|

市場調查報告書

商品編碼

1851114

雙向拉伸聚丙烯薄膜:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)BOPP Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

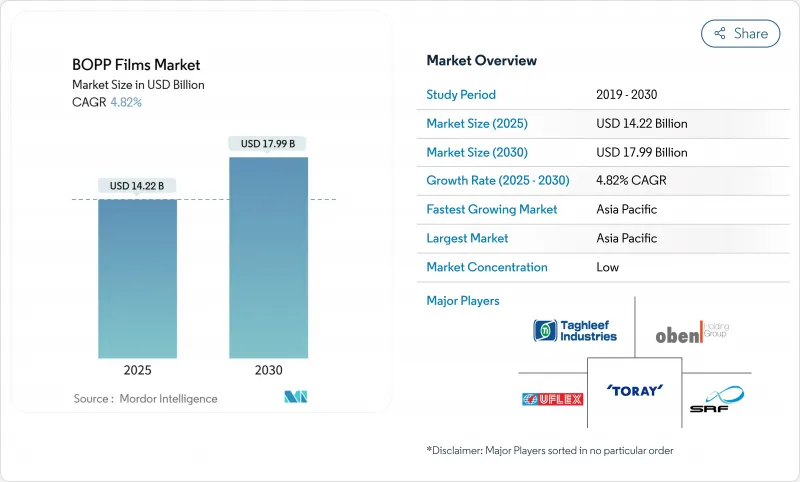

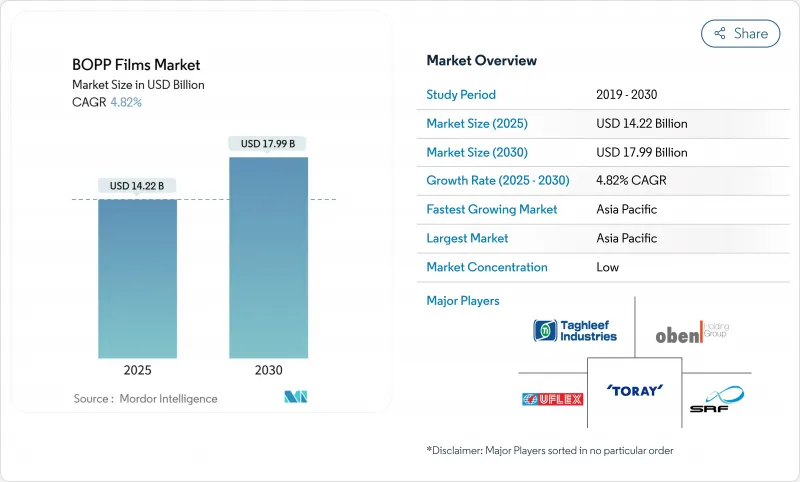

全球BOPP薄膜市場預計到2025年將達到142.2億美元,到2030年將達到179.9億美元,預測期內複合年成長率為4.82%。

成長的驅動力來自簡化的監管流程,這些流程縮短了食品接觸材料的核准週期,並加速了新型雙軸延伸聚丙烯(BOPP) 配方在零食、藥品和電商包裝領域的應用。數位零售的興起促使品牌所有者更傾向於輕巧、可熱封的郵寄薄膜。同時,聚丙烯樹脂價格的波動(預計2025年初北美地區每磅上漲4-5美分)持續擠壓加工商的利潤空間,促使企業進行垂直整合並採取避險策略。在政策方面,歐盟的《包裝和包裝廢棄物法規》(PPWR) 要求到2030年所有包裝都必須可回收利用,這將推動全球供應鏈對單一材料BOPP結構的需求。

全球雙向拉伸聚丙烯薄膜市場趨勢與洞察

開發中國家對高密封性零食包裝的需求激增

都市區雜貨店的擴張和區域零食品牌的優質化正推動雙向拉伸聚丙烯薄膜(BOPP)市場向透明、高光澤等級發展。印度零食製造商如Haldiram's目前正利用透明BOPP將保存期限延長高達20%,並提高產品在現代零售展示中的可見度。東南亞也出現了類似的轉變,食品安全法規鼓勵使用透明包裝以便於檢查。此舉不僅在提供經濟高效的阻隔性能的同時,還能透過防篡改密封減少廢棄物。與PET相比,由於加工成本較低,新興企業將繼續成為主要採用者,以確保2030年市場需求持續成長。

品牌擁有者為實現永續性目標,從PVC包裝膜轉向BOPP包裝膜

監管機構施壓要求淘汰含鹵材料,這加速了全球從PVC包裝膜轉向雙向拉伸聚丙烯(BOPP)包裝膜的轉變。聯合利華承諾在2026年前淘汰PVC,並於2024年做出承諾,因此在其食品和個人保健產品線的軟包裝中選擇了BOPP薄膜。對於雀巢而言,此舉簡化了回收物流,從而節省了10-15%的成本。糖果甜點包裝膜採用BOPP後,回收率也從23%飆升至87%。加工商正在投資新的封口鉗和設備維修,但遵循成本的降低和品牌股權的提升抵消了資本投資的障礙。

