|

市場調查報告書

商品編碼

1630211

混合整合平台:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Hybrid Integration Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

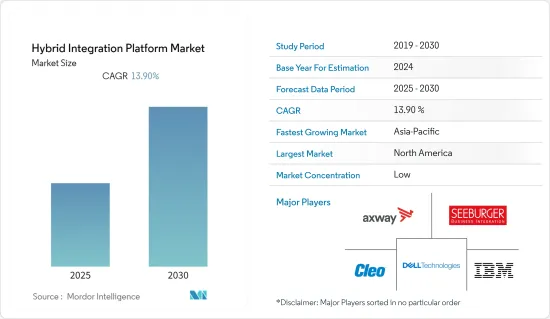

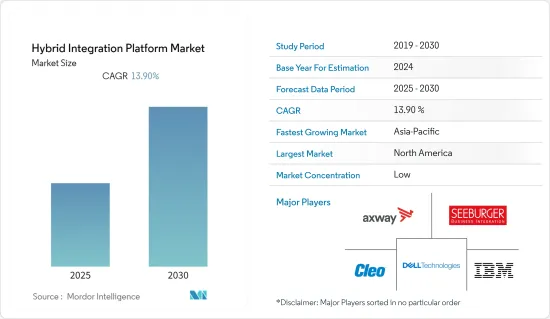

混合整合平台市場預計在預測期內複合年成長率為 13.9%。

主要亮點

- 近年來,對混合雲端的需求不斷增加,因此需要混合整合平台來確保成功部署。透過成功的混合雲端部署實現的成本節約和擴充性正在增強跨行業組織的能力。因此,業內其他公司也計劃利用這一點並擴大該技術的使用。

- 混合整合平台透過 BYOD(企業行動)和巨量資料連接企業、客戶和供應商之間的網路,從而實現本地和雲端基礎的應用程式的整合。因此,混合整合平台的採用正在增加。推動混合整合平台需求的另一個關鍵因素是對雲端基礎的應用程式、資料和服務的需求不斷成長。

- 為了最大限度地實現工業數位化,各行業擴大採用雲端基礎的解決方案是推動工業混合整合平台市場在預測期內成長的關鍵因素。世界各國政府都在數位化方面投入巨資,以提高工作效率和彈性。許多公司擔心不同雲端環境之間的互通性和資料安全性。這種安全需求正在推動對混合整合平台的需求。

- 然而,與開放原始碼整合和互通性相關的高風險被認為是採用混合整合平台的主要限制。隨著企業環境的發展,對混合雲端解決方案和服務的需求不斷增加。企業目前面臨著利用資料庫中的巨量資料來獲得競爭優勢的挑戰。因此,企業被迫適應混合雲端服務。一些最終用戶(例如 BFSI 和醫療保健)正在選擇混合服務,而不是完全切換到雲端。這些採用策略正在為市場上的混合整合平台創造機會。

根據分析,在COVID-19大流行期間,引入用於患者治療和管理的虛擬解決方案是醫療保健行業混合整合平台成長的關鍵驅動力。疫情過後,由於各種終端用戶數位化程度的提高,市場大幅成長。混合雲提供了高可用性、擴充性、業務永續營運、容錯、災害復原、自動軟體更新和靈活性等基本功能。隨著各公司對雲端採用的興趣日益濃厚,隨著時間的推移,許多新功能和服務不斷湧現。

混合整合平台市場趨勢

混合雲端的採用增加推動市場成長

- 該地區的企業正在遷移到雲端,以獲得敏捷性、業務創新、成本效率、擴充性和快速反應能力等優勢。最重要的是,企業正在使用多個雲端。例如,您可以使用銷售團隊作為 CRM 和行銷雲,並使用 AWS 作為開發雲。

- 在金融和醫療保健等具有嚴格合規標準的行業中,公司正在使用公共、本地伺服器和私有雲端解決方案的組合來滿足法規合規性和資料安全措施的要求。

- 連接本地和雲端應用程式以推動數位業務轉型的需求不斷成長,可能會影響未來幾年混合整合平台市場的成長。

- 據 Flexera Software 稱,截至 2022 年 3 月,80% 的企業受訪者表示他們已經部署了混合雲端。在大多數情況下,遷移到混合雲端解決方案意味著同時運行私有雲端公共雲端。

