|

市場調查報告書

商品編碼

1629812

飲料上限和關閉:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Beverage Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

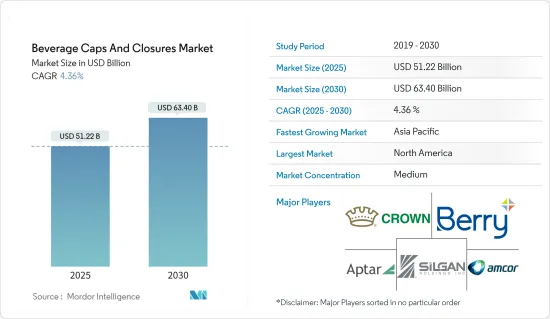

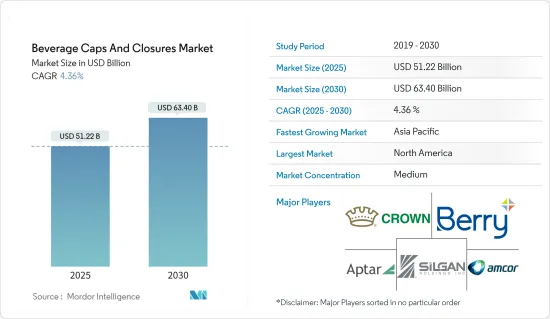

飲料瓶蓋和瓶蓋市場規模預計到 2025 年為 512.2 億美元,預計到 2030 年將達到 634 億美元,預測期內(2025-2030 年)複合年成長率為 4.36%。

主要亮點

- 無論飲料類型或包裝材料如何,瓶蓋和封口對於防止飲料溢出和保持產品新鮮度至關重要。這些部件可延長保存期限,並經過密封以防止微生物污染。在美國,對塑膠瓶蓋和瓶蓋的需求主要是由消費者對便利性和易用性的偏好所驅動的。塑膠蓋有效保護產品免受污染物和微生物的侵害。此外,塑膠蓋和封閉件比金屬蓋和封閉件具有成本優勢。

- 由於瓶蓋和瓶蓋的易用性和永續的包裝質量,全球對瓶蓋和瓶蓋的需求不斷增加。 PET和PP是其生產的主要原料。這些成分廣泛應用於飲料業的酒精和非酒精產品。瓶蓋和封口具有多種功能,包括延長產品保存期限、防止污染物和濕氣以及調節包裝商品中的氧氣含量。隨著需求持續增加,預計市場在預測期內將進一步成長。

- 瓶裝水是銷量成長最快的飲料類別之一。隨著消費者對瓶裝水的需求不斷增加,預計在預測期內對防篡改瓶蓋和密封件的需求將會增加。隨著消費者變得更加注重健康和保健,並從含糖飲料轉向更健康的替代品,瓶裝水是這一趨勢的主要受益者。此外,一些地區的水質問題進一步推動了對瓶裝水的需求,需要強大的包裝解決方案。

- 現代消費者「忙碌」的生活方式正在推動對輕質、易於使用的包裝解決方案的需求。自訂瓶蓋和瓶蓋製造商正在以更輕、更有效率的設計來應對。全球市場的成長進一步受到各類飲料需求不斷成長的推動。這些趨勢正在引發包裝創新,包括可回收材料和針對電子商務需求量身定做的設計。自訂瓶蓋和瓶蓋市場不斷發展,滿足不同行業的消費者偏好和產品要求。

- 此外,生活方式的改變和人均消費量的增加正在推動瓶裝水市場的擴張。都市化、忙碌的生活方式和瓶裝水的便利性促成了它的流行。隨著消費者擴大選擇在旅途中保持水分,製造商正在努力透過提供各種瓶子尺寸和創新的瓶蓋設計來確保產品的安全性和易用性。這一趨勢預計將持續下去,並有望推動瓶裝水包裝的詐欺瓶蓋和密封件市場的進一步成長。

- 塑膠包裝技術的進步帶來了業界產品開發的重大創新。許多公司正在大力投資研發活動,以創造獨特且具成本效益的產品,進而增加市場創新。然而,隨著人們對氣候變遷的日益關注,政府對塑膠包裝使用的法規變得越來越嚴格。預計這些法規將成為預測期內飲料瓶蓋和瓶蓋市場成長的主要限制因素。

