|

市場調查報告書

商品編碼

1630357

印度 BOPP 薄膜:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India BOPP Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

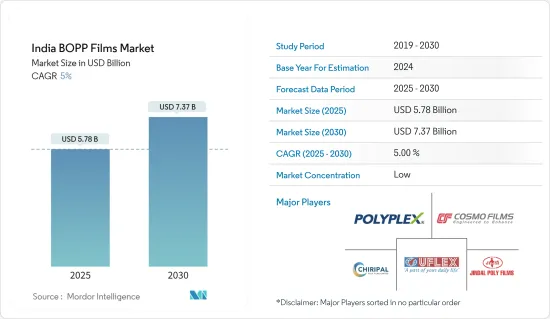

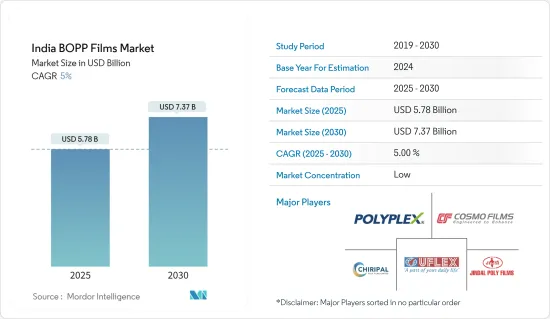

印度BOPP薄膜市場規模預計到2025年為57.8億美元,預計到2030年將達到73.7億美元,預測期內(2025-2030年)複合年成長率為5%。

主要亮點

- 雙軸延伸聚丙烯(BOPP) 薄膜是一種耐用材料,常用於包裝鳥種子、寵物食品、鹿玉米和動物營養產品。它的強度和支撐重量且不易破裂的能力使其成為包裝米和礦物質的首選。目前的趨勢表明,人們正在走向永續包裝解決方案、提高阻隔性能以延長保存期限、進行調整以滿足電子商務包裝要求以及探索生物基材料。

- 由於 BOPP 薄膜與替代包裝材料相比具有更大的靈活性,並且透過增強的密封能力實現更快的包裝,因此預計未來幾年市場趨勢將會加劇。這種需求促使製造商開發生產 BOPP 薄膜的創新技術,以滿足不同產業的需求。印度食品包裝產業對 BOPP 薄膜的需求不斷成長,預計將在未來幾年推動市場成長。

- BOPP薄膜具有優異的防潮性能,金屬化提高了氧氣阻隔性能。這些特性對於食品包裝至關重要,因為它們有助於延長產品保存期限並最大限度地減少食品廢棄物。除了阻隔性外,BOPP 薄膜還具有較窄的標距寬度,可確保可靠的密封。優異的熱封強度、寬密封窗口、低密封起始溫度和良好的機械加工性進一步增強了其在食品包裝領域的有效性並保護食品品質。

- BOPP 薄膜使用量增加的一個主要因素是與其他塑膠薄膜相比,其碳足跡相對較低。由於熔點較低,BOPP 薄膜在轉化過程中所需的能量較少。此外,由於 BOPP 薄膜是聚烯家族的一員,因此它可以有效地與聚乙烯薄膜層壓,並且通常在回收流中受到讚賞。在許多應用中,永續性運動對 BOPP 薄膜的需求產生了積極影響,但往往以替代聚合物為代價。

- BOPP 薄膜用於藥品包裝,如泡殼包裝、藥品和標籤。這些薄膜具有卓越的透明度、防篡改性和耐化學性,使其成為保護和維持藥品完整性的理想選擇。根據 Tata Elxsi 報導,印度製藥和醫療公司擴大參與藥物輸送系統和手術器械設計的早期階段。這種參與正在推動藥品包裝產業的技術進步。這些因素預計將推動市場需求。

- 此外,COVID-19 大流行增加了全國對軟包裝和應用的需求。與日本、美國和西歐等國家相比,印度目前對新鮮和加工肉品和魚貝類的人均軟包裝消費量明顯較低。然而,由於軟包裝解決方案具有眾多優點,包括現場屠宰、增強滅菌、提高可追溯性和召回能力以及延長保存期限,軟包裝解決方案的採用正在增加。

