|

市場調查報告書

商品編碼

1630314

雲端計費:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Cloud Billing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

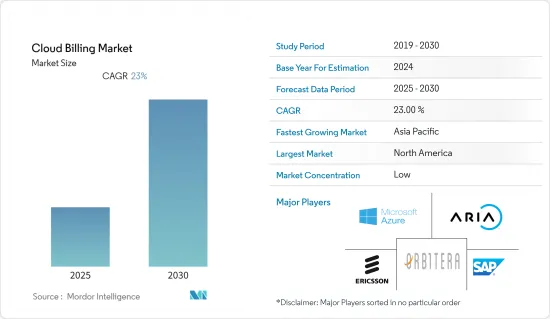

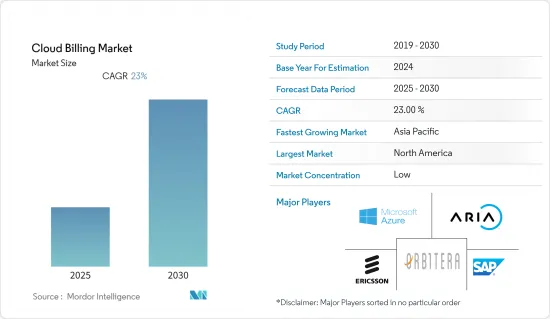

雲端計費市場預計在預測期內複合年成長率為 23%。

主要亮點

- 隨著產業技術格局的變化,公司正在尋找經濟高效的方法來提高市場競爭力。雲端計費解決方案具有成本效益,因為它們有助於降低資源和IT基礎設施的成本,從而推動對雲端計費系統的需求。

- 此外,電子商務和虛擬職場的激增推動了簡化業務和透明收費流程的需求,進一步推動了市場成長。此外,雲端基礎的POS 系統的成長推動了零售業的雲端計費。

- 由於對減少資本和營運支出的需求不斷增加,雲端計費產業預計在未來幾年將進一步成長。隨著雲端的出現,計費已從單獨的後勤部門產品發展成為完整報價到現金流程的重要組成部分。雲端計費使企業能夠降低成本,同時提供優質的客戶服務。 Flexera 研究表明,去年 89% 的企業希望擁有多個混合雲端。因此,減少資本投資和營運成本的需求日益成長,正在推動雲端計費產業的擴張。

- 然而,從本地計費解決方案轉向雲端基礎的收費解決方案的轉變預計將阻礙市場成長,尤其是中小型企業。這是由於與雲端計費解決方案相關的遷移成本以及隱私和資料安全問題。

- COVID-19的疫情對雲端計費業務產生了積極影響。由於全球封鎖,隨著企業引入新的、創意的發票方法,雲端計費系統變得流行。由於其低廉的成本和擴充性,雲端基礎的計費系統在 COVID-19 大流行期間的受歡迎程度顯著增加。

雲端計費市場趨勢

零售業可望展現最大應用

- 電商巨頭的崛起使得線上平台上的產品和服務銷售大幅成長,導致發票、發票等數位文件數量增加。這使得電子商務企業必須擁有雲端計費等解決方案,使他們能夠有效且有效率地管理其資源和營運,並為消費者提供順暢的體驗。

- 企業正在迅速採用雲端技術來獲得更好的控制、分析資料並獲得即時洞察。此外,遷移到雲端使依賴零售的公司能夠在內部探索新的商機,從而為零售商提供相對於傳統零售商店急需的競爭優勢。

- 不斷擴大的零售可能會刺激雲端計費市場。根據美國零售聯合會的數據,去年美國零售總額約 4.86 兆美元,與前一年同期比較增加 530 億美元。雜貨店、餐廳和書店都是零售店的例子。美國約有 400 萬家零售公司。

- 技術進步正在塑造雲端計費產業。領先的雲端計費公司專注於提供雲端計費技術解決方案以加速業務成長。

- 例如,今年 1 月, Oracle擴展了其完整的零售雲端基礎設施,並增加了 Oracle 零售支付雲端服務。這項技術將使美國商家能夠利用簽帳金融卡、Apple、Samsung Pay 和 Google 的最新非接觸式付款,而無需支付額外費用或影響利潤的不可預測性。所有這些都是在透明、固定費用的基礎上完成的,沒有合約延期,沒有鎖定,也沒有每月最低費用。

預計北美將主導市場

- 由於北美主要解決方案提供商的存在,預計北美將在預測期內主導雲端計費市場。該地區也始終處於技術採用的前沿。

- 北美零售市場正在迅速擴張,尤其是加拿大和美國等國家。北美的零售業是最大的零售業之一,擁有好市多、沃爾瑪、家得寶、克羅格和塔吉特等公司。

- 此外,北美也是零售雲端解決方案市場的領導者。與許多其他地區相比,該地區的零售環境更具創新性。此外,雲端解決方案已被該地區的專業零售商廣泛使用。

- 美國的零售額大幅成長,增加了對雲端計費處理大量交易的需求。根據美國人口普查局的數據,美國去年1月零售額預計約為5,181.5億美元,去年10月零售額預計約5,978.3億美元。

