|

市場調查報告書

商品編碼

1629774

支撐劑 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Proppants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

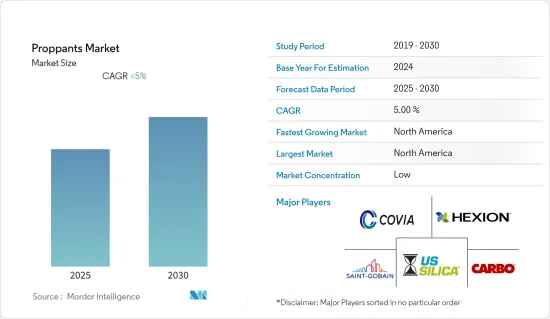

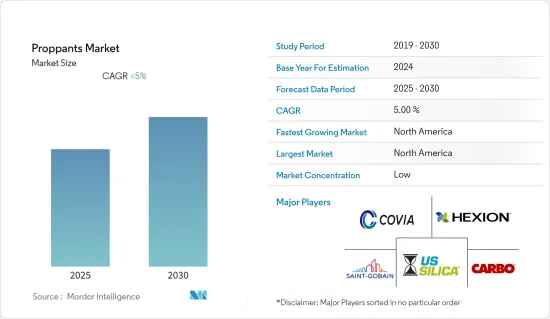

預計支撐劑市場在預測期內的複合年成長率將低於 5%。

支撐劑的主要用途是在石油和天然氣井。由於市場供應過剩,COVID-19 和地緣政治因素減少了原油需求,迫使 OPEC+ 產油國減產。預計這將影響各種支撐劑的需求,包括助焊劑砂、樹脂塗層和陶瓷。

主要亮點

- 從中期來看,水力壓裂技術的改進和頁岩氣生產活動的增加預計將推動市場研究。美國能源資訊署 (EIA) 預測,到 2040 年,頁岩天然氣和石油產量將翻倍。 EIA預計,頁岩氣和緻密油產量將從2015年的約14兆立方英尺(Tcf)增加到2040年的29Tcf,從而增加市場需求。

- 然而,環境問題和嚴格的法規預計將阻礙研究市場的成長。

- 北美主導全球市場,其中美國是最大的消費國。

- 轉向使用陶瓷支撐劑預計將為所研究的市場提供機會。

支撐劑市場趨勢

壓裂砂細分市場預計將主導市場

- 助焊劑砂支撐劑是水力壓裂市場上使用最廣泛的類別。助焊劑砂支撐劑是一種高純度、耐用的圓形顆粒石英砂。

- 它主要由砂岩製成。粒度約為0.1毫米至2毫米,取決於破碎作業的要求。

- 由於其高效能、低成本和可用性,助焊劑砂約佔支撐劑用量的 83%。優質助焊劑砂具有優異的特性,例如高純度矽砂和球形形態,有助於以最小的湍流滲透水力壓裂液。它足夠耐用,能夠承受閉合裂縫的擠壓力,從而增加其作為支撐劑的用途,增加市場需求。

- 濕砂的應用最為廣泛,因為它在油氣井中有廣泛的應用,並且與其他支撐劑相比具有成本優勢。

- 加拿大自2008年起開始生產頁岩氣,預計2040年將佔加拿大天然氣總產量的30%。

- 根據BP《2022年世界能源統計回顧》,全球石油產量將增加140萬桶/日,其中四分之三來自OPEC+石油產量。

- 2022年3月,ADNOC簽署了價值6.58億美元的框架協議,以進一步擴大其鑽井業務和原油產能。 ADNOC 於 2022 年 5 月宣布發現三處石油發現。一是阿布達比最大的陸上油田Bu Hasa,原油生產能力為65萬桶/日。