- 開發「企業用戶」友善的混合整合平台服務和功能來解決業務問題也有望推動混合整合平台市場的成長。此外,對混合雲的需求正在成長,政府可能會頒布立法來增加對混合整合平台的需求,從而推動市場向前發展。

- 此外,去年 3 月,羅傑斯和微軟宣布了一項為期五年的策略合作,幫助企業、中小企業利用混合工作和支援 5G 的解決方案來加速數位化和全面數位化。羅傑斯選擇 Microsoft Azure 作為其基礎架構和技術工作負載的策略雲。該公司利用 Azure 的公共雲端功能來推動創新,實現新的客戶體驗,並使員工能夠在整個企業內更靈活地協作。

亞太地區預計將成為成長最快的市場

- 由於雲端服務採用率的增加和有利的政府法規,預計亞太地區在預測期內將顯著成長。

- 由於混合雲端的使用增加、先進的數位化以及最終用戶行業組織支出的增加,簡化了複雜的資訊儲存過程,亞洲市場正在迅速擴張。

- 根據 NASSCOM 的數據,上年度印度的軟體即服務投資以 17 億美元排名第二。企業和其他組織正在增加對混合雲端服務的投資,因為他們需要在封鎖期間在線上工作,而且由於冠狀病毒的爆發,他們無法經常出差。

- 亞太地區的公司正在積極尋求策略聯盟和收購。去年1月,全球領先的IT基礎設施服務供應商之一Kindril與日本領先的解決方案整合商之一TIS建立策略合作夥伴關係,以加速其客戶的數位轉型。 Kindler 和 TIS 將共同開發加速企業自動化和現代化的營運工具,包括自動化和遠端控制工具的修補程式和更新,以有效且有效率地支援高品質的營運服務。此外,Kindler和TIS擁有廣泛的IT資源,包括資料中心、大型主機和多樣化的雲端環境,將共同最佳化IT資源和專家,為客戶開發最佳的基礎架構。

- 此外,去年10月,提供邊緣雲端服務的Zadara與提供網路基礎設施服務的KINX Inc.達成策略夥伴關係,透過KINX向韓國市場提供儲存即服務。 KINX 的 CloudHub 配置為專用網路,是韓國最大的雲端平台,連接九家主要雲端服務供應商。 CloudHub建置安全可靠、功能豐富且高度可用的多重雲端和混合雲端解決方案。 KINX 的多重雲端和混合雲端系統將受益於 Zadara zStorage 儲存服務。

混合整合平台產業概況

混合整合平台市場高度分散,主要企業包括 Axway Software、Cleo Communications, Inc、Dell Technologies、Seeburger AG 和 IBM Corporation。此外,混合整合平台正在各個行業中使用,為供應商提供了成長機會。市場參與者利用夥伴關係、合併、投資、創新和收購來改進他們的產品並獲得永續的競爭優勢。

2022 年 10 月,微軟和 Meta 合作,為未來的工作和娛樂打造身臨其境型體驗。 Meta Quest 裝置上提供的 Microsoft 365 程式可讓使用者將他們最喜歡的生產力工具(如 Word、Excel、PowerPoint、Outlook 和 SharePoint)中的資料帶入虛擬實境。未來,Meta Quest 裝置將能夠使用 Windows 365,允許使用者使用自己的程式、內容和偏好來串流 Windows 雲端 PC。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 對市場的影響

第5章市場動態

第6章 市場促進因素

- BYOD 採用率增加

- 混合雲端的採用率提高

第7章 市場限制因素

- 與開放原始碼整合相關的風險

第8章市場區隔

- 按組織規模

- 主要企業

- 小型企業

- 按最終用戶產業

- BFSI

- 政府/國防

- 衛生保健

- 零售

- 資訊科技和電訊

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第9章 競爭格局

- 公司簡介

- Axway Software

- Cleo Communications, Inc.

