|

市場調查報告書

商品編碼

1630428

糖包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Sugar Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

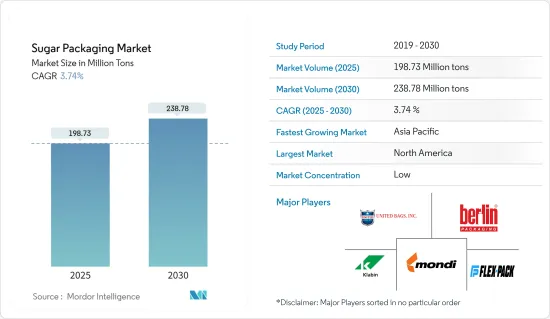

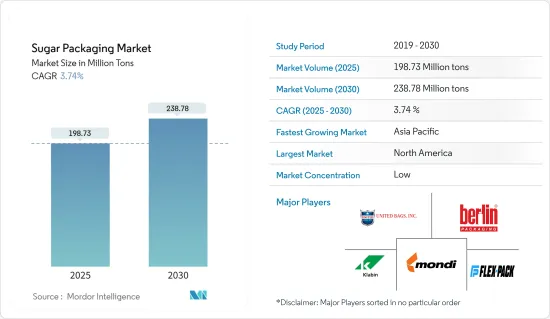

預計2025年食糖包裝市場規模為19,873萬噸,預估至2030年將達2,3,878萬噸,預測期間(2025-2030年)複合年成長率為3.74%。

主要亮點

- 市場正在見證向軟包裝的顯著轉變,因為糖被以各種形式包裝用於散裝和零售目的。由於活性包裝和智慧包裝等包裝技術的創新,糖的軟包裝不僅成為可能,還可以延長保存期限。

- 隨著有機和特殊糖的需求增加,對特殊包裝的需求也隨之增加。這確保了這些高價值產品在運輸和儲存過程中得到保護。此外,隨著貿易變得更加全球化,迫切需要標準化的包裝解決方案來滿足不同國家和地區的多樣化需求。

- 據美國農業部稱,澳洲食糖產量將緩慢成長,2022年和2023年將達到440萬噸。 2022/23 年甘蔗產量預計為 3,300 萬噸。產量的增加與收穫面積的擴大有關,收穫面積增加了 5,000 公頃,達到 35 萬公頃。

- 在健康意識日益增強的市場中,糖行銷克服了主要障礙。儘管消費者可能在不知不覺中選擇含糖量高的產品,但他們在購買原糖時會考慮多種因素。因此,糖袋市場正在大力投資創新包裝解決方案,以增強糖的吸引力並確保易用性。

- 紙是紙袋的主要材料,價格實惠且容易取得。然而,紙袋裡的糖很容易損壞。然而,紙袋裝的糖容易腐爛,且運輸方便快速。其防水防潮性能是其一大優勢。此外,紙袋簡化了銷售、儲存和消費。此外,紙袋具有高度可分解性,有助於最大限度地減少生態足跡。

- 彩色鐵皮是鐵盒包裝材料的首選。這些盒子有圓柱形、矩形、橢圓形和五邊形等形狀,以其耐用性、安全密封和抗破損性而聞名。鐵盒包裝亮麗的外觀、鮮豔的色彩,不僅增強了糖的吸引力,還強調了它的堅固性。除了糖之外,鐵盒也經常被用來包裝糖果零食,許多主要的包裝、禮品和糖果零食製造商都使用鐵盒來展示其產品的品質。

- 塑膠袋在糖包裝中佔據主導地位,是最常用的選擇。因其防潮、防水、性價比高而廣受歡迎。糖生產商經常選擇這些袋子,它們有透明和彩色兩種。尤其是彩色包裝可以增強糖的視覺吸引力,這是老牌和新興糖果糖果零食糖果零食。然而,重大問題迫在眉睫。這些塑膠袋正在加劇日益嚴重的塑膠污染。這款糖包裝機具有出色的多功能性,可以熟練地處理塑膠袋和紙袋,最新的技術確保了性能的一致性。

食糖包裝市場趨勢

塑膠材質佔較大市場佔有率

- Nichrome Packaging Solutions 表示,塑膠包裝因其無與倫比的功能而擁有很大的市場佔有率。在塑膠解決方案中,軟質塑膠包裝的特點是比硬質塑膠包裝使用的原料少70%。

