|

市場調查報告書

商品編碼

1630379

釩氧化還原電池:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Vanadium Redox Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

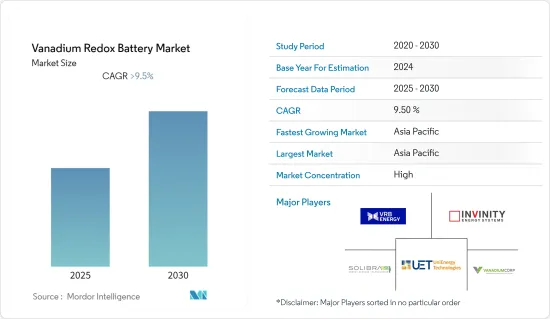

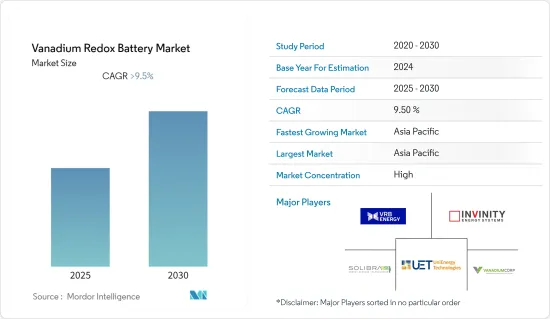

預計全釩氧化還原電池市場在預測期內將維持超過9.5%的複合年成長率。

COVID-19 對 2020 年市場產生了中等影響。目前市場已達到疫情前的水準。

主要亮點

- 減少電池處理對環境的影響以及由於更大的電解儲存槽而增加能源容量等因素預計將在未來幾年推動市場發展。釩氧化還原電池的使用壽命超過20年,且不存在火災隱患或高反應性有毒物質,比鋰離子或鉛酸電池更環保。

- 然而,低能量密度和高資本成本可能會阻礙預測期內的市場成長。

- 隨著可再生能源應用的快速成長,各個組織正在不斷努力以擁有更好的能量密度和高效的能源儲存設施。人們進行了大量的研究和開發,以開發能夠分隔正極和負極端子並防止釩離子交叉混合,同時提供必要的離子電導率的薄膜。陽離子交換膜(CEM)、陰離子交換膜(AEM)和兩性離子交換膜(AIEM)膜的發展可能會增加末端到末端的離子交換。此外,可望提高電池循環性能。因此,預計在不久的將來將提供市場成長機會。

- 預計亞太地區將主導市場,大部分需求來自中國和日本。

釩氧化還原電池市場趨勢

公共產業產業實現顯著成長

- 隨著世界各地碳排放的增加,太陽能板和風力發電機的部署每年都在增加。這兩種技術在尖峰時段都需要能源儲存設施。釩氧化還原電池是儲存這兩種技術產生的多餘能量的理想解決方案。

- 2021年,太陽能發電裝置容量約為849.4吉瓦(GW),風力發電裝置容量約為824.8GW。由於政府的舉措,這些裝置容量預計在預測期內將大幅成長。

- 釩氧化還原電池更有可能用於太陽能電池板和風力發電機裝置,因為它們在技術上優於鋰和鉛酸電池。

- 釩氧化還原電池適用於併並聯型和離並聯型。與鋰離子電池不同,它們可以完全放電,並且電解可重複使用,無需丟棄。此外,所使用的電解是水基的,本質上安全且不易燃。

- 根據國際能源總署(IEA)預測,2025年,太陽能發電量預計將增加至970吉瓦以上,風力發電量將增加至830吉瓦以上,釩氧化還原電池市場預計將在預測期內擴大。

亞太地區預計將主導市場

- 由於亞太地區有多種高功率液流電池在運作,預計全釩氧化還原電池市場將由亞太地區主導。

- 中國、印度、日本和澳洲等國家正努力提高大規模能源儲存容量,進而透過電池技術提高電力安全。

- 截至2022年,與亞太其他國家相比,中國擁有最大的液流電池裝置容量。

- 2022年9月,大連某抑低尖峰負載電廠液流電池能源儲存近期併網發電。全釩液流電池最終將把目前的容量從100MW/400MWh提高到200MW/800MWh。中國科學院估計,它可以提供足夠的電力來滿足20萬居民的日常需求。

- 該計劃是利用我國豐富的釩資源開發可再生能源、改造能源產業、緩解環境問題的重要一步。

- 此外,隨著亞太地區現有和即將推出的太陽能和風電計劃,許多公司都熱衷於在亞太地區企業發展,這有望在未來打開市場。

釩氧化還原電池產業概況

釩氧化還原電池市場正在整合。市場主要企業包括(排名不分先後)VRB Energy、VanadiumCorp Resource Inc.、Invinity Energy Solutions、Solibra Energy Storage Technologies GmbH、UniEnergy Technologies、H2 Inc.和Big power Electrical Technology襄陽公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:百萬美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 最終用戶

- 公共產業

- 商業

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- VRB Energy

- VanadiumCorp Resource Inc.

