|

市場調查報告書

商品編碼

1628830

菸草包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)Tobacco Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

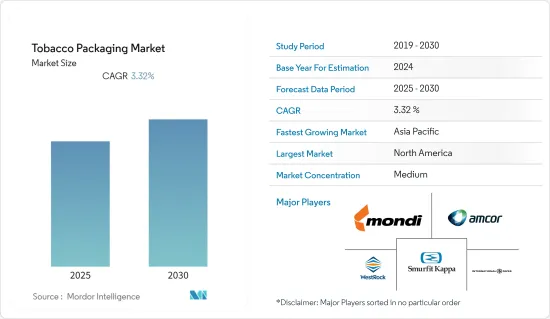

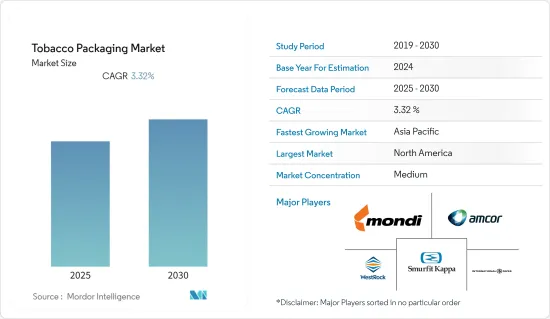

菸草包裝市場預計在預測期內複合年成長率為3.32%

主要亮點

- 隨著捲菸和捲菸消費量的不斷增加,捲菸包裝市場正在經歷顯著成長。全球每年售出近 6.5 兆支捲煙,相當於每天約 180 億支捲菸。此外,根據吸菸與健康行為 (ASH),世界上有 11 億菸草消費者。預計未來 20 年這一數字將成長至 16 億。

- 此外,菸草包裝市場也受到有關避免有吸引力的包裝和使用平裝包裝的法規的約束。在過去的八年中,捲菸包裝需求已顯著轉向平裝。世界衛生組織表示,平裝會降低菸草產品的吸引力,限制菸草包裝作為菸草廣告的一種形式,限制誤導性包裝和標籤,並提高健康警告的有效性,這是一項減少需求的措施。

- 由於風味雪茄的日益普及、肥胖率的上升、一些尖端包裝技術的引入以及其他因素,預計該市場將大幅成長。然而,政府對吸煙的監管不斷加強、大量的反吸煙努力以及各種呼吸道疾病的增加可能在一定程度上限制了我們產品的市場滲透率。

- COVID-19 的傳播對捲菸包裝市場產生了負面影響。由於該疾病侵襲肺部,因此禁止人們使用削弱肺部功能並使個人面臨感染該疾病風險的產品或行為。自病毒爆發以來,對菸草產品的需求減少,加上銷售這些產品的零售店關閉以及供應鏈中斷,導致銷售下降。這種需求下降預計短期內仍將保持低位,並對捲菸包裝產生直接影響。

捲菸包裝市場趨勢

二次包裝預計需求量大

- 捲菸等菸草產品與其他敏感產品一樣,需要具有阻隔性的包裝,以確保最佳的產品交付。二次包裝,例如軟包裝,最終成為傳統的香菸包裝,並且通常包括諸如可重新密封或可重新密封的層壓膜袋或袋等功能。這些包裝具有新的流動包裝外部薄膜,所有這些都有助於滿足阻隔要求。

- 市場上的供應商正在迅速擴大其製造工廠,以期提高產能並獲得更大的行業收益佔有率。例如,2021 年 5 月,盛威科推出了兩項促進包裝循環的重要措施:4evergreen 和 CosPaTox。

- 然而,政府法規和反吸煙宣傳活動在全世界普遍存在,近年來,由於禁止性課稅和監管的增加,菸草消費量有所下降。因此,捲菸包裝的複合年成長率預計在預測期內放緩。例如,新加坡對菸草產品採用平裝。新加坡衛生署表示,該措施將透過限制非吸菸者和兒童吸菸、鼓勵現有吸菸者戒菸以及推廣無菸生活方式,為該國更廣泛的菸草控制目標做出貢獻,最終將導致吸菸率下降。

- 新措施限制在新加坡銷售的所有類型的菸草產品上使用與菸草品牌相關的標誌、顏色、圖像和其他促銷訊息。產品和品牌名稱允許採用標準化字體樣式和顏色。

- 無論零售業蓬勃發展、線上銷售增加和技術進步等宏觀因素如何,新吸菸者數量增加等其他因素預計將推動市場對菸草包裝產品的需求。

亞太地區佔主要佔有率

- 政府採取的減少菸草消費的措施,例如提高價格和提高菸草稅,預計將推動亞太地區的市場成長。例如,日本和印度的傳統捲菸銷售將受到計畫加稅的影響,因此菸草產品發展潛力巨大。

