|

市場調查報告書

商品編碼

1630328

鋁蓋和瓶蓋:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Aluminum Caps and Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

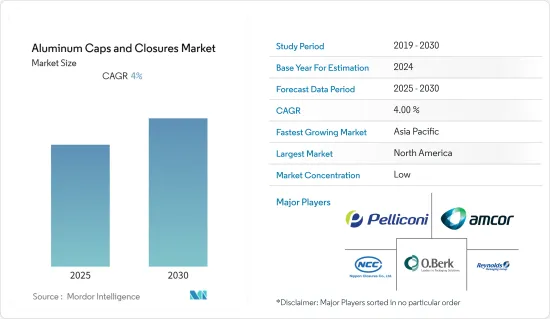

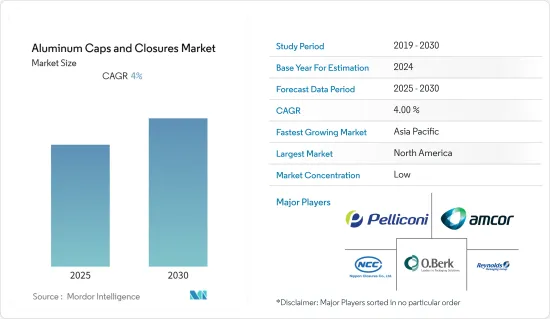

預計鋁瓶蓋和瓶蓋市場在預測期內的複合年成長率為 4%。

主要亮點

- 鋁蓋和瓶蓋對於包裝產業至關重要,也是市場成長的主要驅動力。此外,對包裝產品的需求不斷成長預計將增加全球市場的穩定動能。

- 此外,飲料業是鋁蓋和瓶蓋市場的主要貢獻者之一。各種類型的鋁蓋用於飲料包裝,例如皇冠蓋、鋁ROPP蓋、高鋁蓋、拉環蓋和凸耳蓋。碳酸飲料、能量飲料和酒精飲料是鋁蓋和瓶蓋的主要最終用戶。此外,鋁製瓶蓋的使用正在成為葡萄酒行業的主流,因為鋁製螺旋蓋可以將葡萄酒與氧氣隔絕,並且比軟木塞具有成本優勢。

- 此外,由於鋁製瓶蓋重量輕、堅固耐用,化妝品產業也是鋁製蓋子與封口裝置的重要用戶。由於這些特性,鋁蓋廣泛應用於對兒童有害的化妝品的防兒童蓋(CRC),如香水、彩妝品、護膚品等。例如,波爾公司最近推出了一系列可無限回收的鋁瓶,並配有可重複使用的旋蓋。

- 製藥業是使用鋁蓋和密封件成長最快的行業,因為鋁蓋和密封件具有阻隔性和絕緣性能,使它們能夠安全密封、輕鬆打開和有效重新密封。成藥市場的不斷成長,尤其是糖漿瓶,增加了對鋁蓋和瓶蓋的需求。例如,FDA 法規規定「容器、封閉件和藥品包裝的其他組件必須適合其預期用途,並且不得以任何影響藥品特性、強度、品質或純度的方式使用。」 」 「它不能具有高反應性、添加劑或吸收性。

- 此外,冠狀病毒的傳播增加了藥品市場對瓶蓋和密封件的需求。尤其是2020年第一季呈現高成長。世界各地的藥局報告稱,由於更多顧客填寫 90 天處方並進行恐慌性搶購,收益有所增加。例如,北美的製藥業高度依賴國外市場。隨著美國在 COVID-19 大流行後改變其海外藥品生產政策,預計陸上生產將受到關注。

鋁蓋和瓶蓋市場趨勢

預計醫藥板塊增速最高

- 製藥和醫療保健產業呈現持續成長勢頭,北美、歐洲和亞太地區的需求激增。製藥領域使用的鋁蓋和封閉件是無菌的,通常由層狀材料組成。此外,鋁具有高度可自訂性:本色或彩色、普通或壓花。因此,藥品包裝可以根據消費者的需求來供應。

- 藥品產量的增加和監管變化進一步有利於增值、兒科和老年用藥,預計將在預測期內推動市場發展。例如,2019 年,美國THC 和 CBD 食品契約製造製造商 Growpacker Inc. 宣布推出其正在申請專利的 Cannasafe,這是用於含有 THC 飲料的鋁罐的兒童安全蓋。

