|

市場調查報告書

商品編碼

1630294

半導體電池-市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Batteries For Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

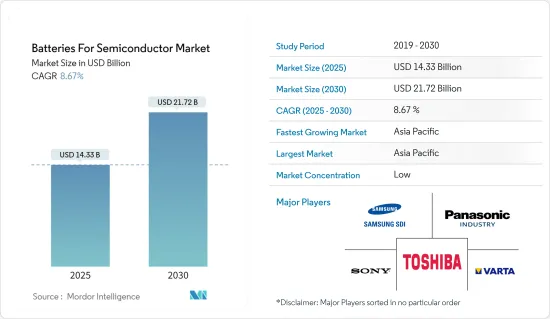

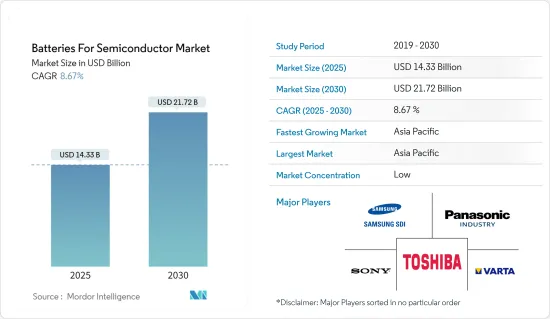

預計2025年半導體電池市場規模為143.3億美元,預計2030年將達217.2億美元,預測期內(2025-2030年)複合年成長率為8.67%。

從長遠來看,電動車的普及和行動電話需求的增加預計將在預測期內推動市場發展。

另一方面,電池的技術挑戰,如能量密度低、壽命短和充電能力慢等,預計將阻礙預測期內的市場成長。

由於能源儲存系統日益普及,預計半導體電池市場將創造重大的機會。

由於亞太地區擁有大規模電池製造基礎設施,預計亞太地區將成為消費電池市場的主導地區。

半導體電池市場趨勢

電動車領域預計將獲得巨大需求

- 電動車(EV)細分市場近年來經歷了顯著成長,這對半導體市場的電池需求產生了重大影響。隨著電動車因其環境效益和技術進步而不斷受到歡迎,對高效、可靠電池的需求變得至關重要。需求激增正在整個半導體市場產生連鎖反應,為產業相關人員創造新的機會和挑戰。

- 根據國際能源總署(IEA)預計,2022年全球電動車保有量將呈上升趨勢,全球插電式輕型電動車累積銷量約1,020萬輛,成長率為2021年至2022年成長56.9%,2018年至2022年成長五倍。

- 支持電動車細分市場成長的關鍵因素之一是全球對環境問題的意識不斷增強。政府和消費者正在倡導更清潔、更永續的交通,而電動車正成為可行的解決方案。因此,政府實施了各種激勵措施、稅收減免和法規來鼓勵電動車的採用。因此,汽車製造商正在將重點轉向電動車生產,從而推動半導體市場對先進電池技術的需求。

- 例如,2023年1月,加拿大政府宣布,從2026年起,該國銷售的汽車中至少20%將是電動車。該公告旨在加速該國電動車的普及,以實現加拿大設定的碳排放目標。政府也宣布將為全國電動車電池製造企業提供生產誘因。

- 電動車細分市場的成長軌跡對半導體產業產生連鎖影響,為市場相關人員創造各種機會。半導體製造商將有機會開發和供應電動車電池、電池管理系統和電力電子所需的尖端組件和晶片。這會增加收益潛力,並有機會在不斷擴大的電動車市場中獲得股權。

- 隨著電動車銷量的增加和政府措施的支持,半導體電池的研發活動預計將變得更加活性化。

亞太地區市場成長顯著

- 亞太半導體電池市場是一個充滿活力、充滿活力的地區,對全球半導體產業影響重大。這個廣闊而多樣化的地區包括許多國家,每個國家都有自己的經濟和技術前景。受快速工業化、家用電子電器產品使用量增加以及電動車市場快速成長等因素影響,亞太半導體市場的電池需求穩定成長。

- 亞太地區半導體電池需求的主要驅動力之一是家用電子電器產品的快速成長。這種成長是由可支配收入的增加和中產階級人口的迅速成長所推動的,特別是在中國和印度等國家。這些消費者擴大採用智慧型手機、筆記型電腦和其他個人電子設備,導致對先進半導體電池為這些設備供電的需求不斷增加。隨著家用電子電器成為日常生活中不可或缺的一部分,亞太地區的半導體製造商準備從這個不斷成長的市場領域中獲利。

