|

市場調查報告書

商品編碼

1630371

西歐電池 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)West Europe Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

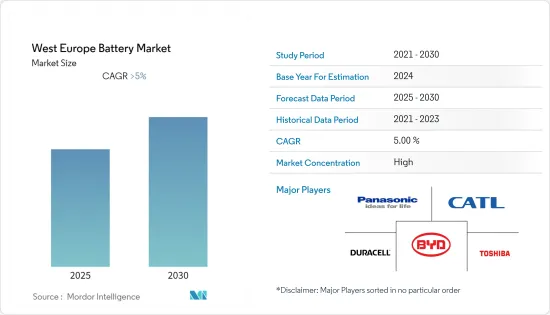

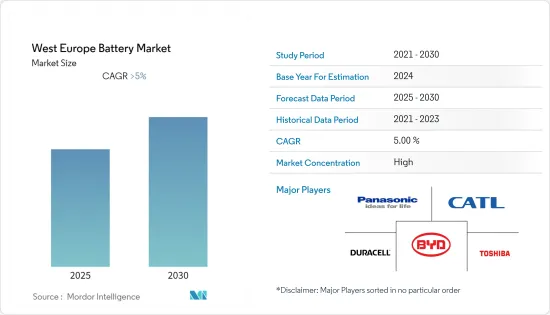

預計西歐電池市場在預測期內將維持5%以上的複合年成長率。

COVID-19 對 2020 年市場產生了負面影響。市場現在可能會達到大流行前的水平。

主要亮點

- 從中期來看,電動車在該地區的不斷普及以及清潔能源來源的未來前景預計將推動市場成長。

- 同時,由於供需不匹配導致的電池原料價格波動預計將阻礙預測期內西歐電池市場的成長。

- 西歐全部區域製造設施數量的增加可能會在預測期內為西歐電池市場創造有利的成長機會。

- 德國在市場上佔據主導地位,並且可能在預測期內實現最高的複合年成長率。這一成長歸因於可再生能源裝置的增加以及從傳統燃料到清潔能源來源的逐步過渡。

西歐電池市場趨勢

鋰離子電池可望主導市場

- 鋰離子電池是一種常用於電子設備和能源汽車的可充電電池。該電池還儲存來自太陽能和風能等再生能源來源的能量。

- 到2030年,歐洲電動車對鋰離子電池的需求預計將達到325吉瓦時。這幾乎代表了全球電動車鋰離子電池需求的大部分。許多歐洲國家正在逐步淘汰內燃機,在此期間電池需求將大幅增加。

- 此外,該地區國家正在尋求國內投資和製造商。德國和法國等國家正計劃減少亞太公司在歐洲的主導地位,影響當地公司在該地區的參與。

- 2022 年 8 月,Eurocell 透露,它正在洽談在荷蘭建設歐洲第一家超級工廠,並向泛歐能源儲存和電動車生態系統供應電池。 Eurocell計畫分兩階段興建新的超級工廠,最快於2025年達到滿載生產。第一階段將涉及 2023 年初為歐洲現有客戶大規模生產先進電池。到 2025 年,第二階段預計在同一地點每年生產超過 4,000 萬個電池。

- 綜上所述,預計鋰離子電池產業將在預測期內主導西歐電池市場。

德國可望主導市場

- 德國是歐盟最大的經濟體,正在吸引世界各地的投資來開發電池製造設施。

- 此外,政府也計畫增加可再生能源發電設施,計畫到2025年可再生能源佔能源消費量總量的40-45%。這可能會推動電池市場,因為電池可用於儲存多餘的可再生能源。 2021 年德國太陽能發電裝置容量為 58.461 吉瓦 (GW),而 2020 年為 53.721 吉瓦 (GW)。

- 德國汽車工業見證了電動車市場的快速成長,這推動了德國電池市場的發展。此外,2020年2月,德國政府正式宣布增加電動車(EV)的環境獎金,並在《德國聯邦公報》上公佈。新的補貼率將適用於2019年11月4日之後註冊的所有車輛,該指令將於2025年12月31日或預算劣化時到期。政府此舉預計將吸引消費者,並可能吸引大公司的投資。

- 2022 年 3 月,電池製造新興企業Northvolt 宣布計劃在德國建造一座新的電池超級工廠。該廠計劃於2025年開業,年產能將達到60吉瓦時,每年可供應約100萬輛汽車。

- 鑑於上述情況,德國預計將在預測期內主導西歐電池市場。

西歐電池產業概況

西歐電池市場較為分散。該市場的主要企業包括(排名不分先後)東芝公司、寧德時代新能源科技有限公司、比亞迪有限公司、松下公司和金霸王公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代產品/服務的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 類型

- 一次電池

- 二次電池

- 科技

- 鋰離子電池

- 鉛酸電池

- 流動

- 其他

- 目的

- 汽車電池

- 工業電池

- 攜帶式電池

- 其他

- 地區

- 德國

- 法國

- 奧地利

- 其他

第6章 競爭狀況

- 合併、收購、聯盟和合資企業

- 主要企業策略

- 公司簡介

- VARTA Microbattery GmbH

- Clarios LLC

- Toshiba Corp

- INTILION GmbH

- Panasonic Corporation

- Tadiran Batteries GmbH

- EAS Batteries GmbH

- Saft Groupe SA

- E4V

- Duracell Inc

- Contemporary Amperex Technology Co Ltd

- BYD Company Ltd.

