|

市場調查報告書

商品編碼

1630204

客戶自助服務軟體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Customer Self-Service Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

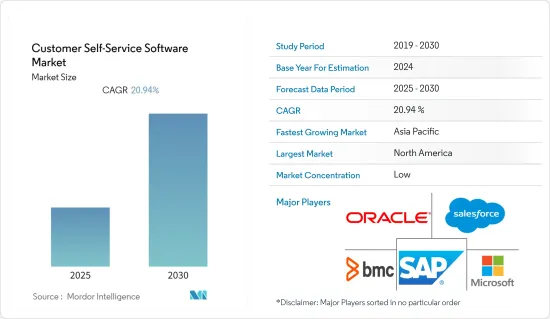

預計客戶自助服務軟體市場在預測期間的複合年成長率為20.94%。

主要亮點

- 越來越多的企業意識到專用、可靠的自助服務入口網站的好處,可以增強其整體品牌形象。自助服務入口網站使客戶即時存取資訊、實現個人化並節省寶貴的時間和組織資源。據 SuperOffice 稱,70% 的客戶現在希望公司網站包含自助服務應用。客製化的知識型自助服務入口網站在增加網站流量方面發揮重要作用。根據 Salesforce 的數據,39% 的千禧世代在有問題時會查看公司的常見問題解答,這表明他們強烈偏好尋找答案。

- 客戶自助服務軟體的主要功能包括在無需人工干預的情況下向用戶提供資訊、幫助最終用戶完成熟悉的任務以及為請求幫助的最終用戶提供持續的支援。許多企業服務台由於人手不足或缺乏立即回答問題的知識而未能滿足所需的期望。因此,公司正在轉向自助服務,使用者可以透過知識庫和自動化任務管理平台自行找到解決方案。

- 數位助理的採用是市場上出現的重要趨勢之一。聊天機器人已成為零售和 BFSI 行業的關鍵自助服務功能。企業正在利用數位虛擬助理來改善客戶體驗。越來越多的公司正在部署支援人工智慧和機器學習的聊天機器人和虛擬助理,以利用關鍵競爭優勢並改善客戶體驗。此外,聊天機器人技術引起了人們的極大興趣,一些公司在客戶關係管理 (CRM) 方面投入了大量資金。

- 然而,客戶可能缺乏意識以及員工不願採用自助服務軟體預計將減緩市場成長。

- 與 COVID-19 大流行相關的景氣衰退導致企業採購標準發生策略轉變,將業務穩定性置於新產品和服務的投資之上。大多數企業在投資自助服務解決方案之前都會三思而後行,因為第三方服務供應商的伺服器和資訊系統中潛在的安全漏洞可能會使客戶隱私面臨風險。然而,在後 COVID-19 市場場景中,與客戶自助服務軟體相關的優勢將在整個預測期內增加對該軟體的需求。

客戶自助服務軟體市場趨勢

雲端服務在零售業的滲透率擴大預計將推動市場成長

- 零售業多年來一直大力採用客戶自助服務解決方案,而這一趨勢預計將持續下去。零售商正在競相採用新技術,自助結帳的採用也不斷成長。自助服務已經進入產品掃描技術,零售巨頭正在擁抱這項技術。

- Jumper.ai 表示,聊天機器人技術不僅僅是零售商的客戶服務工具;它還可以收集獨特的第一方客戶資料。該領域人工智慧的最新趨勢也為該技術提供了發展空間。根據分析公司 Invoca 的數據,近一半 (49%) 的美國消費者對零售業人工智慧技術產生的建議的信任度超過任何其他類型的分析。

- 總部位於美國的 Zappix 提供雲端基礎的數位自助服務解決方案,利用視覺 IVR 的速度和機器人流程自動化 (RPA) 的便利性來提供增強的客戶體驗。該公司聲稱其零售解決方案的好處包括減少座席呼叫、降低客服中心成本、改善客戶體驗、重複流程自動化、有針對性的收益成長機會以及即時座席價值,這包括減少每次呼叫的平均處理時間,使您能夠專注於大批量查詢。