- 此外,亞太地區電動車的採用率正在顯著增加。隨著對環境永續性的日益關注以及政府對推廣電動車的獎勵,中國等國家正在成為電動車市場的重要參與企業。

- 例如,根據中國工業協會(AMMA)的數據,截至2023年5月,中國是最大的電動車(EV)市場,擁有79.3萬輛插電式混合動力汽車(PHEV)和79.3萬輛純電動車(BEV)。 2022年,該國純電動車銷量將達545萬輛,位居世界第一。預計在預測期內仍將是全球最大的電動車市場。

- 因為電動車需要高效可靠的半導體元件來管理電源和電池性能。因此,電動車市場的成長為亞太地區的半導體電池製造商提供了重大機會。

- 總之,亞太半導體市場的電池細分市場充滿活力且快速發展。在家用電子電器和電動車的推動下,該地區對半導體電池的需求不斷成長,為製造商帶來了巨大的商機。因此,鑑於上述幾點,亞太地區將在預測期內主導半導體電池市場。

半導體電池產業概況

半導體電池市場高度細分和整合。主要企業(排名不分先後)包括三星 SDI、索尼公司、松下公司、Varta AG 和東芝公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 對行動裝置的需求增加

- 電動車的普及

- 抑制因素

- 存在技術問題

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 種類

- 鋰離子

- 鎳金屬氫化物

- 鋰離子聚合物

- 鈉離子電池

- 目的

- 家用電子電器產品

- 電動車

- 能源儲存系統

- 其他最終用戶用途

- 市場分析:按地區(2028 年之前的市場規模和需求預測)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 智利

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Samsung SDI Co Ltd.

- Sony Corporation

- Panasonic Corporation

- Varta AG

- Toshiba Corporation

- EnerSys

- GS Yuasa Corporation

- Faradion Limited

- Routejade

- TianJin Lishen Battery Joint-Stock Co. Ltd.

- Market Ranking/Share Analysis

第7章 市場機會及未來趨勢

- 能源儲存系統創新

The Batteries For Semiconductor Market size is estimated at USD 14.33 billion in 2025, and is expected to reach USD 21.72 billion by 2030, at a CAGR of 8.67% during the forecast period (2025-2030).

Over the long term, the increasing adoption of electric vehicles and demand for mobile phones are expected to drive the market during the forecasted period.

On the other hand, technological challenges of batteries, like low energy density, lower lifespan, and slower charging capacity, are expected to hinder the growth of the market during the forecasted period.

Nevertheless, the increasing adoption of energy storage systems is expected to create huge opportunities for the Batteries for Semiconductor Market.

Asia-Pacific is expected to be a dominant region for the Consumer Battery Market due to the presence of a large battery manufacturing infrastructure in the region.

Semiconductor Battery Market Trends

The Electric Vehicle Segment is Expected to Witness Significant Demand

- The electric vehicle (EV) market segment has witnessed substantial growth in recent years, and this has had a significant impact on the demand for batteries in the semiconductor market. As EVs continue to gain popularity due to their environmental benefits and technological advancements, the need for efficient and reliable batteries has become paramount. This surge in demand has generated a ripple effect throughout the semiconductor market, creating new opportunities and challenges for stakeholders in the industry.

- According to the International Energy Agency, global electric vehicles are on the rise in 2022; the cumulative plug-in light electric vehicle sales globally were around 10.2 million units, recording a growth rate of 56.9% between 2021 and 2022 and a fivefold increase between 2018 and 2022.

- One of the key drivers behind the growth of the EV market segment is the increasing global awareness of environmental concerns. Governments and consumers are advocating for cleaner and more sustainable modes of transportation, and EVs have emerged as a viable solution. This has led to various incentives, tax breaks, and regulations promoting the adoption of electric vehicles. As a result, automakers are shifting their focus towards EV production, thus bolstering the demand for advanced battery technologies within the semiconductor market.

- For instance, in January 2023, the Government of Canada announced that at least 20% of the vehicles sold in the country will be electric vehicles from 2026, and it will gradually increase to 60% in 2030 and reach 100% by the end of 2035. This announcement was made to increase the adoption of electric vehicles in the country to meet the carbon emission targets set by Canada. The government has also announced offering production incentives to companies manufacturing electric vehicle batteries nationwide.

