|

市場調查報告書

商品編碼

1628800

歐洲機器視覺系統:市場佔有率分析、產業趨勢與成長預測(2025-2030)Europe Machine Vision Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

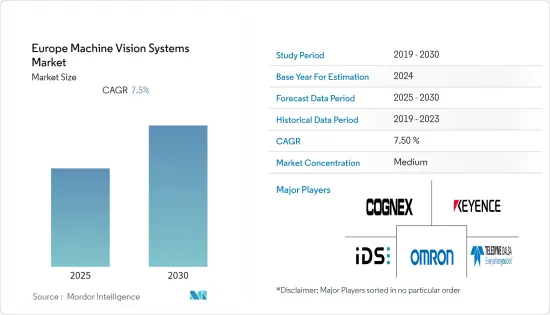

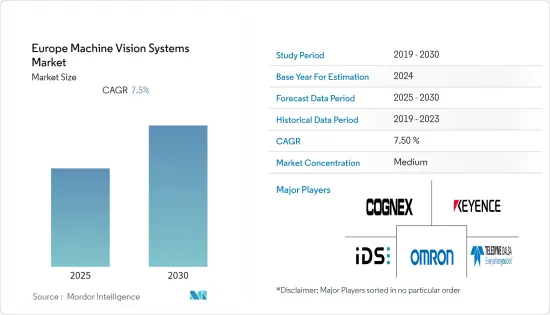

歐洲機器視覺系統市場預計在預測期內複合年成長率為 7.5%

主要亮點

- 供應商在塑造市場格局方面也發揮著重要作用。供應商開發的核心技術包括影像感測器和影像處理演算法、從相機到感測器的視覺產品,以及適用於所有應用和產業的軟體和系統。此外,國內歐洲工廠機器視覺設備的使用也較穩定。

- 隨著對加工產品的需求不斷成長,歐洲預計將成為最有利可圖的市場之一,特別是在英國、德國和法國。此外,監管機構提案的與加工產品品質和衛生相關的更嚴格法規預計將支持歐洲食品產業對視覺系統的需求。

- 此外,過去十年來,機器視覺在食品產業的持續、系統化應用主要歸功於影像處理和模式識別等配置技術的不斷進步。此外,技術的進步使得以低成本引進這些機器成為可能。

- 工業4.0也刺激了機器人等在工業自動化中發揮關鍵作用的技術的發展,工業中的許多核心任務現在都由機器人來管理。 3D機器視覺也支援視覺引導機器人和自動屠宰等新應用。這些視覺引導機器人是 2D 和 3D 相機的組合。

歐洲機器視覺系統市場趨勢

汽車工業顯著成長

- 機器視覺系統解決方案的主要目的是透過將自動化融入各個製造業來恢復人力和技術。該地區的各個市場供應商都發現機器視覺系統在汽車行業中非常有用,可以檢查人眼無法識別的複雜缺陷模式。

- 該地區的供應商包括 Samsara Inc.,這是一家檢測自動化機器視覺解決方案提供商,該公司已在倫敦肖爾迪奇開設了新總部。該公司的產品工程團隊將專注於專門針對歐洲建立新功能。

- 義大利勞動密集服裝產業正在實施智慧工廠解決方案,以降低人事費用並提高利潤率。該國尚未擺脫全球衰退,經濟在過去十年中停滯不前。隨著義大利汽車產業的逐步復甦和紡織製造業的成長,該國的機器視覺市場預計將溫和成長。

- 對自動化、機器人和工業 4.0 技術的投資增加、對安全和檢查視覺系統的需求不斷增加以及產品創新率高是推動歐洲機器視覺系統市場成長的關鍵因素。機器視覺應用(例如用於惡劣環境中即時檢查和分級操作的存在檢測)正在成為整個汽車行業的常態。

