|

市場調查報告書

商品編碼

1630277

小型基地台5G 網路 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Small Cell 5G Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

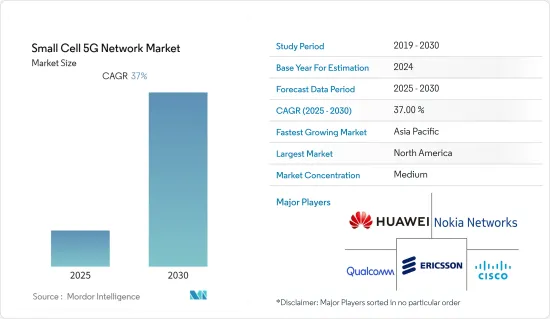

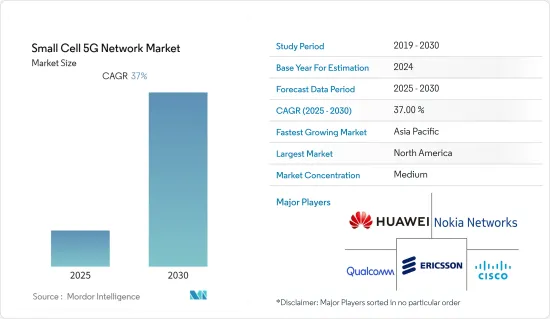

預計小型基地台5G 網路市場在預測期內將以 37% 的複合年成長率成長

主要亮點

- 小型基地台有望成為未來全球 5G 網路的基礎。透過產業合作,可以在全球範圍內以必要的速度大規模部署 5G小型基地台,並使 5G 成為現實。 5G 預計更便宜、更快,但需要透過小型基地台擴展無線網路。

- 小型基地台在當今的環境中至關重要,特別是對於需要更多頻寬和連接設備數量不斷增加的應用而言。例如,Cisco預測,到 2030 年,將有 5,000 億台設備連網。此外,5G通訊業者正專注於在較低頻段安裝小型基地台,以便為客戶提供更好的覆蓋範圍。

- 行動資料流量的增加正在推動市場成長。根據思科視覺網路指數(VNI)的數據,從 2017 年到去年,全球行動資料流量的複合年成長率為 46%,達到每月 77.5Exabyte。根據思科的研究,去年 5G 連線產生的流量是典型 4G 連線的大約 2.6 倍。

- 小型基地台部署是各通訊業者的首要任務,60%的通訊業者將小型基地台視為其4G服務的關鍵要素。沃達豐、AT&T和Softbank Corporation等主要通訊業者除了宏網路外,還部署了小型基地台技術。例如,Verizon 在美國多個城市安裝了小型基地台,包括紐約、芝加哥、亞特蘭大和舊金山。

- 此外,雖然 5G 可以部署在現有的蜂窩無線電頻率上,但營運商很可能能夠使用更高的無線電頻率(20GHz 及以上)進行操作,尤其是行動服務。然而,這些頻率的部署只能在有限的區域內進行,且訊號穿透力也受到限制,因為它們不能穿牆。因此,擴大採用在建築物內使用的小型基地台,這些蜂窩對於智慧型手機和物聯網設備具有出色的連接性。

- COVID-19 的疫情對行動領域產生了重大影響。短期內,我們預計多個市場的 5G 推出將進一步推遲,其中服務受到的打擊最為嚴重。小型基地台5G 設備仍被視為利基市場,因此消費者可能無法負擔。根據 GSMA(行動通訊協會)情報消費者調查,大多數受訪者對升級到 5G 服務的興趣有限。例如,報告發現近80%的英國消費者沒有升級計畫。

