|

市場調查報告書

商品編碼

1630342

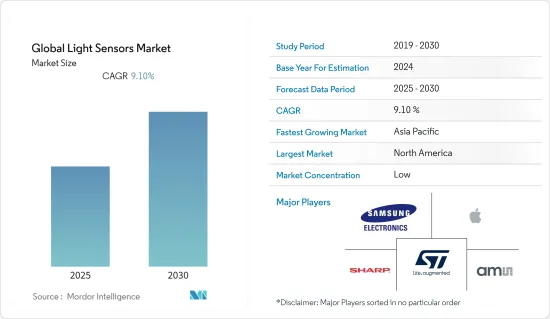

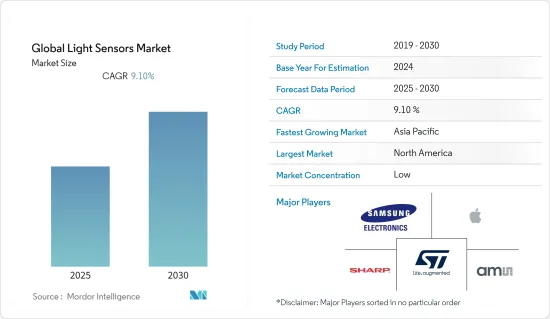

世界光學感測器 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Global Light Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計全球光學感測器市場在預測期內複合年成長率為 9.1%

主要亮點

- 例如,接近光感測器響應紅外線光的變化來檢測移動或與其他物體的接近程度。接近光感測器用於車輛設備,當車輛即將撞到物體時發出警報。接近光感測器在戶外照明中很常見,用於檢測運動以達到安全目的。

- 智慧型手機製造商正在積極將新技術融入其設備中,以提高產品品質和知名度。例如,2022年4月,OPPO推出了其旗艦機型“Oppo F21 Pro”,與上一代IMX615 RGB感測器相比,感光度提高了60%,雜訊降低了35%,並宣布將配備SONYIMX709 RGBW自拍感應器. .

- 在汽車領域,隨著車道偏離警示系統和自動頭燈等新技術的發展,這些感測器正被整合到後視鏡、車內照明、側視鏡、雨量感測器、光學控制旋鈕等。此外,航太和國防、走廊測繪和地形測量、汽車、採礦以及石油和天然氣等行業擴大採用雷射雷達感測器,也為各行業的光學感測器市場提供了成長機會。

- 在 COVID-19大流行期間,家用電子電器產業的成長發生了迅速變化,市場參與企業之間的競爭加劇。家用電子電器製造商目前面臨著將獨特且差異化的產品推向市場的巨大壓力。三星等主要智慧型手機製造商正在與光學感測器製造商合作,整合這兩種技術。例如,2021 年 11 月,MacDermidAlpha Electronics Solutions 與全球半導體領導者意頻譜半導體 (STMicroElectronics) 合作,開發電動車逆變器,提高車輛效率和續航里程,同時顯著降低關鍵燒結成本。

- COVID-19 大流行已將人們的關注重點轉向技術和健康,增加了醫療設備等應用中對環境光感測器的需求。例如,2021 年 10 月,歐司朗開發了一款用於行動裝置和穿戴式裝置的環境光感測器,可偵測 UV-A 光。據該公司稱,陽光中的 UV-C 部分被地球大氣層阻擋,但 UV-A 和 UV-B 輻射到達地球表面。曬傷是由 UV-B 輻射引起的,但 UV-B 只能穿經皮膚的上層。這場 COVID-19 危機預計將為企業提供投資、實施和研究需要較少人為干預的技術的機會。例如,考慮人工智慧和自動化的結合。

光學感測器市場趨勢

家用電子電器預計將佔據較大佔有率

- 家用電子電器領域在光學感測器市場的擴張是由於行動裝置中接近感測器和環境光感測器的使用不斷增加而推動的。由於三星電子(韓國)等主要OEM對光學感測器的使用迅速增加,亞太地區有望實現成長。韓國三星電子是光學感測器市場的重要參與企業。光學感測器嵌入到各種產品類型中,包括三星 Galaxy S6 和三星 Galaxy S6 Edge 等行動設備,以執行接近感測等特定任務。

- 由於感測器技術的小型化和改進,全球對 LED 電視、智慧型手機和智慧照明系統等智慧產品的需求不斷增加。各種感測器技術和通訊介面是這些小工具的核心。隨著互聯產品和5G通訊技術的出現,各種感測器預計將被跨領域採用。此外,光學感測器經常用於住宅和商業穿戴式電子設備。