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 70249

The West Europe Battery Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the medium term, increasing the adoption of electric vehicles in the region and the future outlook toward cleaner energy sources are expected to drive the market's growth.

- On the other hand, variations in the prices of battery raw materials due to a mismatch in demand and supply are expected to hamper the West Europe Battery Market growth during the forecast period.

- Nevertheless, increasing manufacturing facilities across the West Europe region is likely to create lucrative growth opportunities for the West Europe Battery Market in the forecast period.

- Germany dominates the market and is likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing renewable energy installations and phasing from conventional fuel to cleaner energy sources.

West Europe Battery Market Trends

Lithium-ion Batteries are Expected to Dominate the Market

- Lithium-ion batteries are a rechargeable type of battery that is commonly used in electronic devices and energy vehicles. These batteries also store energy from renewable energy sources such as solar and wind.

- Europe's demand for lithium-ion batteries for electric vehicles is expected to amount to 325 gigawatt-hours in 2030. This represents almost the major of the global demand for electric vehicle lithium-ion batteries. Many European countries committed to combustion engine phase-out will substantially increase battery demand in this time frame.

- Moreover, the countries in the region are wanted domestic investment and manufacturers. Countries such as Germany and France have planned to decrease the dominance of Asia-Pacific companies in the European region, affecting local companies' involvement in the area.

- In August 2022, Eurocell confirmed that it is in advanced discussions to build its first European Gigafactory in the Netherlands, supplying battery cells to the energy storage and e-mobility ecosystem across the continent. Eurocell intends to construct its new Gigafactory in two phases reaching total capacity as early as 2025. The first phase will produce advanced battery cells at scale by early 2023 for existing European customers. The second phase, potentially on the same site, will produce more than 40 million cells annually by 2025.

- Hence, owing to the above points, the lithium-ion segment is expected to dominate in the West Europe Battery Market during the forecast period.

Germany Expected to Dominate the Market

- Germany being the largest economy in the European Union has been attracting investments from other countries across the globe for the development of the batteries manufacturing facilities.

- Moreover, the government has targeted increasing the installed renewable energy capacity and has planned to generate 40% to 45% of the total energy consumption from renewable energy by 2025. This will likely drive the battery market as batteries can be used to store extra renewable energy. In 2021, Germany's total installed solar capacity was 58.461 gigawatts (GW), compared to 53.721 gigawatts (GW) in 2020,

- The automotive industry in Germany is witnessing rapid growth in the electric vehicles market, thus driving the country's battery market. Moreover, in February 2020 government of Germany officially announced to increase in environmental bonuses on electric vehicles (EV) with its publication in the German Federal Gazette. The new subsidy rates apply to all vehicles registered after 4th November 2019, and the directive will expire on 31 December 2025 or when the budget is exhausted. This step by the government is expected to attract consumers and is likely to attract investment by major players.

- In March 2022, Battery manufacturing startup Northvolt announced plans to build a new battery cell gigafactory in Germany. The factory was expected to open in 2025 with an annual production capacity of 60 gigawatt-hours and enough to supply around one million cars annually.

- Hence, owing to the above points, Germany is expected to dominate the West Europe battery market during the forecast period.

West Europe Battery Industry Overview

The West Europe Battery Market is fragmented in nature. Some of the major players in the market (not in particular order) include Toshiba Corp, Contemporary Amperex Technology Co. Limited, BYD Company Ltd., Panasonic Corporation, and Duracell Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lithium-ion Battery

- 5.2.2 Lead-acid Battery

- 5.2.3 Flow

- 5.2.4 Others

- 5.3 Application

- 5.3.1 Automotive Batteries

- 5.3.2 Industrial Batteries

- 5.3.3 Portable Batteries

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 Austria

- 5.4.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 VARTA Microbattery GmbH

- 6.3.2 Clarios LLC

- 6.3.3 Toshiba Corp

- 6.3.4 INTILION GmbH

- 6.3.5 Panasonic Corporation

- 6.3.6 Tadiran Batteries GmbH

- 6.3.7 EAS Batteries GmbH

- 6.3.8 Saft Groupe S.A.

- 6.3.9 E4V

- 6.3.10 Duracell Inc

- 6.3.11 Contemporary Amperex Technology Co Ltd

- 6.3.12 BYD Company Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219