- 根據反饋組織 2023 年 4 月報道,超級市場作為主要的食糖分銷商主導英國市場。這些零售商曾聲稱他們只是回應消費者的需求,但後來放棄了這個立場。研究一直強調超級市場的「零售商力量」。超級市場是食品生產者和消費者之間的仲介業者。它的主導地位限制了供應商和消費者,縮小了他們購買和銷售食品的選擇範圍。光是五家超級市場就控制了75%以上的零售市場佔有率,這一事實證明了這種影響力。超級市場利用其「買方力量」向供應商規定條款並影響庫存選擇、品質、數量、包裝和定價。這種動態也適用於寶潔、雀巢和聯合利華等產業巨頭。隨著超級市場糖銷量的增加,對糖包裝的需求也隨之增加,特別是小袋和小袋等軟包裝。快餐店和咖啡店的成長進一步增加了對糖袋的需求。

- 用軟塑膠袋包裝糖的趨勢日益明顯,這種塑膠袋因其防潮性、成本效益以及透過顏色和透明度打造品牌的潛力而受到糖製造商的青睞。

- 儘管如此,市場相關人員對塑膠包裝的替代品很感興趣。生質塑膠的日益普及對傳統塑膠包裝提出了重大挑戰。在預測期內,可回收和可再生材料可能會取代塑膠包裝。

- Logistex Ltd. 強調,巴西貨櫃食糖出口將在因「貨櫃 Ergedon」運動而經歷了兩年的平靜期後於 2023 年恢復。出貨量的增加與巴西食糖產量的增加和海運費的下降同時發生。此外,世界其他主要食糖生產國面臨的挑戰進一步鞏固了巴西的市場領導地位。

- 相反,印度面臨作物挑戰,對於重新進入食糖出口市場猶豫不決,尤其是在轉向乙醇生產的情況下。這為巴西確立其主導地位鋪平了道路。國內生產商更喜歡散貨運輸,但貨櫃運輸對於出口仍然至關重要,通常涉及複雜的談判和高附加價值。

- 海事機構威廉斯指出,2023年,巴西貨櫃糖出口量達294萬噸。佔巴西總出口量的9.4%,與前一年同期比較大幅成長90.1%。這一數字與2017年高峰298萬噸持平,佔總出貨量的10.7%。在裝入容器之前,這些糖通常包裝在由黃麻或編織塑膠等天然材料製成的軟袋或麻袋中,通常帶有塑膠襯裡。

亞太地區將經歷最高的成長

- 亞太地區憑藉食品包裝和品牌的重大創新引領成長。此外,該地區的消費者非常重視糖果零食的奢華體驗。

- 人口成長、收入水準提高、生活方式不斷變化、媒體影響力不斷增強以及經濟強勁,正在推動對包裝的需求。該部門是該地區最重要且發展迅速的部門之一。值得注意的是,印度領先的評級機構 Care Ratings 強調,印度超過 49% 的紙張生產專用於包裝。

- 亞太地區的包裝產業監督多項法規,特別是食品和飲料產業。主要法規包括 1956 年《防止食品摻假法》、2011 年《塑膠廢棄物(管理和處理)條例》和 2011 年《食品安全標準(包裝和標籤)條例》。

- 預期有關食品業紙張和紙漿使用的法規將提振市場。例如,印度食品安全和標準局推出了新的包裝法規,旨在加強紙張在食品包裝中的作用。此外,BIS 標準 IS 4664:1986 允許在食品包裝中使用再生紙漿,這將增加印度糖包裝中紙張的使用。

- 據美國對外農業服務局稱,2023/2024 年周期印度食糖產量約 3,400 萬噸。儘管多年來印度的食糖產量起伏不定,但印度仍自豪地成為僅次於巴西的世界第二大食糖生產國。印度內閣經濟事務委員會 (CCEA) 已核准2023-2024 年週期的新標準,強調黃麻包裝。具體來說,2023-24 年黃麻年標準要求 100% 的食品穀物包裝和 20% 的糖包裝使用黃麻袋。

糖包裝行業概況

這項研究根據材料類型和產品類型考察了全球食糖生產。糖的包裝形式多種多樣,包括散裝和零售,因此向軟包裝的轉變是顯而易見的。活性包裝等新技術不僅加速了這一趨勢,而且還延長了糖的保存期限。塑膠因其無與倫比的功能而在包裝市場佔據主導地位。軟質塑膠包裝在塑膠解決方案中脫穎而出,比硬質包裝使用的原料少 70%。

糖包裝市場適度分散。市場參與者正在提供廣泛的產品客製化,以擴大他們的佔有率並增加收益。主要參與者包括 Mondi Group、United Bags Inc、FlexPack、Klabin SA 和 Berlin Packaging。由於需求不斷成長,公司正在透過該市場的創新獲得永續的競爭優勢。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 印度、中國、歐盟地區等主要國家食糖消費量穩定成長

- 對客製化包裝形式和永續材料的需求不斷成長

- 市場限制因素

- 製造商面臨的營運和監管問題

第6章 市場細分

- 依產品類型

- 軟包裝

- 袋子和小袋

- 香囊

- 包包

- 其他軟包裝

- 硬包裝

- 瓶子和容器

- 軟包裝

- 按材質

- 塑膠

- 紙

- 其他材料

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 印度

- 中國

- 日本

- 泰國

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Mondi Group

- United Bags Inc.

