|

市場調查報告書

商品編碼

1628817

中東和非洲的藥品包裝:市場佔有率分析、產業趨勢和成長預測(2025-2030)MEA Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

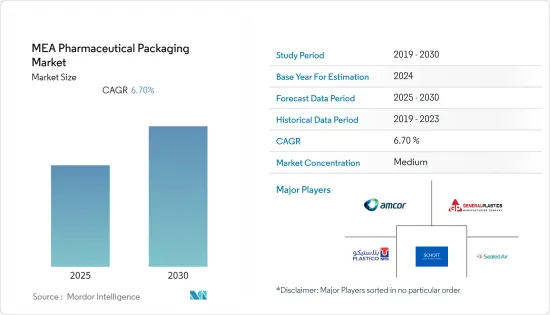

中東和非洲藥品包裝市場預計在預測期內複合年成長率為6.7%

主要亮點

- 中東地區僅佔醫藥包裝市場總量的3.5%。近年來,由於技術的逐步創新以及製藥領域學名藥和專科藥物的增加,塑膠已成為製藥市場上使用最廣泛的包裝材料。為了保護病人利益而對防偽技術的需求不斷成長,進一步推動了藥品包裝的成長。

- 該研究市場的成長前景預計將取決於海灣合作理事會和其他鄰近地區製藥和醫療保健行業的整體成長。生活水準的整體提高、人口老化以及多國政府改善醫療保健產業的努力被視為促進該地區製藥業成長的主要因素。此外,近幾十年來,包裝材料在製藥領域的作用發生了顯著變化。

- 他們現在需要遵守多項監管標準,提供產品訊息,並確保在自行給藥的情況下正確輸送藥物。藥品包裝材料明確分為初級包裝、二級包裝和封閉系統。製藥公司在選擇塑膠包裝材料時必須牢記其目標患者群體、產品穩定性要求、商業性可行性和監管考慮因素。

- 推動市場成長的因素包括該地區健康意識的提高、針對仿冒品的積極措施以及奈米技術和生物技術在製藥領域的貢獻不斷增加。

- 用於對抗地方病、呼吸道疾病和其他流行病的新型醫療保健藥物和設備的出現是推動醫藥塑膠包裝市場成長的主要因素之一。相反,與塑膠使用相關的環境問題以及合規標準的不斷變化預計將阻礙該市場的成長。

- 中東和非洲,特別是南非,正在經歷空前數量的 COVID-19 病例,迫使藥品包裝業務暫停。其他醫療產品生產行業的下滑對 2020 年前幾個月的醫療包裝需求產生了負面影響。此外,包裝材料總產量的減少導致藥包材生產計劃終止,導致藥包材需求減少。中東和非洲其他國家也出現了類似的趨勢,包括沙烏地阿拉伯和阿拉伯聯合大公國。不過,預計該國將透過這種方式克服需求下降的影響,經濟活動將會復甦,特別是在 2021 年初。

中東和非洲藥品包裝市場趨勢

瓶裝部門營業費用佔比最大

該地區不同類型的藥品包裝均使用玻璃和塑膠瓶。大量藥物製劑使用玻璃容器進行包裝,玻璃容器通常是包裝材料的首選。

- 瓶子一直是錠劑和膠囊的首選包裝。也用於包裝糖漿、滴鼻劑、眼藥水等液體製劑。塑膠瓶將繼續在主要藥物容器中佔據最高的市場佔有率,這反映出它們在口服藥物散裝包裝、處方量包裝和固態劑量口服非處方藥散裝包裝中的應用。

- 藥品包裝用塑膠材料的種類很多,包括PVC、PE、PP、PS、PET、尼龍等。 PE、PP、PET的比例最高,但PVC的用量正在減少。大部分塑膠瓶是橢圓形、方形和圓形容器,帶有螺旋頸,適合各種瓶蓋。

- 然而,市場正由寶特瓶主導。使用高密度聚苯乙烯(HDPE) 和聚對苯二甲酸乙二醇酯 (PET) 製造的塑膠瓶比玻璃更廣泛地用於包裝藥品。原因在於其高耐熱性和耐衝擊性、優異的氣體和濕氣阻隔性以及透明度和不透明性。

