|

市場調查報告書

商品編碼

1630324

條狀包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Stick Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

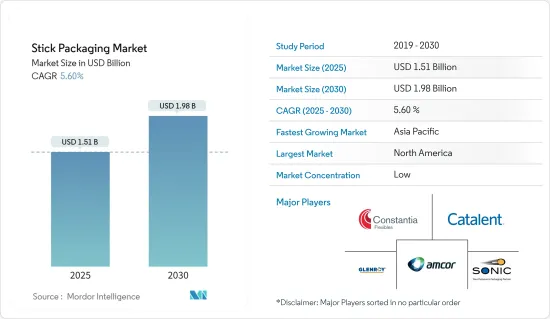

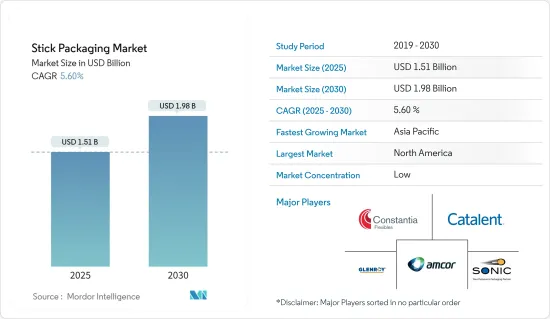

棒狀包裝市場規模預計到 2025 年為 15.1 億美元,預計到 2030 年將達到 19.8 億美元,預測期內(2025-2030 年)複合年成長率為 5.6%。

條狀包裝是軟包裝解決方案,用於包裝液體、凝膠和半固態以方便使用。棒狀包裝尺寸小,形狀細長,適合包裝單份產品。

食品和飲料行業對混合咖啡、營養補充劑以及各種粉末和液體等產品的需求不斷增加,這推動了市場的成長。此外,由於行動食品和飲料消費的趨勢,棒狀包裝變得越來越流行,這對消費者來說很方便。

公司選擇生產棒狀包裝是因為它們方便、便攜且易於消費者使用。隨著食品和製藥業使用單份包裝和小袋,對棒狀包裝的需求不斷增加。隨著粉末狀藥物和藥物的引入,棒狀包裝的使用正在推廣。

印度等新興國家製藥業的快速成長可能會增加對棒狀包裝的需求。據印度品牌股權基金會稱,印度藥品因其價格低廉、品質優良而受到市場青睞,被譽為「世界藥局」。

市場上的各種公司都透過投資為各行業提供永續的棒狀包裝解決方案來關注永續性和可回收性。此外,與常規份裝相比,條狀包裝使用的材料和包裝要少得多,因此更環保、更少浪費。該公司還生產自訂的棒狀包裝,以確保客戶的安全性和可靠性,這推動了市場的成長。

條狀包裝需要對機械進行較高的初始投資,並且由於全球原料價格波動,製造和獲取原料的成本昂貴,這可能會阻礙市場成長。

棒包裝市場趨勢

食品飲料產業預計將佔據最大佔有率

- 棒狀包裝是一種用於將即溶茶、咖啡、維生素補充劑、其他飲料和調味品包裝成單份的容器。棒狀包裝是三邊密封的單劑量袋,通常有標準型、包裹密封型、改良型和條型,取決於消費者的喜好。

- 棒狀袋為食品和飲料提供了實用且易於打開的方式。咖啡館和餐廳的消費者人數不斷增加,增加了對咖啡、糖和鹽的一次性棒狀包裝的需求。此外,隨著北美和歐洲旅遊業的發展,碳酸飲料和加工食品的消費量不斷增加,支撐了市場的成長。

- 條狀包裝體積不大,在材料使用、環境影響或製造商成本效益方面幾乎沒有優勢。因此,條狀包裝越來越受到消費者的歡迎。因此,整個食品產業對棒狀包裝的需求正在增加,預計市場在未來幾年將迅速擴大。

- 咖啡在世界各地年輕消費者中的日益普及、咖啡消費量的增加以及永續生產咖啡的吸引力日益增強,正在推動對棒狀包裝的需求增加。根據國際咖啡組織預測,2023年咖啡消費量與前一年同期比較成長2.2%,支撐市場成長。