- 此外,鋁罐可以形成高效的屏障,而不會影響產品的味道或香氣。從有機角度來看,鋁罐中使用的所有材料都是完全中性的,有助於防止藥物發生味道和顏色的變化。此外,隨著世界各地糖尿病人口的增加,胰島素注射劑、注射器和注射筆的使用也正在增加。這進一步鼓勵了在注射器噴嘴、管瓶和其他藥筒中使用鋁蓋。

- 此外,由於對非處方藥 (OTC) 的需求不斷增加,製藥業呈指數級成長。大多數非處方藥,例如感冒藥和咳嗽藥(糖漿)、眼管和注射劑,都是用鋁製轂、蓋子、管瓶和其他封閉材料製成的。例如,根據 IQVIA 實驗室報告,全球成藥市場正以 3-6% 的成長率成長。由於大部分鋁蓋和密封件用於OTC市場,因此全球市場的需求預計將進一步增加。

預計北美將佔據主要佔有率

- 北美地區擁有 Reynold Group Holding Limited、Silgan Holding、Cary Company、O.Berk Company、Crown Holding 等眾多公司,預計將佔據重要的市場佔有率。此外,食品和飲料行業是該地區鋁蓋和瓶蓋市場的主要消費者之一。鋁蓋和封閉件也用於儲存食物,例如通常儲存在玻璃容器中的穀物。

- 鋁蓋和封閉件由於其回收優勢和易於處置而用於飲料行業。此外,鋁蓋還可延長產品的保存期限。根據 NBWA 的數據,根據美國人口普查人口和啤酒出貨資料,2018 年美國21 歲及以上消費者每人消費了 26.5 加侖啤酒和蘋果酒。此外,根據啤酒協會 2018 年年度報告,美國啤酒產業每年向美國消費者銷售超過 1,193 億美元的啤酒和麥芽飲料。

- 此外,在製藥領域,考慮到環境問題和增強品牌吸引力,各製造商正在用再生塑膠製成的塑膠瓶取代外包裝產品,並更喜歡鋁製瓶蓋以實現差異化。

- 此外,FDA、CPSC 和 ISO 的嚴格監管有助於推動製藥、食品、飲料和化妝品行業的產品創新和複雜性。為了滿足法規要求,鋁蓋和瓶蓋製造商擴大利用產品功能,例如使用方便、防兒童保護和方便老年人。例如,2020 年 2 月,由於鋁包裝需求增加,鮑爾宣布將在美國建造兩家特殊飲料鋁罐工廠。

鋁蓋和瓶蓋產業概述

由於國際供應商的存在,鋁蓋和瓶蓋市場高度分散且競爭激烈。該市場的主要企業包括 Pelliconi &C SpA、O.Berk Company 和 Reynolds Packaging Group Ltd。市場在產品差異化、產品組合和價格方面競爭激烈。

- 2021 年 8 月 - Amkor 和密西根州立大學宣佈建立合作夥伴關係,支持下一代包裝永續創新和人才。 Amkor 決定投資超過 1000 萬美元,長期致力於培養下一代負責任的包裝人才。

- 2021 年 6 月 - Herti AD Shumen 的 GALP Greener Aluminium Cap計劃獲得了挪威撥款的核准,該專案是一項工業 4.0 舉措,旨在引入創新的環保生產流程。該計劃的框架面向業務發展和創新。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- 市場促進因素

- 產品可回收性

- 與其他封閉材料相比具有優越的性能

- 市場限制因素

- 其他類型封閉材料的採用率較高

第5章 COVID-19對鋁包裝產業的影響

第6章 全球鋁瓶蓋庫存市場情勢

- 市場概況、規模和預測

- 按地區分類的市場情景

- 鋁帽產業主要企業名單

第7章 市場區隔

- 按類型

- 螺旋蓋

- 皇冠軟木塞

- 凸耳(按扭動)

- 酵母開放端

- 其他瓶蓋和瓶蓋

- 按用途

- 飲料

- 藥品

- 食物

- 化妝品

- 其他用途

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第8章 競爭格局

- 公司簡介

- Amcor PLC

- O.Berk Company

- Reynolds Packaging Group Ltd Closure Systems International Inc.(CSI)

- Pelliconi & C. SpA

- Nippon Closures Co. Ltd

- Silgan Closures GmbH

- SKS Bottle & Packaging Inc.

