|

市場調查報告書

商品編碼

1630282

非製冷紅外線成像 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Uncooled Infrared Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

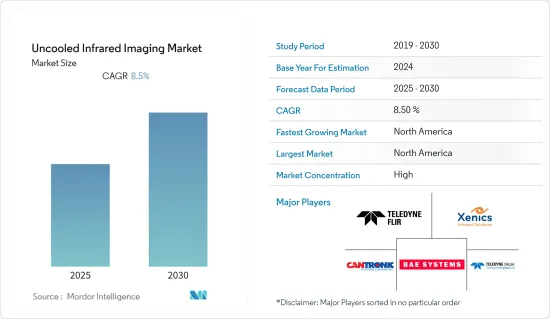

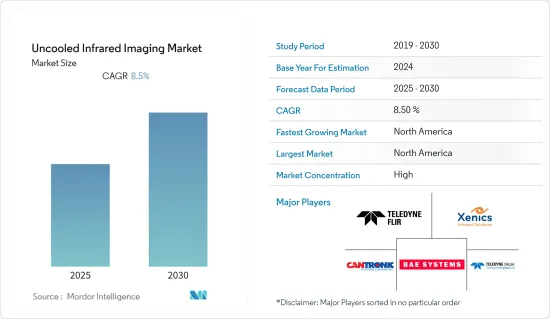

非製冷紅外線成像市場預計在預測期內複合年成長率為 8.5%

主要亮點

- 在過去的十年中,由於使用微系統技術改進了開發和製造程序,非製冷紅外線成像系統已經達到了以前只有製冷紅外線成像儀才能實現的靈敏度。這通常在溫度從 -30 度C到 +30 度C穩定或根本不穩定的探測器中實現。

- 非製冷紅外線相機基於熱檢測器而不是量子檢測器。過去十年中紅外線成像技術的進步,特別是半導體製造和新興的微機械加工,使得以低成本製造小型、複雜的結構成為可能,從而增加了對紅外線檢測器的需求。

- 非冷凍 IT 成像儀收集 8μm 至 12μm頻譜頻寬內的光。此頻寬比3μm至5μm頻譜頻寬具有更寬的頻寬,因此能夠更好地穿透煙霧、灰塵、煙霧、水蒸氣等。

- 目前,該市場主要由商務用領域的需求所驅動。隨著廉價非製冷紅外線成像儀產品組合的不斷成長,除了經典應用之外,智慧型手機等許多應用領域也在不斷擴展。紅外線成像儀最初的應用始於軍事領域,作為步槍瞄準器,用於識別黑暗或能見度較差的目標。

- 雖然冷卻系統在軍事領域的應用不斷增加,但非冷卻系統由於其緊湊的設計、能源效率和低維護要求而越來越受歡迎。 2021年3月,微軟與美國簽署了為期10年的擴增實境頭盔契約,價值高達219億美元。

- 超過 120,000 個 Microsoft HoloLens擴增實境耳機將交付給美國。 HoloLens 可以顯示地圖和指南針,並使用熱成像技術來偵測黑暗中的人員。

非製冷紅外線成像市場趨勢

擴大汽車領域的應用推動成長

- 自動駕駛汽車結合使用感測器和成像技術來控制駕駛功能。車輛熱成像系統所獲得的資訊被輸入車輛的控制系統,進行解釋並用於安全駕駛車輛。

- 亞利桑那州的 Uber 事故等事件表明,自動駕駛系統在各種條件下「看到」行人並做出反應方面面臨著持續的挑戰,特別是在濃霧或明亮陽光等惡劣天氣條件下。像這樣的現實場景為熱感像儀打開了新的大門,使其能夠最有效地快速識別和分類潛在危險,並允許車輛做出適當的反應。

- FLIR Systems 的 Boson 熱像儀配備 12μm 間距氧化釩 (VOx) 非冷卻偵測元件,以防止上述事故發生。該設備與用於物件分類的機器學習演算法相結合,使 ADK 能夠提供來自電磁頻譜紅外線部分的關鍵資料,以改善 AV 決策。

- 此外,2022 年 9 月,Linred 與 Umicore 合作開發熱感測技術,以經濟實惠的方式提高行人自動緊急煞車 (PAEB) 系統在不利照明條件下的性能。歐盟計劃HELIAUS 資助提高汽車應用性能的開發。

- 除了這些應用之外,FLIR Systems 最近還發布了一份白皮書,概述了新型紅外線 (IR) 攝影機技術在解決高速汽車偵測挑戰方面的作用。白皮書補充說,即使在極高的速度下,具有非製冷檢測器的紅外線攝影機也可以提供準確的溫度測量。

- 根據 IEA 的數據,插電式電動車 (PEV) 的銷量預計將達到約 670 萬輛。德國銷售的新車中超過三分之一是電動車,這有可能使其成為插電式電動車的最大市場。預計此類發展將進一步推動汽車領域對非製冷紅外線成像的需求。