預計北美將佔據最大佔有率

- 由於全球最大的食品和製藥公司在美國的業務不斷成長,預計棒狀包裝解決方案將實現盈利成長。根據美國商務部的資料,美國有超過41,080家食品和飲料生產設施。

- 北美旅遊業的成長正在推動食品和飲料消費,推動對棒狀包裝的需求。根據聯合國世界旅遊組織 (UNWTO) 統計,全球約有 13 億外國遊客。此外,2023 年美洲的遊客人數將達到疫情前水準的 90%,從而導致食品和飲料行業對棒狀包裝的需求增加。

- 此外,指數級成長的北美製藥業為棒狀包裝製造商提供了利潤豐厚的機會,為處方藥和非處方藥 (OTC) 提供方便、便攜的單位劑量解決方案。 Catalent Inc. 等公司為粉末、顆粒、凝膠和液體製劑的藥品提供廣泛的條狀包裝解決方案,正在推動市場成長。

- 據美國農業部 (USDA) 稱,美國向加拿大出口面向消費者的食品的增加正在推動該地區的零售業發展。人口成長和不斷成長的中等收入群體也為棒狀包裝製造商創造了利潤豐厚的機會。

棒狀包裝行業概況

由於主要企業的存在,棒狀包裝市場競爭非常激烈,例如: Amcor PLC、Glenroy Inc.、ConstantiaFlexibles、SonicPackagingIndustries 和 CatalentInc. 透過研究和開發,市場參與者正在開發新產品,這些產品已被各個最終用戶行業廣泛接受。

- 2024年2月,總部位於丹麥的Novo Holdings宣布將以165億美元企業價值收購總部位於美國的Catalent。此次收購預計將使 Novo Holdings 加快製造能力並投資於新產品開發。

- 2023 年 9 月 歐洲化妝品公司 QuadPack 推出了 ShapeUp Stick,它可重複填充且可回收,可用於保濕霜、粉底、腮紅和螢光筆。該棒是一種閉塞解決方案,可保護護膚和彩妝配方免於乾燥。 Shape Up 棒由單一材料 PP 製成,底座和蓋子由消費後回收 (PCR) PP 製成。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 易於操作和行動消費的成長趨勢

- 條狀包裝製造過程中對減少材料消耗的需求不斷增加

- 市場限制因素

- 加強對一次性塑膠的禁令

第6章 市場細分

- 按材質

- 塑膠

- 紙

- 金屬

- 按最終用戶產業

- 飲食

- 藥品

- 化妝品

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 義大利

- 德國

- 亞洲

- 中國

- 印度

- 日本

- 韓國

- 澳洲/紐西蘭

- 中東/非洲

- 拉丁美洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Constantia Flexibles

- Glenroy, Inc.

- Aranow Packaging Machinery SL

- Fres-Co System Inc

- Catalent Inc.

- Winpak Ltd

- Sonoco Products Company

- ePac Holdings LLC

- GFR Pharma

- Sonic Packaging Industries

- 熱圖分析

第8章投資分析

第9章 市場機會及未來趨勢

The Stick Packaging Market size is estimated at USD 1.51 billion in 2025, and is expected to reach USD 1.98 billion by 2030, at a CAGR of 5.6% during the forecast period (2025-2030).

Stick packs are flexible packaging solutions that are used to pack liquids, gels, or semi-solids for convenient use. They are small in size and have a narrow shape, enhancing their popularity for packaging single-serve products.

The growing demand in the food and beverage industry for products, including coffee blends, nutritional supplements, and various powders and liquids, is boosting the market's growth. Also, stick packaging is increasingly becoming popular due to the trend of on-the-go food and beverage consumption, which is convenient for consumers.

Companies opt to manufacture stick packs that are convenient, portable, and easy to use for consumers. The demand for stick packaging is increasing as single-serve packs and sachets are being used in the food and pharmaceutical industries. The use of stick packaging is encouraged by the introduction of pharmaceutical products and medications in powder form.

The rapid growth in the pharmaceutical industry in emerging countries such as India is likely to boost the demand for stick packs. According to the Indian Brand Equity Foundation, Indian medicines are preferred in the market due to their low price and high quality, making the country the 'Pharmacy of the World.'

Various companies in the market are focusing on sustainability and recyclability by investing in sustainable stick packaging solutions for various industries. Also, as compared to the regular portion packets, stick packs utilize much less material and packaging, making them environmentally friendly and less wasteful. Also, companies manufacture custom-made stick packaging to ensure customer safety and reliability, which boosts the market's growth.

Stick packaging requires a high initial investment in machinery, and it can be more expensive to produce and acquire materials due to fluctuating prices of raw materials across the globe, which can hamper the market growth.