- Zappix 還表示,其解決方案可以與 CRM、訂單管理系統和其他後端系統整合,將客戶與零售商直接聯繫起來。該公司還提供 Zappix Actionable Analytics,可追蹤客戶旅程並提供分析消費者行為和趨勢的報告。對自助服務解決方案的需求持續成長,其他零售商預計也會跟進。

- 根據 Flexera Software 進行的一項研究,大約 46% 的受訪者將在 2022 年在 Amazon Web Services (AWS) 上運行關鍵工作負載,45% 的受訪者已經在 Azure 上運行關鍵工作負載。因此,由於全球範圍內運行應用程式的公共雲端平台服務的整體使用量迅速增加,客戶自助服務軟體市場在預測期內可能會出現指數級成長。

北美市場佔有率最大

- 北美市場佔有率最大,主導客戶自助服務軟體市場。這是由於社交媒體的盛行、自助服務軟體供應商數量的增加以及自助服務解決方案的高度雲端基礎的部署。據估計,消費者擴大採用網路自助服務解決方案和行動裝置也將推動未來幾年北美市場的成長。此外,幾家領先的客戶自助服務軟體公司的出現也有望支持市場發展。

- 總部位於美國的 Big Fish Games 使用自動化 SmartAssistant,利用來自客戶網路會話的資訊(包括搜尋的關鍵字)來提供 360° 個人化服務。透過這種方法,Big Fish Games 將客戶滿意度提高到約 94%,自助服務網路率達到 96.4%,並節省了 87 萬美元。最近的 COVID-19 疫情進一步擴大了零售業客戶自助服務解決方案的範圍和採用。例如,沃爾瑪在加拿大的 22 家商店推出了自助掃描經銷店。

- Walgreens drugstore.com 在 Facebook 和 Twitter 上提供網路自助服務。在線上搜尋和購物的客戶可以與代理商聊天,了解產品搜尋、問題解決和促銷資訊。透過這項策略,該公司的訂單數量增加了 20%,並透過電話偏轉節省了約 35 萬美元。

- 此外,美國國際連鎖便利商店 7-11 在 Facebook Messenger 上提供聊天機器人,以改善客戶體驗。該聊天機器人不僅使用驅動自動化的人工智慧與客戶對話,還允許用戶註冊 7Rewards 客戶忠誠度計畫、搜尋附近有折扣和宣傳活動的商店等等。

- 領先的本地公司已經在實施人工智慧作為其數位轉型的一部分。例如,摩根大通、美國銀行和第一資本等銀行服務供應商已經推出了聊天機器人形式的虛擬助理。他們還成功簡化了勞動力管理等後端業務,從而降低了高成本。

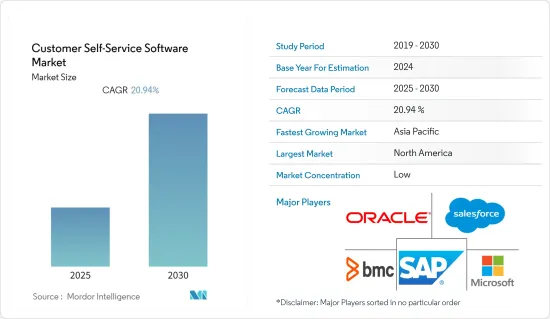

客戶自助服務軟體產業概述

由於 ATM、自助服務終端和自動販賣機等自助服務的增加,客戶自助服務軟體市場變得碎片化。對軟體的需求也在增加,這使得它成為許多公司以其產品進入的有吸引力的市場。此外,許多公司正在提供解決方案來滿足消費者的需求。研究市場的主要企業包括 Oracle Corporation、Salesforce.Com Inc.、SAP SE、Microsoft Corporation、BMC Software Inc. 和 Verint Systems Inc.。

2022 年 12 月,現代分析雲 ThoughtSpot 和分析工程先驅 dbt Labs 宣佈建立正式合作夥伴關係,將自助分析引入現代資料堆疊。這項新的合作關係是近幾個月來的最新合作夥伴關係,旨在為 Huel、Loan Market Group、TotallyMoney、Chick-fil-a、Roche、Nasdaq 和 GoSharing 等共用客戶帶來切實的商業價值。