印度BOPP薄膜市場趨勢

包裝食品的需求增加推動市場成長

- BOPP薄膜是一種用於食品和飲料行業的薄膜,對於包裝零嘴零食、糖果零食、烘焙點心、冷凍食品以及食品和飲料至關重要。這些薄膜具有出色的密封性、有效的香氣屏障、防潮和防氧功能,從而保持包裝產品的新鮮度和品質。 BOPP薄膜用途廣泛,可用於生產多種包裝形式,包括立式袋、真空袋和側插角袋。此類包裝解決方案有助於保護食品和飲料在運輸和儲存過程中免受潛在損壞。

- 由於消費者偏好的變化和生產方法的改進,印度的包裝食品產業正在經歷重大發展。隨著人們對獨特和一流食品的興趣日益濃厚,對需要有效包裝解決方案的產品的需求也顯著增加。因此,印度對食品包裝的需求不斷增加,其中包括數量和品質標準,從而推動了所研究的市場擴張。

- 根據印度投資局報道,印度的食品加工產業是世界上最大的產業之一,預計 2025-2026 會計年度產值將達到 5,350 億美元。值得注意的是,印度食品和飲料包裝產業預計年增率將超過14%,到2029年可能達到860億美元。不斷成長的城市人口使得應對這一挑戰勢在必行,這凸顯了對有效的食品包裝解決方案的需求,以促進食品的運輸、儲存和消費。這一顯著成長預計將加強該地區食品工業的包裝部門,從而導致對 BOPP 薄膜的需求增加。

- 此外,該地區食品加工單位投資的增加預計也將成為市場成長的關鍵驅動力之一。 IBEF 預計,在可支配收入增加以及都市化帶來的生活方式和飲食偏好不斷變化的推動下,印度食品加工行業將從 2022 年的 8,660 億美元成長到 2027 年的 12,740 億美元。食品加工工業部 (MoFPI) 推出了 Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) 和微型食品加工企業 PM 正規化 (PMFME) 等舉措,以支持食品加工企業的建立。預計這些因素也將增加 BOPP 薄膜供應商的市場機會。

- 食品加工行業最近取得了重大進步和投資,預計未來幾年將增加市場機會。例如,食品加工工業部在 2024-2025 會計年度中期預算中收到了 329 億印度盧比(3.96 億美元)的預算,與 2024 會計年度修訂後的預算相比增加了約 13%。這些顯著的發展預計將推動該地區食品包裝領域對 BOPP 薄膜的需求。

- 該地區食品包裝行業領先公司增加的投資預計也將支持市場的進一步成長。 ProPak India 2024 將重點放在食品加工產業投資驅動的食品包裝領域的新興機會。該活動定於 2024 年 9 月舉行,將重點關注印度食品包裝的最新趨勢。一個名為「永續發展廣場」的特殊區域將展示為滿足永續包裝解決方案的迫切需求所做的努力。該地區這些著名的先進包裝預計將推動食品包裝領域的成長。

軟包裝快速成長

- BOPP 薄膜具有出色的防潮性,可有效阻隔氧氣,這對於軟包裝解決方案至關重要。延長保存期限對於減少食物廢棄物發揮重要作用。此外,BOPP 薄膜可提供可靠的密封,規格範圍較窄,超出了單純的阻隔功能。食品和飲料行業對軟包裝的需求不斷增加,立式袋的使用不斷增加是主要的市場促進因素,預計將增強 BOPP 薄膜在軟包裝行業的未來前景。

- 印度零售業的擴張預計將推動該地區對軟包裝的需求。印度零售業被認為是全球成長最快的零售市場之一,不僅在大都會圈,也在層級、層級城市發展。此外,各個領域尤其是食品行業電商銷售的不斷成長,預計將為軟包裝領域的BOPP薄膜提供巨大的市場機會。

- 在網路使用者數量不斷增加和有利的市場條件的推動下,印度電子商務產業有望實現顯著成長。印度電商市場規模預計2024年將達到1,230億美元,2030年將達到3,000億美元。經濟數位化和負擔得起的網際網路服務的可用性是推動印度數位銷售成長的關鍵因素。這一趨勢正在創造對可容納個人化產品的軟包裝解決方案的需求,從而促進市場成長。