飲料瓶蓋與瓶蓋市場趨勢

瓶裝水領域佔據主要市場佔有率

- 在美國等已開發市場以及印度和印尼等新興市場的主要飲料類型中,瓶裝水市場預計將出現最顯著的成長。這一成長是由健康意識的增強、便利性以及某些地區對自來水品質的擔憂所推動的。 2023 會計年度,印度鐵路餐飲旅遊有限公司 (IRCTC) 生產了超過 35 種飲料。 (IRCTC) 生產了超過 3.57 億瓶瓶裝水,幾乎比 2022 年的 1.986 億瓶增加了一倍。這一顯著成長反映出印度瓶裝水市場的快速擴張。

- 瓶裝水市場的擴張導致對塑膠瓶蓋和瓶蓋的需求不斷增加,特別是在不斷擴大的瓶裝水領域。瓶蓋和封口在維持瓶裝水的品質和安全、防止污染和確保新鮮方面發揮著重要作用。隨著全球瓶裝水消費量持續增加,塑膠瓶蓋和瓶蓋製造商可能會享受持續成長的機會。這一趨勢得到了瓶蓋設計創新的進一步支持,包括防篡改功能和改進的密封技術,提高了產品安全性和消費者信心。

- 飲料市場正在經歷從玻璃容器到塑膠容器的轉變,預計這將推動對塑膠瓶蓋和瓶蓋的需求。這種轉變是由塑膠的優點所推動的,包括其重量輕以及能夠減少因破損而造成的產品損失。在更廣泛的市場中,金屬蓋可能會繼續佔據主導地位,特別是作為啤酒瓶的首選密封。葡萄酒產業可能會增加金屬捲裝螺旋蓋的使用,這主要是由於單杯酒瓶的日益普及。

- 此外,瓶裝水是全球銷售成長最快的飲料類別之一。預計在預測期內,消費者對瓶裝水的需求增加將增加對防篡改瓶蓋和密封件的需求。瓶裝水市場的成長是由生活方式的改變和人均消費量所推動的。隨著可口可樂、達能、雀巢、百事可樂、農夫山泉等國際競爭對手的不斷增加,瓶裝水市場競爭對手之間的競爭加劇。

- 塑膠包裝技術的進步徹底改變了飲料業的產品開發。許多公司正在大力投資研發活動,以開發獨特且具有成本效益的產品,而該領域的創新正在顯著增加。

- 許多其他領先公司,例如 Amcor 和 Ball,也採用了類似的策略來提供新的創新最終產品。隨著產業的發展,對產品的需求也在不斷成長,推動了全球飲料產業瓶蓋和瓶蓋的成長。

亞太地區錄得強勁成長

- 亞太地區的瓶蓋和瓶蓋市場由中國主導,其次是印度和日本。有幾個關鍵因素支持這一主導地位。首先,飲料業對瓶裝水和包裝飲料的需求不斷成長,大大推動了市場的發展。其次,在瓶蓋和密封件的生產中使用高性能材料提高了產品品質和功能。第三,該市場受益於廣泛的材料成分,從而實現了包裝解決方案的多樣性。

- 中國的經濟成長在塑造市場狀況方面發揮著重要作用。隨著國家經濟持續快速擴張,中產階級家庭可支配所得大幅增加。購買力的增加導致包裝商品(尤其是飲料)的消費增加,從而推動了對瓶蓋和瓶蓋的需求。這一趨勢預計將持續下去,中國作為亞洲市場領導的地位有望變得更加穩固。

- 亞太地區瓶蓋和瓶蓋市場的擴張主要是由於飲料消費的增加和人口的成長。由於可支配收入的增加,該地區的飲料行業在過去十年中經歷了巨大的成長。受消費者偏好變化的影響,特別是對機能飲料和營養飲料不斷成長的需求,預計這一趨勢將在整個預測期內持續下去。