小型基地台5G網路市場趨勢

電訊細分市場預計將大幅成長

- 小型基地台為行動寬頻和物聯網用戶提供高資料速率,並且能夠處理密集的低速、低功耗設備,是 5G 部署的理想選擇。此屬性可實現毫秒延遲、每平方英里 100 萬台設備和超高速。因此,世界各地的通訊業者主要使用小型基地台技術來部署 5G 技術。據物聯網公司 Telit 稱,美國主要通訊業者計劃嚴重依賴小型基地台技術來實現全國 5G 覆蓋。

- 為了推動向消費者提供 5G 覆蓋的舉措,台灣最大的通訊業者中華電信 (CHT) 與諾基亞合作,採用該公司小型基地台產品組合中的產品。在台灣,中華電信是第一家部署 5G 非獨立 (NSA)小型基地台的通訊業者,可在包括商業設施和旅遊目的地在內的多個地點提供即時5G 覆蓋。

- 諾基亞為 CHT 提供高度適應性的 AirScale 室內無線電 (ASiR) 解決方案和適用於室外和都市區熱點的 AirScale micro RRH,以提高室內覆蓋範圍和容量。除了CHT目前涵蓋的2500多組4G小型基地台之外,這兩種解決方案將有助於營運商滿足5G網路的室內覆蓋和緻密化需求。

- 此外,為所有人提供行動基礎設施解決方案的通訊業者協會小型基地台論壇 (SCF) 宣布推出適用於 5G 的 PHY API,並宣布推出適用於 5G小型基地台硬體、軟體和設備供應商的新PHY API,從而引發了一個競爭性的生態系統。隨著資料使用量和對更快資料的需求的增加,對 5G 網路的需求不斷增加,通訊業者正從 SCF 的競爭生態系統中受益。

- 對於 5G 技術和網路,通訊業者正在探索全新的定價模式,該模式可能取決於互通性以及開放和競爭的環境。隨著網路變得更加分散,用於無線電功能的分散式單元 (DU) 與用於通訊協定堆疊和基頻功能的集中式單元 (CU) 之間的去程傳輸成為關鍵介面。

預計北美將佔據較大市場佔有率

- 由於5G等先進技術的廣泛使用,北美被認為是關鍵市場之一。在美國,通訊業者正在利用小型基地台台來密集化 5G 網路並降低成本,尤其是在大都會圈。 Sprint、AT&T、Verizon、T-Mobile等主要通訊業者積極推動5G網路商用,三星、愛立信、諾基亞、華為、中興等網路設備製造商正與網路設備製造商合作打造10億美元市場。設施的合約。

- 美國無線網路營運商正在大力擁抱小型基地台。產業組織 CTIA 預測,到 2026 年,美國小型基地台數量將超過 80 萬個,高於 2018 年的約 86,000 個。 T-Mobile US 收購 Sprint 後,兩家公司總共持有約 7 萬個小型基地台。該公司計劃將大量頻譜輸送到美國最大、最密集的無線網路。但 Verizon 的小型基地台策略與 T-Mobile 不同。該公司預計毫米波最終將處理 50% 的都市區交通,並計劃在未來幾年內繼續部署約 14,000 個小型基地台,以擴大整體覆蓋範圍。

- 根據愛立信行動報告,到 2024 年,5G 用戶預計將佔北美所有行動用戶的 55%。預計市場將受益於預測期內 5G 用戶數量的增加。

- 2021年6月,高通科技公司在美國宣布推出第二代高通小型蜂巢5G RAN平台(FSM200xx)。該平台旨在擴展移動 5G 毫米波覆蓋範圍和功率效率,支援毫米波中的 1 GHz頻寬、更寬的 200MHz 載波頻寬以及跨 FDD 和 TDD 的 200MHz MHz Sub-6 GHz頻譜聚合,提供高達 8 Gbps 的資料資料並交付。它還支援 eURLLC 等技術,提供對工廠自動化以及設備和機械的關鍵任務控制至關重要的低延遲和鏈路可靠性。