- Berlin Packaging(Qorpak)

- Tecnocap Group

- The Cary Company

- Guala Closures SpA

- Herti JSC

- Federfintech

- Alutop

- RPC Group(PET Power)

- Hicap Closures Co. Ltd

- Easy Open Lid Industry Corp. Yiwu

- Shadong Lipeng Co. Ltd

- Rauh GmbH & Co. Blechwarenfabrikations-KG

- Federfin Tech SRL

- IDEA CAP SRL

第9章 市場未來展望

簡介目錄

Product Code: 68720

The Aluminum Caps and Closures Market is expected to register a CAGR of 4% during the forecast period.

Key Highlights

- Aluminum caps and closures are imperative for the packaging industry, and this serves as the primary driving force for the market's growth. Furthermore, increasing demand for packaged products is anticipated to augment the steady momentum of the global market.

- Also, the beverage industry is one of the major contributors to the aluminum caps and closures market. Various types of aluminum caps are used in beverage packaging, such as crown caps, aluminum ROPP caps, tall aluminum caps, pull ring caps, lugged caps, and others. Carbonated soft drinks, energy drinks, and alcoholic beverages are among the major end-user segments of aluminum caps and closures. Moreover, the use of aluminum closure in the wine industry is becoming predominant, as aluminum screw caps provide better insulation for the wine from oxygen and have cost benefits compared to cork.

- Further, the cosmetic industry is also a prominent user of aluminum caps and closures owing to their lightweight, strong, and durable properties. Due to these properties, aluminum closures are widely used for child-resistant closures (CRC) in cosmetics, such as perfumes, color cosmetics, and skin cosmetics that are harmful to children. For instance, Ball Corporation recently launched an infinitely recyclable aluminum bottle line equipped with reclosable threaded caps.

- Pharmaceutical is the fastest-growing segment that uses aluminum caps and closures due to its barrier and insulating properties, and it can be sealed securely, opened easily, and resealed effectively. Due to the growing market for OTC drugs, especially syrup bottles, aluminum caps, and closures have been witnessing rising demand in the market. For instance, FDA regulations state that "containers, closures, and other parts of drug packages to be suitable for their intended use, must not be reactive, additive or absorptive to the extent that the identity, strength, quality or purity of the drug will be affected ."

- Additionally, The spread of novel coronavirus has augmented the demand for caps and closures in the pharmaceutical market. The growth was especially high in Q1 2020. Pharmacies worldwide reported an increase in their revenues due to 90-day prescriptions and more customers getting involved in panic buying. For instance, The pharmaceutical sector in North America is highly dependent on foreign markets. The onshore production is expected to gain traction due to the United States changed policy of offshore production of medicines post COVID-19 pandemic.

Aluminum Caps & Closures Market Trends

Pharmaceutical Sector is Expected to Witness the Highest Growth Rate

- The pharmaceutical and healthcare industry demonstrates a persistently sturdy growth rate, with surging demand in several regions, like North America, Europe, and Asia-Pacific. Aluminum caps and closures used in the pharmaceutical sector are sterile and are generally composed of layered material. Besides, aluminum can be highly customizable: natural or colored, plain or embossed. Thus, pharmaceutical packaging can be supplied according to the consumers' needs.

- The increased pharmaceutical production and the regulatory changes are further favoring value-added, child-resistant, and senior-friendly closures, which are anticipated to drive the market in the foreseen period. For instance, in 2019, Growpacker Inc., a contract manufacturer of THC- and CBD-infused edibles in the United States, announced the launch of its patent-pending Cannasafe, a child-resistant lid for aluminum cans containing THC-infused beverages.

- Moreover, aluminum closures create a highly effective barrier without affecting the product's taste and smell. All materials used in aluminum closures are perfectly neutral from an organoleptic point of view, helping to prevent taste, color, and other changes that occur in drugs. Additionally, the usage of insulin shots, syringes, and injection pens is increasing with the increase in the diabetic population across the world. This is further driving the use of aluminum caps in syringe nozzles, vials, and other cartridges.

- Additionally, The pharmaceutical industry is exponentially growing with the increase in the demand for over-the-counter (OTC) medicines. Most of the OTC medications, like cold and cough remedies (Syrups), ophthalmic tubes, and injections, consist of aluminum hubs, lids, vials, and other closure materials. For instance, as per the IQVIA's institute report, the OTC drug market is growing at a global rate of 3-6%. Since most of the aluminum caps and closures are used in the OTC market, it is expected to further boost their demand in the global arena.