- 該地區的塑膠瓶蓋和瓶蓋市場受到快速都市化、人口成長和酒精需求增加的推動。此外,隨著越來越多的行業關注塑膠回收和永續性,預計該地區將更多地採用可回收塑膠材料來製造瓶蓋和瓶蓋。到 2023 會計年度,威士忌將成為印度所有類型烈酒中銷量最高的,將超過 2.5 億箱。相比之下,白蘭地銷量約 8,200 萬箱。全國烈酒市場總量接近4億箱。這些趨勢創造了對各種酒精飲料的瓶蓋和瓶蓋的需求。

- 根據 Vericup 最近的一項研究,中國不斷壯大的中產階級需要更複雜的產品,特別是在需要瓶蓋和瓶蓋等塑膠零件的包裝產業。由此,中國塑膠產業正經歷全面變革時期,注重技術和環保理念。市場趨勢正在轉向有吸引力的色彩和印花。公司越來越注重生產引人注目的包裝,因為產品的顏色、形狀、紋理、圖形和印刷傳達了品牌身份確認並將其與商店上的競爭對手區分開來。

飲料瓶蓋和密封件產業概述

飲料瓶蓋和瓶蓋市場高度分散,公司透過提供有競爭力的價格和尖端產品來贏得客戶。 Crown Holdings Inc.、Berry Global Inc.、Aptar Group Inc.、Evergreen Packaging Inc.、Global Closure Systems 是市場上一些主要的參與者。由於研發投資、新市場措施、全球影響力、生產基地和設施、生產能力、產品發布等,市場競爭激烈。

- 2024 年 6 月,BERICAP 在非洲、南美洲和東南亞建立了新的生產設施,擴大了其國際足跡。該公司在肯亞內羅畢和越南胡志明市推出了新工廠,並收購了在秘魯利馬和南非德班設立的生產單位。這些策略性舉措使 Vericup 的生產足跡遍佈 25 個國家的 30 個地點,使客戶能夠從本地計劃支援、物流和服務中受益。

- 2024 年 3 月,全球葡萄酒和烈酒瓶蓋和膠囊領域的領導者 Amcor Capsules 慶祝其 STELVIN 鋁製螺旋蓋系列誕生 60 週年。 STELVIN 瓶蓋於 1964 年在法國索恩河畔沙隆推出,引發了葡萄酒產業的關鍵變革。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 新興經濟體飲料消費增加

- 技術進步與創新的包裝解決方案

- 市場限制因素

- 關於塑膠蓋和密封件使用的嚴格規定

第6章 市場細分

- 按材質

- 金屬

- 塑膠

- 其他材質(橡膠、軟木)

- 按用途

- 啤酒

- 葡萄酒

- 瓶裝水

- 碳酸飲料

- 乳製品

- 調味料/醬料

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 哥倫比亞

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Crown Holdings Inc.

- Berry Global Inc.

- Aptar Group Inc.

- Global Closure Systems

- Silgan Holdings Inc.

- Bericap GmbH & Co. KG

- Guala Closures Group

- Ball Corporation

- Amcor Group

- Pact Group

- Albea Group

- Tetra Laval International

第8章投資分析

第9章 市場機會及未來趨勢

The Beverage Caps And Closures Market size is estimated at USD 51.22 billion in 2025, and is expected to reach USD 63.40 billion by 2030, at a CAGR of 4.36% during the forecast period (2025-2030).

Key Highlights

- Caps and closures are crucial in preventing beverage spillage and maintaining product freshness, regardless of the beverage type or packaging material. These components extend shelf life and protect against microbial contamination through tight seals. In the United States, the demand for plastic caps and closures is primarily driven by consumer preferences for convenience and ease of use. Plastic caps effectively shield products from contaminants and microorganisms. Additionally, plastic caps and closures offer a cost advantage over their metal counterparts.

- The global demand for caps and closures is increasing due to their ease of use and sustainable packaging qualities. PET and PP are the primary raw materials used in their manufacture. These components are extensively utilized in the beverage industry for both alcoholic and non-alcoholic products. Caps and closures serve multiple functions: they extend product shelf life, protect against contaminants and moisture, and regulate oxygen levels in packaged goods. As demand continues to rise, the market is expected to experience further growth during the forecast period.

