|

市場調查報告書

商品編碼

1628827

北美 AMH 和儲存系統:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)NA AMH and Storage Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

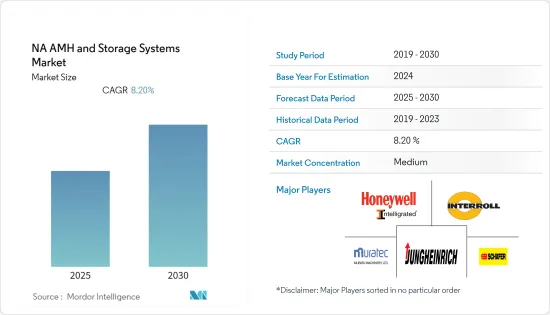

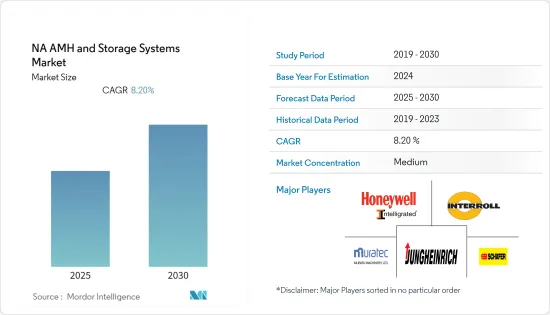

北美 AMH 和儲存系統市場預計在預測期內複合年成長率為 8.2%

主要亮點

- 物料輸送解決方案供應商透過製造可與其他系統無縫整合的靈活系統,作為整體物料輸送計劃的一部分,幫助最終用戶專注於操作中的空間和時間的效用。此外,自動導引車和 AS/RS 已成為最具活力的物料輸送設備和儲存系統解決方案,主要部署在倉庫、配送中心和機場。

- 此外,北美市場也建立了各種夥伴關係。例如,2021 年 2 月,美國著名電子產品量販店百思買 (Best Buy) 宣布與 Bastian Solutions 合作,重新設計其區域配送中心。該計劃涉及整合自動儲存和搜尋技術、輸送機和倉庫執行軟體,以最好地為每個設施提供服務。這種合作關係有助於百思買提供隔日送達服務並有效管理大量進貨。

- 該地區各終端用戶產業對工業 4.0 的日益關注也為市場創造了新的機會。根據美國BDO 的 2021 年工業 4.0 調查,約 50% 的製造商預計數位化投資將在未來 12 個月內帶來收益增加。此外,43% 的受訪者已經實施了機器人流程自動化 (RPA),47% 的受訪者計劃在未來這樣做。改善供應鏈的重點包括客戶訂單週期(19%)、總交貨成本(18%)、計畫績效(18%)和存貨周轉(16%)。

- 此外,該地區勞動力工資的上漲也增加了對新技術的需求,以減少對工人進行物料輸送的依賴。加拿大統計局數據顯示,加拿大企業單位產出人事費用繼前兩季小漲後,2021年第二季上漲2.7%。單位勞動成本的較快成長主要反映了平均時薪在經歷了四分之三的下降後的回升(上漲3.2%)。

北美AMH和儲存系統市場趨勢

自動導引運輸車有望獲得顯著的市場佔有率

- AGV(自動導引自動導引運輸車)的日益普及也是推動市場成長的因素。根據現代物料輸送(MMH) 的數據,11% 的受訪者將在 2021 年使用 AGV,18% 的受訪者計劃在未來 24 個月內使用 AGV。

- 市場上有許多關於自動牽引車和堆高機的創新。例如,2020年12月,豐田宣布推出一款用於倉庫作業的新型中控騎士和核心牽引車自動堆高機。 AGV由豐田堆高機與豐田高級物流子公司Bastian Solutions合作開發,用於製造工廠和物流中心業務的高度重複性任務。豐田的新型堆高機還可以在需要時手動操作,並使用基於光檢測和測距(LIDAR)的導航進行自主操作。

- 此外,該地區所有物流公司之間的競爭環境鼓勵他們透過增加倉儲設施或實現工作自動化來提高現有倉儲設施的效率,從而導致市場上自動導引車的興起,促進使用量的成長。

- 此外,大型倉庫的增加也帶來了對自動堆高機的需求,進一步推動了自動導引車市場的發展。例如,2020 年 11 月,DSV Global Transport Logistics 在多倫多附近開設了加拿大最大的多客戶物流設施。該倉庫提供 111,000 平方英尺的氣候控制空間。