- BOPP 薄膜廣泛應用於醫療和製藥領域,用於包裝醫療產品和醫療設備。其堅固性、使用壽命和透明特性使其成為各種類型醫療包裝(例如袋子、小袋和泡殼包裝)的理想選擇。這種類型的包裝不僅可以保護內容物免受損壞,而且還便於識別。在印度醫藥包裝領域,軟包裝產業備受矚目,其中BOPP薄膜發揮重要作用。

- 據 IBEF 稱,印度製藥業滿足全球各種疫苗需求的 50% 以上、美國非專利藥需求的 40% 和英國所有藥品需求的 25%。根據IBEF的報告,印度政府將在2023會計年度將GDP的2.6%分配給醫療保健,預計2025會計年度將下降至2.5%。預計2030年終,印度醫藥市場規模將達1,300億美元。這些關鍵因素將增加該地區的軟包裝機會,從而有利於 BOPP 市場的成長。

- 供應商正在開發新鮮且創造性的包裝選擇,以應對市場的激烈競爭。創造性包裝包括立式袋越來越受歡迎,尤其是在食品行業。消費者偏好的擴大和對永續包裝選擇的投資增加將導致該地區對軟包裝的需求增加。此外,印度包裝食品和飲料消費量的增加可能會進一步增加對軟包裝的需求並擴大市場機會。

印度BOPP薄膜產業概況

印度BOPP薄膜市場細分,競爭公司之間的對抗關係日益加劇。在這個市場上,玻璃紙、蠟紙、鋁箔等材料因其良好的性能而逐漸被BOPP薄膜取代。

- 2023 年 8 月 作為印度 BOPP 產業的先驅,Cosmo First 已成為軟包裝 BOPP 薄膜的領先製造商。從生產標準通用薄膜轉向生產創新特種薄膜。我們提供尖端的利基解決方案,特別是增值 BoPP 薄膜,適用於包裝、層壓、工業應用和標籤等各種應用。其產品系列多樣化,包括BOPP薄膜、CPP薄膜和BOPET薄膜。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 包裝食品需求增加

- 市場限制因素

- 由於環境法規而需要軟包裝(相對於硬包裝材料)

- 市場機會

- 加大食品加工領域投資

- 提高產能利用率

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場區隔

- 按最終用戶產業

- 軟包裝

- 工業(層壓板、黏合劑、電容器)

- 其他最終用戶產業

第6章 競爭狀況

- 公司簡介

- Polyplex Corporation

- Uflex Corporation

- Cosmo Films

- Chiripal Poly Films

- Jindal Poly Film

- SRF Limited

- Vacmet India

- Garware Polyester

- Max Speciality Films

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 70007

The India BOPP Films Market size is estimated at USD 5.78 billion in 2025, and is expected to reach USD 7.37 billion by 2030, at a CAGR of 5% during the forecast period (2025-2030).

Key Highlights

- Biaxially oriented polypropylene (BOPP) film is a robust material frequently utilized for packaging bird seed, pet food, deer corn, and animal nutrition products. Its strength and capacity to support weight without easily breaking make it the preferred choice for packaging rice and minerals. Present trends indicate a movement toward sustainable packaging solutions, advancements in barrier properties to enhance shelf life, adjustments to meet e-commerce packaging requirements, and the investigation of bio-based materials.

- The market trend is expected to strengthen in the coming years, as BOPP films offer greater flexibility and facilitate quicker packaging through enhanced sealing capabilities in comparison to alternative packaging materials. This demand has prompted manufacturers to develop innovative techniques for the production of BOPP films to meet the needs of diverse industries. The growing demand for BOPP films in the Indian food packaging sector is expected to enhance the market's growth in the coming years.

- BOPP films are characterized by their superior moisture barrier capabilities, while the metalized version enhances oxygen barrier performance. These attributes are vital in food packaging, as they contribute to prolonging the shelf life of products and minimizing food waste. In addition to their barrier characteristics, BOPP films ensure reliable seal integrity due to their narrow gauge spread. Their excellent heat seal strength, wide sealing window, lower seal initiation temperature, and favorable machinability further augment their effectiveness in the food packaging sector, safeguarding food quality.

- A significant factor contributing to the increased utilization of BOPP films is their comparatively low carbon footprint in relation to other plastic films. Due to their lower melting point, BOPP films necessitate less energy for conversion processes. Additionally, as a member of the broader polyolefin chemical family, BOPP films can be effectively laminated with polyethylene films and are generally well-received in recycling streams. In numerous applications, the demand for BOPP films has been positively influenced by the sustainability movement, often at the expense of alternative polymers.

