|

市場調查報告書

商品編碼

1685680

混合雲端:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Hybrid Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

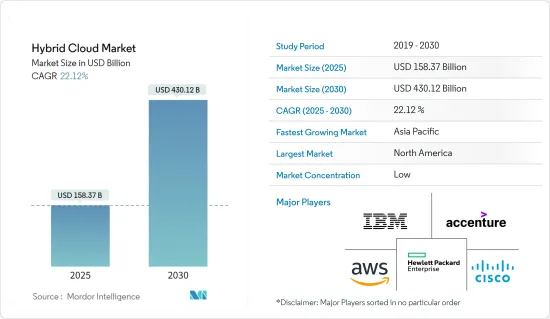

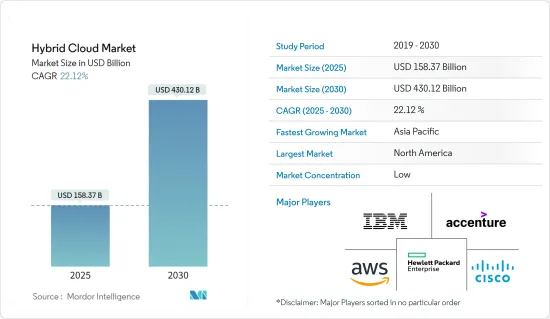

混合雲端市場規模在 2025 年估計為 1583.7 億美元,預計到 2030 年將達到 4301.2 億美元,在市場估計和預測期(2025-2030 年)內以 22.12% 的複合年成長率成長。

雲端運算和工業服務的成長,以及傳統資料中心外包的衰落,證明了向混合基礎設施服務的重大轉變。相較之下,傳統的DCO市場正在萎縮,而對主機託管、基礎設施和公用事業服務的投資正在增加。預計這將導致向雲端基礎設施和託管即服務的轉變。由於這些優勢,混合雲端部署在雲端市場中佔據越來越大的佔有率。

主要亮點

- 近年來,與其他雲端運算服務相比,混合雲端市場整體經歷了強勁成長。擁有大量資料和需要處理請求的組織可以從混合雲端中受益。

- 當企業需要釋放本地資源以儲存更敏感的資料和應用程式時,混合雲端允許他們擴展運算能力,從而無需投入大量資金來滿足短期需求高峰。

- 混合雲端允許企業將其內部部署基礎設施擴展到公有公共雲端,以滿足資訊和處理需求的潛在激增,而無需將其整個資料集暴露給第三方資料中心存取。由於擔心資料安全而最初不願採用此類解決方案的最終用戶現在可以從這些發展中受益。

- 雲端服務要求企業適應這些資源的臨時消耗,而不是不斷購買、編程和維護其他資源和設備。這使得公司可以削減那些不產生利潤的成本。

- 此外,公共部門組織擴大採用超大規模雲,它提供資料中心現代化、統一營運、安全、管理和應用創新等好處。混合雲端支援這些需求。此外,雲端運算還允許政府機構滿足週期性和緊急需求,而不會超出硬體消費量。

- 隨著企業不斷將應用程式和工作負載轉移到混合多重雲端環境,整合和管理的複雜性可能會阻礙市場成長。

- 面對新冠肺炎疫情,出於公共衛生考慮,全球許多國家都強制要求在家工作,因此需要可遠端存取的工作設施。虛擬服務需求的不斷成長、政府人員重組的長期潛力、提供適應性和動態監管模式的需要,再加上公民對這些服務交付的期望不斷提高,都是虛擬服務需求不斷成長的結果。

混合雲端市場趨勢

銀行、金融、服務和保險 (BFSI) 行業佔據市場的大部分佔有率

- 銀行業正在採用混合雲端模式,將關鍵的業務流程和應用程式轉移到私有雲端以提高安全性。此外,非關鍵應用程式正在遷移到公共雲端,以提高靈活性和成本效率。

- 銀行的IT支出很大一部分主要用於維護遺留技術以及管理和維護不同的系統,這迫使銀行投資於結合私有雲端和公共雲端服務的混合雲端解決方案,目的是實現更高可擴展性和跨不同系統的整合度。

