oil production in the United States are estimated to increase to nearly 34 trillion cubic feet by 2050, up from 24.91 trillion cubic feet in 2021.

- Frac sand is the most widely used proppant, while resin-coated and ceramic sands are used for specific applications that involve greater production depths and thermal resistance.

- With the increase in the number of mature fields and the rising energy demand, proppants used in hydraulic fracturing are expected to witness growth, owing to the exploration of unconventional resources, such as coal bed methane, tight oil, and others.

- The increase in the production from mature fields is also expected to be the reason for the significant rise in the demand for ceramic proppants.

North America Proppants Industry Overview

The North American frac sand proppants is a fragmented market. Some major players in the market (in no particular order) include Covia Holdings Corporation, Carbo Ceramics Inc., Imerys, U.S. Silica, and Saint-Gobain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Improvements in Fracking Technology

- 4.1.2 Increasing Usage of Frac Sand (Quantity per Well)

- 4.1.3 Increasing Shale Gas Production Activities

- 4.2 Restraints

- 4.2.1 Environmental Concerns and Legislation

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Supply Chain Overview

- 4.6 Technological Snapshot

- 4.7 Price Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Frac Sand

- 5.1.2 Resin Coated

- 5.1.3 Ceramic

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Badger Mining Corporation

- 6.4.2 CoorsTek Inc.

- 6.4.3 Covia Holdings Corporation

- 6.4.4 Eagle Materials Inc.

- 6.4.5 Fores LTD

- 6.4.6 Halliburton

- 6.4.7 Hexion

- 6.4.8 Hi-Crush

- 6.4.9 Imerys

- 6.4.10 Preferred Proppants LLC

- 6.4.11 Saint-Gobain

- 6.4.12 Schlumberger Limited

- 6.4.13 Superior Silica Sands (Emerge Energy Services)

- 6.4.14 US SILICA

- 6.4.15 WAYFINDER

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus toward the Usage of Ceramic Proppants