- BOPP films are utilized in the packaging of pharmaceuticals, including blister packs, medication strips, and labels. These films provide excellent clarity, tamper-evident features, and chemical resistance, rendering them ideal for safeguarding and maintaining the integrity of pharmaceutical products. As reported by Tata Elxsi, pharmaceutical and healthcare firms in India are increasingly participating in the creation of drug delivery systems and surgical tools from the early design stages. This engagement has fostered technological progress in the pharmaceutical packaging industry. These elements are expected to enhance market demand.

- Moreover, the COVID-19 pandemic increased the demand for flexible packaging applications nationwide. India currently has a significantly lower per capita consumption of flexible packaging for fresh and processed meat and seafood compared to countries like Japan, the United States, and Western Europe. However, the adoption of flexible packaging solutions has been on the rise due to various benefits they offer, including on-site butchering, enhanced sterilization, improved traceability and recall capabilities, and extended shelf life.

India BOPP Films Market Trends

Increased Demand for Packaged Food to Drive the Market Growth

- BOPP films are essential in the food and beverage industry for the packaging of snacks, confectionery, baked goods, frozen foods, and beverages. These films offer superior sealability, an effective barrier against aromas, and protection from moisture and oxygen, thereby maintaining the freshness and quality of the packaged items. BOPP film is versatile and can be utilized to produce various packaging formats, such as stand-up pouches, vacuum pouches, and side-gusseted bags. Such packaging solutions are instrumental in safeguarding food and beverage products from potential damage during transit and storage.

- The packaged food sector in India is undergoing a significant evolution due to changing consumer tastes and improvements in production methods. With a growing interest in unique and top-notch food choices, there is a noticeable increase in the need for products that require effective packaging solutions. Consequently, the demand for food packaging is escalating in India, encompassing quantity and quality standards that will drive the expansion of the market studied.

- As reported by Invest India, the food processing sector in India ranks among the largest globally, with projections indicating that its output will attain USD 535 billion during the fiscal year 2025-2026. Notably, the Indian food and beverage packaging industry is anticipated to experience an annual growth rate exceeding 14%, potentially reaching USD 86 billion by 2029. The growing urban population underscores the urgency of addressing this challenge, emphasizing the necessity for effective food packaging solutions that facilitate the transportation, storage, and consumption of food products. This substantial growth is expected to enhance the packaging sector within the region's food industry, consequently increasing the demand for BOPP films.

- Moreover, the increasing investments in the region's food processing units are also expected to act as one of the significant drivers of the market's growth. As per IBEF, the food processing sector in India is projected to grow to USD 1,274 billion by 2027 from USD 866 billion in 2022, driven by evolving lifestyles and dietary preferences resulting from increased disposable income and urbanization. The Ministry of Food Processing Industries (MoFPI) has introduced initiatives such as Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) and PM Formalisation of Micro food processing Enterprises (PMFME) to support the establishment of food processing businesses. These factors are also anticipated to enhance market opportunities for BOPP film providers.

- The food processing industry has witnessed significant advancements and investments recently, which are projected to enhance the market's opportunities in the upcoming years. As an illustration, the Ministry of Food Processing Industries received a total budget of INR 3,290 crore (USD 396 million) in the Interim Budget 2024-2025, marking a rise of approximately 13% compared to the revised estimates for the fiscal year 2024. These notable developments are anticipated to drive the demand for BOPP films in the region's food packaging sector.

- Nevertheless, the increasing investments by the companies to drive the region's food packaging industry are also expected to drive the market's growth further. ProPak India 2024 is set to highlight emerging opportunities in food packaging driven by investments in the food processing industry. Scheduled for September 2024, the event will focus on the latest trends in food packaging in India. A special area known as the 'sustainability square' will showcase the commitment to tackling the urgent demand for sustainable packaging solutions. These notable advancements in the region are expected to propel growth in the food packaging sector.