- 智慧型手機、LCD/LED 電視和筆記型電腦是推動光學感測器設備需求不斷成長的一些應用。感測器能夠根據這些裝置上的環境光量自動調整螢幕亮度,從而節省電量。使用各種數位感測組件(包括照度檢測器)進行照明控制是現代物聯網照明平台的另一個焦點。

- AMS AG 的接近偵測模組和整合式環境光感測器於 2020 年 7 月推出,使目標商標產品製造商 (OEM) 能夠打造具有近邊框螢幕的行動裝置。與市場上的其他裝置相比,該模組 (TMD2755) 的面積縮小了 40%,體積縮小了 60%。此外,TMD2755 透過允許光學感測器和接近功能安裝到更薄的邊框中,支援行動電話製造商擴大可視區域的努力。這被認為是中階市場消費者對行動電話興趣日益濃厚的關鍵因素。

- 行動電話、LCD 和 LED 等電子設備擴大使用光感應設備,這些設備可以根據光量自動改變螢幕亮度。此功能有助於這些設備節省電力。由於人們越來越關注在行動電話和平板電腦等家用電子電器產品中使用臉部辨識來實現存取和身份驗證、帳戶可用性以及安全/身分詐騙預防等目的,因此光學感測器正在該市場中不斷擴展。

- 穿戴式裝置的採用正在迅速增加,生物醫學領域的創新應用可能會推動市場成長。然而,將感測器整合到設備中所產生的額外成本以及設備壽命的縮短預計將阻礙市場成長。

亞太地區預計將錄得顯著成長率

- 由於人口規模龐大以及智慧型手機和其他家用電子電器產品的需求和產量不斷增加,亞太地區預計將主導光學感測器市場。例如,根據印度蜂窩和電子協會(ICEA)的數據,印度行動電話產值從2019年的1.7兆盧比增加到2020年的2.149兆盧比。 2021 年,儘管受到冠狀病毒大流行的影響,該數字仍達到 22,270 億印度盧比。

- 內建光學感測器的手持設備的採用率不斷提高也是促進該地區光學感測器市場成長的關鍵因素之一。

- 印度等新興經濟體的消費者越來越關注安全性,汽車製造商正在為低成本汽車配備更多感測器。預計這將在可預見的未來推動光學感測器的需求。

- 此外,人們越來越重視採用物聯網 (IoT) 和臉部辨識等尖端技術,而且新興國家加強各行業安全的政府法規也導致光學感測器的部署增加。

- COVID-19 的爆發預計也將影響光學感測器市場佔有率的成長。主要是因為中國、日本和新加坡政府已經開始投資智慧城市的發展。此外,光學感測器在掃描器、快速響應(QR)碼和入侵檢測系統(IDS)中的廣泛使用也推動了市場的擴張。

光學感測器產業概況

由於許多大大小小的公司在市場上競爭,光學感測器市場被細分。透過產品和技術發布、策略夥伴關係、收購、擴張和競爭,這些參與企業尋求在市場上獲得競爭優勢。

- 2022 年 7 月 - Vishay Intertechnology, Inc. 的光電集團推出適用於汽車、智慧家庭、工業和辦公室應用的新型符合 AEC-Q101 要求的反射式光學感測器。 Vishay Semiconductors VCNT2025X01 在小型 2.5 mm x 2.0 mm x 0.6 mm表面黏著技術封裝中整合了紅外線發射器、矽光電電晶體檢測器和日光阻擋濾光片,使其比上一代解決方案 透過更薄、更緊湊。高電流傳輸實現了更高的性能。

- 2021年7月-夏普半導體宣布開發出用於穿戴式裝置的GP2AP130S00F接近感測器,支援I2C通訊協定。平均電流消耗為 40μA(典型值)的低電流消耗設計允許使用電池電源長期運作。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 汽車領域的進步推動了市場

- 智慧型手機和平板電腦中安裝的光學感測器的擴展

- 市場限制因素

- 光學感測器能力低下是限制市場的因素

- 低成本感測器增加了品質下降的威脅

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 類型

- 環境光感測器

- 接近感測器

- RGB顏色感應

- 手勢姿態辨識

- 紫外線/紅外線 (IR) 檢測

- 輸出

- 模擬

- 數位的

- 最終用戶產業

- 家用電子電器

- 車

- 工業的

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- AMS AG

- Sharp Corporation

- STMicroelectronics NV

- Broadcom Inc.