- 此外,ADNOC下游活動的發展是該公司2030年整合策略的核心。 ADNOC 啟動了一項耗資 450 億美元的計劃來升級其下游業務。

- 2022年5月,西澳大利亞海上Crux天然氣天然氣田的開發獲得了殼牌澳洲有限公司及其合資夥伴SGH Energy的最終投資核准。目前運作中的浮體式液化天然氣 (FLNG) 設施 Prelude 將從 Crooks 獲得額外的天然氣供應。計劃預計將於 2022 年開始建設,首批天然氣將於 2027 年交付。

- 同樣,中國是北美以外最早開發頁岩氣資源的國家之一。預計到2040年頁岩氣產量將佔全國天然氣總產量的40%以上。它有可能成為僅次於美國的世界第二大頁岩氣生產國。

- 隨著水力壓裂活動的增加,預計在預測期內對碎砂的需求將會增加。

北美市場佔據主導地位

- 美國是世界上傳統型原油蘊藏量探勘和水力壓裂應用領先的國家之一。

- 與傳統壓裂井生產的原油量相比,水力壓裂井所生產的原油量顯著增加。

- 該國擴大使用水力壓裂技術,特別是頁岩氣和緻密油,對支撐劑的需求產生了積極影響。

- 在美國,約95%的新鑽井採用水力壓裂法,佔天然氣產量的三分之二和原油產量的一半左右。

- 美國是世界領先的石油和天然氣消費國和出口國之一。根據美國能源資訊署(EIA)預測,2022年美國原油產量預計平均為1,190萬桶/日,較2021年增加70萬桶/日。此外,2023年產量將超過1,280萬桶/日,打破先前2019年創下的1,230萬桶/日的年均紀錄。

- 管道公司2021年完成14個油液管計劃。其中包括七個原油管線計劃和七個碳氫化合物/氣液管道計劃。此外,2021年至2025年,美國預計將有169個油氣中游計劃投產,約佔2025年北美計劃開工的所有中游計劃的69%。

- 墨西哥是美國第四大石油生產國,僅次於美國、加拿大和巴西。據Statista稱,2022年3月墨西哥平均原油產量約163萬桶/日。墨西哥國家石油公司Pemex的產能約為每天153萬桶。同時,私人公司本月產量為每天 97,100 桶。近年來,墨西哥私人公司石油產量穩定成長。

- 儘管 COVID-19 對原油價格和貿易產生了重大影響,但預計未來幾年該地區對支撐劑的需求將會成長。這是由於探勘井和成熟井的增加。

- 2022 年 4 月,埃克森美孚透露將投資 100 億美元在圭亞那沿海建設一個全新的海上計劃。這將是該公司在圭亞那的第四個石油生產開發項目,也是其在拉丁美洲最大的石油生產開發項目。圭亞那政府已核准YellowTail計劃,從2025年開始日產25萬桶石油。

- 然而,與水力壓裂過程相關的環境和健康問題以及美國不斷變化的政治局勢可能會限制該國的支撐劑市場。

支撐劑產業概況

支撐劑市場部分分割,沒有參與企業擁有較大的市佔率。研究市場的主要企業包括聖戈班、瀚森、CARBO Ceramics Inc.、COVIA 和 US Silica。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 改良水力壓裂技術

- 頁岩氣生產活動增加

- 抑制因素

- 環境問題和法律法規

- COVID-19 爆發的影響

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 產品類型

- 片狀三明治

- 樹脂塗層

- 陶瓷製品

- 地區

- 亞太地區

- 中國

- 印度

- 印尼

- 馬來西亞

- 泰國

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 俄羅斯

- 挪威

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Badger Mining Corporation

- CARBO Ceramics Inc.

- China Ceramic Proppant(Guizhou)Ltd

- ChangQing Proppant

- CoorsTek Inc.

- Covia Holdings LLC.

- Eagle Materials Inc.

- Emerge Energy Services(Superior Silica Sands)

- Epic Ceramic Proppants Inc.

- Fores LTD

- General Electric(Baker Hughes Company)

- Gongyi Yuanyang Ceramsite Co.,Ltd.