英國預計將出現顯著成長

- 機器視覺系統已成為工業自動化的重要組成部分,以提高準確性和品質保證。由於高品質的產品檢測至關重要,機器視覺系統和服務的需求量很大。

- 此外,製造業對高產量比率的需求不斷成長預計將繼續成為機器視覺技術需求強勁的關鍵驅動力。此外,工業應用需要高生產率,並有望提高國內生產裝置的性能。

- 各種創新也推動了英國市場的成長。例如,2020 年 9 月,英國工業視覺系統 (IVS) 推出了 IVS-COMMAND-Ai,這是一種用於高速自動化視覺檢測的線上檢測解決方案。 IVS-COMMAND-Ai 視覺感測器直接與所有工廠資訊和控制系統通訊,實現完整的零件檢查、引導、追蹤、可追溯性、內建影像和資料儲存。

- 工業和製造業是智慧相機的關鍵驅動力,無人機等技術的日益普及預計將進一步擴大其範圍。 2021 年,由芬蘭 VTT 集團主導的歐洲研究計劃正在開發機器視覺系統,以支援自主無人機和機器人。

歐洲機器視覺系統產業概況

歐洲機器視覺系統市場競爭適中。產品發布、研發、合作和收購是該地區公司為保持競爭力而採取的關鍵成長策略。

- 2021 年 8 月 - Keyence Corporation 推出 XG-X 系列可自訂視覺系統,該系統具有先進的編程介面,具有 3D 和線掃描功能,可實現高品質、高速檢測和控制。 XG-X系列透過高速、高解析度相機實現高精度偵測,為各種製造問題提供穩健的解決方案。

- 2021 年 1 月 - 康耐視公司宣布推出 In-Sight 3D-L4000 嵌入式影像處理系統。這款智慧相機配備3D雷射位移技術,使工程師能夠快速、有效且經濟高效地解決自動化生產線中的各種檢查和測試。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 對品質檢測和自動化的需求不斷增加

- 對準確缺陷檢測的需求不斷成長

- 市場挑戰

- 實施 MV 系統的複雜性

第6章 市場細分

- 按成分

- 硬體

- 視覺系統

- 相機

- 光學/照明系統

- 影像擷取卡

- 其他硬體

- 軟體

- 硬體

- 依產品

- 基於PC

- 智慧型相機底座

- 按最終用戶產業

- 飲食

- 醫療保健/製藥

- 物流/零售

- 車

- 電子/半導體

- 其他最終用戶產業

- 按國家/地區

- 英國

- 德國

- 義大利

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Cognex Corporation

- Keyence Corporation

- Omron Corporation

- Basler AG

- National Instruments Corporation

- Teledyne DALSA

- Datalogic SpA

- Perceptron Inc

- Uss Vision Inc

- IDS Imaging Development Systems GmbH

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 54522

The Europe Machine Vision Systems Market is expected to register a CAGR of 7.5% during the forecast period.

Key Highlights

- The vendors also play a significant role in shaping the market scenario. Players are involved in developing core technology, such as image sensors and image-processing algorithms, vision products from cameras to sensors, from software to systems, for all kinds of applications and industries. Moreover, the domestic use of machine vision equipment in factories in Europe is also relatively stable.

- Europe is expected to be one of the most lucrative markets due to the growing demand for processed products, especially in the United Kingdom, Germany, and France. Moreover, stringent regulations proposed by the regulating bodies pertaining to the quality and hygiene of the processed items are expected to support the demand for vision systems in the European food industry.

- Furthermore, over the last decade, the consistent and systematic application of machine vision in the food industry is mainly attributed to ongoing advancements in constituent methodologies such as image processing and pattern recognition. Also, technological advancements have made it possible to implement these machines at a lower cost.

- Also, Industry 4.0 fueled the development of technologies like robots playing a crucial role in industrial automation, with many core operations in industries being managed by robots. Also, 3D machine vision supports new applications, such as vision-guided robotics and automated butchering. These vision-guided robots are a combination of 2D and 3D cameras.

Europe Machine Vision Systems Market Trends

Automotive Industry to Witness Significant Growth

- The primary goal of machine vision system solutions was to restore human efforts and skills by incorporating automation into various manufacturing industries. Various market vendors in the region are witnessing machine vision systems that are useful in the automotive industry for examining flaws in patterns that are complex for the human eye to recognize.

