|

市場調查報告書

商品編碼

1635377

短波紅外線成像:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Short-wave Infrared Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

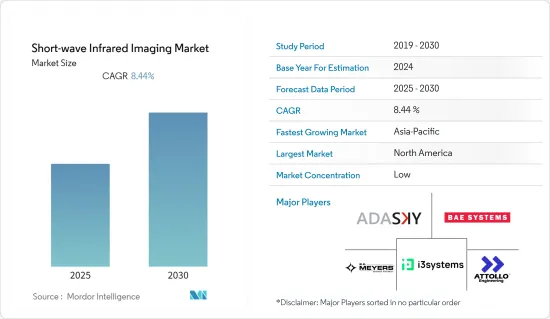

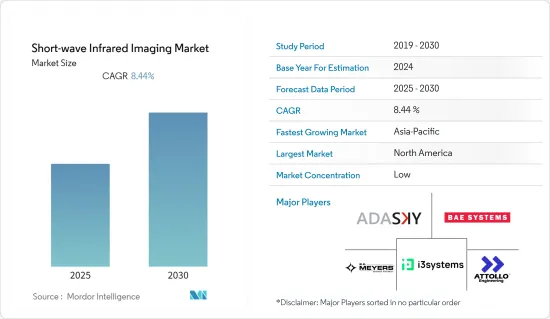

預計短波紅外線成像市場在預測期內的複合年成長率為8.44%。

主要亮點

- 短波紅外線 (SWIR) 成像是一種先進技術,可根據肉眼看不見的電磁波頻譜區域的輻射產生影像。短波長紅外線(SWIR) 成像的優點是感興趣的輻射接近可見頻譜,但通常可以檢測 100°C 以上的溫度。

- 短波長紅外線(SWIR) 成像的波段為 0.7 至 2.5 μm。 SWIR 影像可用於多種應用,包括太陽能電池檢查、電子基板檢查、識別和分類、監控、防偽和製程品管。

- 車輛導航越來越依賴短波紅外線相機。隨著自動駕駛汽車的興起,短波紅外線技術可以幫助霧、雪、灰塵和雨中的導航。最近,以色列新興企業TriEye 為消費汽車市場推出了一款安裝在儀表板上的短波紅外線相機,它可以成功地應對雪、霧、灰塵和雨水,解決了短波紅外線相機在自動駕駛汽車中日益成長的使用問題。

- 世界各地正在對短波長紅外線成像技術的開發進行大量投資。例如,2022年1月,利用奈米材料開發高性能短波長紅外線成像的公司Emberion籌集了600萬歐元,以加速其紅外線成像業務的成長。

- 最近,以色列新興企業TriEye針對消費性汽車市場推出了一款安裝在儀表板上的SWIR相機,可在雪、霧、灰塵和雨中成功導航,並且支援SWIR相機在自動駕駛汽車中的使用擴展。根據納斯達克的數據,到 2030 年,無人駕駛汽車可能會主導市場。因此,這些投資可能會為該領域的已開發市場創造空間。

- 隨著公司之間不斷測試、研究和合作開發自動駕駛汽車,自動駕駛汽車的數量預計在未來幾年將穩定成長。例如,法國自動駕駛汽車製造商 Navya 宣布推出全電動式Autonom Cab,這是首款 100% 自動駕駛機器人計程車。法雷奧也與 Docomo 合作,共同開發聯網汽車。

短波長紅外線成像市場趨勢

軍事國防領域預計將大幅成長

- 熱成像用於國防應用,因為它可以在近乎或完全黑暗的情況下實現高解析度視覺和識別。紅外線 (IR) 波長對於軍事和國防研究與開發至關重要,因為監視和瞄準是在夜間進行的。

- SWIR 系列彌補了可見光波長和紅外線峰值熱靈敏度之間的差距,散射小於可見光波長,並可檢測遠距的低水平反射光,使其成為透過煙霧和霧進行成像的理想選擇。此外,短波紅外線相機是用於安全和監控的有用設備,有時單獨使用或與其他成像器結合使用。

- 2021 年 5 月,一家總部位於墨爾本的公司獲得了一份契約,為陸軍無人機配備下一代監視感測器,這些感測器使用紅外線攝影機晝夜提供穩定的影像。該感測器技術旨在透過利用使用光電、短波和中波紅外線攝影機、雷射測距和目標指定技術的成像系統來增強情報、監視和偵察 (ISR) 能力。