- Halliburton

- Henan Tianxiang New Materials Co., Ltd.

- Hexion

- Nika Petrotech

- Preferred Sands LLC

- Saint-Gobain

- Unimin Energy Solutions(Sibelco)

- US Silica

- Wanli Proppant

第7章 市場機會及未來趨勢

- 轉向使用陶瓷支撐劑

The Proppants Market is expected to register a CAGR of less than 5% during the forecast period.

The major application of proppants is in oil and gas wells. Due to COVID-19 and geopolitics, the demand for crude oil decreased as markets had been over-supplied, thus forcing OPEC+ producers to cut the output. It is expected to affect the demand for various proppants such as frac sand, resin coated, and ceramics.

Key Highlights

- In the medium term, improvements in fracking technology and increasing shale gas production activities are expected to drive the market studied. The Energy Information Administration (EIA) expects shale natural gas and oil production to double by 2040. According to EIA, shale gas and tight oil production will increase from about 14 trillion cubic feet (Tcf) in 2015 to 29 Tcf in 2040, enhancing market demand.

- However, environmental concerns and stringent regulations will likely hinder the studied market's growth.

- North America dominated the market across the world, with the largest consumption from the United States.

- Shifting focus toward using ceramic proppants is expected to provide opportunities for the market studied.

Proppants Market Trends

Frac Sand Segment Expected to Dominate the Market

- Frac sand proppants are the market's most widely used category for hydraulic fracturing. Frac sand proppants are highly pure and durable quartz sand with round grains.

- They are majorly made out of sandstone. Their size ranges from about 0.1 mm to 2 mm in diameter, depending on the requirement of the fracking job.

- Owing to its efficiency, low cost, and availability, frac sand accounts for around 83% of the total proppants usage. Superior characteristics of high-quality frac sand such as high-purity silica sand, a spherical shape that helps in enabling it to be further carried in hydraulic fracturing fluid with minimal turbulence. It possesses the durability to resist crushing forces of closing fractures, enhances its usage as a proppants, and thus increases the market demand.

- Raw frac sand is most widely used due to its broad applicability in oil and natural gas wells and its cost advantage relative to other proppants.

- Canada is producing shale gas since 2008, which is expected to increase and account for 30% of Canada's total natural gas production by 2040.

- According to the BP Statistical Review of World Energy 2022, global oil production hiked by 1.4 million barrels per day, with a three-fourth increase accountable to the OPEC+ oil production volume.

- ADNOC awarded framework agreements worth USD 658 million in March 2022 to expand drilling operations and crude oil production capacity further. ADNOC announced three oil discoveries in May 2022. One was at Bu Hasa, Abu Dhabi's largest onshore field, with a crude oil production capacity of 650,000 barrels per day.

- Further, developing ADNOC's downstream activities is central to the company's 2030 Integrated Strategy. ADNOC launched a USD 45 billion effort to upgrade its downstream operations.

- In May 2022, the development of the Crux natural gas field off the coast of Western Australia was given final investment approval by Shell Australia Pty Ltd (Shell Australia) and its joint venture partner, SGH Energy. The current Prelude floating liquefied natural gas (FLNG) facility will receive additional natural gas supplies from Crux. The project's construction was started in 2022, and the first gas is expected in 2027.

- Similarly, China is among the first countries outside North America to develop shale resources. Shale gas is projected to account for more than 40% of the country's total natural gas production by 2040. It is likely to make the country the second-largest shale gas producer in the world after the United States.

- With increasing hydraulic fracturing activities, the demand for frac sand is projected to increase over the forecast period.

North America Region to Dominate the Market

- The United States is one of the leading countries globally in exploring unconventional crude oil reserves and applying hydraulic fracturing for the same.

- The quantity of oil produced from hydraulically fractured wells is increasing significantly compared to that produced from conventionally fractured wells.

