|

市場調查報告書

商品編碼

1630199

可再生能源複合材料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Composite Materials in Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

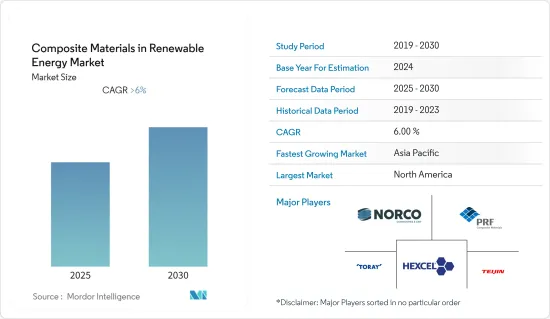

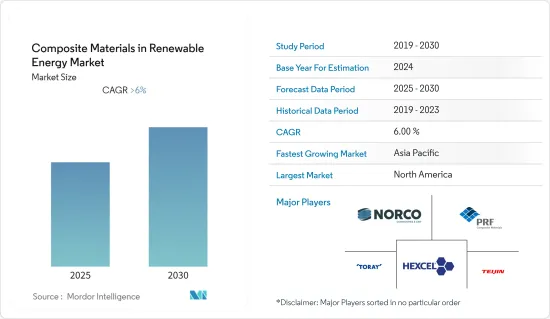

可再生能源複合材料市場預計在預測期內複合年成長率將超過 6%。

由於原料供不應求, COVID-19 對整個行業成長產生了重大影響。然而,全球可再生能源需求的增加推動了疫情後的市場成長。

主要亮點

- 推動市場的主要因素之一是對風力發電機葉片製造的長期需求。

- 然而,對高研發投資的需求阻礙了市場成長。

- 結構生命週期內維護成本的降低預計將為所研究的市場提供顯著的成長機會。

- 北美市場佔有率最高,預計在預測期內將主導市場。

可再生能源複合材料的市場趨勢

風電應用主導市場

- 風能是全球成長最快的能源來源。這一成長的主要驅動力是風力發電成本大幅下降並持續下降,使得競爭逐年加劇。

- 風力發電機葉片製造技術在過去幾年中取得了顯著進展。在渦輪葉片的製造中使用複合材料對於降低成本有重大影響。

- 隨著全球風力發電市場的成長和葉片尺寸的不斷增加,風電場開發商可能需要更多的複合材料來滿足這些需求。

- 許多研究和開發工作也集中在使風力渦輪機葉片更容易回收。 2021 年 9 月,西門子歌美颯推出了 RecyclableBlade,這是世界上第一個用於海上商業用途的可回收風力發電機葉片。

- 美國總統計劃在2030年安裝30GW離岸風力發電。 2021年5月,拜登政府也核准了美國水域首個大型離岸風力發電計劃-位於麻薩諸塞州海岸的800兆瓦葡萄園風電發電工程。

- 2021年,Copower Ocean將建造第一個全尺寸長絲纏繞玻璃纖維增強複合複合材料(GFRP)浮標式波浪能轉換器原型,到2025年將擴大到工業規模的海洋能源發電場。目標是

- 由於上述原因,風電應用可能在預測期內主導市場。

北美市場佔據主導地位

- 可再生能源中使用的複合材料絕大多數在北美生產,其中美國佔據了大部分需求。

- 風電是美國最大的再生能源來源(不包括水力發電),約佔能源消耗的2.5%。

- 此外,對更長渦輪葉片的需求增加將推動複合材料的消費。未來三到五年,離岸風力發電產業預計將在 8-10 MW 渦輪機中使用 300 英尺長的複合材料葉片。

- 美國能源局設定的目標是到2030年美國20%的電力來自風力發電。 2021年,美國風電產業新增風電裝置容量13,413兆瓦,使總裝置容量達到135,886兆瓦。

- 此外,2021年9月,維斯塔斯風力系統公司宣布了訂單為美國290兆瓦風發電工程交付渦輪機的訂單。該計劃的一部分將為密西根州的 Deerfield 2 風電場提供 16 台 6.0 MW 運轉模式的 V162-6.2 MW 渦輪機和一台 5.6 MW 運轉模式的 V150-6.0 MW 渦輪機。

- 此外,為了支持該行業的成長,美國已將聯邦生產稅額扣抵(PTC) 延長五年,以提高市場穩定性。

- 這些因素正在增加該國複合材料的利用率,並且北美地區可能在預測期內主導市場。

可再生能源複合材料產業

可再生能源複合材料市場適度分散,市場佔有率由許多參與者瓜分。市場主要企業包括(排名不分先後)Hexcel Corporation、Teijin Limited、Toray Industries, Inc.、Plastic Reinforcement Fabrics Ltd.、Norco Composites &GRP 等。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進要素

- 與金屬結構相比重量更輕

- 對更長風力發電機葉片的需求增加

- 其他司機

- 抑制因素

- 需要高額研發投入

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 依纖維類型

- 纖維增強聚合物(FRP)

- 碳纖維增強塑膠(CFRP)

- 玻璃纖維增強塑膠(GRP)

- 其他纖維類型

- 按用途

- 太陽能

- 風力

- 水力發電

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- Changzhou Tiansheng New Materials Co. Ltd

- EPSILON Composite Tous droits reserves

- EURO-COMPOSITES

- Evonik Industries AG

- Gurit

- Hexcel Corporation

- JEC GROUP

- Norco Composites & GRP

- Plastic Reinforcement Fabrics Ltd

- Solvay

- Teijin Limited

- Toray Industries, Inc.