- 此外,在該地區營運的市場參與企業正在創造技術以獲得競爭優勢。例如,去年 3 月, Oracle發布了新工具,讓您可以直接在Oracle雲端介面中檢視和管理雲端訂閱和帳單。這些功能是與 Oracle 雲端基礎架構 (OCI) 客戶群密切合作開發的,並受到客戶需求的推動,以滿足關鍵計費範例。因此,這項新功能進一步強化了Oracle透過使雲端支付和使用更易於理解來提供卓越所有權體驗的承諾。

雲端計費產業概況

由於全球不同解決方案供應商的存在,雲端計費市場的競爭格局變得越來越分散。然而,由於不同地區和最終用戶產業的雲端採用案例不斷增加,參與者之間的市場競爭也在加劇。新參與企業和新興企業也在進入市場,這正在稀釋市場佔有率。此外,許多現有的大公司正在製定新的策略和聯盟,以在市場競爭中保持領先地位。 2022 年 9 月,Gentrac 被領先的能源和寬頻服務供應商 Pulse Energy 選為系統遷移合作夥伴。此次合作將加速組織轉型,並協助 Pulse Energy 在整個企業中打造全新的客戶旅程。 Gentrack 雲端計費和營運解決方案現已作為遷移元件在 Amazon Web Services (AWS) 上提供,新增了用於抄表資料、業務分析和洞察以及與 Snowflake 智慧整合的雲端服務。 2022 年 3 月,幫助成長訂閱和基於使用的收益的市場領導者 Aria Systems 宣布,第一個連接北美和歐洲的專用數位基礎設施平台 EXA Infrastructure 成功整合其雲端計費平台,並宣布已開始發行。使用Aria 的當前產品的發票。 EXA 是在 GTT Communications 銷售額達到 21.5 億美元後成立的,GTT Communications 從 2021 年 4 月起選擇 Aria 作為其新營業單位的收費提供者。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力——波特五力

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- CIVID-19市場影響評估

第5章市場動態

- 市場促進因素

- 雲端運算的採用率提高

- 電子商務平台的成長

- 市場限制因素

- 從本地解決方案遷移到雲端基礎的解決方案

- 高成本和資料隱私問題

第6章 市場細分

- 按發展

- 公共雲端

- 私有雲端

- 混合雲

- 按成分

- 平台

- 服務

- 按最終用戶產業

- 零售

- 電力/能源

- 衛生保健

- 通訊

- BFSI

- 其他最終用戶產業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Orbitera Inc.

- Microsoft Corporation

- SAP SE

- ARIA Systems, INC.

- Telefonaktiebolaget LM Ericsson

- Oracle Corporation

- Amazon Web Services, Inc.

- BillingPlatform

- FinancialForce

- Zuora Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Cloud Billing Market is expected to register a CAGR of 23% during the forecast period.

Key Highlights

- As the industry's technological landscape changes, businesses are looking for cost-effective ways to increase their competitiveness in the market. Cloud billing solutions are cost-efficient as they help in reducing the cost of resources and the IT infrastructure, thus driving the demand for the cloud billing system.

- Also, the massive growth in e-commerce and virtualized workplaces is increasing the need for simplified operations and billing process transparency, further driving the market growth. Also, the growth of the cloud-based POS system is giving rise to cloud billing in the retail sector.

- The growing requirement for lower capital and operational expenditures is projected to propel the cloud billing industry forward in the future years. Billing developed from a discrete back-office product to an integral component of the complete quote-to-cash process with the arrival of the cloud. Cloud billing enables organizations to save money while providing exceptional customer service. According to Flexera research, in the last year, 89% of firms desire multiple-hybrid cloud. As a result, the growing need for cheaper capital and operational expenses drives the expansion of the cloud billing industry.

- However, the transition from on-premises to cloud-based billing solutions, especially in small and medium firms, is expected to hinder the market growth. This is due to the costs involved with the transformation and privacy and data security issues related to cloud billing solutions.

- The COVID-19 outbreak had a favorable influence on the cloud billing business. Due to the worldwide lockdown, cloud billing systems have become popular as businesses implement new and inventive invoicing ways. The popularity of cloud-based billing systems increased significantly during the COVID-19 pandemic due to their cheap cost and scalability.

Cloud Billing Market Trends

Retail Sector Expected to Show Maximum Application

- The rise of e-commerce giants has resulted in a substantial surge in the sales of products and services over the online platform, increasing the number of digital documents such as invoices and bills. This has made it imperative for the e-commerce players to have solutions like cloud billing that enable them to effectively and efficiently manage resources and operations, thereby enabling them to provide a smooth experience to their consumers.