- Dell Technologies

- Seeburger AG

- IBM Corporation

- Microsoft Corporation

- MuleSoft LLC(Salesforce.com)

- Oracle Corporation

- SnapLogic Inc.

- Software AG

- TIBCO Software Inc.

- Talend Inc.

- Elastic.io

第10章投資分析

第11章市場的未來

The Hybrid Integration Platform Market is expected to register a CAGR of 13.9% during the forecast period.

Key Highlights

- The demand for hybrid cloud in recent years has gained traction, as has the need for hybrid integration platforms for its successful deployment. The cost savings and scalability achieved by the successful deployment of hybrid clouds have increased the competencies of organizations across industries. So, the other companies in the industry also plan to use this to expand the use of the technology.

- Hybrid integration platforms connect the network between enterprises, customers, and suppliers via BYOD (enterprise mobile) and big data, allowing on-premises applications to integrate with cloud-based applications. As a result, hybrid integration platform adoption is increasing. Another important element driving demand for hybrid integration platforms is the growing need for cloud-based apps, data, and services.

- The increasing deployment of cloud-based solutions across various sectors to maximize industrial digitalization is a significant driving factor for the growth of the industrial hybrid integration platform market throughout the forecast period. Various governments throughout the globe are investing heavily in digitalization to improve job efficiency and flexibility. Many companies are concerned about interoperability across different cloud environments and data security. This security need drives the demand for hybrid integration platforms.

- However, the high risks associated with open-source integration and interoperability are considered major restraints for adopting hybrid integration platforms. The demand for hybrid cloud solutions and services has increased as the enterprise environment has evolved. Organizations are currently facing the challenges of utilizing big data in their databases for competitive advantage. It has pushed enterprises to adapt to hybrid cloud services. Some end users, such as BFSI and healthcare, choose hybrid services instead of completely switching to the cloud. Such adoption measures have created an opportunity for the hybrid integration platform in the market.

During the COVID-19 pandemic, deploying virtual solutions for treating and managing patients was analyzed as a significant driving factor for the growth of the hybrid integration platform in the healthcare sector. After the pandemic, the market grew significantly with increased digitization among various end users. The hybrid cloud provided essential features like high availability, scalability, business continuity, fault tolerance, disaster recovery, automatic software updates, flexibility, etc. With the growing interest in cloud adoption by various enterprises, many new features and services have emerged over time.

Hybrid Integration Platform Market Trends

Increasing Adoption of Hybrid Cloud Drives the Market Growth

- Enterprises across regions are switching to the cloud to benefit in terms of agility, operational innovation, cost-effectiveness, scalability, and the ability to respond faster. Most importantly, enterprises use more than one cloud. For example, they might use Salesforce for CRM and marketing clouds and AWS for the development cloud.

- In industries like finance and healthcare, where compliance standards are rigid, enterprises often have a mix of public, on-premise servers and private cloud solutions, owing to the regulatory compliance and data security measures they must adhere to.

- The growing need to connect on-premises and cloud applications to drive digital business transformation is probably going to have an impact on the growth of the hybrid integration platform market over the next few years.

- According to Flexera Software, as of March 2022, 80 percent of enterprise respondents stated they had implemented a hybrid cloud in their organizations. Most of the time, moving to hybrid cloud solutions means running both private and public clouds at the same time.

- Developing "business user"-friendly hybrid integration platform services and capabilities to tackle business difficulties is also expected to boost the hybrid integration platform market's growth. Also, the need for a hybrid cloud is growing, and the government is likely to pass laws that will increase the demand for hybrid integration platforms, which will move the market forward.

- Furthermore, in March last year, Rogers and Microsoft announced a five-year strategic collaboration to assist large, small, and medium-sized company clients in accelerating digitization and entirely using hybrid work and 5G-enabled solutions. Rogers has chosen Microsoft Azure as its strategic cloud for infrastructure and technology workloads. The company would use Azure's public cloud capabilities to drive innovation, unleash new customer experiences, and empower workers to collaborate more agilely throughout the enterprise.