- 混合雲端也擴大被採用來應對這一領域的挑戰。這些挑戰包括無卡交易的增加、多個銀行分店的數位化、向遠端工作系統的過渡以及對線上文件的需求。

- 業務的混合雲端轉型降低了成本,提高了效率,並使銀行能夠更好地控制客戶,從而推動了混合雲端在 BFSI 行業的發展。

- 全球 BFSI 產業混合雲端的成長是由消費者對混合雲端的偏好變化、數位化顛覆的增加以及邊緣運算、物聯網 (IoT) 和人工智慧整合等技術進步所推動的。然而,由於銀行業和金融科技產業對提升運算能力的需求增加,COVID-19 疫情導致全球 BFSI 市場混合雲端激增。

北美佔據主要市場佔有率

- 預計北美將佔據混合雲端市場的大部分佔有率。該地區的許多公司正在尋求提供公共雲端以外的服務。我們正在進入一個新時代,IT服務旨在將政府、產業和傳統基礎設施結合在一起。為了改善業務和服務客戶,這些公司正在採用混合雲端策略。

- 北美率先推行自帶裝置 (BYOD) 文化,推動了 BYOD 的廣泛採用。因此,企業開始擺脫傳統的雲端模型並轉向混合雲,使用私有雲端雲來確保敏感的業務資訊的安全,同時根據需要為員工提供基於公共雲端解決方案的更多應用程式存取權限,以滿足需要現場存取的特定應用程式的需求。這一趨勢已被證實有助於提高生產力,預計在預測期內將繼續並擴大。 BYOD 趨勢在加拿大公司中也變得越來越普遍。由於平板電腦和智慧型手機將更頻繁地用於存取關鍵業務訊息,預計 BYOD 在該國的擴張將對混合雲端市場在預測期內產生積極影響。

- 此外,COVID-19 疫情加速了美國各行各業公司對雲端運算的採用。許多優先採用雲端運算的美國公司指出,疫情只會讓雲端運算變得更加重要。

- 此外,為了擴大消費群並滿足各種應用的需求,重要的公司也正在與其他公司合併並投資新計畫。例如,2023 年 5 月,IBM 宣布推出混合雲網格 (Hybrid Cloud Mesh),這是一款軟體即服務 (SaaS),可協助企業管理其混合多重雲端基礎架構。為了幫助現代企業跨混合多重雲端和異質環境營運基礎架構,IBM Hybrid Cloud Mesh 基於「以應用程式為中心的連接」構建,可自動執行公共雲端和私有雲端之間應用程式流量的流程、管理和可觀察性。

- 總體而言,靈活性、資料安全性、降低成本、數位轉型、增強分析和特定產業要求的需求是推動北美混合雲端市場發展的一些關鍵因素。由於這些原因,企業被迫轉向混合雲端解決方案來平衡靈活性、控制力和創新性。

混合雲端產業概覽

混合雲端產業高度分散,有多個重要的競爭對手。目前,只有少數幾家大公司在市場佔有率上佔據主導地位。這些市場領導專注於擴大海外消費群。這些公司正在聯合採取策略性措施來增加市場佔有率和盈利。該公司還透過收購一家專門從事混合雲端運算技術的新興企業來增強其產品能力。主要市場參與者包括Cisco公司、惠普企業公司、亞馬遜網路服務公司 (亞馬遜)、Accenture公司和 IBM 公司。

- 2023 年 3 月,Flexera 宣布 Flexera One FinOps 全面上市。此解決方案加強了IT資產管理(ITAM)和FinOps的整合,同時有助於增強企業的FinOps和中央雲端團隊的能力,大大改善了雲端使用和收費的檢視和分配方式,有效地管理大型混合IT設施,並使他們能夠運作自己的私有雲端。

- 2023年3月,NTT通訊株式會社宣布,將作為其商業共同創造計劃「智慧世界的OPEN HUB」的一部分,啟動一項涉及職場虛擬世界的計劃,旨在為所有人,包括那些在工作場所和時間上受到限制的人,擴大可能性。它還計劃鼓勵解決日本勞動人口減少等問題。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

第5章 市場動態

- 市場促進因素

- 雲端服務與現有系統之間的互通性標準需求日益增加

- 隨著企業數位化,提高業務績效和投資收益

- 市場挑戰

- 合規性問題、遷移複雜性、安全風險

- 評估新冠肺炎疫情對市場的影響

第6章 市場細分

- 按類型

- 解決方案

- 服務

- 按最終用戶產業

- 政府及公共機構

- 衛生保健

- 銀行、金融、服務和保險 (BFSI)

- 零售

- 資訊和通訊技術

- 媒體與娛樂

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- Hewlett Packard Enterprise Company

- Amazon Web Services(Amazon Inc.)