North America is Expected to Hold a Major Share

- The North American region is expected to have a significant market share, which is home to many companies, such as Reynold Group Holding Limited, Silgan Holding, Cary Company, O.Berk Company, and Crown Holding. Moreover, the food and beverage industry is one of the major consumers of the aluminum caps and closures market in the region. Aluminum caps or closures are also used to store food products, such as grains, typically stored in glass containers.

- Aluminum caps and closures are used in the beverage industry due to their recycling advantages and ease of disposal. Also, aluminum closure increases the shelf life of the product. According to the NBWA, based on the US census population statistics and beer shipment data, the US consumers aged 21 years and older consumed 26.5 gallons of beer and cider per person during 2018. Also, according to the Beer Institute Annual report, 2018, the US beer industry sells more than USD 119.3 billion in beer and malt-based beverages to US consumers each year.

- Furthermore, in the pharmaceutical sector, concerning the environmental issues and enhancing the brand appeal, various manufacturers are replacing outer box products with plastic bottles made from recycled plastic and prefer aluminum closures to distinguish.

- Additionally, Stringent regulations by the FDA, CPSC, and ISO have been instrumental in driving product innovation and sophistication across the pharmaceutical, food and beverage, and cosmetic industries. To meet the regulation, Aluminum Cap and closure manufacturers are increasingly using product features, such as convenience of use, child resistance, and senior friendliness. For instance, in February 2020, Ball corporation announced building two specialty beverage aluminum can plants in the United States due to its rise in aluminum packaging.

Aluminum Caps & Closures Industry Overview

The aluminum caps and closures market is highly fragmented and competitive due to the presence of international vendors. Some of the key players of this market are Pelliconi & C. SpA, O.Berk Company, and Reynolds Packaging Group Ltd, among others. Intense competition prevails in the market in terms of product differentiation, portfolio, and pricing.

- August 2021 - Amcor and Michigan State University announced their partnership to support innovation and talent in the next generation of packaging sustainability. Amcor decided to invest over USD 10 million for a long-term commitment to developing the next generation of responsible packaging talent.

- June 2021 - Herti AD Shumen received the approval from Norway Grants for the project GALP Greener Aluminum Cap as an initiative of industry 4.0 for implementation of green innovative production processes. The framework of this project is towards business development and innovation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Recyclability of the Products

- 4.4.2 Superior Properties Compared to Other Closure Materials

- 4.5 Market Restraints

- 4.5.1 High Adoption Rate of Other Types of Closure Materials

5 IMPACT OF COVID-19 IMPACT ON THE ALUMINUM PACKAGING INDUSTRY

6 GLOBAL ALUMINUM CAP STOCK MARKET LANDSCAPE

- 6.1 Market Overview, Sizing, and Forecast

- 6.2 Market Scenario across Different Geographies

- 6.3 List of Major Companies in the Aluminum Cap Stock Industry

7 MARKET SEGMENTATION

- 7.1 Type

- 7.1.1 Screw Caps

- 7.1.2 Crown Cork

- 7.1.3 Lugs (Press Twist)

- 7.1.4 East Open End

- 7.1.5 Other Types of Caps & Closures

- 7.2 Application

- 7.2.1 Beverages

- 7.2.2 Pharmaceutical

- 7.2.3 Food

- 7.2.4 Cosmetics

- 7.2.5 Other Applications

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor PLC

- 8.1.2 O.Berk Company

- 8.1.3 Reynolds Packaging Group Ltd Closure Systems International Inc. (CSI)

- 8.1.4 Pelliconi & C. SpA

- 8.1.5 Nippon Closures Co. Ltd

- 8.1.6 Silgan Closures GmbH

- 8.1.7 SKS Bottle & Packaging Inc.

- 8.1.8 Berlin Packaging (Qorpak)

- 8.1.9 Tecnocap Group

- 8.1.10 The Cary Company

- 8.1.11 Guala Closures SpA

- 8.1.12 Herti JSC

- 8.1.13 Federfintech

- 8.1.14 Alutop

- 8.1.15 RPC Group (PET Power)

- 8.1.16 Hicap Closures Co. Ltd

- 8.1.17 Easy Open Lid Industry Corp. Yiwu

- 8.1.18 Shadong Lipeng Co. Ltd

- 8.1.19 Rauh GmbH & Co. Blechwarenfabrikations-KG

- 8.1.20 Federfin Tech SRL

- 8.1.21 IDEA CAP SRL

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219