- 此外,與其他生產普通盒子的國家不同,該國生產色彩鮮豔且有吸引力的捲菸包裝。描繪著名河流、養護、稀有名貴國寶、著名建築、名勝古蹟、名貴花卉等的捲菸包裝逐漸流行。例如,熊貓、牡丹、春花、黃山、騰宮廷等中國主要捲菸品牌在其包裝上使用了這些設計和圖像。

- 中國煙草業等特點鼓勵與其他國家根本不同的品牌和視覺文化。捲菸包裝標誌和圖形不僅賦予強烈而深厚的傳統文化歷史感,而且融入民族自豪感和鼓勵煙草使用,從而擴大了國內捲菸包裝市場。

- 該地區關於使用平裝和有關菸草使用的圖形警告的法規越來越多,這大大限制了市場研究。例如,2022 年7 月,印度政府衛生與家庭福利部透過2022 年7 月21 日的GSR 248(E) 修訂了《2008 年捲菸和其他菸草產品(包裝和標籤)規則》,使所有通知都成為新的規定菸草產品包裝上指定的健康警告。

煙草包裝行業概況

主要企業包括 WestRock CompanyWest、Amcor Limited、國際紙業公司、Smurfit Kappa Group PLC、Phillip Morris International Inc. 和 Sonoco Products Company。由於市場上的供應商跨地區爭奪市場佔有率,市場集中度適中。因此,市場集中度將是適度的。

- 2022 年 3 月 - WestRock 在克萊蒙特擴建 285,000 平方英尺的消費包裝工廠破土動工。這項 4,700 萬美元的投資由 One North Carolina Fund 提供的基於績效的津貼提供支持。

- 2022 年 2 月 - WestRock 宣布計劃在華盛頓州朗維尤開設一家新的瓦楞紙箱工廠,以滿足西北太平洋地區客戶日益成長的需求。新的瓦楞紙箱工廠將為太平洋西北地區的所有工業部門和市場提供服務。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 消費者對菸草作為娛樂的偏好

- 市場限制因素

- 政府監管導致市場停滯

- COVID-19 對市場狀況的影響

第5章市場區隔

- 按材質

- 紙和紙板

- 塑膠

- 其他材料

- 按包裝類型

- 基本的

- 中學

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- WestRock Company

- Amcor Limited

- The International Paper Company

- Smurfit Kappa Group PLC

- Mondi Group

- Innova Films Limited

- Phillip Morris International Inc.

- Sonoco Products Company

- Siegwerk Druckfarben AG & Co. KGaA

- Japan Tobacco International

- Treofan Film international

- Stora Enso Oyj

第7章 投資分析

第8章市場展望

簡介目錄

Product Code: 55202

The Tobacco Packaging Market is expected to register a CAGR of 3.32% during the forecast period.

Key Highlights

- Owing to the growing consumption of cigarettes and tobacco, the market for tobacco packaging is witnessing considerable growth. Nearly 6.5 trillion cigarettes are sold worldwide yearly, which translates to roughly 18 billion cigarettes daily. Furthermore, there are 1.1 billion tobacco consumers globally, according to the Action on Smoking and Health (ASH). This number is anticipated to grow to 1.6 billion over the next two decades.

- Furthermore, the packaging market for tobacco has been witnessing mandatory regulations regarding avoiding attractive packaging and adopting plain packaging. The need for tobacco packaging has significantly shifted toward plain packaging over the past eight years. According to WHO, plain packaging is a considerable demand reduction measure that reduces the attractiveness of tobacco products, restricts tobacco packaging as a form of tobacco advertising and promotion, limits misleading packaging and labeling, and increases the effectiveness of health warnings.

- Significant market growth will also result from the rising popularity of flavored cigars, the rise in obesity rates, the introduction of numerous cutting-edge packaging methods, and other factors. However, the increase in government regulations on smoking, the number of anti-smoking efforts, and the rise in various respiratory ailments may, to some extent, limit the product's market penetration.

- The spread of COVID-19 has impacted the tobacco packaging market negatively, as the disease attacks the lungs, and people are prohibiting the use of products and behaviors that weakens the lungs and put individuals at risk of contracting the disease. The decreased demand for tobacco products combined with the closure of retail shops selling these products and supply chain disruptions have decreased sales since the virus spread. This reduced demand is anticipated to stay low in the short run, impacting tobacco packaging directly.

Tobacco Packaging Market Trends

Secondary Packaging to Witness Significant Demand

- Like other sensitive goods, tobacco products such as cigarettes require packaging, which provides barrier properties to deliver the product in optimum condition. Secondary packaging, such as flexible packaging, has eventually become the traditional packaging for tobacco and typically includes functionality such as re-closable or re-sealable laminated film pouches and bags. These packs have a new flow-wrapped outer film, all contributing to the barrier requirements.