第7章市場機會與未來趨勢

- 降低結構生命週期內的維護成本

The Composite Materials in Renewable Energy Market is expected to register a CAGR of greater than 6% during the forecast period.

COVID-19 highly impacted overall industry growth due to the raw material supply shortage. However, increased demand for renewable energy globally propelled the market growth post-pandemic.

Key Highlights

- One of the major factors driving the market is the demand for longer wind turbine blade manufacturing.

- However, the need for high R&D investments is hindering the market's growth.

- Lower maintenance costs over the structure's lifespan are expected to provide a significant growth opportunity for the market studied.

- North America accounts for the highest market share and is expected to dominate the market during the forecast period.

Composite Materials in Renewable Energy Market Trends

Wind Power Application to Dominate the Market

- The wind is the fastest-growing energy source globally. The prime factor for this increase is that the wind energy cost dropped and continues to drop dramatically, making it more competitive each year.

- The technology for manufacturing wind turbine blades significantly progressed over the past years. Using composites in turbine blade manufacturing, highly influences the decrease in cost.

- As the wind energy market grows globally and blade sizes continue to increase, wind farm developers will need more composite materials to help meet these demands.

- Many R&D efforts also focus on making wind blades more recyclable. In September 2021, Siemens Gamesa launched RecyclableBlade, the world's first recyclable wind turbine blade for commercial use offshore.

- The US President planned to deploy 30 GW of offshore wind energy in offshore wind by 2030. In May 2021, the Biden administration also approved the first major offshore wind project in US waters, the 800-MW Vineyard Wind energy project off the coast of Massachusetts.

- In 2021, CorPower Ocean built the first full-scale prototype of its filament-wound glass fiber-reinforced composite (GFRP) buoy-shaped wave energy converters, which the company aims to scale up into industrial-scale ocean energy farms by 2025.

- Due to the above reasons, wind power applications will likely dominate the market studied over the forecast period.

North America to Dominate the Market

- North America dominates the composite materials in renewable energy, with most of the demand coming from the United States.

- Wind power is the largest renewable energy source in the United States (excluding hydroelectricity), accounting for around 2.5% of energy consumption.

- Furthermore, the rising demand for long turbine blades will boost composite material consumption. In the next three to five years, 300-foot-long composite blades on 8 to 10 MW turbines are expected in the offshore wind energy sector.

- The US Department of Energy set an objective that by 2030, 20% of US electricity will be produced from wind energy. In 2021, the United States wind industry installed 13,413 MW of new wind capacity, bringing the cumulative total to 135,886 MW.

- Additionally, in September 2021, Vestas Wind Systems AS announced orders to deliver turbines for 290 MW of wind projects in the United States. Part of this project is supplying 16 units of the V162-6.2 MW turbines in a 6.0 MW operating mode and one V150-6.0 MW machine in a 5.6 MW operating mode for the Deerfield 2 wind farm in Michigan.

- Additionally, to boost the growth of this industry, the United States extended the federal Production Tax Credit (PTC) by five years, thereby creating exceptional market stability.

- These factors above are augmenting the composites' usage in the country, owing to which the North American region is likely to dominate the market studied during the forecast period.

Composite Materials in Renewable Energy Industry Overview

The composite materials in the renewable energy market are moderately fragmented as the market share is divided among many players. Key players in the market include Hexcel Corporation, Teijin Limited, Toray Industries, Inc., Plastic Reinforcement Fabrics Ltd., and Norco Composites & GRP, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Reduced Weight Compared to Metallic Structures

- 4.1.2 Augmenting Demand for Longer Wind Turbine Blades

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Need for High Investments in R&D

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Fiber Type

- 5.1.1 Fiber-Reinforced Polymers (FRP)

- 5.1.2 Carbon-Fiber-Reinforced Polymers (CFRP)

- 5.1.3 Glass-Reinforced Plastic (GRP)

- 5.1.4 Other Fiber Types

- 5.2 Application

- 5.2.1 Solar Power

- 5.2.2 Wind Power

- 5.2.3 Hydroelectricity

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis ** / Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Changzhou Tiansheng New Materials Co. Ltd

- 6.4.2 EPSILON Composite Tous droits reserves

- 6.4.3 EURO-COMPOSITES

- 6.4.4 Evonik Industries AG

- 6.4.5 Gurit

- 6.4.6 Hexcel Corporation

- 6.4.7 JEC GROUP

- 6.4.8 Norco Composites & GRP

- 6.4.9 Plastic Reinforcement Fabrics Ltd

- 6.4.10 Solvay

- 6.4.11 Teijin Limited

- 6.4.12 Toray Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Lower Maintenance Costs over the Lifespan of the Structure