北美繼續主導市場

- 非冷凍紅外線成像系統應用於ADAS技術,與成像技術結合來控制駕駛功能。車輛熱成像系統所獲得的資訊被輸入車輛的控制系統,進行解釋並用於安全駕駛車輛。

- 北美是全球最大的汽車製造地之一。該地區的經濟成長影響了乘用車和商用車的銷售。根據美國經濟分析局的數據,2021 年美國汽車業銷售了約 1,490 萬輛輕型汽車。該統計數據包括零售銷售的約 330 萬輛汽車和近 1,160 萬輛輕型卡車。

- 該地區是知名汽車製造商(超過 13 家主要汽車製造商)和雷達感測器供應商(例如博世和洛克希德馬丁)的所在地,預計將成為創新源泉,並有望佔據重要的市場佔有率。該地區也可能成為採用 ADAS 車輛和自動交通解決方案的先驅之一。德意志銀行預計,到2021年,美國ADAS產量預計將達到1,845萬台。

- 國防工業仍是非製冷紅外線成像系統最重要的消費者。美國軍方在全球最高國防預算的支持下,預計將繼續推動熱成像產業的成長。美國軍方正致力於開發氧化釩技術。世界各地軍隊使用的所有熱成像設備均採用非製冷檢測器。此外,該地區被認為是軍事和國防費用,以美國為首。 2021會計年度,總統拜登簽署了7,777億美元的年度軍事預算。

- 2021 年 10 月,美國授予 Leonardo DRS Inc. 一份契約,生產具有自主瞄準能力的改良紅外線機槍武器瞄準具。美國已授予萊昂納多 DRS 第二份武器瞄準人員服務系列 (FWS-CS) 合約。 LRIP 階段簽署了價值 1890 萬美元的固定價格合約。

- 該系統整合了高解析度10um高清熱焦平面陣列、彩色日間相機、雷射測距儀和彈道解計算器,可自動調整分劃線以適應範圍和環境條件,允許使用者使用不受干擾的分劃線技術. 你可以準確地發射你的武器。

非製冷紅外線成像產業概述

非冷凍紅外線成像市場高度整合。由於成像儀等產品的廣泛商業應用,預計該市場在不久的將來將顯著成長。近期市場趨勢如下:-

- 2022 年 2 月 - LAMpAS 在歐盟的資助下推出高速紅外線相機。 NIT(New Infrared Technologies SL)公司開發了一款專門適應 LAMPAS 製程要求的高速非製冷紅外線相機。該相機可以檢測雷射表面結構化過程中積聚的熱量。

- 2021 年 4 月 - FLIR Systems 推出了採用小型、輕量、低功耗封裝的發射型玻色子非製冷熱像儀。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 擴大在汽車領域的應用

- 低成本和緊湊的設計

- 市場問題

- 替代技術的出現

第6章 市場細分

- 按用途

- 車

- 軍隊

- 家用電子電器

- 測繪和測量

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- FLIR Systems Inc.

- Xenics NV

- Cantronic Systems Inc.

- BAE Systems Inc.

- Teledyne DALSA Inc.(Teledyne Technologies Inc.)

- Zhejiang ULIRVISION Technology Co. Ltd(Ulirvision)

- Vigo System SA

- Axis Communications AB(Canon Inc.)

- Lynred USA Inc.(Sofradir SAS)

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 66918

The Uncooled Infrared Imaging Market is expected to register a CAGR of 8.5% during the forecast period.

Key Highlights

- Over the last ten years, uncooled IR imaging systems have reached a sensibility that was previously only possible with cooled IR imagers through improved development and manufacturing processes using microsystem technology. This is usually implemented in detectors stabilized in temperatures between -30°C to +30°C or not stabilized at all.

- The uncooled IR cameras are based on thermal detectors instead of quantum detectors. The advancements in thermal imaging over the last decade, especially with semiconductor manufacturing and emerging micromachining, enabled the production of small intricate structures at low cost and drove the demand for thermal detectors.

- The uncooled IT imagers collect the light at 8μm to 12μm spectral band. The band provides better penetration through smoke, dust, smog, water vapor, etc., due to its higher bandwidth from 3 μm to 5 μ m spectral band.

- Currently, the market studied is primarily driven by the demand from the commercial segment. With the growing portfolio of inexpensive uncooled IR imagers, in addition to the classic applications, many other fields of application have also increased, such as smartphones. The original application for IR imagers started in the military sector for the sight of rifles, where it is used for target recognition in darkness or poor visibility.

- While cooling systems continue to find increasing applications in the military sector, the growing popularity of uncooled systems can be attributed to their compact design and energy-efficient and low-maintenance operation. In March 2021, Microsoft received a 10-year deal with the United States Army for augmented reality headgear valued at up to USD 21.9 billion.

- More than 120,000 Microsoft HoloLens augmented reality headsets will be delivered to the US Army. It will be able to show a map and compass and use thermal imaging to detect persons in the dark.

Uncooled Infrared Imaging Market Trends

Increasing Application in Automotive Sector will Foster Growth

- Autonomous vehicles use sensors in conjunction with imaging technologies to control driving functions. The information picked up by the thermal imaging systems of the vehicles is fed into the vehicle's control system, interpreted, and used to safely put the vehicle through its paces.