- Vendors in the region, such as Samsara Inc, a provider of machine vision solutions designed to automate inspections, opened its new headquarters in London, Shoreditch. Its Product and Engineering team will be dedicated to building new features specific to Europe.

- The Italian garment industry, which is labor-intensive, is adopting smart factory solutions to reduce labor costs and increase its profit margin. The country is still emerging from the global recession, and its economy has been stagnant over the last decade. The gradual recovery of the automotive sector in Italy and the growth of textile manufacturing will lead to the moderate growth of the country's machine vision market.

- The growing investment in automation, robotics, and Industry 4.0 technologies, increasing need for safety and inspection vision systems, and high rate of product innovation are significant factors driving the growth of the European machine vision systems market. Machine vision applications like presence detection to real-time inspection and grading tasks in harsh environments are becoming standard across the automotive industry

United Kingdom Expected to Witness Significant Growth

- Machine vision systems have become an indispensable element of industrial automation to gain greater precision and quality assurance in the country. The vital requirement for high-quality product inspection is witnessing the demand for machine vision systems and services.

- Further, strengthening the requirement for high production yield in the manufacturing industry is anticipated to remain a significant driver for enhanced demand in machine vision technology. Also, Industrial applications demand higher productivity expected to boost the performance of production units in the country.

- Also, various innovations are driving the market growth in the united kingdom. For instance, in September 2020, Industrial Vision Systems (IVS), based in the United Kingdom, introduced the IVS-COMMAND-Ai in-line inspection solution for high-speed automated visual inspection. The IVS-COMMAND-Ai Vision Sensors communicate directly with all factory information and control systems, enabling complete part inspection, guidance, tracking, traceability, built-in image, and data saving.

- Industrial and manufacturing will be significant growth drivers for smart cameras, and rising adoptions of technologies like drones are further expected to expand the scope. In 2021, a European research project led by Finnish group VTT is developing machine vision systems to support autonomous drones and robots.

Europe Machine Vision Systems Industry Overview

The Europe Machine Vision Systems Market is moderately competitive in nature. Product launches, high expense on research and development, partnerships, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition.

- August 2021 - Keyence Corporation introduced a customizable vision system XG-X series Advanced programming interface with 3D and linescan capabilities for high-quality, high-speed inspection and control. The XG-X Series provides high-speed, high-resolution cameras for high-accuracy inspection, providing robust solutions to a wide range of manufacturing problems.

- January 2021 - Cognex Corporation announced In-Sight 3D-L4000 embedded vision system. The smart camera, which features 3D laser displacement technology, enables engineers to quickly, effectively, and cost-effectively solve a variety of inspections and testing on automated production lines.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Quality Inspection and Automation

- 5.1.2 Rising Demand for Accurate Defect Detection

- 5.2 Market Challenges

- 5.2.1 Complications in the Implementation of Mv Systems

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 Vision Systems

- 6.1.1.2 Cameras

- 6.1.1.3 Optics and Illumination Systems

- 6.1.1.4 Frame Grabber

- 6.1.1.5 Other Types of Hardware

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Product

- 6.2.1 PC-based

- 6.2.2 Smart Camera-based

- 6.3 By End-User Industry

- 6.3.1 Food and Beverage

- 6.3.2 Healthcare and Pharmaceutical

- 6.3.3 Logistic and Retail

- 6.3.4 Automotive

- 6.3.5 Electronics and Semiconductors

- 6.3.6 Other End-user Industries

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 Italy

- 6.4.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cognex Corporation

- 7.1.2 Keyence Corporation

- 7.1.3 Omron Corporation

- 7.1.4 Basler AG

- 7.1.5 National Instruments Corporation

- 7.1.6 Teledyne DALSA

- 7.1.7 Datalogic SpA

- 7.1.8 Perceptron Inc

- 7.1.9 Uss Vision Inc

- 7.1.10 IDS Imaging Development Systems GmbH

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219