- The electric vehicle market segment's growth trajectory has a cascading effect on the semiconductor industry, creating a range of opportunities for market players. Semiconductor manufacturers have a chance to develop and supply the cutting-edge components and chips required for EV batteries, battery management systems, and power electronics. This translates to increased revenue potential and the chance to capitalize on the expanding EV market.

- With the increasing sales of electric vehicles and the supportive government policies, the segment is expected to increase further, increasing the research and development activities in the battery for semiconductor segment.

Asia-Pacific Account for Significant Market Growth

- The Asia-Pacific market segment for batteries in the semiconductor market is a pivotal and dynamic region with significant implications for the global semiconductor industry. This vast and diverse region encompasses many countries, each with its unique economic and technological landscape. The demand for batteries in the semiconductor market within the Asia Pacific region has been steadily rising, driven by factors that include rapid industrialization, increasing consumer electronics usage, and the burgeoning electric vehicle market.

- One of the critical drivers for the demand for semiconductor batteries in the Asia-Pacific region is the exponential growth in consumer electronics. This growth is driven by rising disposable incomes and a surging middle-class population, especially in countries like China and India. These consumers are increasingly adopting smartphones, laptops, and other personal electronic devices, which, in turn, fuels the need for advanced semiconductor batteries to power these gadgets. As consumer electronics become an integral part of everyday life, semiconductor manufacturers in the Asia-Pacific region are poised to benefit from this growing market segment.

- Additionally, the Asia-Pacific region has witnessed a substantial uptick in electric vehicle adoption. With an increasing focus on environmental sustainability and government incentives to promote electric vehicles, countries like China have become significant players in the electric vehicle market.

- For instance, according to the China Association of Automobile Manufacturers (AMMA), as of May 2023, China is the largest market for electric vehicles (EV), with an estimated 0.793 million plug-in hybrid Electric vehicles (PHEVs) and 2.146 million battery electric vehicles (BEVs) being sold. In 2022, the country recorded the highest sales of battery electric vehicles, with 5.45 million. It is expected to remain the world's largest electric car market during the forecast period.

- This, in turn, has led to soaring demand for advanced batteries in the semiconductor market, as EVs require efficient and reliable semiconductor components to manage power and battery performance. The growth of the electric vehicle market, therefore, offers substantial opportunities for semiconductor battery manufacturers in the Asia-Pacific region.

- In conclusion, the Asia-Pacific market segment for batteries in the semiconductor market is a dynamic and rapidly evolving landscape. The region's growing demand for semiconductor batteries, driven by consumer electronics and electric vehicles, offers significant opportunities for manufacturers. Therefore, per the above points, the Asia-Pacific region will dominate the battery for semiconductor market during the forecasted period.

Semiconductor Battery Industry Overview

The batteries for semiconductor market are highly fragmented and consolidated. The major companies (in no particular order) include Samsung SDI Co Ltd, Sony Corporation, Panasonic Corporation, Varta AG, and Toshiba Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Mobile Devices

- 4.5.1.2 Rising Adaption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Availability of Technical Challenges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Lithium-Ion

- 5.1.2 Nickel-Metal Hydride

- 5.1.3 Lithium-Ion Polymer

- 5.1.4 Sodium-Ion Battery

- 5.2 End-User Application

- 5.2.1 Consumer Electronics

- 5.2.2 Electric Vehicles

- 5.2.3 Energy Storage System

- 5.2.4 Other End-User Applications

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Asia-Pacific

- 5.3.2.1 China

- 5.3.2.2 India

- 5.3.2.3 Japan

- 5.3.2.4 South Korea

- 5.3.2.5 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Chile

- 5.3.4.2 Brazil

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Samsung SDI Co Ltd.

- 6.3.2 Sony Corporation

- 6.3.3 Panasonic Corporation

- 6.3.4 Varta AG

- 6.3.5 Toshiba Corporation

- 6.3.6 EnerSys

- 6.3.7 GS Yuasa Corporation

- 6.3.8 Faradion Limited

- 6.3.9 Routejade

- 6.3.10 TianJin Lishen Battery Joint-Stock Co. Ltd.

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Energy Storage System