Stick Packaging Market Trends

The Food and Beverage Industry is Expected to Hold the Largest Share

- Stick packs are single-serve packaging containers of instant tea, coffee, vitamins, and other beverages or flavorings. A stick pack is a single-dose bag sealed on three sides, which is generally available in standard, lap-seal, shaped, and strip types according to consumer preference.

- Stick pouches provide practical and easy openings for food and beverage products. Growing consumer footfall in cafes and restaurants has increased the demand for single-use stick packaging for coffee, sugar, and salt. Also, the growing tourism industry in North America and Europe is boosting the consumption of carbonated drinks and processed foods, thus driving the market's growth.

- Stick packs are less bulky and provide few advantages in terms of material use, environmental impact, and cost-effectiveness for manufacturers. As a result, stick-packed items are becoming increasingly popular with consumers. Therefore, it is predicted that the market will experience rapid expansion in the approaching years due to the growing need for stick packaging throughout the food industry.

- The growing coffee consumption due to an increase in the popularity of coffee among young consumers across the globe, along with the rise in appeal for sustainably sourced coffee, is boosting the demand for stick packaging in hotels, restaurants, and cafes. According to the International Coffee Organization, coffee consumption increased by 2.2% in 2023 compared to the previous year, boosting the market's growth.

North America is Expected to Hold the Largest Share

- Stick packaging solutions are predicted to experience profitable growth due to the growing presence of some of the world's biggest food and pharmaceutical firms in the United States. According to data from the US Department of Commerce, there are more than 41,080 food and beverage manufacturing facilities in the United States.

- The growing tourism industry in North America is boosting food and beverage consumption, enhancing the demand for stick packaging. According to the UN World Tourism Organization (UNWTO), an estimated 1.3 billion international tourists were recorded around the world. Additionally, tourist arrivals in the Americas in 2023 reached 90% of pre-pandemic levels, resulting in growth in demand for stick packaging in the food and beverage industry.

- Additionally, North America's exponentially growing pharmaceutical industry is a lucrative opportunity for manufacturers to produce stick-packs that provide a convenient, portable unit-dose solution for prescription and over-the-counter (OTC) medicines. Companies such as Catalent Inc. provide a wide range of stick-pack solutions for powder, granule, gel, and liquid formulation of medicines, thus boosting the market's growth.

- According to the US Department of Agriculture (USDA), the growing consumer-oriented food exports from the United States to Canada are boosting the retail sector in the region. The growing population and rise in middle-class incomes have also created a lucrative opportunity for stick packaging manufacturers.

Stick Packaging Industry Overview

The stick packaging market is highly competitive owing to the presence of key players such as Amcor PLC, Glenroy Inc., Constantia Flexibles, Sonic Packaging Industries, and Catalent Inc. Through research and development, the players in the market are developing new products that are being widely accepted across various end-user industries. However, the market remains consolidated.

- February 2024: Novo Holdings, a Denmark-based company, announced the acquisition of Catalent Inc., a US-based company, at USD 16.5 billion on an enterprise value basis. The acquisition is likely to help Novo Holdings accelerate its manufacturing capacity and invest in new product development.

- September 2023: QuadPack, a European cosmetics company, introduced ShapeUp Stick, which is refillable and recyclable and can be used for moisturizer, foundation, blush, and highlighter. The stick is an airtight solution for skincare and makeup formulas, protecting them from drying out. ShapeUp Stick is a mono-material PP, while the base and cap are made of post-consumer recycle (PCR) PP.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ease of Handling and Rising Trend of On-the-go Consumption

- 5.1.2 Rising Demand for Reduced Material Consumption While Manufacturing Stick Packs

- 5.2 Market Restraints

- 5.2.1 Increasing Bans on Single-use Plastics

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Metal

- 6.2 By End-user Industry

- 6.2.1 Food and Beverages

- 6.2.2 Pharmaceuticals

- 6.2.3 Cosmetics

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Italy

- 6.3.2.4 Germany

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia and Newzealand

- 6.3.4 Middle East and Africa

- 6.3.5 Latin America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Constantia Flexibles

- 7.1.3 Glenroy, Inc.

- 7.1.4 Aranow Packaging Machinery SL

- 7.1.5 Fres-Co System Inc

- 7.1.6 Catalent Inc.

- 7.1.7 Winpak Ltd

- 7.1.8 Sonoco Products Company

- 7.1.9 ePac Holdings LLC

- 7.1.10 GFR Pharma

- 7.1.11 Sonic Packaging Industries

- 7.2 Heat Map Analysis