2022 年 5 月,Savant 宣布與資料雲公司 Snowflake 建立技術合作夥伴關係。我們與 Snowflake 的合作將使我們的共同客戶能夠從 Snowflake 獲得各種關鍵業務洞察,而無需 BI 或工程團隊的參與。此次夥伴關係將有助於推進 Savant 的使命,即為企業領導者隨時隨地提供所需的見解和資料。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 雲端服務擴充

- 網路安全和隱私的需求不斷成長

- 市場限制因素

- 市場監理的演變

第6章 市場細分

- 按發展

- 雲

- 本地

- 透過提供

- 解決方案

- 基於網路的

- 移動基地

- 按服務

- 解決方案

- 按最終用戶產業

- BFSI

- 衛生保健

- 零售

- 政府機構

- 資訊科技/通訊

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Oracle Corporation

- Salesforce.Com Inc.

- SAP SE

- Nuance Communications Inc.

- BMC Software Inc.

- Microsoft Corporation

- Verint Systems Inc.

- Zappix Inc

- Zendesk Inc

- Zoho Corporation Pvt. Ltd

第8章投資分析

第9章 市場的未來

The Customer Self-Service Software Market is expected to register a CAGR of 20.94% during the forecast period.

Key Highlights

- An increasing number of organizations now understand the benefits of reliable and dedicated self-service portals for enhancing the company's overall brand image. Self-service portals provide customers instant access to information, allow personalization, and save valuable time and organizational resources. According to SuperOffice, 70% of customers now expect a company's website to include a self-service application. The customized knowledge-based self-service portal plays a significant role in bringing in more website traffic. According to Salesforce, 39% of millennials check a company's FAQ when they have a question, showing a strong preference for finding answers.

- Some of the significant features of customer self-service software are it provides information to users without human interaction, assists end-users in completing familiar tasks, and provides continuous support to end-users seeking assistance. Most of the company helpdesks fail to deliver the required expectations, either due to being short-staffed or a lack of knowledge to answer a question immediately. Hence companies adopt these self-services, which help users find solutions themselves, often through a knowledge base or automated task management platform.

- The adoption of digital assistants is one of the significant trends emerging in the market. In the Retail and BFSI industry, chatbots have become a primary self-service feature. The companies utilize digital virtual assistants to enhance the customer experience. More companies are implementing AI- and ML-enabled chatbots and virtual assistants to leverage vital competitive advantages and improvise customer experiences. Further, chatbot technology is gaining much interest, with several companies investing significantly in Customer Relationship Management (CRM).

- However, it is projected that a potential lack of customer awareness and employee reluctance to implement self-service software will somewhat constrain market growth.

- The COVID-19 pandemic-related economic downturn led to a strategic shift in the purchasing criteria used by businesses, as they began putting business stability ahead of investing in new products and services. Before investing in self-service solutions, most companies think twice since any potential security holes in their third-party service providers' servers and information systems can jeopardize their clients' privacy. However, in the post-COVID-19 market scenario, owing to the benefits associated with customer self-service software, the demand for the software will increase throughout the forecast period.

Customer Self-Service Software Market Trends

Increased Penetration of Cloud Services in the Retail sector is Expected to Drive the Market Growth

- The retail sector has been a significant adopter of customer self-service solutions for many years, and the trend is also expected to continue in the coming years. Retail companies are vying to deploy new technologies and are witnessing the growing adoption of self-service checkouts. Self-service has already made inroads in product-scanning technology, which retail majors are incorporating.

- According to Jumper.ai, chatbot technology isn't just a customer service tool for retailers, as it also can collect unique first-party customer data. The recent trend of AI in the sector is also developing space for technology. According to analytics firm Invoca, nearly half (49%) of US consumers trusted advice generated by AI technology in the retail category more than any other type analyzed.

- US-based Zappix offers cloud-based digital self-service solutions that leverage the speed of Visual IVR and the convenience of Robotic Process Automation (RPA) to provide enhanced customer experiences. Some of the claimed benefits of the solutions for retailers mentioned by the company are reduced calls to agents, lower contact center costs, enhanced customer experience, automation of repetitive processes, targeted revenue growth opportunities, enabling live agents to focus on high-value queries, and shorter average handling times per call, among others.

- Zappix also claims that its solution can be integrated with any CRM, Order Management System, and other back-end systems to connect customers directly to the retailer. The company also offers Zappix Actionable Analytics which tracks the customer journey and provides reports analyzing consumer behavior and trends. With other retail companies expected to follow suit, the demand for self-service solutions is poised to increase.