Asia Pacific is Expected to be the Fastest Growing Market

- Asia-Pacific is expected to expand at a significant rate over the forecast period, owing to the high adoption of cloud services and favorable government regulations.

- With the rising use of hybrid clouds, high digitalization, and increasing expenditure by organizations in end-user industries, the market is quickly expanding in Asia, easing the complicated process of storing information.

- According to NASSCOM, software-as-a-service investment in India would have come in second with USD 1.7 billion in the previous year. Infrastructure-as-a-service investment would have reached USD two billion.Businesses and other organizations are investing more in hybrid cloud services because they need to work online during the lockdown and can't travel as much because of the coronavirus outbreak.

- In the Asia-Pacific region, companies actively make strategic partnerships and acquisitions. In January last year, Kyndryl, one of the major global providers of IT infrastructure services, announced that it was expanding its strategic relationship with TIS, one of the leading Japanese solution integrators, for the Japanese market, intending to expedite clients' digital transformation. Kyndryl and TIS would work together to develop operational tools to encourage corporate automation and modernization, such as automation tools and remote-control tool patches and updates that can effectively and efficiently support high-quality operational services. Furthermore, with a wide range of IT resources, such as data centers, mainframes, and varied cloud environments, Kyndryl and TIS collaborate to optimize IT resources and specialists to develop the best infrastructure for clients.

- Furthermore, in October last year, Zadara, a provider of edge cloud services, announced a strategic partnership with KINX Inc., a provider of internet infrastructure services, to provide its zStorage, storage-as-a-service, to the Korean market via KINX's CloudHub. KINX's CloudHub, configured as a private network, is Korea's biggest cloud platform, connecting nine of the main cloud service providers. CloudHub creates multi-cloud and hybrid cloud solutions that are safe, secure, versatile, and highly available. KINX's multi-cloud and hybrid cloud systems would benefit from Zadara zStorage storage services.

Hybrid Integration Platform Industry Overview

The hybrid integration platform market is highly fragmented, with significant players like Axway Software, Cleo Communications, Inc., Dell Technologies, Seeburger AG, and IBM Corporation. Moreover, a hybrid integration platform is used in various industries to provide vendors with growth opportunities. Players in the market are using partnerships, mergers, investments, innovations, and acquisitions to improve their products and gain a competitive edge that will last.

In October 2022, Microsoft and Meta partnered to create immersive experiences for the future of work and play. Microsoft 365 programs are available on Meta Quest devices, allowing users to engage with material from their favorite productivity tools such as Word, Excel, PowerPoint, Outlook, and SharePoint in virtual reality. In the future, Meta Quest devices will be able to use Windows 365, and users will be able to stream a Windows Cloud PC with their own programs, content, and preferences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

6 Market Drivers

- 6.1 Increasing Adoption of BYOD

- 6.2 Increasing Adoption of Hybrid Cloud

7 Market Restraints

- 7.1 Risks Involved in Open Source Integration

8 MARKET SEGMENTATION

- 8.1 By Organization Size

- 8.1.1 Large Enterprises

- 8.1.2 Small- and Medium-size

Enterprises (SME)

- 8.2 By End-User Industry

- 8.2.1 BFSI

- 8.2.2 Government and Defense

- 8.2.3 Healthcare

- 8.2.4 Retail

- 8.2.5 IT and Telecom

- 8.2.6 Other End-User Industries

- 8.3 Geography

- 8.3.1 North America

- 8.3.2 Europe

- 8.3.3 Asia Pacific

- 8.3.4 Rest of the World

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Axway Software

- 9.1.2 Cleo Communications, Inc.

- 9.1.3 Dell Technologies

- 9.1.4 Seeburger AG

- 9.1.5 IBM Corporation

- 9.1.6 Microsoft Corporation

- 9.1.7 MuleSoft LLC (Salesforce.com)

- 9.1.8 Oracle Corporation

- 9.1.9 SnapLogic Inc.

- 9.1.10 Software AG

- 9.1.11 TIBCO Software Inc.

- 9.1.12 Talend Inc.

- 9.1.13 Elastic.io