- Accenture PLC

- IBM Corporation

- Alibaba Cloud(Alibaba Group Holding Limited)

- Rackspace Technology Inc.

- Oracle Corporation

- Google LLC

- Equinix Inc.

- VMware Inc.

- Panzura Inc.

- Flexera Software LLC

- Dell EMC(Dell Technologies Inc.)

- Intel Corporation

- Fujitsu Ltd

- NTT Communications Corporation

- DXC Technology Company

- Lumen Technologies Inc.

- Microsoft Corporation

第8章投資分析

第9章:市場的未來

The Hybrid Cloud Market size is estimated at USD 158.37 billion in 2025, and is expected to reach USD 430.12 billion by 2030, at a CAGR of 22.12% during the forecast period (2025-2030).

A major shift towards hybrid infrastructure services is apparent from the growth of cloud computing and industrial service, as well as a drop in traditional data center outsourcing. Compared to this, the conventional DCO market is shrinking, with investments in colocation and hosting as well as an increase in infrastructure utility services. This is expected to drive the shift to cloud infrastructure as a service and hosting. As a result of its advantages, hybrid cloud deployment continues to make up an increasing share of the cloud market.

Key Highlights

- In recent years, the Hybrid Cloud market has experienced a strong overall growth in comparison to other cloud computing services. For organisations with a large amount of data and the need to process requests, it offers some benefits.

- When businesses need to free up local resources for more sensitive data or applications, using a hybrid cloud allows them to scale computing capacity and help eliminate the necessity of investing large amounts of capital in handling short term spikes in demand.

- Hybrid cloud enables businesses to increase their onpremises infrastructure up to the Public Cloud in response to any surge that may occur, without exposing entire data sets to Third Party Data Centres' access when there are fluctuations in demand for information and processing. The end users concerned about their data security and initially reluctant to adopt such a solution have been able to benefit from these developments.

- Instead of purchasing, programming and maintaining other resources or equipment on a continuous basis, businesses with cloud services are required to cover the temporary consumption of these resources. This will help to reduce the costs that businesses do not make a profit from.

- Furthermore, the adoption of Hyperscale cloud with benefits including data center modernization, consolidated operation, security and management, as well as application innovation is being pursued by public bodies. Such needs can be supported by the Hybrid Cloud. Moreover, cloud computing allows government organisations to cope with a cyclical demand or emergency needs without exceeding an excessive amount of hardware consumption.

- As enterprises continue migrating their applications and workloads to a hybrid multicloud environment, integration and management become more complex which might hamper market growth

- In the face of a COVID-19 pandemic, many countries around the world are imposing work from home due to public health safety concerns which have led to the need for remotely accessible working facilities. The growing demand for virtual services, the longer term potential to recast the government workforce, and the need to provide adaptive and dynamic regulatory models are the result of increased demand for virtual services, coupled with increasing citizen expectations for the delivery of these services.

Hybrid Cloud Market Trends

Banking, Finance, Services, and Insurance (BFSI) Sector to Hold Major Share in the Market

- The banking sector has been using the hybrid cloud model, through which critical banking processes and applications are migrated to private clouds for better security. Moreover, non-critical applications are moving to the public cloud for agility and cost efficiency.

- As the majority of the banks' IT spending is primarily on maintaining their legacy technologies, along with managing and maintaining disparate systems, Consequently, they have had to invest in a Hybrid Cloud solution that consists of an onpremise mix of private and public cloud services with the aim of achieving higher scalability and integration across their various systems.

- Hybrid cloud is also increasingly being adopted to tackle issues in this sector. These issues include the increased number of transactions without cards, the digitization of several bank branches, the shift to remote working systems, the need for online documentation, etc.

- Modifying the hybrid cloud for banking leads to cost reduction, increases efficiency, and enables banks to manage their customers better, resulting in the growth of hybrid cloud in the BFSI industry.

- The growth of hybrid cloud in the BFSI industry worldwide is driven by a shift in consumers' preference toward hybrid cloud, an increase in digital disruptions, and technological advances like the integration of edge computing, (IoT), and artificial intelligence. However, the COVID-19 pandemic led to a sharp rise in the hybrid cloud in the BFSI market globally, owing to increased demand for increased computing power across banks and the overall fintech sector.

North America to Hold Significant Market Share

- A significant share of the hybrid cloud market is expected to be held in North America. A number of companies in the region are going beyond public clouds. They're entering a new era in which IT services are designed to combine government, industry and traditional infrastructure. In order to help them improve their business and provide services to their customers, these organisations have implemented a hybrid cloud strategy.