- Businesses are quickly adopting cloud technology to manage better and analyze data to gain real-time insights. Furthermore, cloud migration allows businesses that rely on retail to explore new business opportunities within their company and provides retailers with a much-needed competitive edge over traditional retail outlets.

- The expanding retail sales industry is likely to fuel the cloud billing market. As per the National Retail Federation, overall retail sales in the U.S. reached nearly 4.86 trillion U.S. dollars last year, up USD 53 billion from the previous year. Grocery shops, restaurants, and booksellers are examples of retail establishments. The U.S. has around four million retail enterprises.

- Technological advancements are shaping the cloud billing industry. Major cloud billing firms are focusing on providing technology solutions for cloud billing to speed up business growth.

- For instance, in January this year, Oracle expanded its full retail cloud infrastructure by adding the Oracle Retail Payments Cloud Service. With the technology, U.S. merchants can take the most up-to-date contactless payment alternatives, such as debit/credit cards and Apple, Samsung Pay, and Google, without the added charges and unpredictability that eat into their profits. This is all done with clear, fixed-fee pricing, with no contract extensions, lock-ins, or monthly minimums.

North America Expected to Dominate the Market

- North America is anticipated to dominate the cloud billing market during the forecast period, owing to the presence of major solution providers in the region. Also, the region has always remained at the forefront of technology adoption.

- The retail market in North America is expanding rapidly, particularly in nations such as Canada and the United States. The retail industry in North America is one of the largest, owing to the existence of businesses such as Costco, Walmart, Home Depot, Kroger, and Target.

- Furthermore, North America is the market leader for retail cloud solutions. Compared to many other regions, the region features one of the more innovative retail environments. In addition, cloud solutions are widely used in specialty retailers in the region.

- Retail sales in the United States are expanding significantly; this rise is likely to generate demand for cloud billing for processing huge volumes of transactions. According to the US Census Bureau, retail sales in the United States in January last year were nearly USD 518.15 billion, and retail sales in October last year were estimated to be around USD 597.83 billion.

- Furthermore, market participants having a presence in the region are creating technologies to acquire a competitive advantage. Oracle, for example, announced new tools in March last year to see and control the cloud subscription and invoicing directly in the Oracle Cloud Interface. These capabilities were developed in close collaboration with a group of Oracle Cloud Infrastructure (OCI) clients and were motivated by their requirements to meet major billing use cases. Consequently, this new feature adds to the company's commitment to providing a superior ownership experience by making cloud paying and usage more straightforward.

Cloud Billing Industry Overview

The cloud billing market's competitive landscape is gradually shifting towards fragmentation, owing to the presence of various solution providers across the globe. However, due to the increased instances of cloud adoption in various regions and end-user industries, the market competitiveness amongst the players is also increasing. Also, new and emerging players are entering the market, hence diluting the market share. Moreover, many existing major players are forming new strategies and partnerships to stay ahead of the competition in the market. In September 2022, Gentrack was chosen by Pulse Energy, a top provider of energy and broadband services, to be their system transition partner. The collaboration will accelerate organizational change and assist Pulse Energy in creating fresh client journeys throughout its enterprise. The Gentrack Cloud Billing and Operations solution will be made available on Amazon Web Services (AWS) as a transition component, with additional cloud services for meter reading data, business analytics and insights, and intelligent integration driven by Snowflake. In March 2022, Aria Systems, the market leader in assisting companies in growing subscription and usage-based income, announced that EXA Infrastructure, the first dedicated digital infrastructure platform linking North America and Europe, has successfully integrated its cloud billing platform and has begun invoicing for current products utilizing Aria. Following the USD 2.15 billion sales from GTT Communication, which had chosen Aria to serve as the new entity's billing provider starting in April 2021, EXA was established.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of CIVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Cloud Computing

- 5.1.2 Growth in E-commerce Platforms

- 5.2 Market Restraints

- 5.2.1 Transition From On-Premise to Cloud-Based Solutions

- 5.2.2 High Costs Involved and Data Privacy Issues

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Public Cloud

- 6.1.2 Private Cloud

- 6.1.3 Hybrid Cloud

- 6.2 By Component

- 6.2.1 Platform

- 6.2.2 Services

- 6.3 By End-user Industry

- 6.3.1 Retail

- 6.3.2 Power & Energy

- 6.3.3 Healthcare

- 6.3.4 Telecommunications

- 6.3.5 BFSI

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 South Korea

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East & Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 South Africa

- 6.4.5.3 Saudi Arabia

- 6.4.5.4 Rest of Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Orbitera Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 SAP SE

- 7.1.4 ARIA Systems, INC.

- 7.1.5 Telefonaktiebolaget LM Ericsson

- 7.1.6 Oracle Corporation

- 7.1.7 Amazon Web Services, Inc.

- 7.1.8 BillingPlatform

- 7.1.9 FinancialForce

- 7.1.10 Zuora Inc.