- 愛立信也小型基地台,愛立信將為加拿大通訊和媒體公司羅傑斯通訊公司的5G網路獨家供應5G無線接取網路(RAN)和5G核心網路(5GC)以及Massive MIMO無線電,MINI-LINK微波技術也是其中的一部分。這項技術。羅傑斯的 5G 網路最初將使用 2.5GHz 頻段,並計劃隨著服務擴展到其他市場而擴展到 600MHz 5G 頻譜。

小型基地台 5G 網路產業概況

小型基地台5G網路市場適度整合。市場上現有的主要供應商包括諾基亞網路公司、思科系統公司、Telefonaktiebolaget LM Ericsson 和高通技術公司。這些公司從事產品開發、策略夥伴關係關係以及併購以推出新產品。然而,許多新供應商(例如 Baicells Technologies)正在進入市場,並且在整個預測期內競爭格局可能會發生變化。

2023 年 10 月,三星解鎖了其創新的「Strand Small Cell」。該平檯面向有興趣利用其現有的基礎設施和頻譜擴大基於 5G 的蜂窩服務範圍的有線通訊供應商。這一一體化平台於去年與 Comcast 合作推出,是該公司計劃透過與 Verizon 簽訂的 MVNO(虛擬行動服務業者)協議來補充其蜂窩服務的計劃的核心。現在所有相關人員都可以使用它。

2023 年 10 月,沃達豐和諾基亞宣布加強合作夥伴關係,並計劃在義大利進行首個商用 5G 開放無線接取網路(RAN) 測試營運。全球最大的 RAN 供應商之一諾基亞與沃達豐無與倫比的泛歐洲網路的結合為更多獨立軟體供應商和本地企業使用開放 API 參與提供了一個平台。這將促進競爭和創新,提高歐洲競爭力,並在更具彈性的供應鏈支持下加強數位自主權。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 行動資料流量增加

- 網路技術和連接設備的演變

- 市場限制因素

- 回程傳輸連線不良

第 6 章 技術概覽

- 毫微微基地台

- 微微型基地台

- 微蜂巢

- 區域基地台

第7章 市場區隔

- 按運轉環境

- 室內的

- 戶外的

- 按行業分類

- 通訊業者

- 公司

- 住宅

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第8章 競爭格局

- 公司簡介

- Airspan Networks Inc.

- Telefonaktiebolaget LM Ericsson

- Qualcomm Technologies Inc.

- Nokia Networks

- Huawei Technologies Co. Ltd

- ZTE Corporation

- CommScope Inc.

- Cisco Systems Inc.

- Qucell Inc.

- Samsung Electronics Co. Ltd

- NEC Corporation

- Baicells Technologies Co. Ltd

第9章投資分析

第10章未來的機會

The Small Cell 5G Network Market is expected to register a CAGR of 37% during the forecast period.

Key Highlights

- Small cells are expected to be the foundation of future global 5G networks. The deployment of 5G small cells at a large scale and required speed worldwide is made possible by industry coordination, making 5G a reality. Although 5G promises to be cheaper and faster, it requires expanding the wireless network using small cells.

- Small cells are essential in the current environment, particularly for applications that demand more bandwidth and the growing number of connected devices. For example, Cisco Systems Inc predicts that 500 billion devices will be online by 2030. Additionally, 5G telecom providers are focused on installing small cells in low-frequency bands to provide customers better coverage.

- The increasing mobile data traffic is driving the market growth. According to the Cisco Visual Networking Index (VNI), global mobile data traffic increased at a CAGR of 46% from 2017 to last year, reaching 77.5 exabytes per month. In the previous year, a 5G connection produced around 2.6 times as much traffic as the typical 4G connection, according to Cisco's study.

- Small cell deployment is a top priority for various operators, with 60% of operators believing them to be a crucial component of their 4G services. Leading carriers such as Vodafone, AT&T, and Softbank have already implemented small-cell technologies in addition to their macro networks. For example, Verizon has installed small cells in several US cities, including New York, Chicago, Atlanta, and San Francisco.