Flexible Packaging to Grow Significantly

- BOPP films are distinguished by their moisture resistance and function as an effective barrier against oxygen, which is essential for flexible packaging solutions. Their role in prolonging shelf life is significant, as they contribute to a reduction in food waste. Furthermore, BOPP films provide reliable seal integrity with a narrow gauge spread, surpassing mere barrier functions. The increasing demand for flexible packaging within the food and beverage sector, along with the rising use of stand-up pouches, are key market drivers anticipated to enhance the prospects for BOPP films in the flexible packaging industry.

- The expanding retail sector in India is anticipated to boost the demand for flexible packaging within the region. Recognized as one of the fastest-growing retail markets globally, the Indian retail industry is evolving not only in major metropolitan areas but also in tier-1 and tier-2 cities. Furthermore, the increasing e-commerce sales across various sectors, particularly in the food industry, are expected to create significant market opportunities for BOPP films in the flexible packaging domain.

- India is poised for substantial growth in the e-commerce industry, driven by the increasing number of internet users and favorable market conditions. The market value of the e-commerce sector in India is forecasted to reach USD 123 billion by 2024, with expectations to hit USD 300 billion by 2030. The digitization of the economy and the availability of affordable internet services are among the key factors propelling the growth of digital sales in India. This trend is creating a demand for flexible packaging solutions that can accommodate personalized products, thereby contributing to market growth.

- BOPP film is widely utilized in the healthcare and pharmaceutical sectors for packaging medical products and devices. Its robustness, longevity, and see-through nature make it an ideal choice for creating various types of medical packaging, such as bags, pouches, and blister packs. This type of packaging not only safeguards the contents from harm but also facilitates effortless identification. The flexible packaging industry is gaining prominence in the Indian pharmaceutical packaging sector, with BOPP film playing a significant role.

- As per IBEF, the Indian pharmaceutical industry caters to more than 50% of the global demand for various vaccines, 40% of generic demand in the United States, and 25% of all medicine in the United Kingdom. IBEF reports that the Indian government allocated 2.6% of the country's GDP toward healthcare in the fiscal year 2023, with expectations for this figure to decrease to 2.5% by the fiscal year 2025. The Indian pharmaceutical market is projected to reach a value of USD 130 billion by the end of 2030. These significant factors are poised to boost opportunities for flexible packaging in the region, thereby benefiting the BOPP market's growth.

- Vendors are developing fresh and creative packaging options to endure the intense competition in the market. Creative packaging encompasses stand-up pouches, which have become increasingly popular, especially in the food industry. As a result of the expanding consumer preferences and growing investments in sustainable packaging options, there will be an increase in demand for flexible packaging in the region. Furthermore, the rising consumption of packaged food and beverages may further drive the demand for flexible packaging in India, thereby enhancing market opportunities.

India BOPP Films Industry Overview

The Indian BOPP film market is fragmented, and its competitive rivalry is increasing because of the increasing presence of many players running their businesses in national and international boundaries. The market is gradually substituting materials such as cellophane, waxing paper, and aluminum foils with BOPP films due to their favorable properties.

- August 2023: As a trailblazer in the BOPP industry in India, Cosmo First established itself as one of the foremost manufacturers of BoPP films for flexible packaging. The company successfully transitioned from producing standard commodity films to focusing on innovative specialty films. It delivers cutting-edge niche solutions, specifically value-added BoPP films, for various applications, including packaging, lamination, industrial uses, and labeling. Its product portfolio encompasses a diverse array of BOPP films, CPP films, and BOPET films.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Packaged Food

- 4.3 Market Restraints

- 4.3.1 Environmental Regulation Paving Way for Flexible Packaging Requirements (over Rigid Packaging materials)

- 4.4 Market Opportunities

- 4.4.1 Increasing Investments in the Field of Food Processing

- 4.4.2 Increasing Capacity Utilization

- 4.5 Industry Value Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By End-user Vertical

- 5.1.1 Flexible Packaging

- 5.1.2 Industrial (Lamination, Adhesive, and Capacitor)

- 5.1.3 Other End-user Verticals

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Polyplex Corporation

- 6.1.2 Uflex Corporation

- 6.1.3 Cosmo Films

- 6.1.4 Chiripal Poly Films

- 6.1.5 Jindal Poly Film

- 6.1.6 SRF Limited

- 6.1.7 Vacmet India

- 6.1.8 Garware Polyester

- 6.1.9 Max Speciality Films

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219