- Bottled water is one of the fastest-growing beverage categories in terms of volume. This increasing consumer demand for bottled water is expected to drive the need for tamper-proof caps and closures during the forecast period. The growing awareness of health and wellness among consumers has shifted from sugary drinks to healthier alternatives, with bottled water being a primary beneficiary of this trend. Additionally, concerns about water quality in some regions have further boosted the demand for bottled water, necessitating robust packaging solutions.

- The modern consumer's "on-the-go" lifestyle has driven demand for lightweight, user-friendly packaging solutions. Custom caps and closures manufacturers are responding with lighter and more efficient designs. The global market growth is further propelled by increasing demand for various beverage types. These trends have led to packaging innovations, including recyclable materials and designs catering to e-commerce needs. The custom caps and closures market continues evolving, meeting consumer preferences and product requirements across diverse industries.

- Moreover, changes in lifestyle patterns and increased per capita consumption fuel the expansion of the bottled water market. Urbanization, busy lifestyles, and the convenience of bottled water have contributed to its popularity. As consumers increasingly opt for on-the-go hydration, manufacturers are responding by offering a variety of bottle sizes and innovative closure designs that ensure product safety and ease of use. This trend will likely continue, driving further growth in the tamper-proof caps and closures market for bottled water packaging.

- Technological advancements in plastic packaging have led to significant innovations in product development within the industry. Many companies invest heavily in research and development activities to create unique and cost-effective products, resulting in increased market innovations. However, the growing concern over climate change has led to stringent government regulations on plastic usage for packaging. These regulations are expected to be the primary constraint on the growth of the beverage caps and closures market during the forecast period.

Beverage Caps And Closures Market Trends

Bottled Water Segment Holds a Significant Market Share

- The bottled water market is expected to register the most substantial gains among major beverage types in developed markets like the United States and developing areas such as India and Indonesia. This growth is driven by increasing health consciousness, convenience, and concerns about tap water quality in some regions. In the financial year 2023, Indian Railways Catering & Tourism Corporation Ltd. (IRCTC) produced over 357 million units of bottled water, nearly doubling their production from 198.60 million units in 2022. This significant increase reflects the rapidly expanding bottled water market in India.

- The growing market for bottled water is creating increased demand for plastic caps and closures, particularly within the expanding bottled water segment. Caps and closures play a crucial role in maintaining the quality and safety of bottled water, preventing contamination, and ensuring freshness. As bottled water consumption continues to rise globally, manufacturers of plastic caps and closures are likely to see sustained growth opportunities. This trend is further supported by innovations in cap design, such as tamper-evident features and improved sealing technologies, which enhance product safety and consumer confidence.

- The ongoing transition from glass to plastic containers is expected to boost demand for plastic caps and closures in the beverage market. This shift is driven by plastic's advantages, including its lightweight nature and ability to reduce product loss through breakage. In the broader market, metal caps will continue to dominate, particularly as the preferred closure for beer bottles. The wine industry is likely to see an increase in metal roll-on screw cap usage, primarily due to the growing popularity of single-serve wine bottles.

- Moreover, bottled water is one of the beverage categories with the fastest growth in terms of volume globally. There would be a rise in the consumer demand for bottled water, raising the need for tamper-evident caps and closures in the forecast period. The bottled water market's growth is fueled by changes in lifestyle and per capita consumption. The competitive rivalry in the market for bottled water is intensified by the increasing presence of international competitors like Coca-Cola, Danone, Nestle, PepsiCo, and Nongfu Spring.

- Technology advancements in plastic packaging have resulted in innovations in product development in the beverage industry. Many companies are investing significantly in R&D activities to develop unique and cost-effective products, and innovation in this space is increasing significantly.

- Many other major companies, such as Amcor and Ball Corp., follow similar strategies and offer new and innovative final products. With innovations in the industry, the demand for products is also growing, thus driving the growth of caps and closures in the beverages industry around the globe.

Asia-Pacific to Register Major Growth

- The Asia-Pacific caps and closures market is dominated by China, with India and Japan following closely behind. Several key factors drive this leadership position. First, the beverage industry's increasing demand for bottled water and packaged drinks has significantly boosted the market. Second, adopting high-performance materials in cap and closure manufacturing has enhanced product quality and functionality. Third, the market benefits from a wide range of material compositions, allowing for versatility in packaging solutions.