- With growing hydraulic fracturing applications in the country, especially for shale gas and tight oil purposes, the demand for proppants is witnessing a positive impact.

- About 95% of new wells drilled in the United States are hydraulically fractured, accounting for two-thirds of the total marketed natural gas production and about half of the country's crude oil production.

- The United States is one of the world's largest consumers and exporters of oil and gas. According to US Energy Information Administration (EIA), Crude oil production in the United States was expected to average 11.9 million barrels per day (b/d) in 2022, up 0.7 million b/d from 2021. Also, the output will exceed 12.8 million b/d in 2023, breaking the previous annual average record of 12.3 million b/d set in 2019.

- Pipeline companies completed 14 petroleum liquids pipeline projects in the United States in 2021. It includes 7 crude oil pipeline projects and 7 hydrocarbon gas liquids pipeline projects. Further, from 2021 to 2025, the United States is expected to begin operations on 169 midstream oil and gas projects, accounting for approximately 69% of all upcoming midstream project starts in North America by 2025.

- Mexico is America's fourth-largest oil producer after the United States, Canada, and Brazil. According to Statista, Mexico's crude oil production averaged around 1.63 million barrels daily in March 2022. Mexico's state-owned oil corporation, Pemex, produced approximately 1.53 million daily barrels. Meanwhile, private company output totaled 97.1 thousand barrels per day that month. Private companies' oil output in Mexico steadily increased in recent years.

- Although COVID-19 severely impacted the price and trade of crude oil, the region is anticipated to witness growth in demand for proppants in the coming years. It is owing to the increasing number of exploration and maturing wells.

- In April 2022, Exxon revealed it would invest USD 10 billion in a brand-new offshore project off the coast of Guyana. It will be the company's fourth oil production development in the nation and the biggest in Latin America. The Guyanan government approved the YellowTail project, which planned to generate 250,000 barrels of oil daily, production starting in 2025.

- However, the environmental and health concerns associated with the hydraulic fracturing process and the changing political scenario in the United States may serve as a restraint for the proppants market in the country.

Proppants Industry Overview

The proppants market is partially fragmented, with no player with a significant share to influence the market. The studied market's major players include Saint-Gobain, Hexion, CARBO Ceramics Inc., COVIA, and U.S. Silica.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Improvements in Fracking Technology

- 4.1.2 Increasing Shale Gas Production Activities

- 4.2 Restraints

- 4.2.1 Environmental Concerns and Legislation

- 4.2.2 Impact of COVID-19 Outbreak

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Frac Sand

- 5.1.2 Resin Coated

- 5.1.3 Ceramics

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Indonesia

- 5.2.1.4 Malaysia

- 5.2.1.5 Thailand

- 5.2.1.6 Vietnam

- 5.2.1.7 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Russia

- 5.2.3.4 Norway

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Badger Mining Corporation

- 6.4.2 CARBO Ceramics Inc.

- 6.4.3 China Ceramic Proppant (Guizhou) Ltd

- 6.4.4 ChangQing Proppant

- 6.4.5 CoorsTek Inc.

- 6.4.6 Covia Holdings LLC.

- 6.4.7 Eagle Materials Inc.

- 6.4.8 Emerge Energy Services (Superior Silica Sands)

- 6.4.9 Epic Ceramic Proppants Inc.

- 6.4.10 Fores LTD

- 6.4.11 General Electric (Baker Hughes Company)

- 6.4.12 Gongyi Yuanyang Ceramsite Co.,Ltd.

- 6.4.13 Halliburton

- 6.4.14 Henan Tianxiang New Materials Co., Ltd.

- 6.4.15 Hexion

- 6.4.16 Nika Petrotech

- 6.4.17 Preferred Sands LLC

- 6.4.18 Saint-Gobain

- 6.4.19 Unimin Energy Solutions (Sibelco)

- 6.4.20 U.S. Silica

- 6.4.21 Wanli Proppant

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus toward the Usage of Ceramic Proppants