- 此外,該地區大量使用瓶子來透過處方箋分發口服藥物。郵寄到藥局的大劑量包裝在方便的塑膠瓶中。

- 因此,根據要求和用途,製成了瓶子的類型。藥品包裝產業對塑膠瓶的易用性和高需求將支持市場成長,並將在 2021-2026 年預測期內佔據市場佔有率佔有率。

沙烏地阿拉伯搶佔盈利的市場佔有率

沙烏地阿拉伯已成為藥品包裝產業最賺錢的市場之一。藥品進口占市場的80%以上,嚴重依賴外部市場來滿足不斷成長的國內需求。藥品包裝材料廣泛用於再包裝和出口在該地區加工的半成品藥品。這些重新包裝的藥品在鄰國進行商業銷售,以回應供需模式。

- 近年來,醫療保健方面的公共支出有了顯著改善。慢性病,特別是 COVID-19 和其他健康疾病的增加,正在促進製藥業的成長。預計該地區特種藥物的使用將出現高速成長。

- 沙烏地阿拉伯被譽為中東地區的藥品製造熱點。據估計,該國佔海灣合作理事會醫藥市場的一半以上。沙烏地阿拉伯政府已採取多項積極措施,使高度依賴石油和原油的國內部門多元化。沙烏地阿拉伯的醫療保健產業因擁有最先進的醫療網路之一而聞名於世。

- 此外,四個「經濟」城市(即KAEC、PABMEC、KEC、JEC)的發展預計將為該地區建立藥品加工設施創造新的機會。輝瑞等製藥巨頭對擴大業務以加強其在海灣合作理事會地區的立足點非常感興趣。

- 然而,與當地公司的合作仍然是一個重大挑戰,因為跨國公司需要滿足品質標準並遵守當地法規。沙烏地阿拉伯食品藥物管理局以及其他海灣合作理事會成員國負責制定該地區的藥品價格。藥品製造商可能會鼓勵藥品包裝公司降低價格,以降低整體製造成本。

- 由於油價波動,該地區目前正處於成長轉型期,但強勁的經濟儲備預計將在短期內抵消油價下跌的影響。這些宏觀經濟變化預計將對藥品包裝市場產生間接影響。然而,預計報告期間整體需求仍將維持在高水準。

中東和非洲藥品包裝產業概況

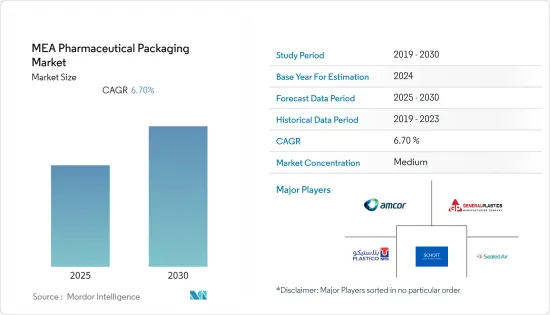

中東和非洲的藥品包裝市場較為分散,主要企業包括 Indevco 集團、Amcor Worldwide、General Plastics、沙烏地阿拉伯塑膠包裝系統有限公司和 Sealed Air Corporation,這些都是新公司。

- 2021 年 4 月 - Amcor 開發出革命性的可回收醫療保健包裝,即新型 AmSky泡殼系統。這是一項最新的創新,正在改變醫療保健包裝的永續性,使我們能夠消除泡殼包裝中的 PVC 並提高 Amcor 醫療保健的可回收性。這項創新為藥品包裝提供了耐兒科且適合老年人的解決方案。

- 2021 年 9 月 - 肖特股份公司收購了一家位於亞利桑那州的微陣列解決方案公司,擴大了該公司的業務並增強了其在生物科學領域的能力。透過此次收購,客戶將受益於增強的開發和製造能力,包括高密度微陣列列印。

- 2021 年 11 月 - INDEVCO 與終結塑膠廢棄物聯盟合作,協助減少中東和北非地區的塑膠廢棄物。 INDEVCO 是中東和北非 (MENA) 區域任務小組 AEPW(終結塑膠垃圾聯盟)的聯合主席。 AEPW 區域任務小組 (RTG) 的目標是將消除塑膠廢棄物的全球策略轉化為適合當地資源、挑戰和需求的區域策略。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第 2 章執行摘要

第3章調查方法

第4章市場動態

- 市場概況

- 市場促進因素

- 提高對環境問題的認知並採用新的監管標準

- 慢性疾病患者快速增加

- 市場限制因素

- 由於供應商議價能力而導致原物料成本波動

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 依材料類型

- 塑膠

- 玻璃

- 其他(紙/紙板、金屬)

- 依產品類型

- 瓶子

- 管瓶/安瓿

- 注射器

- 管子

- 蓋子和封口

- 小袋

- 標籤

- 其他產品類型

第6章 競爭狀況

- 公司簡介

- Indevco Group

- Amcor Worldwide

- Rexam PLC

- Schott AG

- Sealed Air Corporation

- Saudi Arabia plastic Packaging Systems Co.