- China's economic growth has played a crucial role in shaping the market landscape. As the country's economy continues to expand rapidly, middle-class families are experiencing a substantial increase in their disposable incomes. This rise in purchasing power has led to higher consumption of packaged goods, particularly beverages, driving the demand for caps and closures. The trend is expected to continue, further solidifying China's position as the market leader in the Asia region.

- The Asia-Pacific caps and closures market is experiencing expansion, primarily driven by increasing beverage consumption and population growth. The region's beverage industry has grown enormously over the past decade, attributed to rising disposable incomes. This trend is expected to continue throughout the forecast period, influenced by evolving consumer preferences, particularly the growing demand for energy and nutritional drinks.

- The plastic caps and closures market in this region has been driven by rapid urbanization, population growth, and increasing alcohol demand. Additionally, the region's adoption of recyclable plastic materials for caps and closures is expected to rise as industries increasingly emphasize plastic recycling and sustainability. In the financial year 2023, whiskey had the highest sales volume among various spirits in India, exceeding 250 million cases. Brandy, in contrast, had a sales volume of approximately 82 million cases. The country's overall spirits market sales approached 400 million cases. This growing trend creates demand for caps and closures for various alcoholic beverages.

- A recent survey by Bericap indicates that China's expanding middle class is demanding more sophisticated products, particularly in the packaging industry, which requires plastic components like caps and closures. Consequently, China's plastic industry is undergoing a comprehensive transformation, focusing on technology and environmentally friendly concepts. The market is experiencing a trend toward attractive colors and printing. Companies are increasingly emphasizing the production of eye-catching packages, as the color, shape, texture, graphics, and printing of products communicate brand identity and differentiate them from competitors on store shelves.

Beverage Caps And Closures Industry Overview

The beverage caps and closures market is fragmented, with firms varying for customers by offering competitive prices and cutting-edge products. Crown Holdings Inc., Berry Global Inc., Aptar Group Inc., Evergreen Packaging Inc., and Global Closure Systems are a few of the market's biggest companies. Due to R&D investments, new market efforts, global presence, production sites and facilities, production capabilities, and product launches, the market is competitive.

- June 2024: BERICAP broadened its international footprint by setting up new production facilities in Africa, South America, and Southeast Asia. The company launched new plants in Nairobi, Kenya, and Ho Chi Minh City, Vietnam, and also acquired established production units in Lima, Peru, and Durban, South Africa. These strategic moves brought BERICAP's total to 30 production sites in 25 countries, ensuring customers benefit from localized project support, logistics, and services.

- March 2024: Amcor Capsules, a worldwide leader in crafting closures and capsules for wine and spirits, marked the 60th anniversary of its STELVIN aluminum screw cap range. Launched in 1964 in Chalon-sur-Saone, France, the STELVIN cap heralded a pivotal evolution in the wine industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Beverage Consumption in Developing Economies

- 5.1.2 Technological Advancements and Innovative Packaging Solutions

- 5.2 Market Restraints

- 5.2.1 Stringent Regulations on the Usage of Plastic caps and closures

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Metal

- 6.1.2 Plastic

- 6.1.3 Other Materials (Rubber, Cork)

- 6.2 By Application

- 6.2.1 Beer

- 6.2.2 Wine

- 6.2.3 Bottled water

- 6.2.4 Carbonated soft drinks

- 6.2.5 Dairy products

- 6.2.6 Condiments and sauces

- 6.2.7 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Mexico

- 6.3.5.3 Colombia

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 Saudi Arabia

- 6.3.6.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crown Holdings Inc.

- 7.1.2 Berry Global Inc.

- 7.1.3 Aptar Group Inc.

- 7.1.4 Global Closure Systems

- 7.1.5 Silgan Holdings Inc.

- 7.1.6 Bericap GmbH & Co. KG

- 7.1.7 Guala Closures Group

- 7.1.8 Ball Corporation

- 7.1.9 Amcor Group

- 7.1.10 Pact Group

- 7.1.11 Albea Group

- 7.1.12 Tetra Laval International