- Vishay Intertechnology Inc.

- Apple Inc.

- Elan Microelectronic Corp.

- Everlight Electronics Co. Ltd

- Maxim Integrated Products Inc.

- Samsung Electronics Co. Ltd

- Sitronix Technology Corporation

- ROHM Co. Ltd

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 69419

The Global Light Sensors Market is expected to register a CAGR of 9.1% during the forecast period.

Key Highlights

- For instance, proximity light sensors respond to changes in infrared light to detect motion or proximity to another object. They are used for devices in vehicles that sound an alarm when the vehicle is close to bumping into an object. Proximity light sensors are common in outdoor lights to detect motion for security purposes.

- Smartphone manufacturers are actively incorporating new technologies into their devices to improve their product quality in terms of product quality and vision. For instance, in April 2022, Oppo announced that its model, Oppo F21 Pro, will feature the flagship Sony IMX709 RGBW selfie sensor that is 60% more sensitive to light and reduces noise by 35% when compared to the previous generation IMX615 RGB sensor.

- In the automotive segment, with the development of new technologies such as lane assist, automatic headlights, and many more, these sensors are being integrated into rear-view mirrors, interior lighting, side-view mirrors, rain sensor, optical control knobs, and many more. Also, the increased adoption of LiDAR sensors in various industry verticals, such as aerospace and defense, corridor mapping and topographical survey, automotive, mining, and oil and gas, has also created growth opportunities for the light sensors market across industries.

- During the Covid-19 pandemic, the consumer electronics sector's growth rapidly changed, increasing competition among market players. Consumer electronics manufacturers are currently under enormous pressure to bring unique and differentiated products to market. Major smartphone manufacturers like Samsung collaborate with light sensor manufacturers to integrate both technologies. For instance, in November 2021, MacDermidAlpha Electronics Solutions announced a collaboration with STMicroelectronics, a global semiconductor leader helping customers across the spectrum of sensing applications, on a key sinter technology for Electric Vehicles inverter assemblies to increase vehicle efficiency and range while lowering production costs significantly.

- Due to the massive COVID-19 outbreak, people's priorities shifted to technology and health, increasing demand for ambient light sensors in applications such as medical devices. For instance, in October 2021, Osram developed an ambient light sensor for mobile devices and wearables that detects UV-A light. According to the company, while the UV-C portion of sunlight is blocked by the earth's atmosphere, UV-A and UV-B radiation reach the earth's surface. Sunburn is caused by UV-B radiation, which only penetrates the upper layers of the skin. This COVID-19 crisis is expected to provide opportunities for businesses to invest in, implement, and research technologies requiring a less human touch. For example, consider the combination of AI and automation.

Light Sensors Market Trends

Consumer Electronics is Expected to Hold a Major Share

- The consumer electronics sector's expansion in the light sensors market has been propelled by the increasing use of proximity sensors and ambient light sensors in mobile devices. Due to a surge in the use of light sensors by the leading OEMs, including Samsung Electronics Co., Ltd., APAC may present prospects for growth (South Korea). The South Korean company Samsung Electronics Co., Ltd. is a significant player in the market for light sensors. It has integrated light sensors into a variety of product categories, including mobile devices like the Samsung Galaxy S6 and Samsung Galaxy S6 edge, that carry out specific tasks like proximity detection.

- Global demand for smart gadgets, such as LED televisions, smartphones, and smart lighting systems, has risen as a result of miniaturization and improvements in sensor technology. Different sensor technologies and communication interfaces are at the heart of these gadgets. The adoption of various sensors across sectors is projected to increase with the advent of connected products and 5G communication technology. Additionally, optical sensors are frequently employed in both residential and commercial wearable electronics equipment.

- Smartphones, LCD/LED televisions, and laptops are some of the applications that are driving the increase in demand for light sensor devices. As a result of the sensors' ability to automatically adjust the screen brightness based on how much ambient light these devices get, electricity savings are made possible. The control of lighting utilizing various digital sensing components involving illuminance detectors is another key emphasis of contemporary IoT lighting platforms.

- The proximity detection module and integrated ambient light sensor from AMS AG were released in July 2020, enabling mobile handset Original Equipment Manufacturers (OEMs) to create mobile handsets with almost bezel-less screens. In comparison to other devices on the market, the module (TMD2755) is 40% lower in area and 60% smaller in volume. Moreover, TMD2755 aids mobile phone manufacturers' efforts to expand the viewable display area by allowing the light-sensing and proximity features to be contained in a thinner bezel. This has been cited as a major contributor to rising consumer interest in mobile phones in the mid-range market segment.

