|

市場調查報告書

商品編碼

1628793

北美 SSD(固態硬碟)快取:市場佔有率分析、產業趨勢、成長預測(2025-2030 年)NA SSD Caching - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

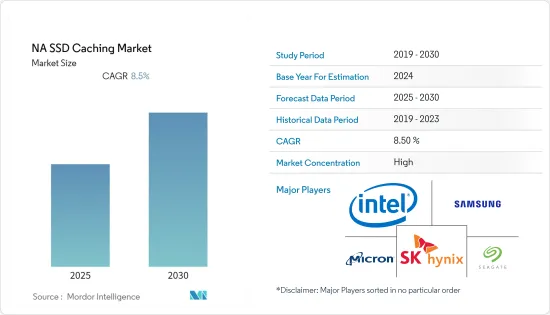

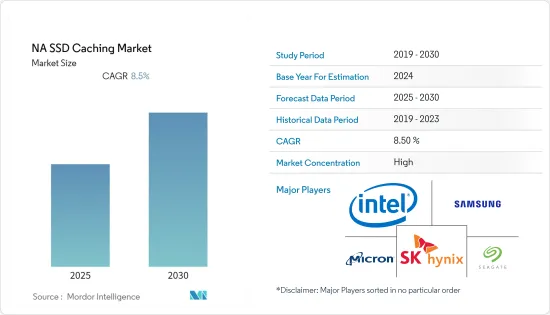

北美 SSD 快取市場預計在預測期內複合年成長率為 8.5%

主要亮點

- SSD 快取是英特爾首個智慧回應技術,旨在提高使用傳統硬碟的電腦的效能。由於 SSD 速度更快,因此該技術可降低成本並縮短應用程式執行時間。 IT 專業人員現在已經意識到這些好處,他們正在探索利用 SSD 快取技術的不同方法。

- SSD 快取需要 SSD 硬碟和支援軟體的組合才能執行所需的功能。由於SSD硬碟價格昂貴,因此它們與傳統硬碟結合使用以獲得更好的效能效率。市場仍在成長,企業正在實施這些解決方案以降低成本並提高效率。這些公司需要分析來自各種資料來源的龐大資料。 SSD 解決方案讓您的生活更輕鬆,而無需大量投資於高功率驅動器和解決方案。

- 北美是筆記型電腦、平板電腦和Ultrabooks的龐大市場。隨著平板電腦的推出,筆記型電腦市場也在改變。對加速資料傳輸和節省消費者時間的重視已經改變了蘋果、惠普、戴爾和聯想等開發人員的運算動態。大力提倡使用SSD以節省時間。

- 該地區在智慧零售市場佔有很大佔有率,產生大量資料,增加了對儲存解決方案的需求。根據美國商務部和人口普查局的數據,2021年第三季美國電商零售額預計為2,146億美元。Ultrabooks電腦市場也出現了新舉措來應對平板電腦現象,三星、宏碁和戴爾等大公司都宣布了自己的產品線。所有這些新技術都可能有助於SSD市場,因為它們將繼續在市場上使用。

- COVID-19的疫情將對市場產生重大影響。原物料供應將受到影響,擾亂價值鏈並造成產品通膨風險。儘管 COVID-19 病例有所下降,但隨著中國和韓國的電子產品供應鏈開始復甦,供應鏈缺口預計將縮小。冠狀病毒的爆發影響了在武漢設有工廠、第三方組裝和原料的SSD供應商。由於工人返工被推遲,在病毒限制下,各行業產能運轉率。

北美SSD快取市場趨勢

企業級儲存預計將佔據較大佔有率

- 伺服器通常由一組硬碟 (HDD) 組成,或連接到儲存區域網路 (SAN),而儲存區域網路 (SAN) 本身就是一大組硬碟。在商業儲存網路中,伺服器技術的改進造成了 I/O 效能的差距。基於 SSD 的快取用於透過降低 I/O 延遲和提高 IOPS 效能來彌補 I/O 效能差距。基於伺服器的快取無需升級儲存陣列或在關鍵網路資料路徑中安裝其他設備。伺服器 SSD 快取透過處理網路邊緣關鍵伺服器的大部分 I/O 需求,有效降低儲存網路和陣列要求。這種需求的減少可以提高其他相關伺服器的儲存效能並延長儲存基礎架構的使用壽命。

- SSD 快取在企業環境中用於儲存先前要求的資料(當資料穿過網路時),以便在需要時快速檢索。將先前要求的材料放入臨時儲存中可以減少對公司頻寬的需求,並加快對最新資訊的存取。企業級SSD要麼將資料永久儲存在非揮發性半導體記憶體中,要麼暫時快取資料。這些 SSD 使用NAND快閃記憶體,與旋轉 HDD 相比,可提供更好的效能和更低的功耗。隨著各行業對運算速度的需求不斷提高,SSD快取變得越來越重要。於是,不少企業紛紛進入SSD快取市場。因此,SSD快取的成本有所下降。