- Vendors in the market are rapidly expanding their manufacturing plants, intending to increase their production capacity and gain a larger share of the industry revenue pie. For instance, in May 2021, Siegwerk marked its presence with two important initiatives, 4evergreen and CosPaTox, to promote its circularity in packaging.

- However, government regulations and anti-smoking campaigns are prevalent globally, and prohibitive taxation & regulations have increased over the last few years, which has led to a decline in cigarette consumption. As a result, tobacco packaging is expected to post a slow CAGR during the forecast period. For instance, Singapore has adopted plain packaging of tobacco products; the Ministry of Health Singapore stated that the measure would contribute to achieving broader tobacco control goals in the country by discouraging non-smokers and children from taking up smoking, encouraging current smokers to quit, and promoting a tobacco-free lifestyle, which will ultimately lead to reduced smoking prevalence.

- This new measure will restrict the use of logos, colors, images, or other promotional information associated with the tobacco brand on all types of tobacco products sold in Singapore. Product and brand names will be allowed in a standardized font style and color.

- Regardless of the macro factors, such as the booming retail sector, increase in online sales, technological advancements, and other factors, like an increase in several new smokers, etc., are expected to contribute to the demand for tobacco packaging products in the market.

Asia Pacific to Hold a Major Share

- The government's measures to decrease cigarette consumption by raising prices and enacting extra cigarette taxes are expected to fuel market growth in the Asia-Pacific region. For instance, traditional cigarette sales in Japan and India will be impacted by the planned tax increases, which will present a significant potential for developing tobacco products.

- Furthermore, the country produces colorful and attractive tobacco packages, unlike other countries producing plain boxes. There is a high prevalence of cigarette packets bearing images of famous rivers, maintains, rare and precious national treasures, well-known buildings, historical sites, and rare flowers. For instance, the major Chinese cigarette brands, including Panda, Peony, Chunghwa, Mount Huangshan, and The Pavilion of Prince Teng, have such designs or images on their packaging.

- Characteristics such as the tobacco industry in China encourage a brand and visual culture that is fundamentally different from those of other countries. The signs and graphics on cigarette packaging not only carry a strong and deep sense of the history of traditional culture but also integrate a sense of national pride, encouraging tobacco use and thereby augmenting the market for tobacco packaging in the country.

- The increase in regulations regarding the adoption of plain packaging and graphic regarding warnings of tobacco usage in the region has been significantly restraining the market studied. For instance, in July 2022, The Ministry of Health and Family Welfare, Government of India notified new sets of specified health warnings for all tobacco product packs by amending the Cigarettes and Other Tobacco Products (Packaging and Labeling) Rules, 2008 vide GSR 248(E), dated July 21, 2022.

Tobacco Packaging Industry Overview

The major companies include WestRock CompanyWest, Amcor Limited, The International Paper Company, Smurfit Kappa Group PLC, Phillip Morris International Inc., and Sonoco Products Company, among others. The market is moderate in concentration as the vendors in the market vary for market share across regions among players. Therefore market concentration will be moderate.

- March 2022 - The WestRock company broke ground on a 285,000-square-foot expansion at its consumer packaging facility in Claremont. The USD 47 million investment was bolstered by a performance-based grant from the One North Carolina Fund.

- February 2022 - WestRock Company announced its plans to build a new corrugated box plant in Longview, Washington, to meet the growing demand from its regional customers in the Pacific Northwest. The new corrugated box plant will serve all industry segments and markets in the Pacific Northwest.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Consumer Preference for tobacco as a Recreative Habit

- 4.4 Market Restraints

- 4.4.1 Government Regulations Causing the Market to Stagnate

- 4.5 Impact of COVID-19 on the Market Landscape

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Paper and Paperboard

- 5.1.2 Plastic

- 5.1.3 Other Materials

- 5.2 By Packaging Type

- 5.2.1 Primary

- 5.2.2 Secondary

- 5.3 By Geograpgy

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 WestRock Company

- 6.1.2 Amcor Limited

- 6.1.3 The International Paper Company

- 6.1.4 Smurfit Kappa Group PLC

- 6.1.5 Mondi Group

- 6.1.6 Innova Films Limited

- 6.1.7 Phillip Morris International Inc.

- 6.1.8 Sonoco Products Company

- 6.1.9 Siegwerk Druckfarben AG & Co. KGaA

- 6.1.10 Japan Tobacco International

- 6.1.11 Treofan Film international

- 6.1.12 Stora Enso Oyj

7 INVESTMENT ANALYSIS

8 MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219