|

市場調查報告書

商品編碼

1637749

瀝青 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Bitumen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

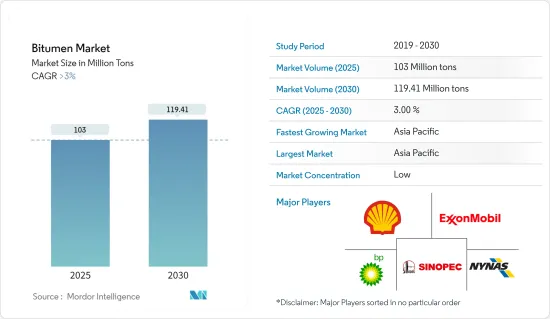

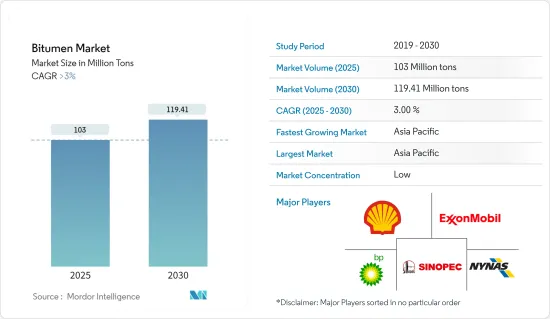

預計2025年瀝青市場規模為1.03億噸,2030年將達1,1941萬噸,預測期間(2025-2030年)複合年成長率超過3%。

COVID-19 對全球市場的瀝青需求產生了負面影響。在新冠肺炎 (COVID-19) 疫情期間,世界各地許多建築計劃暫停,瀝青的使用量減少。然而,一旦停工和限制放鬆,關鍵地區的建設活動仍在繼續。從那時起,市場一直穩步成長。

主要亮點

- 道路建設和維修活動的增加以及商業和國內建築業對瀝青作為填充材、黏合劑和密封劑的需求不斷增加,推動了瀝青市場的成長。

- 另一方面,日益嚴重的環境問題(例如使用會產生有害大氣排放的瀝青)正在阻礙市場成長。

- 瀝青加工的研究和開發,以改善高性能瀝青產品和道路基礎設施的開發,預計將在未來幾年為瀝青市場創造各種機會。

- 亞太地區在瀝青市場中佔據主要佔有率,預計在預測期內仍將維持最高複合年成長率。

瀝青市場趨勢

道路建設領域佔市場主導地位

- 道路建設產業是全球最大的瀝青消費者之一,佔瀝青總消費量的很大一部分。鋪設道路、高速公路和其他交通基礎設施所需的大量瀝青使其在該市場佔據主導地位。

- 瀝青路面耐用、柔韌且耐候,適合道路建設計劃。瀝青道路可以承受繁重的交通負荷、不同的天氣條件和其他環境因素,確保長期性能和成本效益。

- 據 FMI Corporation(諮詢和投資銀行)稱,到 2024年終,北美的工程和建築支出預計將增加 2%。

- 此外,根據美國人口普查局公佈的資料,2020年美國私人交通建設將增加163.1億美元,2023年將達193.9億美元。

- 作為一個新興經濟體,由於都市化進程的加速以及從傳統領域向新興第二產業的轉變,亞太地區的基礎設施計劃預計將大幅增加,特別是在交通運輸領域。此外,日益成長的經濟繁榮正在推動消費產業的基礎設施融資,例如運輸和製造業,這些產業供應原料並將其出售給消費者。

- 中國建築工程總公司 (CSCEC) 已簽署 2022 年新建公路總長 4,623 公里的總合,高於 2020 年的 4,186 公里。這一趨勢也支撐著瀝青市場。

- 根據NIP,印度撥出1億美元的投資預算用於基礎建設。印度已撥出開發多個工業走廊的預算,包括德里-孟買工業走廊、阿姆利則-加爾各答工業走廊、維札格-清奈工業走廊、班加羅爾-清奈工業走廊和班加羅爾-孟買工業走廊。這些計劃預計將於 2025 年 3 月完成,未來幾年對瀝青的需求預計將增加。