- 此外,2021 年 11 月,作為 ENVision 計畫的一部分,DARPA 聘請了三個小組來開發增強型直視夜視設備,其尺寸和重量與普通眼鏡相似。這三個組織開發了緊湊、輕巧的夜視眼鏡,可從通用頻寬提供 1.5 微米至 12 微米的頻譜帶,其中包括近紅外線以及短波、中波和長波紅外頻譜頻寬。

- 英國國會稱,2020/21年度國防支出將為424億英鎊現金。與前一年同期比較,名義價值增加了 25 億英鎊,實際價值增加了 17 億英鎊。因此,2024/25年度國防現金預算將比2020/21年度增加62億英鎊。然而,這種支出成長的實際價值很低,特別是考慮到通貨膨脹不斷上升。經通貨膨脹調整後,國防支出預計將增加 15 億英鎊。

北美佔最大市場佔有率

- 美國擁有世界上最高的國防開支,是短波紅外線相機和技術的主要市場之一。據美國國防部稱,總統預算請求為7,054億美元,較2020會計年度核准的7,046億美元預算(不包括自然災害應急資金)小幅增加約0.1%。面對資金減少,美國做出了一些艱難的決定,將資源集中在最重要的優先事項上。

- 為了促進這項決策,國防部長埃斯珀發起了一項全面的全國防審查,結果削減了近 57 億美元,2021 會計年度的營運成本融資效率提高了2 億美元,並進行了額外的活動和職能重組實現了價值 10 億美元的服務業投資。該計劃使國防部能夠更有效地為更高級別的國防戰略 (NDS) 優先事項提供資源。

- 該地區的公司正在尋求國內外公司的各種投資,以加強其熱成像業務。例如,2021 年 10 月,工業自動化、自動駕駛汽車和其他應用的影像感測器解決方案提供商 SWIR Vision Systems Inc. 籌集了 500 萬美元。這筆資金將用於推進該公司的 CQD 感測器解決方案,並發展其在全球工業和國防市場的 SWIR 相機業務。

- 2021 年5 月,Elbit Systems 宣布推出下一代先進多感測器有效負載系統(AMPS NG),主要在現有日間CCD(電荷耦合元件)電視感測器中添加短波紅外線(SWIR) 技術,並具有獨特的高性能雙感測器。

- 此外,2022 年 1 月,大眾市場短波紅外線 (SWIR) 感測技術供應商 TriEye 宣布與汽車產品供應商 Hitachi Astemo 合作。兩家公司將攜手合作,透過加速TriEye技術的推出,進一步增強ADAS(高級駕駛輔助系統)在惡劣天氣和照度條件下的能力。

短波紅外線成像產業概述

短波紅外線成像市場競爭激烈,國內外廠商活躍。國際玩家透過與當地玩家的合作在每個國家開展業務。隨著市場預計將擴大並提供更多機會,更多參與者可能很快就會進入該市場。該市場的主要企業包括 BAE Systems、BE Myers & Company 和 Attro Engineering。

- 2022 年 2 月 - 總部位於芬蘭埃斯波的 Emberion 推出具有寬頻譜和寬動態範圍成像性能的 VIS-SWIR(可見光/短波紅外線)相機,以滿足機器視覺和監控市場的需求,並宣布資金籌措。

- 2021 年11 月- 短波紅外線(SWIR) 感測技術供應商TriEye 與英特爾和三星合作,將一種幫助自動駕駛和駕駛員輔助系統提高惡劣條件下的能見度的感測技術商業化,獲得保時捷7400 萬美元的融資。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 短波紅外線相機在軍事和國防領域的擴展

- 對小型化和低功耗技術的需求

- 自動駕駛汽車的擴張

- 市場挑戰/限制

- SWIR 相機和檢測器高成本

第6章 市場細分

- 按波長

- 1微米

- 1.7微米

- 2.1微米

- 依感測器類型

- 線感測器

- 影像儀

- 按整合級別

- 成像儀/線檢測器

- 相機/系統

- 按最終用戶產業

- 軍事/國防

- 醫療保健與研究

- 車

- 其他最終用戶產業

- 按地區

- 北美洲

- 亞太地區

- 歐洲

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Adasky, Ltd.