- In addition, 5G can be deployed on existing cellular radio frequencies but may enable operators to use higher radio frequencies (over 20 GHz) to make it operable, especially for mobile services. However, deployment at these frequencies is only possible in constrained areas, and signal penetration is restricted as it does not go through walls. This increases the adoption of small cells for in-building applications, with excellent connectivity for smartphones and IoT devices.

- The COVID-19 outbreak had a significant impact on the mobile sector. In the short term, the 5G rollout in several markets will be further delayed, and its services will be the hardest hit. Consumers may be unable to spend on small cell 5G devices as it is still considered a niche market. According to Groupe Speciale Mobile Association (GSMA) Intelligence's consumer survey, most respondents had limited interest in upgrading to 5G services. For instance, according to the report, nearly 80% of consumers in the United Kingdom did not plan to upgrade.

Small Cell 5G Network Market Trends

Telecom Operators Segment is Expected to Grow Significantly

- Small cells are equipped to handle large data rates for mobile broadband and IoT users and dense populations of low-speed and low-power devices, making them ideal for the 5G rollout. This characteristic offers millisecond latencies, a million devices per square mile, and extremely high speeds. As a result, telecom operators worldwide are mainly using small cell technology to bring out 5G technology. According to IoT company Telit, major US telecom companies plan to rely heavily on small cell technology for 5G coverage nationwide.

- To boost the initiative of providing 5G coverage to consumers, Taiwan's largest telecom operator, Chunghwa Telecom (CHT), teamed up with Nokia for products from its small cells portfolio. In Taiwan, CHT was the first operator to roll out 5G non-standalone (NSA) small cells, providing instant 5G coverage in several places, including commercial and tourism locations.

- Nokia will provide CHT with its adaptable AirScale indoor Radio (ASiR) solution and its AirScale micro RRH for outdoor and urban hotspots to improve interior coverage and capacity. In addition to CHT's current base of more than 2,500 sets of 4G small cells, these two solutions will help operators meet the needs of a 5G network's indoor coverage and densification.

- Furthermore, the Small Cell Forum (SCF), a telecoms organization that makes mobile infrastructure solutions available to everyone, issued a PHY API for 5G, which has sparked a competitive ecosystem for suppliers of 5G small cell hardware, software, and equipment. Telecom providers benefit from the competitive ecosystem of the SCF by driving up the demand for the 5G network as the demand for data usage and high-speed data rises.

- For 5G technologies and networks, telecom operators are searching for a fundamentally new pricing model that might rely on interoperability and an open, competitive environment. As networks get decentralized, the front haul between a distributed unit (DU) for radio functions and a centralized unit (CU) for protocol stacks and baseband functions is a crucial interface.

North America is Expected to Hold a Significant Market Share

- North America is considered one of the leading markets due to its widespread use of advanced technology like 5G. In the United States, telecom operators are leveraging small cells to densify their 5G network, particularly in metropolitan areas, while reducing costs. Major operators like Sprint, AT&T, Verizon, and T-Mobile have shown a positive approach toward commercializing 5G networks, with billion-dollar agreements made with network equipment manufacturers such as Samsung, Ericsson, Nokia, Huawei, and ZTE to develop their 5G network infrastructure.

- Wireless network operators in the United States are largely embracing small cells. CTIA, the trade association, has forecasted that by 2026, there will be more than 800,000 small cells in the United States, up from about 86,000 in 2018. After the acquisition of Sprint Corporation by T-Mobile US, they have about 70,000 small cells together. The company plans to pour significant amounts of spectrum onto the biggest and densest wireless network in the United States. However, Verizon's small cell strategy differs from T-Mobile's. It expects mmWave to handle 50% of urban traffic eventually and aims to continue deploying around 14,000 small cells over the next few years to expand the overall coverage.

