|

市場調查報告書

商品編碼

1628816

先進碳材料:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Advanced Carbon Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

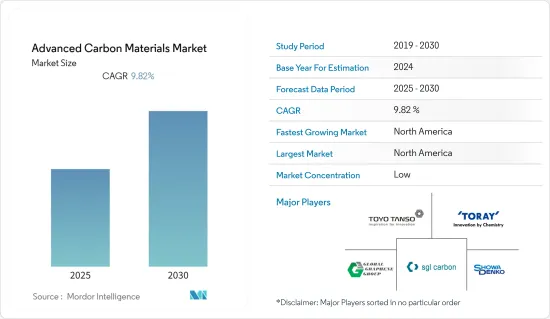

先進碳材料市場預計在預測期內複合年成長率為9.82%。

COVID-19 大流行對市場產生了負面影響。這是因為製造設施和工廠因封鎖和限制而關閉。供應鏈和運輸中斷進一步阻礙了市場。然而,2021年產業復甦,市場需求恢復。

主要亮點

- 短期來看,建築業對碳纖維增強塑膠的需求不斷增加,以及汽車和航空業對輕質複合材料的日益關注,是推動研究市場成長的因素之一。

- 另一方面,碳纖維複合材料的高成本和成品生產的浪費可能會阻礙市場成長。

- 然而,利用廢棄物生產先進碳材料預計將在預測期內提供許多機會。

- 北美在消費量最高的市場中佔據主導地位,緊隨其後的是亞太地區。

先進碳材料市場趨勢

航太和國防主導市場

- 基於最終用戶產業,航太和國防佔據市場最大佔有率之一。近年來,該領域增加了許多新產品。先進碳材料是許多航太和國防應用的絕佳選擇,因為它們提供您所需的強度、耐用性和穩定性。

- 由於其輕質且高剛性的設計結構,飛機中的傳統金屬結構擴大被碳纖維(例如碳纖維增強塑膠(CFRP))所取代。從飛機和噴射機的內部到直升機的葉輪,複合材料正成為航太產業的重要組成部分。

- 在亞太地區,隨著許多國家增加國防平台和技術支出,航太業正在蓬勃發展。

- 印度的民用和軍用航空業已成為近年來該國成長最快的產業之一。印度政府稱,2021年民航業為印度GDP貢獻了300億美元。預計到2024年,這一成長將使國內航空市場躍居全球第三。與全球平均水平相比,空中交通量正在迅速成長。機隊數量可能從 600 架(截至 2022 年 10 月)增加到 2024 年的 1,200 架。因此,航班數量的增加預計將導致先進碳材料市場的需求增加。

- 此外,2022 年 4 月,HAL 和以色列航太工業公司 (IAI) 簽署了一份關於在印度將商用(客用)飛機改裝為多任務加油機運輸(MMTT)飛機的合作備忘錄。

- 隨著新冠肺炎 (COVID-19) 疫情後電子商務業務的蓬勃發展,航空貨運市場不斷擴大,2022 年貨機訂單將不斷增加。例如,2022 年 10 月,盧森堡的 Cargolux Airlines 向波音公司訂購了 10 架 777-8 貨機,並可選擇另外購買 6 架。

- 中國佔據僅次於美國的第二大航空貨運市場的地位。根據波音《2022年商用市場展望》,到2041年,中國民航機預計將從3,900架成長到9,600架。

- 2022 年 2 月,波音公司獲得美國國防部一份價值 1.037 億美元的契約,根據對外軍售(FMS)計劃向泰國交付8 架 AH-6 輕型攻擊偵察直升機。該直升機計劃取代泰國皇家陸軍使用的老化 AH-1F 眼鏡蛇直升機,預計交付時間到 2024 年。

