|

市場調查報告書

商品編碼

1630197

歐洲改質瀝青 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Modified Bitumen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

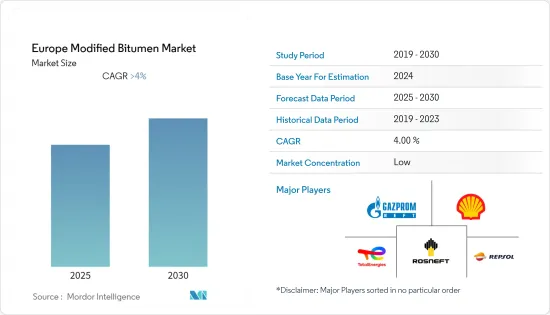

歐洲改質瀝青市場預計在預測期內複合年成長率將超過 4%。

COVID-19 對全球市場改質瀝青的需求產生了負面影響。 COVID-19期間,主要道路建設計劃暫停,從而減少了全球改性瀝青的消耗。但2021年產業呈現復甦態勢,帶動市場需求回升。

主要亮點

- 短期來看,道路建設和維修活動的增加、建築重建和翻新的增加是推動市場成長的因素。

- 另一方面,施工過程中由於非熟練工人造成的火災風險以及與瀝青相關的職業健康危害是影響研究市場成長的一些因素。

- 生產膠粉改質瀝青等的創新方法可能會在未來幾年創造市場機會。

- 由於建築業需求的不斷成長,德國在整個歐洲的改性瀝青市場上佔據主導地位。

歐洲改質瀝青市場趨勢

道路建設活動的需求增加

- 改質瀝青混凝土混合物已成為道路、機場跑道、滑行道、自行車道等的重要建築材料。

- 黏合劑改質劑和骨材改質劑改質劑用於提高瀝青路面的性能,以提高其對路面破壞(如熱裂、車轍和剝落)的抵抗力,並延長其使用壽命。

- 改質瀝青的需求成長高於平均。瀝青的需求與目前正在進行的道路建設活動水準直接相關。

- 經濟活動放緩、勞動力短缺和供應鏈問題導致產量下降至疫情前水準以下。預計這將減少道路計劃的資金並阻礙市場成長。例如,2021/22年度英國公共部門的道路支出超過120億英鎊(163.971億美元),比前一年減少8,800萬英鎊(1.2024億美元)。

- 此外,CAPA《2022年機場建設與投資審查報告》顯示,截至2022年3月,歐洲機場共有177個基礎建設計劃,總投資數1,090億美元。因此,改性瀝青市場可望因跑道建設而上漲。

- 所有上述因素預計將在預測期內推動改質瀝青市場的需求。

德國在歐洲市場佔據主導地位

- 德國是歐洲最大的改質瀝青市場,預計在預測期內將擴大。德國是歐洲最大的建築國。

- 基礎設施計劃的投資增加,包括客運和貨運的高容量運輸基礎設施、現有公路、鐵路和水路網路的結構維護,以及對吸引私人投資的聯邦能源政策的審查,近年來改性瀝青的消費量有所增加。

- 根據2030年聯邦交通基礎建設計畫(FTIP),政府計畫在2016年至2030年間投資2,600億歐元建設公共交通網路,其中49.3%為公路模式,49.3%為鐵路模式,41.6%為水路模式。 %。對各種基礎設施計劃的此類計劃投資預計將在預測期內擴大改性瀝青市場。

- 此外,由於壓力和應變增加、道路和橋樑老化、升級現有鐵路網路的投資增加以及聯邦水道物理結構的更換,對聯邦公路基礎設施結構維護的需求預計將不斷成長。 。

- 此外,2022年,德國道路建設價格(StraBen)成長速度超過其他類型的基礎設施,2022年價格指數較去年同期從124.75上漲至與前一年同期比較。

- 此外,較低的利率、較高的實際可支配收入以及歐盟和德國政府的大量投資正在支持經濟成長。

- 所有這些因素預計將在預測期內推動該國的改質瀝青需求。

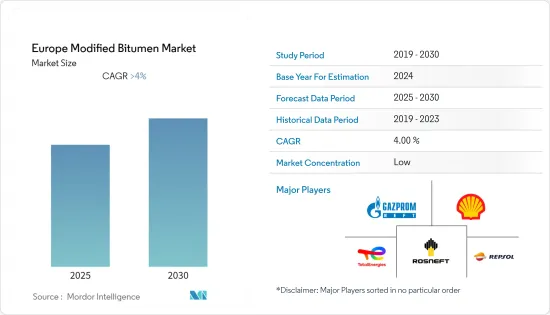

歐洲改質瀝青產業概況

歐洲改質瀝青市場本質上是細分的。市場上的主要參與企業包括(排名不分先後)俄羅斯石油公司(ROSNEFT)、殼牌公司(Shell PLC)、俄羅斯天然氣工業股份公司石油公司(Gazprom Neft PJSC)、TotalEnergies 和雷普索爾公司(Repsol) 。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 道路建設和維修活動增加

- 建築重建與裝修增加

- 改質瀝青的品質優於普通瀝青。

- 抑制因素

- 與瀝青相關的職業健康危害

- 施工期間的火災風險

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 改質劑類型

- 聚丁二烯(SBS)

- 無規立構聚丙烯(APP)

- 橡膠粉

- 天然橡膠

- 其他改質劑類型

- 如何申請

- 熱瀝青

- 冷瀝青

- 火炬應用

- 申請方法

- 道路建設

- 屋頂/管道

- 其他

- 地區

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ALMA PETROLI Spa

- BITUMINA HI-TECH PAVEMENT BINDERS LLC

- Cepsa

- Colas SA

- Eni SpA

- Exxon Mobil Corporation

- Gazprom Neft PJSC

- GRUPA LOTOS SA

- Nynas AB

- OMV Aktiengesellschaft

- ORLEN Asfalt Sp ZOO

- Puma

- Repsol

- ROSNEFT

- Shell PLC

- TotalEnergies

第7章 市場機會及未來趨勢

- 膠粉改質瀝青的創新製造方法

- 奈米技術在瀝青改質的應用

The Europe Modified Bitumen Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively affected the demand for modified bitumen in the global market. Major road construction projects were temporarily suspended during COVID-19, thereby reducing modified bitumen consumption worldwide. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing road construction and repair activities, and increasing building renovation and remodeling are some of the factors driving the growth of the market.