- FLexPack

- Berlin Packaging

- Grupo Bio Pappel

- Swiss Pack Limited

- Packman Industries

- TedPack Company Limited

- Klabin SA

- Shri Salasar Plastics

第8章投資分析

第9章市場的未來

The Sugar Packaging Market size is estimated at 198.73 million tons in 2025, and is expected to reach 238.78 million tons by 2030, at a CAGR of 3.74% during the forecast period (2025-2030).

Key Highlights

- The market is witnessing a notable shift towards flexible packaging, especially as sugar is being packaged in various formats for both bulk and retail purposes. Thanks to innovations in packaging technologies, such as active and smart packaging, flexible packaging for sugar is not only feasible but also extends its shelf life.

- With the rising demand for organic and specialty sugars, there's an increasing need for specialized packaging. This ensures the protection of these high-value products during transportation and storage. Moreover, as trade becomes more globalized, there's a pressing need for standardized packaging solutions that meet the varied requirements of different countries and regions.

- According to USDA, Australia's sugar production is set to see a modest rise, reaching 4.4 million tons for the years 2022 and 2023. In the 2022/23 cycle, sugarcane production is estimated at 33.0 million tons. This increase in output is linked to an expansion in the harvested area, which has grown by 5,000 hectares to reach 350,000 hectares.

- In a market increasingly focused on health, sugar marketing is navigating significant hurdles. While consumers might unknowingly choose products high in sugar, they consider multiple factors when purchasing unprocessed sugar. As a result, the sugar bag market is heavily investing in innovative packaging solutions to boost sugar's appeal and ensure user-friendliness.

- Paper, the go-to material for paper bags, is both affordable and easily sourced. Yet, sugar in paper bags is more prone to damage. Despite this vulnerability, paper bags enable quick and convenient transportation. Their waterproof and moisture-proof qualities stand out as significant advantages. Moreover, paper bags simplify selling, storage, and consumption. An added environmental perk of using paper for bags is its degradability, leading to a minimal ecological footprint.

- Tinted tin iron is the favored material for packaging in iron boxes. These boxes, available in shapes like cylinders, rectangles, ovals, and pentagons, are celebrated for their durability, secure sealing, and damage resistance. The bright appearance and vibrant colors of iron box packaging not only enhance sugar's appeal but also underscore its robustness. Beyond sugar, these iron boxes are a go-to for candy packaging, with many leading packaging, gift, and candy producers leveraging them to signify product quality.

- Plastic bags reign supreme in sugar packaging, being the most commonly used option. Their moisture-proof and waterproof nature, combined with cost-effectiveness, makes them a favorite. Sugar producers often opt for these bags, available in both transparent and colored variants. Colorful wraps, especially, can elevate sugar's visual allure, a strategy embraced by both established and budding confectionery makers. Yet, a major concern looms: these plastic bags contribute to the growing issue of plastic pollution. Versatility shines through as sugar packing machines adeptly handle both plastic and paper bags, and with modern technology, they promise consistent performance.

Sugar Packaging Market Trends

Plastic Material to Hold Significant Market Share

- According to Nichrome Packaging Solutions, plastic packaging holds a significant market share due to its unparalleled functionality. Among plastic solutions, flexible plastic packaging is notable for using 70% less raw material than its rigid counterpart.

- As reported by Feedback Organization in April 2023, supermarkets dominate the UK market as primary sugar sellers. While these retailers once claimed to merely respond to consumer demand, they've since abandoned this stance. Research has consistently spotlighted the 'retailer power' of supermarkets. Acting as intermediaries, they bridge food producers and consumers. Their dominance restricts both suppliers and customers, curtailing choices in buying and selling food. This influence is evident as just five supermarkets control over 75% of the retail market share. Leveraging their 'buyer power', supermarkets dictate terms to suppliers, influencing stock selection, quality, quantity, packaging, and pricing decisions. This dynamic holds even for industry giants like Procter & Gamble, Nestle, and Unilever. With supermarkets bolstering sugar sales, they're simultaneously driving up demand for sugar packaging, especially in flexible formats like pouches and sachets. The growth of quick-service restaurants and coffee shops has further amplified the demand for sugar sachets.

- There's a growing trend of packaging sugar in flexible plastic bags, favored by sugar manufacturers for their moisture resistance, cost-effectiveness, and branding potential through color or transparency.

- Despite this, market players are gravitating towards alternatives to plastic packaging. The rising adoption of bioplastics poses a significant challenge to traditional plastic packaging in the industry. Over the forecast period, recyclable and renewable materials are poised to potentially replace plastic packaging.