- 如今,各種企業中的資料中心應用程式處理不斷成長的資料集。頁快取的快取有效性因其容量小而受到限制。與硬碟和 DRAM 相比,新興的基於快閃記憶體的 SSD 具有更低的延遲和更低的成本。因此,基於SSD的快取在資料中心中普遍使用。根據世界雲端指數,資料中心流量增加了資料儲存需求。由於SSD的高效能,高流量資料中心對SSD快取的需求將會很高。透過 SSD 快取,資料中心和雲端處理環境可以透過加速每秒輸入/輸出操作 (IOP) 並減少延遲來容納更多用戶並每秒處理更多交易。

- 北美和亞太地區的許多公司開始提供可用作快取設備的 SSD。例如,三星的商用 SSD 為幾乎所有應用程式提供了廣泛的企業資料儲存和快取選擇。透過利用OEM在資料中心 SSD 方面深厚的專業知識,三星能夠提供低延遲、高速且高度可靠的資料儲存解決方案,從而提高伺服器效能和效率。

- 隨著雲端、物聯網、巨量資料、人工智慧和邊緣運算等新興技術變得更加普遍,北美可能成為關鍵市場。隨著這些技術的日益普及,對儲存的需求不斷成長,該地區的市場正在不斷成長。由於擁有成熟的基礎設施,可以快速應用先進技術,該地區已成為一個重要的市場。為了獲得競爭優勢並提高企業生產力,該地區的企業正在增加IT基礎設施的支出。因此, IT基礎設施設備中需要SSD快取來節省時間、加速資料傳輸並實現高效能。該地區正在迅速用 SSD 取代傳統硬碟。

雲端儲存引領市場

- 雲端平台正在支援新的、複雜的經營模式,近年來組織了更多基於全球的整合網路。在雲端上部署儲存解決方案可以提高便利性並降低整體擁有成本,因為服務供應商負責提供最長的執行時間、資料安全性和定期更新。

- 透過讓資料更接近客戶來減少延遲的需求,以及要求資料在不同區域中本地儲存的政府和企業法規,預計將推動美國雲端儲存的成長。該地區擁有複雜雲端基礎架構的企業需要能夠快速儲存、搜尋、處理和分析大量業務關鍵資料的系統。由於這種需求,美國許多公司正在從基於 SATA 的 SSD 轉向基於 NVMe 的 SSD 作為主儲存。最新的 NVMe SSD 具有快取功能。資料中心產業正在迅速擴張,並且越來越注重效率和最大運作。例如,IBM公司在日本開設了四個新的雲端資料中心,以滿足該國對認知能力不斷成長的需求。

- 此外,雲端還充當 IT 轉型的催化劑,讓您可以靈活地將您的首選雲端與現有的本地基礎設施按照最適合您工作負載的比例進行混合和匹配。

- 此外,對成本最佳化和業務敏捷性的日益關注導致了雲端資料中心的擴張。雲端服務還可以輕鬆適應不斷變化的條件,以滿足新的要求。這使得客戶公司能夠專注於他們的核心競爭力,進而帶來整體成長。

- 非結構化資料每年成長超過 50%,託管服務供應商正在轉向雲端儲存作為領先商機。隨著儲存管理需求的不斷成長,這一點得到了進一步增強。隨著先進技術的出現,公司開始專注於更新其儲存系統以跟上競爭。混合雲端就是這樣的趨勢之一,並且正在顯著推動市場成長。然而,安全和資料傳輸網路頻寬的缺乏給市場成長帶來了挑戰。

北美SSD快取產業概況

北美SSD快取市場主要集中在擁有最尖端科技和經驗的科技巨頭手中。為了保持競爭力,公司定期推出具有創新和進步的新產品。行業主要企業利用收購、合作、投資、合併、技術進步和引進來保持競爭力。

- 2020 年 5 月 - 三星開發出一款新型 SSD,支援最新的 PCIe Gen.4 標準和 E1.S外形規格。該公司的新款 PM9A3 SSD 採用三星第六代 3 位元 V-NAND 技術,具有三種外形規格: E1.S、M.2 和美國 U.2。 E1.S 和 U.2 版本的 SSD 的連續式讀取和寫入速度分別高達 6,500 MB/s 和 3,500 MB/s。

- 2020 年 5 月—英特爾公司透露,將於今年稍後推出 144 層 3D NAND QLC SSD。據英特爾稱,Alder Stream Optane SSD 將於今年稍後推出單埠配置,並於 2021 年推出雙埠配置。 Alder Stream 使用第二代 3D XPoint 介質,與第一代的兩層相比,有四層。它還具有採用最新軟體和 PCIe 4 鏈路技術的新型控制器 ASIC。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

第5章市場動態

- 市場動態介紹

- 市場促進因素

- SSD 相對於傳統 HDD 的改進

- 市場挑戰

- SSD高產品成本與低時延的矛盾

第6章 市場細分

- 按用途

- 企業儲存

- 個人儲存

第7章 競爭狀況

- 公司簡介

- Intel Corporation

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- Western Digital Corporation

- QNAP Systems Inc.