- 此外,聯合航空還宣布啟動新航線服務,這是其「最大的跨大西洋航線擴張」。隨著一切恢復正常,新的航空公司也開始營運。 2022年8月,印度新航空公司阿卡薩航空開始營運,一開始每週有28個航線,並逐漸增加兩條航線。 2022 年 10 月,阿拉斯加航空計劃訂購 52 架波音 737 MAX 飛機,擴大機隊規模。該航空公司宣布計劃在 2023年終前擁有一支全波音幹線機隊。

- 所有上述因素預計將在預測期內推動先進碳材料市場的成長。

北美市場佔據主導地位

- 由於美國、加拿大和墨西哥等國家的存在,預計北美地區將在預測期內主導市場。

- 美國是世界上最大的經濟體。航太和國防等各領域對碳纖維、奈米碳管、石墨烯、特殊石墨、碳發泡體、奈米晶鑽石(NCD)、類金剛石碳(DLC)和富勒烯等各種尖端材料的需求不斷增加,由於最終用戶行業的需求不斷成長,預計在預測期內,對先進碳材料的需求將高速成長。

- 例如,根據OICA的數據,2022年美國汽車產量為1,006萬輛,較2021年成長10%,較2020年成長14%。因此,汽車產量的增加預計將導致對先進碳材料的需求增加。

- 此外,根據北約國家的國防支出,2022年美國的國防支出支出估計為8,220億美元。這使得美國的國防預算成為北約成員國中最大的。因此,美國國防開支的增加預計將導致北美地區對先進碳材料的需求增加。

- 由於上述因素,北美地區的先進碳材料市場預計在預測期內將顯著成長。

先進碳材料產業概況

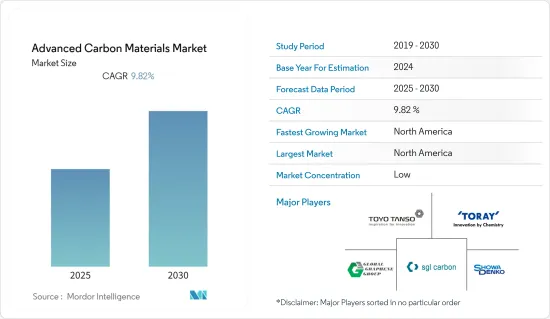

先進碳材料市場因其性質而部分分割。市場的主要企業包括(排名不分先後)東麗工業株式會社、東洋炭素、Global Graphene Group、SGL Carbon 和 SHOWA DENKO KK。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建築業對碳纖維增強塑膠的需求增加

- 奈米碳管技術進展

- 其他司機

- 抑制因素

- 碳纖維複合材料高成本

- 成品生產中的廢棄物

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 產品類型

- 碳纖維

- 特殊石墨

- 奈米碳管

- 石墨烯

- 碳泡沫(包括碳奈米泡沫)

- 其他(富勒烯、類金剛石碳(DLC)、奈米晶鑽石(NCD))

- 目的

- 航太/國防

- 電子產品

- 運動的

- 車

- 建造

- 能源

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Arkema

- Arry International Group Limited

- CFOAM LLC

- FutureCarbon GmbH

- Formosa Plastics Corporation

- Global Graphene Group

- GrafTech International

- Graphenea, Inc.

- Graphite India Limited

- Antolin

- Grupo Graphenano

- Haydale Graphene Industries plc

- Hexcel Corporation

- Hyperion Catalysis International

- Jiangsu Cnano Technology Co., Ltd.

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Ningbo Morsh Technology

- Nano-C

- Nanocyl SA

- Nippon Graphite Fiber Co., Ltd

- Perpetuus Advanced Materials PLC

- POCO

- SGL Carbon

- Shenzhen Sanshun Nano New Materials Co. Ltd

- SHOWA DENKO KK

- Solvay

- TEIJIN LIMITED

- The Sixth Element(Changzhou)Materials Technology Co.,Ltd

- Thomas Swan & Co. Ltd.

- Tokai Carbon Co., Ltd.