- Electronic devices like mobile phones, LCDs, and LEDs are increasingly using light sensor devices to automatically alter the screen brightness in reaction to the quantity of light they are exposed to. This capability helps these devices conserve electricity. Light sensors are expanding in this market as a result of the growing focus on using facial recognition in consumer electronics, such as mobile phonesand tablets, for access and authentication, account accessibility, and security/identity fraud protection.

- The surge in the adoption of wearable devices and innovative applications in the biomedical sector may boost the growth of the market. However, the extra costs incurred due to the incorporation of sensors in devices and reduction in the life of the device are expected to hinder the market growth.

Asia-Pacific is Expected to Register a Significant Growth Rate

- Asia-Pacific is expected to dominate the light sensors market, owing to its larger population size and increasing demand and production of smartphones and other consumer electronics. For instance, according to India Cellular and Electronics Association (ICEA), the value of mobile phone production in India increased from INR 1,700 billion in 2019 to INR 2,149 billion in 2020. In 2021, the value totaled to INR 2,227 billion, despite the impact of the coronavirus pandemic.

- An increase in the adoption rate of handheld devices with inbuilt light sensors is also one of the key factors contributing to the growth of the light sensors market in the region.

- With an increase in the safety concerns among the consumers in the developing economies, such as India and the ASEAN countries, the automobile manufacturers are incorporating more sensors in low-cost vehicles. This is expected to drive the demand for light sensors in the foreseeable future.

- Further, the growing emphasis on the adoption of the latest technologies, such as the Internet of Things (IoT), facial recognition, and government regulations in the emerging economies to enhance security across various industry verticals are leading to increased deployment of light sensors, which is, in turn, boosting the growth of the industry in the region.

- The COVID-19 outbreak is also expected to impact the growth of the Light sensors market share. Primarily due to the governments in China, Japan, and Singapore starting to invest in the development of smart cities. Furthermore, the widespread use of light sensors in scanners, Quick Response (QR) codes, and intrusion detection systems (IDS) is driving market expansion.

Light Sensors Industry Overview

The light sensors market is fragmented, due to many large and small players churning the competition in the market. Through product and technology launches, strategic partnerships, acquisitions, expansions, and collaborations, these players are trying to gain a competitive edge in the market.

- July 2022 - The Optoelectronics group of Vishay Intertechnology, Inc. introduced a new AEC-Q101-qualified reflective optical sensor for automotive, smart home, industrial, and office applications. Offering a lower profile than previous-generation solutions while delivering improved performance with a higher current transfer ratio (CTR) and operating temperature, the Vishay Semiconductors VCNT2025X01 integrates an infrared emitter, silicon phototransistor detector, and daylight blocking filter in a miniature 2.5 mm by 2.0 mm by 0.6 mm surface-mount package.

- July 2021 - Sharp Semiconductor Co., Ltd. announced the development of the GP2AP130S00F proximity sensor for wearable devices that supports the I2C communication protocol. Its low current consumption design with an average current consumption of 40 μA (typ.) enables long-duration operation on battery power.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Advancements in the Automotive Sector Fuel the Market

- 4.4.2 Growing Implementation of Light Sensors in Smartphones and PC Tablets

- 4.5 Market Restraints

- 4.5.1 Low Light Sensing Capabilities Act as a Restraining Factor

- 4.5.2 Low-cost Sensors are Increasing the Threat to Scale Down the Quality

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Ambient Light Sensing

- 5.1.2 Proximity Detector

- 5.1.3 RGB Color Sensing

- 5.1.4 Gesture Recognition

- 5.1.5 UV/Infrared Light (IR) Detection

- 5.2 Output

- 5.2.1 Analog

- 5.2.2 Digital

- 5.3 End-user Industry

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive

- 5.3.3 Industrial

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AMS AG

- 6.1.2 Sharp Corporation

- 6.1.3 STMicroelectronics NV

- 6.1.4 Broadcom Inc.

- 6.1.5 Vishay Intertechnology Inc.

- 6.1.6 Apple Inc.

- 6.1.7 Elan Microelectronic Corp.

- 6.1.8 Everlight Electronics Co. Ltd

- 6.1.9 Maxim Integrated Products Inc.

- 6.1.10 Samsung Electronics Co. Ltd

- 6.1.11 Sitronix Technology Corporation

- 6.1.12 ROHM Co. Ltd

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219