- 由於所有這些因素,在預測期內,全球瀝青市場可能會成長。

亞太地區主導市場

- 印度、中國和其他東南亞國家等國家的快速工業化和都市化帶動了道路、高速公路、機場、港口等基礎設施計劃的大規模投資,帶動了馬蘇瀝青的需求。

- 亞太地區的建築業是瀝青最大的消費者之一,正在進行的住宅、商業和工業建設計劃推動了對瀝青材料的需求,例如用於道路鋪裝、屋頂和防水的瀝青。

- 中國即將推出的「十五五」計畫將重點放在交通、能源、水利系統和城市發展等領域的新型基礎設施計劃。第一輪包括約2900個計劃,包括東北地區、京津冀地區高標準農地建設。

- 印度品牌資產基金會(IBEF)公佈的資料顯示,從2000年4月到2023年3月,印度建築開發(包括住宅、基礎設施和建築開發計劃)的外國直接投資(FDI)增加至263.5億美元。

- 印度即將推出的預計將增加瀝青需求的計劃包括德里-孟買工業走廊、巴拉特馬拉計劃、古吉拉突邦國際金融科技城(GIFT)、科欽智慧城市、新孟買國際機場等。

- 印度國家投資促進和便利化局公佈的資料顯示,印度已撥出1.4兆美元預算用於2024年基礎建設。其中,可再生能源佔24%,公路和高速公路佔18%,城市基礎設施佔17%,鐵路佔12%。

- 由於上述因素,預計亞太地區的瀝青需求在預測期內將會增加。

瀝青產業概述

瀝青市場是細分的,沒有一家大公司擁有壓倒性的佔有率。主要參與企業(排名不分先後)包括埃克森美孚、殼牌、BP PLC、NYNAS AB 和中國石油化學股份有限公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 道路建設和維修活動增加

- 商業和住宅建築施工的需求

- 抑制因素

- 環境問題

- 其他限制因素

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原料分析

第5章市場區隔(市場規模(數量))

- 依產品類型

- 路面等級

- 硬質等級

- 氧化級

- 瀝青乳液

- 聚合物改質瀝青

- 其他產品類型(乳化型)

- 按用途

- 道路建設

- 防水的

- 膠水

- 其他用途(工業塗料)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 泰國

- 馬來西亞

- 越南

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 西班牙

- 土耳其

- 北歐的

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BMI Group(Icopal Enterprise ApS)

- Bouygues Group

- BP PLC

- China Petroleum & Chemical Corporation

- ENEOS Corporation(JXTG Nippon Oil & Energy Corporation)

- Exxon Mobil Corporation

- Indian Oil Corporation Ltd

- Kraton Corporation

- Marathon Oil Company(Marathon Petroleum LP)

- NYNAS AB

- Shell

- Suncor Energy Inc.

第7章 市場機會及未來趨勢

- 用於道路基礎設施改善的瀝青加工研究與開發

- 高性能瀝青產品的開發

The Bitumen Market size is estimated at 103 million tons in 2025, and is expected to reach 119.41 million tons by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

COVID-19 adversely influenced the demand for bitumen on the global market. During COVID-19, a large number of construction projects were on hold, reducing the use of bitumen throughout the world. However, as lockdowns and restrictions eased, there was continued construction activity in major regions. Since then, the market has been growing steadily.

Key Highlights

- The growth of the bitumen market is driven by increased road construction and repair activities, as well as a growing demand from both commercial and domestic building sectors for bitumen as fillers, adhesives, or sealants.

- On the flip side, increasing environmental concerns, such as the utilization of bitumen, which generates several harmful atmospheric emissions, have been hindering the market's growth.

- Research and development on bitumen processing to improve the development of high-performance bitumen products and road infrastructure are expected to create various opportunities for the bitumen market in the upcoming years.

- Asia-Pacific is expected to hold a significant share of the bitumen market and witness the highest CAGR during the forecast period.

Bitumen Market Trends

Road Construction Segment to Dominate the Market

- The road construction industry is one of the largest consumers of bitumen globally, accounting for a significant portion of total bitumen consumption. The sheer volume of bitumen required for paving roads, highways, and other transportation infrastructure contributes to its dominance in the market.

- Bitumen-based asphalt pavements offer excellent durability, flexibility, and resistance to weathering, making them well-suited for road construction projects. Asphalt roads can withstand heavy traffic loads, varying weather conditions, and other environmental factors, ensuring long-term performance and cost-effectiveness.

- According to the FMI Corporation (a consulting and investment bank), engineering and construction spending in North America is expected to increase by 2% by the end of 2024.

- Moreover, according to the data released by the United States Census Bureau, the value of private construction for transportation in the United States increased by USD 16.31 billion in 2020 to USD 19.39 billion in 2023.