- As per a survey conducted by Flexera Software, in 2022, about 46% of respondents are running significant workloads on Amazon Web Services (AWS), and 45% are already running significant workloads on Azure. Thus, with the surge in the overall utilization of public cloud platform services running applications throughout the globe, the Customer Self-Service Software Market will witness an exponential growth rate during the predicted period.

North America Contributes to Maximum Market Share

- North America has the largest market share and dominates the customer self-service software market. This is due to the rising social media penetration, significant self-service software vendors, and high cloud-based deployment of self-service solutions. The increasing penetration of web self-service solutions and mobile among consumers is also estimated to encourage the growth of the North American market in the next few years. Additionally, the presence of several leading customer self-service software players is anticipated to supplement the development of the market studied.

- US-based Big Fish Games uses an automated SmartAssistant that leverages information from the customer's web session (including keywords searched) to offer a 360° personalized service. Using this approach, Big Fish Games has increased customer satisfaction to about 94%, achieved a self-service web rate of 96.4%, and saved USD 870,000. The recent COVID-19 outbreak further expanded the scope and adoption of customer self-service solutions in the retail industry. For instance, in its 22 Canadian stores, Walmart has deployed self-scanning outlets.

- Walgreen's Drugstore.com offers web self-service on Facebook and Twitter. Customers who search and shop online can chat with an agent to find products, resolve issues, and learn about promotions. With this strategy, the company has raised order sizes by 20% and saved around USD 350,000 through call deflection.

- Also, 7-Eleven Inc., an American international chain of convenience stores, offers a chatbot on Facebook Messenger to enhance the customer experience. The chatbot converses with the customers, using AI that powers automation, but also lets the users sign up for the 7Rewards customer loyalty program and find a nearby store with available discounts and promotions.

- Major regional companies have already embraced AI as a part of their digital transformation. For instance, banking service providers, like JP Morgan Chase, Bank of America, and Capital One, have already deployed virtual assistants in the form of chatbots. They have also successfully streamlined their back-end operations, such as workforce management, thereby saving high costs.

Customer Self-Service Software Industry Overview

The customer self-service software market is fragmented due to the rise in self-service, like ATMs, kiosks, and vending machines. The need for software is also increasing, which makes the market attractive for many companies to enter with their product offerings. Moreover, many players are offering solutions catering to the need of the consumers. Some key players in the market studied are Oracle Corporation, Salesforce.Com Inc., SAP SE, Microsoft Corporation, BMC Software Inc., and Verint Systems Inc., among others.

In December 2022, ThoughtSpot, the Modern Analytics Cloud company, and dbt Labs, a pioneer in analytics engineering, declared a formal partnership to bring self-service analytics to the modern data stack. The new alliance builds on the two companies' main work in recent months to create robust integrations that can provide tangible business value to shared customers such as Huel, Loan Market Group, TotallyMoney, Chick-fil-a, Roche, Nasdaq, and GoSharing.

In May 2022, Savant announced a technology partnership with Snowflake, the data cloud company, for self-service Analytics that allows joint customers to extract various key operational insights from Snowflake, without involving their BI and engineering teams. This partnership helps in the advancement of Savant's mission to make insights and data available to business leaders when and where they're needed.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Penetration of Cloud Services

- 5.1.2 Growing Demand for Network Security and Privacy

- 5.2 Market Restraints

- 5.2.1 Evolving Market Regulations

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Offering

- 6.2.1 Solution

- 6.2.1.1 Web-based

- 6.2.1.2 Mobile-based

- 6.2.2 Service

- 6.2.1 Solution

- 6.3 By End-User Industry

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Retail

- 6.3.4 Government

- 6.3.5 IT and Telecommunication

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 Salesforce.Com Inc.

- 7.1.3 SAP SE

- 7.1.4 Nuance Communications Inc.

- 7.1.5 BMC Software Inc.

- 7.1.6 Microsoft Corporation

- 7.1.7 Verint Systems Inc.

- 7.1.8 Zappix Inc

- 7.1.9 Zendesk Inc

- 7.1.10 Zoho Corporation Pvt. Ltd