- 堆高機技術研發的擴大預計將與工業 4.0、人工智慧和機器學習的投資齊頭並進,為 AGV 的蓬勃發展創造條件。此外,COVID-19 也提高了消費者對電子商務的採用和接受度,從而產生了各個最終用戶行業對遠端物料輸送和儲存系統的需求,這也為堆高機的自主或無人駕駛技術創造了新的機會。

美國預計將獲得主要市場佔有率

- 美國是世界上最重要的機器人市場之一,銷售受到該地區汽車行業需求的推動。例如,根據國際機器人聯合會(IFR)發布的《世界機器人2020工業機器人》報告,美國工廠運作的工業機器人數量約為29.3萬台,與前一年同期比較增加7%。新型機器人銷售量維持高位,2019 年出貨量為 33,300 台。機器人技術的發展為市場創造了新的機會。

- 此外,該地區的倉庫空間不斷擴大,增加了對 AMH 和儲存系統的需求。根據勞工統計局的數據,倉庫將從 2019 年的 18,736 個增加到 2020 年的 19,190 個。此外,亞馬遜和沃爾瑪等公司正在透過建造新倉庫來迅速擴大其足跡。 2021 年 5 月,亞馬遜宣布將建造一座 380 萬平方英尺的倉庫,是美國最大的倉庫之一。

- 對移動機器人、人工智慧和機器學習的投資也推動了該國的成長。例如,國家機器人計畫3.0 2021重點在於加速美國機器人的開發和使用。

- 根據2020年Honeywell智慧自動化投資調查,超過一半的美國公司願意投資自動化以在不斷變化的市場環境中生存。最願意投資自動化的產業是電子商務(60%)、食品飲料(59%)和物流(55%)。這為AMH和儲存系統部署創造了新的機會。

- 倉庫自動化程度的提高、AMH(自動物料輸送)的採用增加以及熄燈自動化等趨勢是推動美國的一些關鍵因素。

北美AMH和儲存系統產業概況

北美 AMH 和儲存系統市場與大量區域和全球參與者競爭中等。市佔率較大的主要廠商都在注重技術創新、併購、夥伴關係、擴大海外基本客群。公司正在利用策略合作措施來提高盈利。

- 2020年8月,村田機械與Alpen株式會社簽約,打造首個3D機器人倉庫系統「Alphabot」。此外,阿爾彭集團的主要物流中心阿爾彭小牧物流中心將引進ALPHABOT,以補充儲存容量,並將揀選、分類和包裝作業減少約60%。

- 2020 年 7 月 - Interroll 完成了位於喬治亞海勒姆(亞特蘭大)的第二家工廠的建設。 Interroll 投資 1,100 萬美元,顯著提高了在該地區的產能。英特諾在美洲地區的計劃活動持續保持高水準。同時,該公司將創新解決方案快速推向市場。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對工業生態系的影響

第5章市場動態

- 市場促進因素

- 技術進步不斷推動市場成長

- 電子商務的快速成長導致倉庫自動化

- 工業 4.0 投資推動對 AMH 和儲存系統的需求

- 市場挑戰

- 缺乏技術純熟勞工

- 高資本要求

第6章 市場細分

- 依產品類型

- 軟體

- 硬體

- 服務

- 一體化

- 依設備類型

- 移動機器人

- 自動導引運輸車(AGV)

- 自動堆高機

- 自動拖車/曳引機/標籤

- 單元貨載

- 組裝

- 自主移動機器人(AMR)

- 自動化倉庫系統(ASRS)

- 固定飛彈

- 旋轉木馬

- 垂直升降模組

- 自動輸送機

- 腰帶

- 滾筒

- 調色盤

- 開賣

- 堆垛機

- 傳統的

- 機器人

- 分類系統

- 移動機器人

- 按最終用戶

- 飛機場

- 車

- 飲食

- 零售/倉庫/配送中心/物流中心

- 一般製造業

- 藥品

- 小包裹

- 電子/半導體製造

- 其他最終用戶

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- JBT Corporation

- Honeywell Intelligrated(Honeywell International Inc.)