- Logistex Ltd. highlights a rebound in Brazilian sugar exports via containers in 2023, after a two-year lull, influenced by the "containergeddon" movement. This increase in shipments coincided with a rise in Brazil's sugar production and a decline in seafreight rates. Additionally, challenges faced by other major global sugar producers further cemented Brazil's market leadership.

- Conversely, India faced harvest challenges and was hesitant to re-enter the sugar export market, especially with its shift towards ethanol production. This opened the door for Brazil to assert its dominance. While national producers favored bulk shipping, container shipments remained vital for exports, often involving intricate negotiations and higher value additions.

- In 2023, Brazil's containerized sugar exports reached 2.94 million tons, as noted by maritime agency Williams. This constituted 9.4% of Brazil's total exports and marked a remarkable 90.1% increase from previous years. The figure was on the verge of matching the 2017 peak of 2.98 million tons, which represented 10.7% of total shipments. Before container loading, these sugars are typically packaged in flexible bags or sacks made from woven natural materials like jute or woven plastic, frequently featuring a plastic inner lining.

Asia-Pacific to Witness Highest Growth

- The Asia-Pacific region leads in growth, driven by notable innovations in food packaging and branding. Additionally, consumers in this region place a high value on the indulgent experience of sugar confectionery.

- Rising population, increasing income levels, evolving lifestyles, heightened media influence, and a robust economy are fueling the demand for packaging. This sector stands out as one of the most vital and rapidly expanding in the region. Notably, Care Ratings, a leading credit rating agency in India, highlights that over 49% of the country's paper production is dedicated to packaging.

- Several regulations oversee the packaging industry in the Asia-Pacific, particularly in the food and beverage sectors. Key regulations include the Prevention of Food Adulteration Act of 1956, the Plastic Waste (Management and Handling) Rules of 2011, and the Food Safety and Standards (Packaging and Labelling) Regulations of 2011.

- Anticipated regulations on paper and pulp usage in the food sector are poised to boost the market. For example, India's Food Safety and Standards Authority has rolled out new packaging regulations, aiming to bolster paper's role in food packaging. Furthermore, the BIS standard IS 4664: 1986, which allows recycled pulp in food packaging, is set to enhance paper's prominence in India's sugar packaging.

- As per the USDA Foreign Agricultural Service, India produced around 34 million metric tons of sugar in the 2023/2024 cycle. While sugar production in India has seen its ups and downs over the years, the nation proudly stands as the world's second-largest sugar producer, trailing only Brazil. In the 2023-2024 cycle, India's Cabinet Committee on Economic Affairs (CCEA) approved new norms emphasizing jute packaging. Specifically, the 2023-24 Jute Year norms mandate that jute bags must be used for 100% of food grains and 20% of sugar packaging.

Sugar Packaging Industry Overview

The study considers sugar production globally based on material type and product type. As sugar is packaged in various formats for both bulk and retail, there's been a notable shift towards flexible packaging. New technologies, like active packaging, not only facilitate this trend but also extend the shelf life of sugar. Plastic dominates the packaging market due to its unmatched functionality. Flexible plastic packaging stands out among plastic solutions, utilizing 70% less raw material than its rigid counterpart.

The sugar packaging market is moderately fragmented. Players in the market are offering extensive product customization to increase their share and augment their revenue. Some of the key players are Mondi Group, United Bags Inc, FlexPack, Klabin S.A., Berlin Packaging and more. The companies have a sustainable competitive advantage through innovations in this market, owing to the growing need.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Increase in the Consumption of Sugar in Major Countries such as India, China and EU Regions

- 5.1.2 Rising Demand for Customized Packaging Formats and Sustainable Materials

- 5.2 Market Restraints

- 5.2.1 Operational and Regulatory Concerns Faced by the Manufacturers

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Flexible Packaging

- 6.1.1.1 Bags and Pouches

- 6.1.1.2 Sachets

- 6.1.1.3 Sacks

- 6.1.1.4 Other Flexible Packaging Types

- 6.1.2 Rigid Packaging

- 6.1.2.1 Jars and Containers

- 6.1.1 Flexible Packaging

- 6.2 By Material Type

- 6.2.1 Platsic

- 6.2.2 Paper

- 6.2.3 Other Material Type

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Thailand

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mondi Group

- 7.1.2 United Bags Inc.

- 7.1.3 FLexPack

- 7.1.4 Berlin Packaging

- 7.1.5 Grupo Bio Pappel

- 7.1.6 Swiss Pack Limited

- 7.1.7 Packman Industries

- 7.1.8 TedPack Company Limited

- 7.1.9 Klabin S.A.

- 7.1.10 Shri Salasar Plastics