- North America pioneered the bring-your-own-device (BYOD) culture, resulting in widespread incorporation. As a result, organisations have begun to move away from traditional cloud models and are moving towards hybrids in order to ensure the safety of sensitive business information by using Private Cloud while giving employees more access to applications based on Public Cloud solutions which is required for certain applications that require field access. This trend was observed to benefit productivity, and it is expected to continue and grow during the forecast period. The BYOD trend is also becoming more and more common in Canada's companies. The growth of BYOD in the country is projected to increase, and it is estimated that over the forecast period this will have a positive effect on the Hybrid Cloud Market as tablets and smartphones become more frequently used for access to business critical information.

- Additionally, the COVID-19 pandemic accelerated cloud usage for US companies in every industry. Many US enterprises prioritizing cloud adoption in their organization noted the increased importance of cloud due to the pandemic.

- Moreover, to increase their consumer base and better meet demands across various applications, significant companies are also merging with other businesses and investing in new projects. For instance, in May 2023, IBM has announced Hybrid Cloud Mesh, a Software as a Service offering that allows enterprises to take management of their hybrid multicloud infrastructure. In order to help modern enterprises operate their infrastructure across hybrid multicloud and heterogeneous environments, IBM Hybrid Cloud Mesh is built on "applicationcentric connectivity" that automates the process, management or observability of application traffic between public and private clouds.

- Overall, the demand for flexibility, data security, cost reduction, digital transformation, enhanced analytics, and industry-specific requirements are some of the significant factors that are driving the hybrid cloud market in North America. Due to these reasons, businesses are being compelled to use hybrid cloud solutions in order to strike a balance between agility, control, and innovation.

Hybrid Cloud Industry Overview

The hybrid cloud industry is highly fragmented, with multiple significant competitors. Few major firms presently dominate the industry in terms of market share. These market leaders are concentrating on growing their consumer base in overseas nations. These businesses use collaborative strategic efforts to expand their market share and profitability. Companies in the industry are also purchasing start-ups focused on hybrid cloud computing technologies to boost their product abilities. Some key market players are Cisco Systems Inc., Hewlett-Packard Enterprise Company, Amazon Web Services (Amazon Inc.), Accenture PLC, and IBM Corporation, among others.

- In March 2023, Flexera announced the general availability of Flexera One FinOps. This solution helps in strengthening an enterprise's FinOps and central cloud teams while enhancing the convergence of IT asset management (ITAM) and FinOps, empowering enterprises to significantly improve the way they view and allocate cloud usage and charging, effectively manage hybrid IT estates on a large scale, and be able to operate their own private cloud.

- In March 2023, NTT Communications Corporation announced the launch of efforts involving digital humans and the virtual world as part of its business co-creation program, "OPEN HUB for Smart World," with the goal of broadening possibilities for all people, including those with workplace or time constraints. It plans to encourage solutions to address problems such as Japan's declining labor force participation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need for Interoperability Standards Between Cloud Services and Existing Systems

- 5.1.2 The Ability to Offer Improved Business Performance and Greater Return on Investments as Businesses Embracing Digitalization

- 5.2 Market Challenges

- 5.2.1 Compliance Issues, Migration Complexity, and Security Risks

- 5.3 Assessment of the Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By End-user Industry

- 6.2.1 Government and Public Sector

- 6.2.2 Healthcare

- 6.2.3 Banking, Finance, Services, and Insurance (BFSI)

- 6.2.4 Retail

- 6.2.5 Information and Communication Technology

- 6.2.6 Media and Entertainment

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Hewlett Packard Enterprise Company

- 7.1.3 Amazon Web Services (Amazon Inc.)

- 7.1.4 Accenture PLC

- 7.1.5 IBM Corporation

- 7.1.6 Alibaba Cloud (Alibaba Group Holding Limited)

- 7.1.7 Rackspace Technology Inc.

- 7.1.8 Oracle Corporation

- 7.1.9 Google LLC

- 7.1.10 Equinix Inc.

- 7.1.11 VMware Inc.

- 7.1.12 Panzura Inc.

- 7.1.13 Flexera Software LLC

- 7.1.14 Dell EMC (Dell Technologies Inc.)

- 7.1.15 Intel Corporation

- 7.1.16 Fujitsu Ltd

- 7.1.17 NTT Communications Corporation

- 7.1.18 DXC Technology Company

- 7.1.19 Lumen Technologies Inc.

- 7.1.20 Microsoft Corporation