- SSI SCHEFER AG

- Daifuku Co. Limited

- Kardex Group

- Beumer Group GMBH & Co. KG

- Jungheinrich AG

- Murata Machinery Limited

- TGW Logistics Group GmbH

- Witron Logistik

- System Logistics

- Interroll Group

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 55098

The NA AMH and Storage Systems Market is expected to register a CAGR of 8.2% during the forecast period.

Key Highlights

- Vendors of material handling solutions gradually veered toward the modern approach of helping end-users focus on their operations' space and time utility by manufacturing flexible systems that can seamlessly integrate with other systems as part of the overall material handling plan. Also, automated guided vehicles and AS/RS have emerged as the most dynamic material handling equipment and storage systems solutions and are mainly deployed in warehouses, distribution centers, and airports.

- Further, various partnerships are witnessing in the North American Market. For instance, In February 2021, Best Buy, a prominent US-based consumer electronics store, announced redesigning its regional distribution centers in partnership with Bastian Solutions. The project included integrating automated storage and retrieval technology, conveyor, and warehouse execution software to serve each facility best. The association has assisted Best Buy in offering next-day delivery and managing large inbound shipments effectively.

- The focus on Industry 4.0 across different end-user industries in the region also presents new opportunities for the market. According to the 2021 Industry 4.0 survey by the BDO United States, almost 50% of the manufacturers anticipate their digital investments may lead to revenue increases in the next 12 months. Also, 43% of the respondents have deployed robotic process automation (RPA), while 47% plan to deploy it in the future. Some of the crucial aspects for improving the supply chain include customer order cycle (19%), total delivery cost (18%), performance to plan (18%), and inventory turnover (16%).

- Additionally, the increasing labor rates in the region are also developing the need for new technologies that help reduce the dependency on laborers for material handling. According to Statistics Canada, Labour costs per unit of output of Canadian businesses increased by 2.7% in the second quarter of 2021, following slight increases in the previous two quarters. The more rapid growth in unit labor costs primarily reflects the rebound in the average compensation per hour worked (+3.2%), following three-quarters of the decline.

North America AMH & Storage Systems Market Trends

Automated Guided Vehicle Expected to Witness Significant Market Share

- The growing adoption of Automated Guided Vehicles (AGVs) is also a factor that is driving the growth of the market. According to the Modern Materials Handling (MMH), 11% of the respondents will use AGVs in 2021, while 18% plan to use them in the next 24 months.

- The market is witnessing various innovations for automated tow and forklifts. For instance, In December 2020, Toyota announced a new Center-Controlled Rider and CoreTow Tractor Automated Forklifts for warehouse operations. The AGVs were developed by Toyota Forklift, in collaboration with Bastian Solutions, a subsidiary of Toyota Advanced Logistics company, for applications in manufacturing facilities and distribution center operations to perform highly repetitive tasks. Also, the new forklifts by Toyota operate manually whenever required and can work autonomously by utilizing light detection and ranging (LIDAR) based navigation.

- Also, the competitive environment among all the logistics players in the region encourages them to either increase their warehouse establishments or increase the efficiency of current warehouses establishments by automating the operations, which drives the use of automated guided vehicle growth in the market.

- Furthermore, the growth of large-scale warehouses is also presenting a need for automated forklifts, further driving the automated guided vehicle market. For instance, In November 2020, DSV Global Transport Logistics opened the largest Multi-Client Logistics Facility in Canada Near Toronto. The warehouse offers 111,000 sq. ft of climate-controlled space.

- The growing R&D in forklift technology is expected to create a scope for AGV, which is in line with the investments in Industry 4.0, artificial intelligence, and machine learning. Furthermore, COVID-19 has also increased consumer adoption and acceptance of e-commerce and created a need for remote material handling and storage systems in different end-user industries, which is also expected to create new opportunities for autonomous or driverless technologies in forklifts.

United States Expected to Witness Significant Market Share

- The United States is one of the significant robot markets worldwide, with sales being influenced by the demand from the automotive industry in the region. For instance, According to the World Robotics 2020 Industrial Robots report presented by the International Federation of Robotics (IFR), a record of about 293,000 industrial robots operating in factories of the United States an increase of 7% compared with the previous year. Sales of new robots remain on a high level, with 33,300 units shipped in 2019. The growth in robotics technology creates new opportunities for the market.

- The growing warehouse space in the region is also developing a need for automated material handling and storage equipment. According to the Bureau of Labor Statistics, warehouses increased from 18,736 in 2019 to 19190 in 2020. Furthermore, companies such as Amazon and Walmart are expanding their footprint rapidly with new warehouses. In May 2021, Amazon announced a 3.8 million square feet warehouse, one of the country's largest warehouses.