- BAE Systems Plc

- BE Meyers & Co.

- i3system

- Attollo Engineering

- Aixtron SE

- Alkeria SRL

- Allied Vision

- BaySpec

- Raptor Photonics

- STMicroelectronics NV

- Lockheed Martin

第8章投資分析

第9章 市場的未來

The Short-wave Infrared Imaging Market is expected to register a CAGR of 8.44% during the forecast period.

Key Highlights

- Short-wave infrared imaging (SWIR) is an advanced technique for producing images based on radiation in the region of the electromagnetic spectrum, which is invisible to the naked eye. Short-wave infrared (SWIR) imaging is distinct because the radiation of interest is nearer to the visible spectrum but will still permit temperature sensing, usually over 100 °C.

- Short-wave infrared (SWIR) imaging consists of a wavelength band from 0.7 - 2.5μm. SWIR imaging is used in various applications, including solar cell inspection, electronic board inspection, identification and sorting, surveillance, anti-counterfeiting, process quality control, etc.

- Vehicle navigation is increasingly relying on SWIR cameras. With the rise of self-driving cars, SWIR technology can assist in navigating through fog, snow, dust, and rain. Recently, Israeli start-up TriEye introduced a dashboard-mounted SWIR camera for the consumer car market that can successfully navigate through snow, fog, dust, and rain, responding to the expanding use of SWIR cameras in autonomous vehicles.

- A lot of investments are going on around the globe to develop short-wave infrared imaging technology. For instance, in January 2022, Emberion, a developer of high-performance short-wave infrared imaging using nanomaterials, raised EUR 6 million to accelerate infrared imaging business growth.

- Recently, Israeli start-up TriEye introduced a dashboard-mounted SWIR camera for the consumer car market that can successfully navigate through snow, fog, dust, and rain, responding to the expanding use of SWIR cameras in autonomous vehicles. According to a NASDAQ, driverless automobiles will likely dominate the market by 2030. Thus, these investments are also likely to create a scope for the market studied in this sector.

- Due to ongoing testing, research, and collaborations between companies to develop autonomous cars, the number of autonomous vehicles is anticipated to grow robustly in the upcoming years. For instance, French autonomous vehicle maker, Navya introduced an all-electric and fully autonomous Autonom Cab, the first 100% autonomous robot taxi. Another company, Valeo, partnered with Docomo to jointly develop connected cars.

Short-wave Infrared Imaging Market Trends

Military & Defense Segment is Expected to Have a Significant Growth

- Infrared imaging is used in defense applications to enable high-resolution vision and identification in near and total darkness. The infrared (IR) wavelengths are essential for military and defense research and development because surveillance and targeting occur at night.

- The SWIR region bridges the gap between visible wavelengths and peak thermal sensitivity of infrared, scattering less than visible wavelengths and detecting low-level reflected light at longer distances, which is ideal for imaging through smoke and fog. Moreover, SWIR cameras are useful security and surveillance devices, sometimes by themselves and often combined with other imagers.

- In May 2021, a Melbourne-based firm received a contract to equip the Army drones with next-generation surveillance sensors to provide stable images day or night using infrared cameras. The sensor technology aims to enhance intelligence, surveillance, and reconnaissance (ISR) capability by leveraging an imaging system that uses electro-optical, short wave, and medium wave infrared cameras, along with laser range finding and target designation technology.

- Moreover, in November 2021, DARPA hired three groups to develop enhanced direct-view night-vision systems of a size and weight near those of typical eyeglasses as a part of its ENVision program. These three organizations will develop small and lightweight night-vision eyeglasses to extend visual access beyond near-infrared to include short-wave, mid-wave, and long-wave infrared spectral bands through a common aperture giving users access to spectral ranges from 1.5 to 12 microns.

- According to the UK parliament, defense spending in 2020/21 was GBP 42.4 billion in cash terms. This is a nominal rise of GBP 2.5 billion over the previous year and a real increase of GBP 1.7 billion. As a result, the yearly defense budget in 2024/25 will be GBP 6.2 billion more in cash terms than in 2020/21. However, the real worth of this spending rise is lower, especially in light of growing inflation. Defense spending is estimated to rise by GBP 1.5 billion when adjusted for inflation.