聚丙烯樹脂價格波動

預計2025年初北美聚丙烯價格將上漲4-5美分/磅,與2024年開始的類似漲幅相呼應。印度雙向拉伸聚丙烯(BOPP)價格曾達到每噸1020美元,但國內需求僅成長11%,而新增產能卻成長了20%,導致行業盈利跌至十年來的最低點8%。加工企業面臨現金流緊張的局面,並加速併購以實現規模經濟。

細分市場分析

預計到2030年,金屬化薄膜的複合年成長率將達到8.36%。到2024年,透明薄膜將佔以金額為準的51.32%,對於強調產品新鮮度的零食和烘焙食品櫥窗而言至關重要。加工商對高真空金屬化設備的投資,使得泡殼包裝的金屬化BOPP薄膜市場規模將超過30億美元。

白色、不透明和珠光等級的BOPP薄膜常用於標籤紙、膠帶和高檔包裝,以提供美觀的對比度和紫外線阻隔性,但與通用透明等級的BOPP薄膜相比,其市場佔有率仍然較小。諸如AluBond和AlOx之類的特種塗層透過提高與金屬的黏合性和光學透明度,拓寬了BOPP薄膜的應用範圍,並正在推動BOPP薄膜市場的發展,以替代受監管藥品包裝盒中的PVdC塗層PVC。

厚度大於45微米的薄膜市場正以7.54%的複合年成長率成長,這主要得益於工業膠帶、化肥袋和立式袋等需要機械剛度的應用領域。 15-30微米厚度的薄膜仍佔36.34%的市場佔有率,在注重成本平衡的零嘴零食包裝和標籤領域保持主導地位。順序雙軸取向技術目前已將機器方向的取向角度提升至12度,使以往僅限於較厚薄膜的性能也能應用於更薄的薄膜。這種技術變革可能會逐漸削弱厚薄膜在非關鍵包裝領域的優勢。

厚度小於15微米的特殊薄膜面臨捲繞和穿孔的問題,但聚合物成核劑和可控冷卻技術可以改善其製程穩定性。厚度為30-45微米的中厚薄膜仍然是藥品包裝和高檔咖啡內襯的主要材料,兼顧了剛度和阻隔性能。這種多樣性體現了雙向拉伸聚丙烯薄膜市場多層次的成長模式。

本報告涵蓋雙軸延伸聚丙烯薄膜的市場分析,按薄膜類型(透明、金屬化、其他)、厚度(小於 15 毫米、15-30 毫米、其他)、應用(包裝、標籤、環繞、其他)、最終用戶行業(食品、食品和飲料、其他)以及地區(北美、歐洲、亞太地區、南美、中東和非洲)進行細分。

區域分析

亞太地區預計到2024年將佔總營收的45.21%,複合年成長率(CAGR)高達8.43%,是成長最快的地區,這主要得益於印度聚合物消費量在2024會計年度至2025會計年度間成長8.5%。一體化生產、低廉的人事費用以及接近性零食和醫藥市場等優勢,為亞太地區帶來了結構性優勢。然而,烯烴供應過剩和老舊資產運作正在擠壓利潤空間,促使企業採取選擇性停產和出口導向生產模式的調整。

在北美,隨著電子商務拓展農村配送業務並推動郵寄薄膜消費,市場需求穩定成長。然而,樹脂的揮發性正挑戰加工商的盈利,並促使他們在垂直整合和再生材料應用方面進行創新。在歐洲,為滿足PPWR法規的要求,阻隔性可回收複合材料的需求推動了本地品牌所有者對單一材料雙向拉伸聚丙烯(BOPP)的投資。

中東和非洲正受益於基礎設施的改善。 UFlex位於埃及的工廠毗鄰消費市場,並可利用其與歐洲的貿易便利。在南美,當地食品加工商瞄準的是品牌化的常溫零嘴零食,但貨幣波動和對樹脂進口的依賴限制了成長。這些區域案例凸顯了雙向拉伸聚丙烯薄膜市場地理分佈的多樣性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 開發中國家對高透明度零嘴零食包裝的需求激增

- 品牌擁有者出於永續性目標,將PVC包裝膜更換為BOPP包裝膜。

- 電子商務的蓬勃發展推動了熱封BOPP郵寄薄膜的需求。

- 一家綜合性聚烯製造商迅速擴大產能

- 可回收單一材料層壓板的商業化

- 市場限制

- 聚丙烯樹脂價格波動

- 中國運作的傳統生產線拉低了全球利潤率

- 在高階細分市場中,生物基阻隔薄膜面臨競爭

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 主要宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 按膠片類型