- Incidents like the Uber accident in Arizona show the challenges persistent for AV systems to 'see' and react to pedestrians in every condition, especially in inclement weather like thick fog or blinding sun glare. Real scenarios like these open new avenues for thermal cameras that are the most effective in quickly identifying and classifying potential hazards to help the vehicle react accordingly.

- FLIR's Boson thermal camera that features a 12-µm pitch vanadium oxide (VOx) uncooled detector has been launched to avoid the above incidents. This device is paired with machine-learning algorithms for object classification, with the ADK providing critical data from the infrared portion of the electromagnetic spectrum to improve the decision-making of AVs.

- Furthermore, in September 2022, Lynred, in collaboration with Umicore, developed a thermal sensing technology to improve the performance of Pedestrian Autonomous Emergency Braking (PAEB) systems in adverse lighting conditions at an affordable cost. The EU project HELIAUS funds the development to boost the performance of automotive applications.

- In addition to these applications, FLIR Systems recently published a white paper outlining the role of new Infrared (IR) camera technologies in addressing the difficulties of high-speed automotive testing. The paper adds that infrared cameras with uncooled detectors can measure temperature accurately at extremely high speeds.

- According to IEA, it is anticipated that the sales of plug-in electric light vehicles (PEV) will reach around 6.7 million units. Germany could become the largest market for plug-in electric vehicles as over one in three new cars sold in the country were electric vehicles. Such developments will further boost the demand for uncooled infrared imaging in the automotive sector.

North America will Continue to Dominate the Market

- Uncooled IR imaging systems have applications in the ADAS technologies, in conjunction with imaging technologies, to control driving functions. The information picked up by the thermal imaging systems of the vehicles is fed into the vehicle's control system, interpreted, and used to safely put the vehicle through its paces.

- North America is one of the largest automotive manufacturing hubs in the world. The region's economic growth posed an impact on the sale of passenger and commercial vehicles. The car sector in the United States sold around 14.9 million light vehicle units in 2021, according to the US Bureau of Economic Analysis. This statistic comprises approximately 3.3 million automobiles and just under 11.6 million light truck units sold at retail.

- Housing prominent automakers (over 13 major auto manufacturers) and vendors offering radar sensors (Bosch and Lockheed Martin, among others), the region is expected to emerge as a source of innovation and is estimated to hold a significant market share. The region is also likely to be one of the pioneers in adopting ADAS-enabled vehicles and self-driven transportation solutions. According to Deutsche Bank, the US ADAS unit production volume is expected to reach 18.45 million by 2021.

- The defense industry remains the most critical consumer of uncooled infrared imaging systems. Backed by the highest defense budget in the world, the US military is expected to continue to drive the growth of the infrared imaging industry. The US Military has a firm focus on the development of Vanadium Oxide technology. All thermal imaging equipment used by militaries across the world uses uncooled detectors. Moreover, the region is regarded as the highest spending region for its military and defense expenditure driven by the United States. In FY 2021, President Joe Biden signed a USD 777.7bn annual military budget into law.

- In October 2021, the US army awarded Leonardo DRS Inc. a contract to build improved infrared machinegun weapon sights with autonomous aiming. The US army has awarded Leonardo DRS a second contract for the Family of Weapon Sight-Crew Served (FWS-CS). For the LRIP phase, a firm, fixed-price contract worth USD 18.9 million has been awarded.

- The system integrates a high-resolution 10um high-definition thermal focal plane array, color day camera, laser range finder, and ballistic solution calculator to auto-adjust reticles for range and environmental conditions, allowing users to fire the weapon precisely with the disturbed reticle technology.

Uncooled Infrared Imaging Industry Overview

The Uncooled Thermal Imaging market is highly consolidated. The market is expected to put forth impressive volumes in the near future due to the wide range of commercial applications that the products like imagers have. Some of the recent developments in the market are as follows: -

- February 2022 - LAMpAS has launched a high-speed I.R. camera funded by European Union. The company's New Infrared Technologies S.L. (NIT) has developed a high-speed uncooled I.R. camera specifically adapted to the requirements of LAMPAS processes. The camera can detect the heat accumulated during laser surface structuring processes.

- April 2021 - FLIR Systems has launched a radiometric version of the boson thermal imaging camera module, representing the uncooled thermal imaging technology within a small, lightweight, and low-power package.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Application in the Automotive Sector

- 5.1.2 Low Cost and Compact Design

- 5.2 Market Challenges

- 5.2.1 Emergence of Alternative Technology

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Automotive

- 6.1.2 Military

- 6.1.3 Consumer Electronics

- 6.1.4 Mapping and Surveying

- 6.1.5 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 FLIR Systems Inc.

- 7.1.2 Xenics NV

- 7.1.3 Cantronic Systems Inc.

- 7.1.4 BAE Systems Inc.

- 7.1.5 Teledyne DALSA Inc. (Teledyne Technologies Inc.)

- 7.1.6 Zhejiang ULIRVISION Technology Co. Ltd (Ulirvision)

- 7.1.7 Vigo System SA

- 7.1.8 Axis Communications AB (Canon Inc.)

- 7.1.9 Lynred USA Inc. (Sofradir SAS)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219