- On the flip side, the risk of fire during installation due to unskilled labor and occupation health hazards regarding asphalt are some of the factors affecting the growth of the market studied.

- Nevertheless, innovative methods to produce crumbed rubber-modified bitumen and others are likely to create opportunities for the market in the coming years. are likely to act as an opportunity in the future.

- Germany dominated the modified bitumen market across Europe due to the increasing demand from the construction industry.

Europe Modified Bitumen Market Trends

Increasing Demand from Road Construction Activities

- Modified bitumen concrete mixture has been an important construction material for roads, airport runways, taxiways, bicycle paths, etc.

- Modifiers, such as binder modifiers and aggregate modifiers, are used to improve the performance of asphalt pavements, in terms of increased resistance to pavement distresses, such as thermal cracking, rutting, stripping, etc., thereby prolonging the service life.

- The demand for modified bitumen has been witnessing above-average growth. The demand for bitumen has a direct correlation with the level of ongoing road construction activities.

- Due to the rise in economic inactivity, labor shortages, and supply chain issues are below pre-pandemic levels. Therefore, it is anticipated that a decline in funding for road projects will impede market growth. For instance, public sector spending on roads in the United Kingdom was over GBP 12 Billion (USD 16397.1 Million) in 2021/22, a decrease of GBP 88 Million ( USD 120.24 Million) when compared with the previous year.

- Moreover, according to the Airport Construction and Investment Review Report 2022 by CAPA, there are 177 infrastructure projects at European airports, with a collective investment value of USD 109 billion as of March 2022. Therefore, this is expected to create an upside fpr modified bitumen market from runway constructions.

- All of the aforementioned factors are expected to drive demand for modified bitumen market over the forecast period.

Germany to Dominate the Market in European Region

- Germany had the largest market for modified bitumen in Europe, which is expected to increase during the forecast period. Germany has the largest construction industry in Europe.

- Growing investments in infrastructural projects such as high-capacity transport infrastructure for passenger and freight transport, structural maintenance of the existing road, rail, and waterway networks, and revision in federal government energy policies to attract more private investment have increased the consumption of modified bitumen in recent years.

- Under the 2030 Federal Transport Infrastructure Plan (FTIP), the government has planned to invest EUR 260 billion between 2016 and 2030 in the high-capacity transport network of which the road mode accounts for 49.3 %, the rail mode accounts for 41.6 % and the waterway mode accounts for 9.1 % of funds. This planned investment in various infrastructural projects is estimated to increase the market for modified bitumen during the forecast period.

- In addition, growing need for structural maintenance of federal trunk road infrastructure due to growing stresses and strains and increasing age of the road and bridge fabric, increase in investment to upgrade existing rail network, and rising necessity to replace physical structures on the federal waterways is expected to increase the demand for modified bitumen.

- Moreover in 2022, the price for the construction of roads (StraBen) in Germany grew faster than that of any other type of infrastructure, the price index in 2022 rose to 145 for roads from 124.75 compared to previous year.

- Furthermore, the growth is supported by lower interest rates, increase in real disposable incomes, and numerous investments by the European Union and the German Government.

- All the factors are estimated to boost the demand for modified bitumen in the country during the forecast period.

Europe Modified Bitumen Industry Overview

The European modified bitumen market is fragmented by nature. Some of the major players in the market include ROSNEFT, Shell PLC, Gazprom Neft PJSC, TotalEnergies, and Repsol, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Road Construction and Repair Activities

- 4.1.2 Increasing Building Renovation and Remodeling

- 4.1.3 Superior Quality of Modified Bitumen over Normal Bitumen

- 4.2 Restraints

- 4.2.1 Occupation Health Hazards Regarding Asphalt

- 4.2.2 Risk of Fire during Installation

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Modifier Type

- 5.1.1 Styrene-butadiene-styrene (SBS)

- 5.1.2 Atactic Polypropylene (APP)

- 5.1.3 Crumb Rubber

- 5.1.4 Natural Rubber

- 5.1.5 Other Modifier Types

- 5.2 Application Method

- 5.2.1 Hot Asphalt

- 5.2.2 Cold Asphalt

- 5.2.3 Torch-applied

- 5.3 Application

- 5.3.1 Road Construction

- 5.3.2 Roofing and Piping

- 5.3.3 Other Applications

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 Italy

- 5.4.4 France

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALMA PETROLI Spa

- 6.4.2 BITUMINA HI-TECH PAVEMENT BINDERS LLC

- 6.4.3 Cepsa

- 6.4.4 Colas SA

- 6.4.5 Eni S.p.A.

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 Gazprom Neft PJSC

- 6.4.8 GRUPA LOTOS S.A.

- 6.4.9 Nynas AB

- 6.4.10 OMV Aktiengesellschaft

- 6.4.11 ORLEN Asfalt Sp ZOO

- 6.4.12 Puma

- 6.4.13 Repsol

- 6.4.14 ROSNEFT

- 6.4.15 Shell PLC

- 6.4.16 TotalEnergies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovative Methods for the Production of Crumbed-rubber-modified Bitumen

- 7.2 Incorporation of Nanotechnology in Bitumen Modification