- TORAY INDUSTRIES, INC.

- Toyo Tanso Co.,Ltd.

- XG Sciences, Inc.

第7章 市場機會及未來趨勢

- 利用廢棄物生產先進碳材料

- 能源領域的潛在應用

The Advanced Carbon Materials Market is expected to register a CAGR of 9.82% during the forecast period.

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing demand for carbon fiber-reinforced plastic in the construction industry and increasing focus on lightweight composites in the automotive and aviation industries are some of the factors driving the growth of the market studied.

- On the flip side, the high cost of carbon fiber composites and wastage in the production of finished products is likely to hinder the growth of the market studied.

- However, the production of advanced carbon materials from bio-waste is anticipated to provide numerous opportunities over the forecast period.

- North America dominated the market with the largest consumption, followed closely by Asia-Pacific.

Advanced Carbon Materials Market Trends

Aerospace and Defense to Dominate the Market

- Aerospace and defense accounts for one of the largest shares in the market, based on the end-user industry. Over the past few years, there have been a number of new products added to this field. Advanced carbon materials are perfect choices for numerous aerospace and defense applications, as they provide strength, endurance, and stability, as required.

- Conventional metal structures are increasingly being replaced by carbon fibers, such as carbon fiber-reinforced plastics (CFRP) in aircraft, owing to their light yet stiff design structures. From the interior of an airplane or a jet to the rotor blades of a helicopter, composite materials are emerging as integral parts of the aerospace industry.

- In Asia-Pacific, the aerospace industry is growing at a fast rate, as many countries have increased their spending on defense platforms and technologies.

- The civil and military aviation industry in India emerged as one of the fastest-growing industries in the country in the past few years. According to the Indian government, the commercial aviation sector contributed USD 30 billion to India's GDP in 2021. With this growth, the domestic aviation market is projected to rank third globally by 2024. As air traffic has been growing rapidly in the country as compared to the global average. The air fleet number may rise from 600 (as of October 2022) to 1,200 during 2024. Therefore, increasing in the number of air fleet is expected to created an upside demand for advanced carbon materials market.

- Moreover, in April 2022, to transform Civil (Passenger) aircraft into Multi-Mission Tanker Transport (MMTT) aircraft in India, HAL and Israel Aerospace Industries (IAI) have signed a Memorandum of Understanding.

- With the e-commerce operations increasing rapidly since COVID-19, the air cargo market has increased, and thus the orders for freighter aircraft have increased in 2022. For instance, in October 2022, Luxembourg's Cargolux airlines placed an order with Boeing for 10 777-8 freighters along with options for 6 additional aircraft.

- China holds the position of second largest air freight market only next to the United States. According to Boeing's Commercial Market Outlook 2022, China's commercial airfleet is expected to grow from 3,900 to 9,600 by 2041.

- In February 2022, Boeing was awarded a contract worth USD 103.7 million by the US Department of Defense to deliver eight AH-6 light attack reconnaissance helicopters to Thailand under foreign military sale (FMS). The helicopters are planned to replace the aging AH-1F Cobra helicopters in service of the Royal Thai Army, and deliveries are expected to run through 2024.

- Furthermore, United Airlines has announced that it has started operating on new routes, describing it as its "largest transatlantic expansion." With everything returning to normal, new airlines have started operations. Akasa Air, a new Indian airline, has started its operations in August 2022, starting with one route with 28 flights a week and gradually adding two more routes. In October 2022, Alaska Airlines placed an order for 52 Boeing 737 MAX aircraft with a plan to expand its fleet. The airline announced plans to have an all-Boeing mainline fleet by the end of 2023.

- All factors above are likely to fuel the growth of the advanced carbon materials market over the forecast period.

North America Region to Dominate the Market

- The North American region is expected to dominate the market during the forecast period due to the presence of countries like the United States, Canada, and Mexico.