- The investments in mobile robotics, artificial intelligence, and machine learning are also driving the country's growth. For instance, The National Robotics Initiative 3.0 2021 focuses on accelerating the development and use of robots in the United States.

- According to the 2020 Honeywell Intelligrated Automation Investment Study, more than half of the companies in the United States are increasingly open to investing in automation to survive changing market conditions. The industries that are most willing to invest in automation are e-commerce (60%), grocery, food, and beverage (59%), and logistics (55%). Thus, creating new opportunities for the adoption of automated material handling and storage systems.

- The increase in warehouse automation, rising adoption of automated material handling, and trends, like lights-out automation, are some of the major factors driving the United States.

North America AMH & Storage Systems Industry Overview

The North America Automated Material Handling and Storage Systems Market is moderately competitive, with a considerable number of regional and global players. The major vendors with a prominent share in the market are focusing on innovations, mergers and acquisitions, partnerships, and expanding customer base across foreign countries. The companies are leveraging on strategic collaborative initiatives to increase their profitability.

- August 2020 - Murata Machinery Ltd signed a contract with Alpen Co. Ltd to construct the first 3D robot warehousing system, ALPHABOT. Further, ALPHABOT will be introduced at the Alpen Komaki Distribution Center, one of Alpen Group's main distribution centers, to complement its storage capacity and reduce picking, sorting, and packaging operations by approximately 60%.

- July 2020 - Interroll completed construction of the second plant in Hiram (Atlanta), Georgia. The USD 11 million investment gives Interroll a substantial increase in capacity for the region. At Interroll, the Americas region continues to see a high level of project activities. At the same time, the company is quickly introducing innovative solutions to the markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Industry Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Technological Advancements Aiding Market Growth

- 5.1.2 Rapid Growth in E-commerce Leading to Warehouse Automation

- 5.1.3 Industry 4.0 Investments Driving the Demand for Automated Material Handling and Storage Systems

- 5.2 Market Challenges

- 5.2.1 Unavailability for Skilled Workforce

- 5.2.2 High Capital Requirements

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Software

- 6.1.2 Hardware

- 6.1.3 Services

- 6.1.4 Integration

- 6.2 By Equipment Type

- 6.2.1 Mobile Robots

- 6.2.1.1 Automated Guided Vehicle(AGV)

- 6.2.1.1.1 Automated Forklift

- 6.2.1.1.2 Automated Tow/Tractor/Tug

- 6.2.1.1.3 Unit Load

- 6.2.1.1.4 Assembly Line

- 6.2.1.2 Autonomous Mobile Robots(AMR)

- 6.2.2 Automated Storage and Retrieval System(ASRS)

- 6.2.2.1 Fixed Asile

- 6.2.2.2 Carousel

- 6.2.2.3 Vertical Lift Module

- 6.2.3 Automated Conveyor

- 6.2.3.1 Belt

- 6.2.3.2 Roller

- 6.2.3.3 Pallet

- 6.2.3.4 Overhead

- 6.2.4 Palletizer

- 6.2.4.1 Conventional

- 6.2.4.2 Robotic

- 6.2.5 Sortation System

- 6.2.1 Mobile Robots

- 6.3 By End-User

- 6.3.1 Airport

- 6.3.2 Automotive

- 6.3.3 Food and Beverage

- 6.3.4 Retail/Warehousing/Distribution Centers/Logistic Centers

- 6.3.5 General Manufacturing

- 6.3.6 Pharmaceuticals

- 6.3.7 Post and Parcel

- 6.3.8 Electronics and Semiconductor Manufacturing

- 6.3.9 Other End-Users

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JBT Corporation

- 7.1.2 Honeywell Intelligrated (Honeywell International Inc.)

- 7.1.3 SSI SCHEFER AG

- 7.1.4 Daifuku Co. Limited

- 7.1.5 Kardex Group

- 7.1.6 Beumer Group GMBH & Co. KG

- 7.1.7 Jungheinrich AG

- 7.1.8 Murata Machinery Limited

- 7.1.9 TGW Logistics Group GmbH

- 7.1.10 Witron Logistik

- 7.1.11 System Logistics

- 7.1.12 Interroll Group

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219