- General Plastics Limited

- Medical Packaging(SAE)

- Frank NOE Limited

- Rose Plastics Medical Packaging

第7章 投資分析

第8章市場的未來

The MEA Pharmaceutical Packaging Market is expected to register a CAGR of 6.7% during the forecast period.

Key Highlights

- The Middle East region accounts for a meager portion of 3.5% of the overall pharmaceutical packaging market. Over the last few years, plastics have emerged as the most widely used packaging materials in the pharmaceutical market owing to incremental technological changes and growth in generic and specialty drugs in the pharmaceutical sector. The increasing need for anti-counterfeiting techniques to protect the interests of patients has further strengthened the growth of pharmaceutical packaging.

- The growth prospects of the study market are expected to be dependent on the overall growth of the pharmaceutical and healthcare sector in GCC and other neighboring regions. An overall rise in living standards, coupled with an increase in the aging population and the endeavors of several governments towards improving their healthcare sector, can be seen as major factors contributing to the growth of the pharmaceutical sector in this region. Moreover, the role of packaging materials in the pharma sector has greatly evolved over the last few decades.

- They are now expected to comply with several regulatory standards and provide product information and ensure proper drug delivery in case of self-administering drugs. The pharmaceutical packaging materials have been distinctly categorized into primary, secondary, and closure systems. Pharmaceutical companies have to be mindful of their target patient base, product stability requirements, commercial viability, and regulatory considerations while opting for plastic packaging materials.

- The major drivers for growth in this market include growing health awareness in the region, proactive measures against counterfeit products, and increased contribution of nanotechnology and biotechnology practices in the pharmaceutical sector.

- The advent of new healthcare medicines and devices to counter endemics, respiratory diseases, and other prevalent ailments is one of the major drivers for growth in the pharmaceutical plastic packaging market. Conversely, environmental concerns related to the use of plastics and constant changes in compliance standards are expected to impede the growth in this market.

- In the Middle East and Africa, particularly South Africa, an unprecedented number of COVID-19 cases have resulted in the suspension of the medical packaging business. The decline in other medical product production sectors had a negative impact on medical packaging demand in the first month of 2020. Moreover, the decrease in the total production of packaging materials led to the termination of the medical packaging material production project, which led to a decrease in the demand for medical packaging materials. Similar trends were observed in other countries in the Middle East and Africa, namely Saudi Arabia and the UAE. However, the country is likely to overcome the decline in demand in this way, and economic activity is expected to recover, especially in early 2021.

MEA Pharmaceutical Packaging Market Trends

Bottle Packaging segment to hold biggest operating expense

Glass and Plastic Bottles are used for various kinds of drug packaging in the region. A considerable number of pharmaceutical formulations have been packaged using glass containers, and they are usually the first choice of packaging materials.

- Bottles have been the preferred mode of packaging tablets and capsules. They are also used for packaging liquid dosages like syrups, nasal and ophthalmic medications. Plastic bottles will continue to have the highest market share among primary pharmaceutical containers, reflecting the usage in the bulk and prescription dose packaging of oral ethical drugs and the packaging of solid dose oral over-the-counter medicines in large quantities.

- There are many kinds of medicine packaging plastic materials, including PVC, PE, PP, PS, PET, nylon, etc. The PE, PP, and PET account for the largest proportion; however, the amount of PVC is reducing. The largest share within plastic bottles is for ovals, square and round containers with threaded necks designed to fit a wide variety of closures.

- However, the market is getting progressively occupied by Plastic bottles. Plastic bottles manufactured using high-density polyethene (HDPE) and polyethene terephthalate (PET) are being used to pack pharmaceuticals than glass. This is due to high temperature and impact resistance, the excellent barrier to gas and moisture, and transparency and opacity properties.

- Moreover, bottles are used in large quantities for oral drugs that are distributed through prescription in the region. Bulk dose volumes that are mailed to pharmacies are conveniently packed in plastic bottles.

- Hence, based on the requirement and usage, the types of bottles are made. The ease of use and high demand for plastic bottles in the pharmaceutical packaging industry will help the market grow, and it will be the highest market shareholder in the forecast period of 2021-2026.