- Infrastructure projects are expected to increase significantly in developing Asia-Pacific economies, particularly the transport sector, due to increased urbanization and shifting focus from traditional sectors toward emerging secondary industries. In addition, the growing economic prosperity is driving infrastructure financing toward consumer sectors such as transport and manufacturing, where raw materials are provided and sold to consumers.

- The China State Construction Engineering Corporation (CSCEC) signed a total of 4,623 kilometers of new road construction in 2022, up from 4,186 kilometers in 2020. This trend also supports the bitumen market.

- Under NIP, India allocated an investment budget of ~USD 1000 million for infrastructure. India passed a budget to develop several industrial corridors, including the Delhi-Mumbai Industrial Corridor, Amritsar-Kolkata Industrial Corridor, Vizag-Chennai Industrial Corridor, Bengaluru-Chennai Industrial Corridor, and the Bengaluru-Mumbai Industrial Corridor. These projects are expected to be completed by March 2025, which is expected to increase the demand for bitumen in the coming years.

- Owing to all these factors, the bitumen market is likely to grow globally during the forecast period.

Asia-Pacific to Dominate the Market

- The rapid industrialization and urbanization in various countries such as India, China, and other Southeast Asian nations have led to significant investments in infrastructure projects, including roads, highways, airports, and ports, driving the demand for bitumen.

- The construction sector in Asia-Pacific is one of the largest consumers of bitumen, with ongoing residential, commercial, and industrial construction projects fueling the demand for bitumen-based materials such as asphalt for road paving, roofing, and waterproofing.

- China's upcoming 15th Five-Year Plan focuses on new infrastructure projects in transport, energy, water systems, and urban development. The first batch includes about 2,900 projects, including the construction of high-standard farmland in northeast China and the Beijing-Tianjin-Hebei region.

- In India, according to the data published by the Indian Brand Equity Foundation (IBEF), foreign direct investment (FDI) in construction development, such as housing, infrastructure, and construction development projects, was valued at USD 26.35 billion between April 2000 and March 2023.

- The upcoming projects in India that are assumable to increase the demand for bitumen include the Delhi-Mumbai Industrial Corridor, Bharatmala Project, Gujarat International Finance Tec-City (GIFT), Smart City Kochi, and Navi Mumbai International Airport.

- According to the data published by the National Investment Promotion and Facilitation Agency, India has allocated a budget of USD 1.4 trillion for infrastructure for FY 2024. Of this, 24% is for renewable energy, 18% is for roads and highways, 17% is for urban infrastructure, and 12% is for railways.

- The factors mentioned above are expected to increase the demand for bitumen in Asia-Pacific during the forecast period.

Bitumen Industry Overview

The bitumen market is fragmented, with no major players having a dominant share. Some of the major players (not in any particular order) include Exxon Mobil Corporation, Shell, BP PLC, NYNAS AB, and China Petroleum & Chemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Road Construction and Repair Activities

- 4.1.2 Demand from Commercial and Domestic Building Constructions

- 4.2 Restraints

- 4.2.1 Environmental Concerns

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Product Type

- 5.1.1 Paving Grade

- 5.1.2 Hard Grade

- 5.1.3 Oxidized Grade

- 5.1.4 Bitumen Emulsions

- 5.1.5 Polymer Modified Bitumen

- 5.1.6 Other Product Types (Emulsified)

- 5.2 By Application

- 5.2.1 Road Construction

- 5.2.2 Waterproofing

- 5.2.3 Adhesives

- 5.2.4 Other Applications (Industrial Coatings)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Thailand

- 5.3.1.7 Malaysia

- 5.3.1.8 Vietnam

- 5.3.1.9 ASEAN Countries

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Spain

- 5.3.3.7 Turkey

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombian

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BMI Group (Icopal Enterprise ApS)

- 6.4.2 Bouygues Group

- 6.4.3 BP PLC

- 6.4.4 China Petroleum & Chemical Corporation

- 6.4.5 ENEOS Corporation (JXTG Nippon Oil & Energy Corporation)

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 Indian Oil Corporation Ltd

- 6.4.8 Kraton Corporation

- 6.4.9 Marathon Oil Company (Marathon Petroleum LP)

- 6.4.10 NYNAS AB

- 6.4.11 Shell

- 6.4.12 Suncor Energy Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research and Development on Bitumen Processing to Improve Road Infrastructure

- 7.2 Development of High-Performance Bitumen Products