- The United States is the world's largest and most powerful economy. With the growing demand for various advanced materials such as (carbon fibers, carbon nanotubes, graphene, special graphite, carbon foams, nanocrystalline diamond (NCD), diamond-like-carbon (DLC), and fullerenes) in different end-user industries, including aerospace and defense, electronics, automotive, and energy, among others, is expected to propel the demand for advanced carbon materials at high rates through the forecast period.

- For instance, according to OICA, in 2022, automobile production in the United States amounted to 10.06 million units, which showed an increase of 10% compared to 2021 and 14% compared to 2020. Therefore, increasing automobile production is expected to create an upside demand for advanced carbon materials.

- Moreover, according to the Defence Expenditure of NATO Countries, in 2022, the United States spent an estimated USD 822 billion on defence. This makes their defence budget, by far, the biggest out of all the NATO members. Therefore, increasing expenditure on defense from the United States is expected to create an upside demand for advanced carbon materials in North America region.

- Owing to the above-mentioned factors, the market for advanced carbon materials in North America region is projected to grow significantly during the forecast period.

Advanced Carbon Materials Industry Overview

The advanced carbon materials market is partially fragmented in nature. The major players in this market (not in a particular order) include TORAY INDUSTRIES INC., Toyo Tanso Co. Ltd, Global Graphene Group, SGL Carbon, and SHOWA DENKO K.K.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Carbon Fiber Reinforced Plastic in the Construction Industry

- 4.1.2 Technological Advancements in Carbon Nanotubes

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High-cost of Carbon Fiber Composites

- 4.2.2 Wastage in the Production of Finished Products

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Carbon Fibers

- 5.1.2 Special Graphite

- 5.1.3 Carbon Nanotubes

- 5.1.4 Graphene

- 5.1.5 Carbon Foams (Includes Carbon Nanofoams)

- 5.1.6 Others (Fullerenes, Diamond-like Carbon (DLC), Nanocrystalline Diamond (NCD))

- 5.2 Application

- 5.2.1 Aerospace and Defence

- 5.2.2 Electronics

- 5.2.3 Sports

- 5.2.4 Automotive

- 5.2.5 Construction

- 5.2.6 Energy

- 5.2.7 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 Arry International Group Limited

- 6.4.3 CFOAM LLC

- 6.4.4 FutureCarbon GmbH

- 6.4.5 Formosa Plastics Corporation

- 6.4.6 Global Graphene Group

- 6.4.7 GrafTech International

- 6.4.8 Graphenea, Inc.

- 6.4.9 Graphite India Limited

- 6.4.10 Antolin

- 6.4.11 Grupo Graphenano

- 6.4.12 Haydale Graphene Industries plc

- 6.4.13 Hexcel Corporation

- 6.4.14 Hyperion Catalysis International

- 6.4.15 Jiangsu Cnano Technology Co., Ltd.

- 6.4.16 Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- 6.4.17 Ningbo Morsh Technology

- 6.4.18 Nano-C

- 6.4.19 Nanocyl SA

- 6.4.20 Nippon Graphite Fiber Co., Ltd

- 6.4.21 Perpetuus Advanced Materials PLC

- 6.4.22 POCO

- 6.4.23 SGL Carbon

- 6.4.24 Shenzhen Sanshun Nano New Materials Co. Ltd

- 6.4.25 SHOWA DENKO K.K.

- 6.4.26 Solvay

- 6.4.27 TEIJIN LIMITED

- 6.4.28 The Sixth Element (Changzhou) Materials Technology Co.,Ltd

- 6.4.29 Thomas Swan & Co. Ltd.

- 6.4.30 Tokai Carbon Co., Ltd.

- 6.4.31 TORAY INDUSTRIES, INC.

- 6.4.32 Toyo Tanso Co.,Ltd.

- 6.4.33 XG Sciences, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Production of Advanced Carbon Materials from Biowaste

- 7.2 Potential Uses in Energy Sector