- NetApp Inc.

- Kioxia(Toshiba Memory Corporation)

- SK Hynix Inc.

- ADATA Technology Co. Ltd

- Seagate Technology LLC

- Transcend Information Inc.

- Inspur Group

- Microsemi(Microchip Technology Inc.)

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 54395

The NA SSD Caching Market is expected to register a CAGR of 8.5% during the forecast period.

Key Highlights

- SSD Caching, first introduced by Intel as Smart Response Technology provides improved performance for computers that use traditional hard drives. The technology reduces cost and reduces time to run an application as SSDs are faster. These benefits are now being realized by IT professionals and they are looking for various ways to take advantage of SSD Caching techniques.

- SSD Caching requires a combination of SSD drive and supporting software to perform the required functioning. SSD drives are costly, hence a combination of it is used with traditional hard drives to enhance performance efficiency. The market is still growing, with enterprises deploying these solutions to cut down costs and improve efficiency. These enterprises are required to analyze huge data sets coming through various data sources. Using SSD solution makes the task easier without investing too much in high powered drives and solutions.

- North America is a big market for notebooks, tablets, and ultrabooks. With the launch of tablets, the laptop market has also changed. With more emphasis on saving time of the consumers to speed up transfer of data, the dynamics of computing has changed for the developers like Apple, HP, Dell, Lenovo etc. There has been a strong push for using SSD to save time.

- The region holds a significant smart retail market share, which generates a huge amount of data, in turn creating the demand for storage solutions. According to the Census Bureau of the Department of Commerce, retail e-commerce sales in the United States were estimated to be USD 214.6 billion in the third quarter of 2021. The new push in laptop market for Ultrabooks to counter the tablet phenomenon is also growing with big companies like Samsung, Acer, Dell etc. releasing their own line of products. All these new technologies will help the SSD market because of their continued use in this.

- The outbreak of COVID-19 has a significant effect on the market. The raw materials supply is affected, hence the value chain is disrupted, causing an inflationary risk on products. The supply chain gap is projected to narrow as the electronics supply chains in China and South Korea begin to recover, notwithstanding a drop in COVID-19 cases. The coronavirus outbreak had an impact on SSD suppliers with factories, third-party assemblers, or source materials in Wuhan. Due to the tardy return of labourers amidst the virus-based limitations, the industries were running at low utilisation.

North America SSD Caching Market Trends

Enterprise Storage Expected to Hold Major Share

- Servers are typically configured with banks of hard disc drives (HDD) or connected to storage area networks (SANs), which are large banks of hard drives themselves. In the business storage network, improvements in server technology caused an I/O performance gap. SSD-based caching is used to close the I/O performance gap by lowering I/O latency and enhancing IOPS performance. Server-based caching does not necessitate storage array upgrades or the installation of any other appliances in the data path of important networks. SSD caching in servers effectively reduces the requirement for storage networks and arrays by servicing large percentages of the I/O demand of important servers at the network edge. This decrease in demand improves storage performance for other associated servers, potentially extending the storage infrastructure's useful life.

- SSD caching is used in a corporate environment to store previously requested data as it passes through the network, allowing it to be retrieved fast when needed. Placing previously requested material in temporary storage lessens the demand on an enterprise's bandwidth and speeds up access to the most up-to-date information. Enterprise SSDs either store data permanently or momentarily cache data in nonvolatile semiconductor memory. NAND flash memory is used in these SSDs, which provide better performance and use less power than spinning HDDs. SSD caching is becoming more important as the demand for computing speed rises across a variety of industries. As a result, a number of companies have entered the SSD cache market. This resulted in a decrease in the cost of SSD caches.

- Currently, data-center applications in a variety of businesses are processing an expanding volume of data sets. The page cache's caching impact is hampered by its low capacity. In comparison to hard discs and DRAM, emerging flash-based SSDs provide lower latency and lower costs. As a result, SSD-based caching is commonly used in data centers. According to the worldwide cloud index, data center traffic has seen an increase in data storage requirements. Because of its high-performance features, the high-traffic data center will increase demand for SSD caching. SSD caching allows data centers and cloud computing environments to host more users and complete more transactions per second by accelerating input/output operations per second (IOPs) and reducing latency.