- According to the Ericsson Mobility Report, by 2024, 5G subscriptions are anticipated to make up 55% of all mobile subscriptions in the North American region. The market is expected to benefit from the increase in 5G subscriptions over the projected period.

- In June 2021, Qualcomm Technologies Inc. launched its second-generation Qualcomm 5G RAN Platform for Small Cells (FSM200xx) in the United States. The platform is designed to expand mobile 5G mmWave coverage and power efficiency, providing data speeds of up to 8 Gbps with bandwidth support of 1 GHz on mmWave, wider 200MHz carrier bandwidth support, and 200 MHz of Sub-6 GHz spectrum aggregation across FDD and TDD, providing data rates of up to 4 Gbps. It also supports technologies like eURLLC to provide low latency and link dependability essential for factory automation and mission-critical control of equipment and machines.

- Ericsson has also collaborated with Rogers Communications Inc., a Canadian communication and media company, to install 5G across its network in Canada. The 5G radio access network (RAN) and 5G core (5GC) for Rogers' 5G network are exclusively supplied by Ericsson, and small cells, conventional and Massive MIMO radios, and MINI-LINK microwave technologies are also part of the technology. The Rogers 5G network is initially using a 2.5 GHz band and will expand to operate on the 600 MHz 5G spectrum as the service expands to other markets.

Small Cell 5G Network Industry Overview

The market for small cell 5G networks is moderately consolidated. Some of the key existing vendors in the market include Nokia Networks, Cisco Systems Inc., Telefonaktiebolaget LM Ericsson, and Qualcomm Technologies Inc., among others. These companies implement product development, strategic partnerships, and mergers & acquisitions to launch new products. However, many new vendors, such as Baicells Technologies Co. Ltd, have entered the market, which may change the competitive landscape throughout the forecast period.

In October 2023, Samsung unlocked access to its innovative "Strand Small Cell," which is targeted at cable telecommunication providers interested in expanding the reach of their 5G-based cellular services using already owned infrastructure and spectrum holdings. The all-in-one platform was initially unveiled last year in partnership with Comcast as core to the cable giant's plans to supplement cellular services through a mobile virtual network operator (MVNO) agreement with Verizon. It's now available to all interested parties.

In October 2023, Vodafone and Nokia announced a strengthening of their partnership with plans to run a commercial 5G Open radio access network (RAN) pilot in Italy for the first time. Bringing together Nokia, one of the world's largest RAN providers, and Vodafone's unrivaled pan-European network will provide a platform for more independent software providers and local companies to enter the fray using open APIs. This will encourage competition and innovation, boosting Europe's competitiveness and giving it greater digital autonomy underpinned by a more resilient supply chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competition

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Mobile Data Traffic

- 5.1.2 Evolution of Network Technology and Connectivity Devices

- 5.2 Market Restraints

- 5.2.1 Poor Backhaul Connectivity

6 TECHNOLOGY SNAPSHOT

- 6.1 Femtocell

- 6.2 Picocell

- 6.3 Microcell

- 6.4 Metrocell

7 MARKET SEGMENTATION

- 7.1 By Operating Environment

- 7.1.1 Indoor

- 7.1.2 Outdoor

- 7.2 By End-User Vertical

- 7.2.1 Telecom Operators

- 7.2.2 Enterprises

- 7.2.3 Residential

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia Pacific

- 7.3.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Airspan Networks Inc.

- 8.1.2 Telefonaktiebolaget LM Ericsson

- 8.1.3 Qualcomm Technologies Inc.

- 8.1.4 Nokia Networks

- 8.1.5 Huawei Technologies Co. Ltd

- 8.1.6 ZTE Corporation

- 8.1.7 CommScope Inc.

- 8.1.8 Cisco Systems Inc.

- 8.1.9 Qucell Inc.

- 8.1.10 Samsung Electronics Co. Ltd

- 8.1.11 NEC Corporation

- 8.1.12 Baicells Technologies Co. Ltd