- 透明的

- 金屬化

- 不透明/白色

- 珠光

- 其他膠片類型

- 按厚度

- 小於15微米

- 15-30µm

- 30-45µm

- 45微米或以上

- 透過使用

- 包裹

- 標籤和環繞

- 貼合加工

- 感壓膠帶

- 其他應用

- 按最終用戶行業分類

- 食物

- 飲料

- 製藥和醫療

- 個人護理和化妝品

- 產業

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 肯亞

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Taghleef Industries

- Jindal Poly Films

- Toray Industries

- SRF Limited

- Uflex Ltd

- Cosmo Films

- Polyplex Corp

- Oben Holding Group

- Treofan Group

- Vacmet India

- NAN YA Plastics

- Mitsui Chemicals Tohcello

- Futamura Chemical

- Innovia Films

- Irplast SpA

- Inteplast Group

- Biofilm SA

- Manucor Spa

- Dunmore Corp

- Tatrafan SRO

第7章 市場機會與未來展望

The global BOPP films market size stands at USD 14.22 billion in 2025 and is projected to advance to USD 17.99 billion by 2030, translating into a 4.82% CAGR over the forecast period.

Growth stems from regulatory streamlining that shortens food-contact approval cycles, accelerating adoption of novel biaxially oriented polypropylene (BOPP) formulations for snack, pharmaceutical, and e-commerce packaging. Rising digital retail has pushed brand owners to favor lightweight, heat-sealable mailer films that reduce packaging volume by 23% compared with corrugated formats. Meanwhile, polypropylene resin volatility-prices in North America rose 4-5 cents per pound in early 2025-continues to squeeze converter margins, encouraging vertical integration and hedging instruments. On the policy front, the European Union's Packaging and Packaging Waste Regulation (PPWR) requires all packaging to be recyclable by 2030, catalyzing demand for mono-material BOPP structures across global supply chains.

Global BOPP Films Market Trends and Insights

Surging Demand for High-Clarity Snack Packaging in Developing Economies

Urban grocery expansion and premiumization of regional snack brands are pushing the BOPP films market toward transparent, high-clarity grades. Indian snack producers such as Haldiram's now leverage transparent BOPP to extend shelf life by up to 20%, boosting product visibility in modern retail displays. Similar shifts in Southeast Asia are driven by food-safety rules that favor see-through packs for easy inspection. The move enables cost-effective barrier performance while reducing waste through tamper-evident seals. Emerging players, incentivized by lower conversion costs versus PET, remain key adopters, ensuring sustained demand through 2030.

Brand-Owner Switch from PVC Wrap to BOPP for Sustainability Goals

Regulatory pressure to eliminate halogenated substrates has accelerated the global pivot from PVC wraps to BOPP. Unilever's 2024 commitment to phase out PVC by 2026 frames BOPP films as the material of choice for flexible packs across food and personal care lines. The shift yields 10-15% cost savings at Nestle due to simplified recycling logistics, while recyclability rates jumped from 23% to 87% after migrating confectionery wraps to BOPP. Converters invest in new sealing jaws and equipment retrofits, but lower compliance fees and positive brand equity offset capex hurdles.

Volatility in Polypropylene Resin Prices

North American polypropylene prices climbed 4-5 cents per pound in early 2025, echoing similar hikes from 2024. India's BOPP prices touched USD 1,020 per ton, yet domestic demand rose only 11% against 20% fresh capacity, pushing industry profitability toward a decade-low 8%. Converters face cash-flow strain and accelerate M&A to gain economies of scale.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce Boom Driving Heat-Sealable BOPP Mailer Films

- Commercialization of Recycle-Ready Mono-Material Laminates

- Under-Utilized Legacy Lines in China Depressing Global Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metallized films secured an 8.36% CAGR outlook through 2030 as pharmaceutical packs demand superior oxygen and moisture barriers. Transparent films held 51.32% of the BOPP films market in 2024 by value, proving indispensable in snack and bakery windows that highlight product freshness. Converter investment in high-vacuum metallizers supports premium foil-equivalent performance at lower weight. In parallel, the BOPP films market size tied to metallized grades for blister over-wraps is projected to top USD 3 billion by 2030, buoyed by stringent stability mandates.

White, opaque, and pearlescent variants serve labelstock, tape, and luxury wraps, providing aesthetic contrast and UV opacity. Yet, their share remains niche compared with commodity clear grades. Specialty coatings such as AluBond and AlOx are widening the application canvas by improving metal adhesion and optical clarity, reinforcing the BOPP films market as a replacement for PVdC-coated PVC within regulated drug cartons.