- Many businesses in North America and Asia-Pacific have begun to provide SSDs that can be utilized as caching devices. Samsung commercial SSDs, for example, offers a wide range of enterprise data storage and caching choices for almost any application. Samsung can provide low-latency, high-speed, and dependable data storage solutions to boost server performance and efficiency by leveraging its deep OEM expertise in data center SSDs.

- North America is likely to be a major market as modern technologies such as cloud, IoT, Big Data, AI, and edge computing gain traction. The market in the region is rising due to the increasing need for storage as a result of the widespread usage of such technologies. This region became an important market due to the presence of a well-established infrastructure that allows for the faster application of sophisticated technology. To obtain a competitive advantage and increase corporate productivity, businesses in the region are boosting their IT infrastructure spending. As a result, SSD caching in IT infrastructure devices has become necessary to save time, speed up data transfer, and achieve high performance. In the region, traditional hard disc drives are being replaced at a rapid rate by SSDs.

Cloud Storage to Drive the market

- Cloud platforms enabled new, complex business models and have been orchestrating more global-based integration networks in recent years. The deployment of storage solutions over the cloud offers greater convenience, as the service vendor is solely responsible for providing maximum uptime, data security, and periodic updates, thus, decreasing the total cost of ownership.

- The need to reduce latency by moving data closer to the customer, as well as governmental and business regulations for data to be kept locally within different areas, are projected to drive growth in cloud storage in the United States. Enterprises in the region that are installing complex cloud infrastructures want systems that can store, retrieve, process, and analyze large amounts of business-critical data fast. As a result of this demand, many firms in the United States are switching from SATA-based SSDs to NVMe-based SSDs for primary storage. The latest NVMe SSDs include caching capabilities. The data center sector is rapidly expanding, with a greater emphasis on efficiency and maximum uptime. For example, IBM Corporation built four new cloud data centers in the country in response to increased demand for cognitive capabilities in the country.

- In addition, the cloud acts as a catalyst for IT transformation, providing the flexibility to combine the preferred clouds and existing on-premises infrastructure in the ratio best suited for the workload.

- Furthermore, the rising focus on cost optimization and business agility has led to the expansion of cloud data centers. Also, cloud services adapt easily to the changing landscape to meet new requirements. This allows the client organization to focus on their core competency, which, in turn, results in their overall growth.

- With the unstructured data expanding by more than 50% annually, managed service providers are looking at cloud storage as an upfront revenue opportunity. This was further augmented by the greater need for storage control. The foray of advanced technologies prompts companies to emphasize updating their storage system to match with the competition. Hybrid cloud is one such trend that provides a significant boost to market growth. However, security and the lack of network bandwidth for data transfer can challenge the growth of the market.

North America SSD Caching Industry Overview

The SSD Caching Market in North America is largely concentrated, with technology behemoths exerting supremacy thanks to cutting-edge technology and experience. To be competitive, businesses introduce new items with innovations and advancements on a regular basis. Acquisitions, partnerships, investments, mergers, and technological advances, and introductions are all used by major industry actors to stay competitive.

- May 2020 - Samsung developed a new SSD with support for the latest PCIe Gen. 4 standard and an E1.S form factor. The company's new PM9A3 SSD uses Samsung's sixth-generation 3-bit V-NAND technology and will be available in three form factors: E1.S, M.2, and U.2. The E1.S and U.2 versions of the SSD can reach peak sequential read and write speeds of up to 6,500 MB/s and 3,500 MB/s, respectively.

- May 2020 - The Intel Corporation has revealed that a 144-layer 3D NAND QLC SSD will be available later this year. The Alder Stream Optane SSD will be available in a single port configuration this year and a dual-port configuration in 2021, according to Intel. Alder Stream employs second-generation 3D XPoint media, which has four layers as opposed to two in the first version. It features a new controller ASIC with the most up-to-date software and PCIe 4 link technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Introduction to Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Improvements Offered by SSDs Over Conventional HDDs

- 5.3 Market Challenges

- 5.3.1 High Cost of Products and Inconsistency regarding Low-rate Latency by SSDs

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Enterprise Storage

- 6.1.2 Personal Storage

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Samsung Electronics Co. Ltd

- 7.1.3 Micron Technology Inc.

- 7.1.4 Western Digital Corporation

- 7.1.5 QNAP Systems Inc.

- 7.1.6 NetApp Inc.

- 7.1.7 Kioxia (Toshiba Memory Corporation)

- 7.1.8 SK Hynix Inc.

- 7.1.9 ADATA Technology Co. Ltd

- 7.1.10 Seagate Technology LLC

- 7.1.11 Transcend Information Inc.

- 7.1.12 Inspur Group

- 7.1.13 Microsemi (Microchip Technology Inc.)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219