North America Accounts For the Largest Market Share

- US defense spending is the highest in the world and one of the prominent markets for SWIR cameras and technology. According to the US Department of Defense, compared to the FY 2020 authorized amount of USD 704.6B (excluding natural disaster emergency funds), the President's budget request of USD 705.4B represents a minor gain of around 0.1%. Given this reduced funding level, the Department made several difficult decisions to ensure that resources are focused on the Department's top priorities.

- To facilitate that decision-making, Secretary of Defense Esper launched a comprehensive Defense-Wide Review, which resulted in nearly USD 5.7 billion in savings for FY 2021, USD 0.2 billion in Working Capital Fund efficiencies, and another USD 2.1 billion in activities and functions realigned to the Services. This program enabled the Department to better resource higher-level National Defense Strategy (NDS) priorities.

- Companies in the region are seeking various investments from national and international firms to boost their infrared imaging business. For instance, in October 2021, SWIR Vision Systems Inc., a provider of image sensor solutions for industrial automation, autonomous vehicles, and other applications, has raised USD 5 million, which will be used to advance the company's CQD sensor solutions to grow the company's SWIR camera business in the global industrial and defense markets.

- In May 2021, Elbit Systems announced the next generation of its Advanced Multi-Sensor Payload System (AMPS NG), primarily adding Shortwave Infrared (SWIR) technology into the existing day CCD (Charge-Coupled Device) TV sensors and a unique, highly capable dual FLIR sensor design.

- Furthermore, in January 2022, TriEye, the mass-market Short-Wave Infrared (SWIR) sensing technology provider, announced the collaboration with Hitachi Astemo, a supplier of automotive products. The companies will work together to further enhance the capabilities of advanced driver assistance systems (ADAS) for adverse weather and low-light conditions by accelerating the launch of TriEye technology.

Short-wave Infrared Imaging Industry Overview

The Short-wave Infrared Imaging Market is highly competitive, with several local and international players active. International participants operate in the countries through partnerships with local players. With the market expected to broaden and yield more opportunities, more players will enter the market soon. Key players in the market include BAE Systems, B.E Meyers & Co., and Attollo Engineering, among others. The recent developments in the market are -

- February 2022 - Espoo, Finland-based Emberion announced that the company had raised EUR 6 million in funding to address the needs of the machine vision and surveillance markets for VIS-SWIR (Visible/Short Wave Infrared) cameras with broad-spectrum and wide dynamic range imaging performance.

- November 2021 - TriEye, a Short-Wave Infrared (SWIR) sensing technology provider, has received USD 74 million in funding from Intel, Samsung, and Porsche to commercialize a type of sensing technology that can be used to help autonomous and driver assistance systems to see better in adverse conditions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Covid-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in penetration of SWIR cameras in military & defense vertical

- 5.1.2 Need for Miniaturization and Low-power Consumption Technology

- 5.1.3 Increasing Adoption of Autonomous Vehicles

- 5.2 Market Challenges/Restraints

- 5.2.1 High Cost of SWIR Cameras and Detectors

6 MARKET SEGMENTATION

- 6.1 By Wavelength

- 6.1.1 1 micron

- 6.1.2 1.7 micron

- 6.1.3 2.1 micron

- 6.2 By Type of Sensors

- 6.2.1 Line detectors

- 6.2.2 Imagers

- 6.3 By Level of Integration

- 6.3.1 Imagers/ Line detectors

- 6.3.2 Cameras/Systems

- 6.4 By End-User Industries

- 6.4.1 Military & Defense

- 6.4.2 Healthcare & Research

- 6.4.3 Automotive

- 6.4.4 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Asia Pacific

- 6.5.3 Europe

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Adasky, Ltd.

- 7.1.2 BAE Systems Plc

- 7.1.3 B.E Meyers & Co.

- 7.1.4 i3system

- 7.1.5 Attollo Engineering

- 7.1.6 Aixtron SE

- 7.1.7 Alkeria S.R.L

- 7.1.8 Allied Vision

- 7.1.9 BaySpec

- 7.1.10 Raptor Photonics

- 7.1.11 STMicroelectronics N.V

- 7.1.12 Lockheed Martin