Saudi Arabia to hold profitable market share

Saudi Arabia has emerged as one of the most lucrative markets for the pharmaceutical packaging sector. Drug imports account for more than 80% of the market, as it heavily relies on external markets for meeting the ever-growing domestic demand. Pharmaceutical packaging materials are widely used for the repackaging and export of semi-finished medicaments processed in this region. These repackaged drugs are commercially sold in neighboring countries to address the demand-supply paradigm.

- Public spending on healthcare has improved considerably over the last few years; the rise in chronic diseases, especially COVID-19 and other health ailments, has contributed to the growth of the pharmaceutical sector. The use of specialty pharma drugs is expected to witness high growth in this region.

- Saudi Arabia is widely known as a pharma manufacturing hot spot in the Middle East. The country has been estimated to account for more than half of the GCC pharmaceuticals market. The Saudi government has been taking several proactive measures to diversify the domestic sector, which is heavily reliant on petroleum and oil. The Saudi Arabian healthcare sector is world-renowned as one of the most sophisticated healthcare networks.

- Moreover, the development of four 'economic' cities (namely KAEC, PABMEC, KEC, and JEC) is expected to create new opportunities for the establishment of pharmaceutical processing units in this region. Pharma giants like Pfizer have taken a keen interest in expanding their operations in a bid to gain more ground in the GCC region.

- However, collaborating with local companies remains a considerable challenge for global companies, as they are required to meet their quality standards and comply with regional regulations. The Saudi Food and Drug Authority, in conjunction with other GCC member countries, is responsible for the pricing of pharmaceutical products in this region. Pharmaceutical packaging companies could be prompted to cut down on their prices by drug manufacturers in a bid to keep the overall production costs under check.

- This region is currently growing through a transition due to the fluctuations in the oil prices; however, strong economic reserves are expected to offset the impact of the reduction in oil prices in the short term. These macroeconomic changes are anticipated to have an indirect impact on the pharmaceutical packaging market. However, the overall demand shall remain fairly high over the reporting period.

MEA Pharmaceutical Packaging Industry Overview

The Middle East and Africa Pharmaceutical Packaging Market are fragmented due to the presence of key players like Indevco group, Amcor Worldwide, General Plastics, Saudi Arabia Plastic Packaging Systems Co., and Sealed Air Corporation; all these players are investing in new innovations and for R&D upscaling the industry.

- April 2021 - Amcor developed breakthrough recyclable healthcare packaging, the new AmSky blister system, the recent innovation to transform the sustainability of healthcare packaging and to eliminate PVC from blister packaging, enabling Amcor healthcare to improve its recyclability. This innovation offers child-resistant and senior-friendly solutions for pharmaceutical packaging.

- Sep 2021 - SCHOTT AG acquired the Arizona-based microarray solutions compnay extending the companies presence and strengthening its bioscience capabilities. This acquisition helps customers to benefit from enhanced development and manufacturing capabilities, including high-density microarray printing.

- Nov 2021 - INDEVCO partners with the Alliance to End Plastic Waste to help reduce plastic waste in the Middle East and North Africa region. INDEVCO took on the role of Co-Chair to the Alliance to End Plastic Waste (AEPW), the Middle East & North Africa (MENA) Regional Task Group. The objective of the AEPW Regional Task Group (RTG) is to translate its global strategy for eliminating plastic waste into a regional strategy that tailors to the local resources, challenges, and needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Awareness of Environmental Issues and Adoption of New Regulatory Standards

- 4.2.2 Surging Number of Chronic Disease Cases

- 4.3 Market Restraints

- 4.3.1 Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 Material Type

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Others (Paper and Paperboard, Metal)

- 5.2 Product Type

- 5.2.1 Bottles

- 5.2.2 Vials and Ampoules

- 5.2.3 Syringes

- 5.2.4 Tubes

- 5.2.5 Caps and Closures

- 5.2.6 Pouches

- 5.2.7 Labels

- 5.2.8 Other Product Types

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Indevco Group

- 6.1.2 Amcor Worldwide

- 6.1.3 Rexam PLC

- 6.1.4 Schott AG

- 6.1.5 Sealed Air Corporation

- 6.1.6 Saudi Arabia plastic Packaging Systems Co.

- 6.1.7 General Plastics Limited

- 6.1.8 Medical Packaging ( S.A.E)

- 6.1.9 Frank NOE Limited

- 6.1.10 Rose Plastics Medical Packaging