- Invinity Energy Solutions

- Solibra Energy Storage Technologies GmbH

- UniEnergy Technologies

- H2 Inc.

- Big pawer Electrical Technology Xiangyang Inc. Co.,Ltd

第7章 市場機會及未來趨勢

The Vanadium Redox Battery Market is expected to register a CAGR of greater than 9.5% during the forecast period.

COVID-19 moderately impacted the market in 2020. Currently. The market has reached pre-pandemic levels.

Key Highlights

- Factors such as the lower environmental impact of battery disposal and the high energy capacity of having larger electrolyte storage tanks are likely to drive the market in the coming years. With a life span of more than 20 years and no presence of fire hazards and highly reactive or toxic substances, vanadium redox batteries are more environmentally friendly than lithium-ion and lead-acid batteries.

- However, low energy density and high capital costs are likely to hinder the market growth during the forecast period.

- With the rapid growth of renewable energy applications, different organizations have made continuous efforts to have better energy density and efficient energy storage facilities. Numerous research and developments are taking place on the development of the membrane that separates the positive and negative terminals and prevents cross mixing of vanadium ions while providing required ionic conductivity. Development of Cation Exchange Membrane (CEM), Anion Exchange Membrane (AEM), and Amphoteric Ion Exchange Membrane (AIEM) membranes are likely to increase the ionic exchange in between the terminals. Moreover, it is expected to improve the battery's cyclability performance of the battery. Thus, it is expected to render an opportunity for the growth of the market in the near future.

- The Asia-Pacific is expected to dominate the market with majority of the demand coming from China and Japan.

Vanadium Redox Battery Market Trends

Utility Sector to Witness Significant Growth

- With the growing carbon emissions around the world, the deployment of both solar panels and wind turbines are increasing over the years. Both technologies require energy storage facilities during peak hours. A vanadium redox battery is an ideal solution to store the surplus energy generated by both technologies.

- During 2021, solar and wind energy have an installed capacity of around 849.4 gigawatts (GW) and 824.8 GW, respectively. With government initiatives, these capacities are likely to witness significant growth during the forecast period.

- On account of its technical advantages over lithium and lead-acid batteries, it is likely to find more use in the installation of solar panels and wind turbines.

- Vanadium redox battery is suitable for grid and off-grid connections. Unlike a lithium-ion battery, it can be discharged completely, and the electrolyte can be reused and doesn't need to be disposed of. Moreover, the electrolyte used is aqueous and inherently safe, and non-flammable.

- According to the International Energy Agency (IEA), the solar photovoltaic and wind energy sectors are likely to increase their capacity to more than 970GW and 830GW by 2025, which is expected to expand the vanadium redox battery market during the forecast period.

Asia-Pacific Likely to Dominate the Market

- The Asia-Pacific is expected to dominate the vanadium redox battery market as the region has several operational flow battery installations with large power ratings.

- Countries such as China, India, Japan, and Australia are striving to boost their large-scale energy storage capacity through battery technologies that could, in turn, enhance electric stability.

- As of 2022, China holds the highest capacity of flow batteries installed compared to other countries in the Asia-Pacific region.

- In September 2022, The Energy Storage from the Flow Battery in northeast China's Dalian, the peak-shaving power station, has recently been wired into the grid. The vanadium flow battery will eventually increase its present 100 MW/400 MWh capacity to 200 MW/800 MWh. The Chinese Academy of Sciences estimates that it can provide enough electricity to cover the daily needs of 200,000 inhabitants.

- This project represents a key step in utilizing China's rich vanadium resources for renewable energy development that will transform the energy industry and help alleviate environmental problems.

- Moreover, with existing and upcoming solar and wind projects in the region, many companies are keen on deploying and expanding their business in Asia-Pacific, which is expected to develop the market in the future.

Vanadium Redox Battery Industry Overview

The vanadium redox battery market is consolidated. The key players in the market (not in a particular order) include VRB Energy, VanadiumCorp Resource Inc., Invinity Energy Solutions, Solibra Energy Storage Technologies GmbH, UniEnergy Technologies, H2 Inc, and Big pawer Electrical Technology Xiangyang Inc. Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Utility

- 5.1.2 Commercial

- 5.1.3 Others

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 South America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 VRB Energy

- 6.3.2 VanadiumCorp Resource Inc.

- 6.3.3 Invinity Energy Solutions

- 6.3.4 Solibra Energy Storage Technologies GmbH

- 6.3.5 UniEnergy Technologies

- 6.3.6 H2 Inc.

- 6.3.7 Big pawer Electrical Technology Xiangyang Inc. Co.,Ltd