Films above 45 µm are growing at 7.54% CAGR thanks to industrial tapes, fertilizer bags, and stand-up pouches that need mechanical rigidity. The 15-30 µm segment nonetheless captures 36.34% of the BOPP films market size, maintaining primacy for cost-balanced snack wraps and labels. Sequential biaxial stretching techniques now raise machine-direction orientation to ratios of 12, yielding thinner films with performance once limited to heavier gauges. This engineering shift could gradually erode heavy-gauge dominance in non-critical packaging.

The sub-15 µm niche faces winding and puncture concerns; however, polymer nucleating agents and controlled cooling have improved process stability. Middle-weight 30-45 µm films remain staples for pharmaceutical over-wrap and premium coffee liners, balancing stiffness and barrier demands. Such diversity illustrates the multi-tiered growth profile underlying the BOPP films market.

The Report Covers Biaxially Oriented Polypropylene Films Market Analysis and is Segmented by Film Type ( Transparent, Metallized, and More), Thickness ( Less Than 15 Mm, 15 - 30 Mm, and More), Application (Packaging, Labeling and Wrap-Arounds, and More), End-User Vertical (Food, Beverage, and More) and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific accounted for 45.21% of 2024 revenue and records the fastest 8.43% CAGR, underscored by India's polymer consumption growth of 8.5% in FY 2024-25. Integrated production, low labor costs, and proximity to snack and pharmaceutical demand create structural advantages. Nonetheless, olefin oversupply and under-utilized legacy assets weigh on margins, prompting selective shutdowns and export rebalancing.

North America illustrates steady demand growth as e-commerce expands rural deliveries, fueling mailer film consumption. Resin volatility, however, challenges converter profitability, spurring vertical integration and recycled-content innovations. Europe centers on high-barrier, recycle-ready laminates to meet PPWR mandates, encouraging mono-material BOPP investments among local brand owners.

The Middle East & Africa benefits from infrastructure upgrades; UFlex's Egypt complex positions it near consumer markets while leveraging trade access to Europe. South America advances as local food processors move toward branded, shelf-stable snacks, yet currency volatility and import dependency on resin temper growth. Together, these regional narratives underline the geographically diversified trajectory of the BOPP films market.

- Taghleef Industries

- Jindal Poly Films

- Toray Industries

- SRF Limited

- Uflex Ltd

- Cosmo Films

- Polyplex Corp

- Oben Holding Group

- Treofan Group

- Vacmet India

- NAN YA Plastics

- Mitsui Chemicals Tohcello

- Futamura Chemical

- Innovia Films

- Irplast S.p.A

- Inteplast Group

- Biofilm SA

- Manucor Spa

- Dunmore Corp

- Tatrafan SRO

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for high-clarity snack packaging in developing economies

- 4.2.2 Brand-owner switch from PVC wrap to BOPP for sustainability goals

- 4.2.3 E-commerce boom driving heat-sealable BOPP mailer films

- 4.2.4 Rapid capacity additions by integrated polyolefin producers

- 4.2.5 Commercialization of recycle-ready mono-material laminates

- 4.3 Market Restraints

- 4.3.1 Volatility in polypropylene resin prices

- 4.3.2 Under-utilized legacy lines in China depressing global margins

- 4.3.3 Competition from bio-based barrier films in premium niches

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Key Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Film Type

- 5.1.1 Transparent

- 5.1.2 Metallized

- 5.1.3 Opaque / White

- 5.1.4 Pearlescent

- 5.1.5 Other Film Type

- 5.2 By Thickness

- 5.2.1 Less than 15 µm

- 5.2.2 15 - 30 µm

- 5.2.3 30 - 45 µm

- 5.2.4 More than 45 µm

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.2 Labeling and Wrap-Arounds

- 5.3.3 Laminating

- 5.3.4 Pressure-Sensitive Tapes

- 5.3.5 Other Application

- 5.4 By End-user Vertical

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Pharmaceutical and Medical

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Industrial

- 5.4.6 Other End-user Vertical

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Taghleef Industries

- 6.4.2 Jindal Poly Films

- 6.4.3 Toray Industries

- 6.4.4 SRF Limited

- 6.4.5 Uflex Ltd

- 6.4.6 Cosmo Films

- 6.4.7 Polyplex Corp

- 6.4.8 Oben Holding Group

- 6.4.9 Treofan Group

- 6.4.10 Vacmet India

- 6.4.11 NAN YA Plastics

- 6.4.12 Mitsui Chemicals Tohcello

- 6.4.13 Futamura Chemical

- 6.4.14 Innovia Films

- 6.4.15 Irplast S.p.A

- 6.4.16 Inteplast Group

- 6.4.17 Biofilm SA

- 6.4.18 Manucor Spa

- 6.4.19 Dunmore Corp

- 6.4.20 Tatrafan SRO

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment