|

市場調查報告書

商品編碼

1630392

中國數位貨運:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)China Digital Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

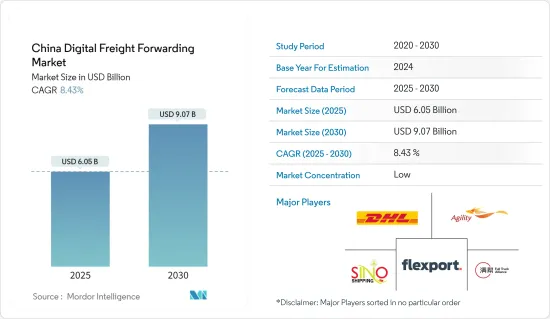

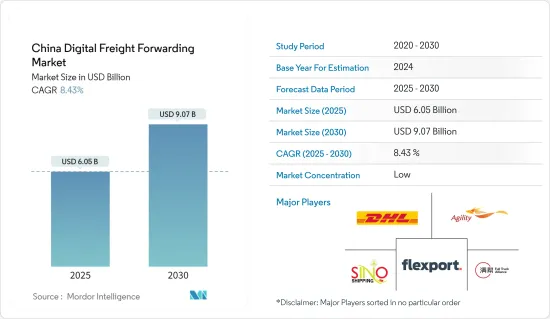

預計2025年中國數位貨運市場規模為60.5億美元,2030年將達90.7億美元,預測期間(2025-2030年)複合年成長率為8.43%。

中國數位貨運市場分析的重點是數位技術的應用,以簡化和增強中國境內的傳統貨運流程。貨運代理涉及代表托運人使用海運、空運、鐵路和卡車等運輸方式組織和促進跨境貨物運輸。透過採用線上平台、軟體和先進的資料分析,中國的數位貨運代理正在實現這一流程的現代化並最佳化運輸的各個方面。

正如中國運輸部在2023年提到的,近年來,由於電子商務的蓬勃發展以及對即時物流解決方案的需求不斷增加,中國數位貨運市場經歷了顯著成長。

根據中國政府預測,2023年,上海、深圳、寧波/舟山將成為全球貨櫃吞吐量最高的港口,其中上海吞吐量超過3600萬標準箱,其次是寧波/舟山,達到3500萬標準箱。量超過2700萬標準箱。這一激增凸顯了中國經濟的復甦和港口基礎設施的擴張,從而促進了區域和全球貿易。到2023年9月,中國港口總合將超過2.3億標準箱,與前一年同期比較去年同期成長5.2%。隨著中國數位貨運市場的擴大,國內外公司正在利用技術來最佳化業務並降低成本。

中國數位化貨運市場趨勢

電子商務領域的崛起推動市場

中國電子商務產業的快速成長有多種因素。中國政府推出了一系列加強電子商務和數位經濟的措施,特別注重加強網路基礎設施和促進創業。

行動技術的進步和廣泛的網際網路連接使電子商務在中國各地隨處可見,消費者和企業主都受益。此外,消費者還可享受支付寶、微信支付等多種行動付款解決方案的便利,促進無縫線上交易。

根據業內專家預測,2023年,中國將佔全球貨運市場收益的6.0%。展望 2030 年,美國將在收益方面主導全球市場。在亞太地區,到 2030 年,中國的貨運市場將在收入方面處於領先地位。印度被認為是亞太地區成長最快的市場,預計到 2030 年估值將達到 177.321 億美元。

航空貨運量的增加預計將推動市場

由於技術進步以及對高效、經濟高效的物流解決方案日益成長的需求,中國的數位貨運市場正在經歷快速轉型。在托運人和承運人擴大採用數位平台和解決方案的推動下,該市場預計將在未來幾年顯著成長。

產業專家表示,空運是最快的運輸方式之一,非常適合運輸時間敏感的貨物,例如需要緊急交付的生鮮產品或高價商品。空運在物流的第一個優點就是交貨速度。

2023年,中國跨境電商產品進出口值為2.38兆元(3,283億美元),與前一年同期比較去年同期成長15.6%。根據海關總署統計,光是跨境電商出口產品就達1.83兆元(與前一年同期比較億美元),年增近20%。

中國數位貨運產業概況

本報告重點介紹了在中國數位貨運市場中營運的主要企業。市場競爭激烈,沒有參與企業佔據主要佔有率。該市場是細分的,預計在預測期內將會成長。中國數位貨運代理市場的主要企業包括 DHL、Flexport、Agility Logistics 和 Freightos。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 目前的市場狀況

- 價值鏈/供應鏈分析

- 投資場景洞察

- 深入了解政府法規和舉措

- 線上貨運和數位平台的技術發展概述

- 中國電商物流貨運概況

- 地緣政治與疫情如何影響市場

第5章市場動態

- 促進因素

- 政府的一帶一路計劃

- 5G技術融入貨物物流

- 抑制因素

- 物流市場區隔

- 地緣政治貿易壁壘

- 機會

- 碳中和物流目標

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 客戶議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第6章 市場細分

- 按運輸方式

- 海洋

- 航空

- 路

- 鐵路

- 按公司類型

- 小型企業

- 大企業和政府

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- Flexport

- Youtrans

- Full Truck Alliance(Manbang group)

- Agility Logistics Pvt. Ltd(Shipa Freight)

- Twill

- Freightos

- DHL Group

- Kuehne+Nagel International AG

- FreightBro

- Cogoport

- SINO SHIPPING

- DB Schenker

- MOOV

- WICE Logistics*

- 其他公司

第8章 市場未來展望

第9章 附錄

- 宏觀經濟指標(GDP 分佈,依活動分類)

- 經濟統計-交通運輸和倉儲業對經濟的貢獻

The China Digital Freight Forwarding Market size is estimated at USD 6.05 billion in 2025, and is expected to reach USD 9.07 billion by 2030, at a CAGR of 8.43% during the forecast period (2025-2030).

The China Digital Freight Forwarding Market Analysis focuses on the application of digital technologies to streamline and enhance the traditional freight forwarding process within China. Freight forwarding involves organizing and facilitating the shipment of goods across international borders on behalf of shippers, utilizing ocean, air, rail, or truck transportation modes. By employing online platforms, software, and advanced data analytics, digital freight forwarders in China are modernizing this process, optimizing various facets of shipping.

In recent years, China's digital freight forwarding market has experienced significant growth, driven by e-commerece boom and incresing demand for real-time logistics solutions as mentioned by the Chinese Ministry of Transport in 2023.

According to the Government of China, in 2023, Shanghai, Shenzhen, and Ningbo-Zhoushan led the world as some of the busiest container ports, with Shanghai processing over 36 million TEUs, closely followed by Ningbo-Zhoushan at 35 million TEUs, and Shenzhen surpassing 27 million TEUs. This surge underscores China's economic recovery and its expanding port infrastructure, bolstering both regional and global trade. By September 2023, Chinese ports collectively managed over 230 million TEUs, reflecting a year-on-year uptick of 5.2%. As China's digital freight forwarding market expands, both domestic and international companies are harnessing technology to optimize operations and curtail costs.

China Digital Freight Forwarding Market Trends

Rise in E-Commerce Sector Driving the Market

Several factors have fueled the rapid growth of China's e-commerce industry. The Chinese government has rolled out a series of policies to bolster e-commerce and the digital economy, with a particular focus on enhancing internet infrastructure and promoting entrepreneurship.

With advancements in mobile technology and widespread internet connectivity, e-commerce has become both available and accessible across China, benefiting consumers and business owners alike. Furthermore, residents enjoy the convenience of diverse mobile payment solutions, such as Alipay and WeChat Pay, facilitating seamless online transactions.

According to industry experts, in 2023, China represented 6.0% of the global freight forwarding market in terms of revenue. Looking ahead to 2030, the U.S. is poised to dominate the global market in terms of revenue. Within the Asia Pacific region, China's freight forwarding market is set to take the lead in revenue by 2030. India, recognized as the fastest-growing market in the Asia Pacific, is on track to achieve a valuation of USD 17,732.1 million by 2030.

Increasing Air Cargo Shipments Expected to Drive the Market

The digital freight forwarding market in China is undergoing rapid transformation, driven by technological advancements and the growing need for efficient and cost-effective logistics solutions. The market is expected to achieve significant growth in the coming years, fueled by the increasing adoption of digital platforms and solutions by both shippers and carriers.

According to industrial experts, air transportation is one of the fastest modes of transportation available, making it ideal for transporting time-sensitive products, such as perishable goods and high-value items requiring urgent delivery. The primary advantage of air transport in logistics is the speed of delivery.

In 2023, China's imports and exports of cross-border e-commerce products were worth CNY 2.38 trillion (USD 328.3 billion), up 15.6 percent year-on-year. Products exported for cross-border e-commerce alone reached CNY 1.83 trillion (USD 0.25 trillion), up nearly 20 percent year-on-year, according to the General Administration of Customs.

China Digital Freight Forwarding Industry Overview

The report covers the major players operating in the Chinese digital freight forwarding market. The market is highly competitive, with none of the players occupying the major share. The market is fragmented, and it is expected to grow during the forecast. The major players in the Chinese digital freight forwarding market include DHL, Flexport, Agility Logistics, and Freightos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Insights on Investment Scenarios

- 4.4 Insights on Government Regulations and Initiatives

- 4.5 Brief on Technology Development in Online Freight Forwarding and Digital Platforms

- 4.6 Overview on E-commerce Logistics and Freight Forwarding in China

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Government's Belt and Road Initiative

- 5.1.2 Integration of 5G Technology in Freight Logistics

- 5.2 Restraints

- 5.2.1 Fragmentation in the Logistics Market

- 5.2.2 Geopolitical Trade Barriers

- 5.3 Opportunities

- 5.3.1 Carbon-Neutral Logistics Goals

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Customers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Mode of Transportation

- 6.1.1 Ocean

- 6.1.2 Air

- 6.1.3 Road

- 6.1.4 Rail

- 6.2 By Firm Type

- 6.2.1 SMEs

- 6.2.2 Large Enterprises and Governments

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Flexport

- 7.2.2 Youtrans

- 7.2.3 Full Truck Alliance (Manbang group)

- 7.2.4 Agility Logistics Pvt. Ltd (Shipa Freight)

- 7.2.5 Twill

- 7.2.6 Freightos

- 7.2.7 DHL Group

- 7.2.8 Kuehne + Nagel International AG

- 7.2.9 FreightBro

- 7.2.10 Cogoport

- 7.2.11 SINO SHIPPING

- 7.2.12 DB Schenker

- 7.2.13 MOOV

- 7.2.14 WICE Logistics*

- 7.3 Other Companies

8 FUTURE OUTLOOK OF THE MARKET

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 9.2 Economic Statistics - Transport and Storage Sector Contribution to Economy